After reporting strong earnings, Microsoft Corp.’s (NASDAQ: MSFT) market capitalization reached $1 trillion. The stock is up about 25% this year.

[in-text-ad]

The basic numbers:

Microsoft Corp. today announced the following results for the quarter ended March 31, 2019, as compared to the corresponding period of last fiscal year:

· Revenue was $30.6 billion and increased 14%

· Operating income was $10.3 billion and increased 25%

· Net income was $8.8 billion and increased 19%

· Diluted earnings per share was $1.14 and increased 20%

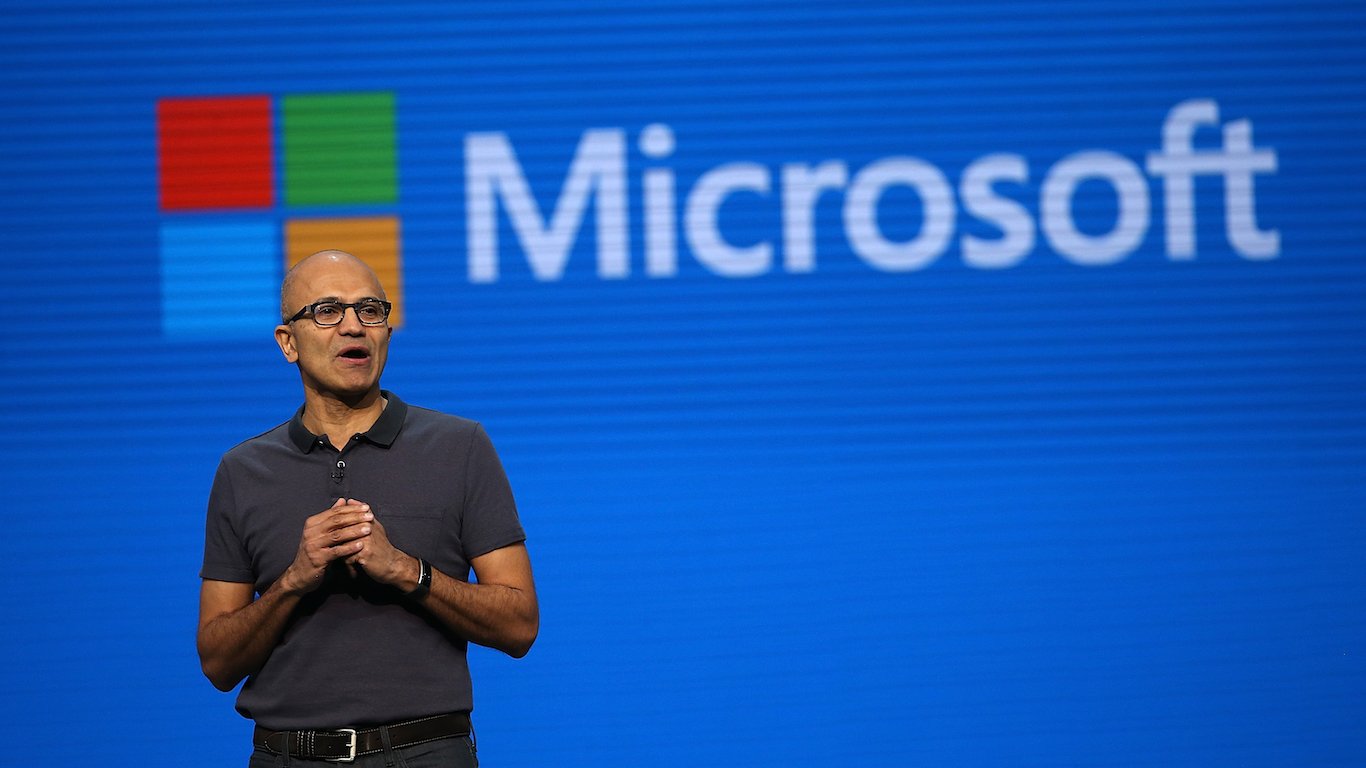

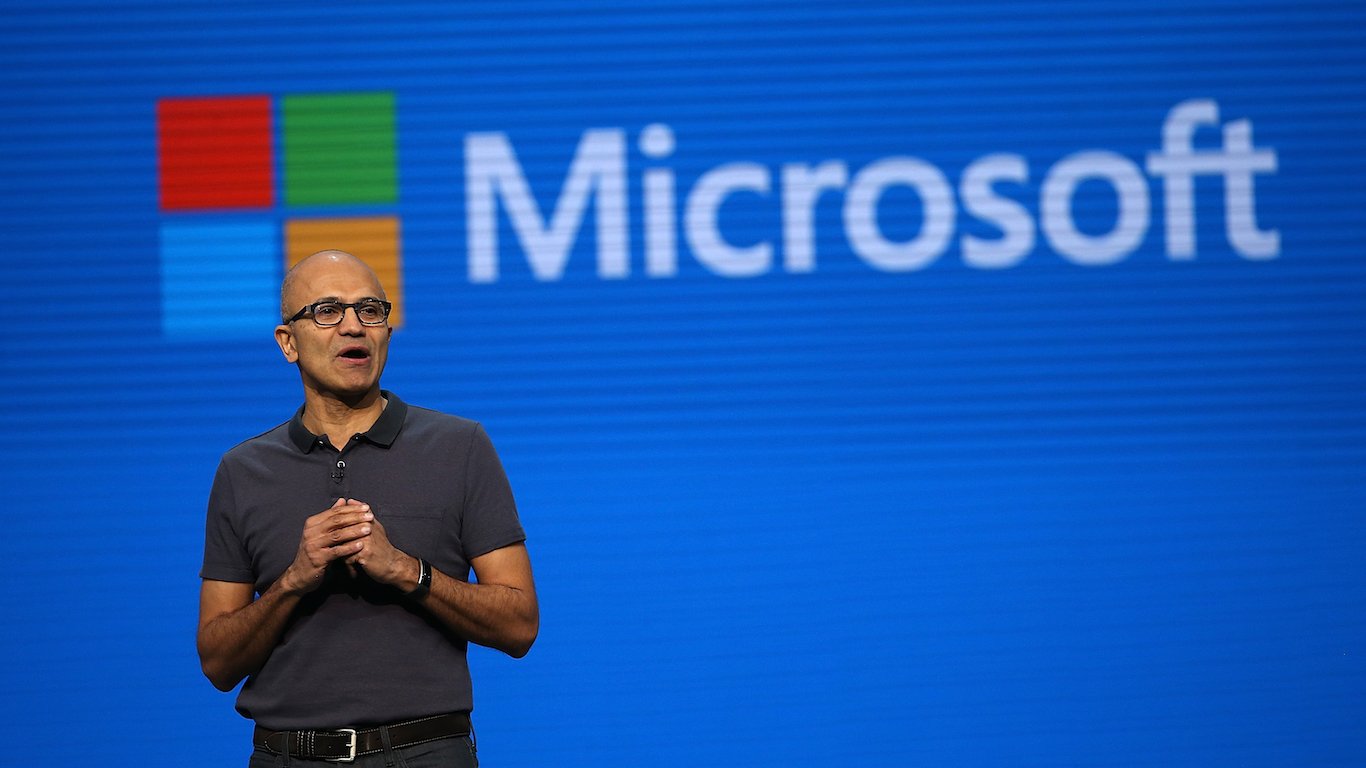

“Leading organizations of every size in every industry trust the Microsoft cloud. We are accelerating our innovation across the cloud and edge so our customers can build the digital capability increasingly required to compete and grow,” said Satya Nadella, CEO of Microsoft.

Microsoft returned $7.4 billion to shareholders in the form of share repurchases and dividends in the third quarter of fiscal year 2019.

“Demand for our cloud offerings drove commercial cloud revenue to $9.6 billion this quarter, up 41% year-over-year,” said Amy Hood, executive vice president and chief financial officer of Microsoft. “We continue to drive growth in revenue and operating income with consistent execution from our sales teams and partners and targeted strategic investments.”

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.