By David Callaway, Callaway Climate Insights

The more ESG funds perform, the greater the conundrum around them. What are environmental, social and governance securities? How can I measure them? Where can I buy them? Also, what’s in them?

These are common questions by investors, and increasingly by the financial adviser community, as each quarter of outperformance breeds more investor interest and funds flow.

As in the first quarter, the top ESG funds in the past three months as we approach the end of June benefited from holdings in tech companies, particularly the shelter-in-place names like Netflix (NFLX) and Amazon (AMZN). The legitimacy of these companies in ESG portfolios could be debated, but not their impact.

Part of the answer might be in what asset manager Jeff Gitterman tells us this week in an analysis on the readiness of the financial advisory community to react to investor demands for ESG assets. Don’t regard ESG investing as a theme, but as a process of due diligence in selecting the right securities, he says.

The better a company’s management, the higher their ESG score should be. Effective management usually translates to stock performance, too. Check out our list of top ESG funds and ETFs heading into the end of the quarter, and Gitterman’s interview and podcast with our own Robert Powell.

Plus, as we were going to press, or whatever you call hitting the send button on this newsletter, California utility PG&E Corp. pleaded guilty to 84 counts of manslaughter in connection with the 2018 wildfire, which destroyed Paradise, Calif. In a rare acknowledgement of corporate negligence that caused deaths, the company admitted its failure to maintain power line equipment in the area led to fires under drought conditions.

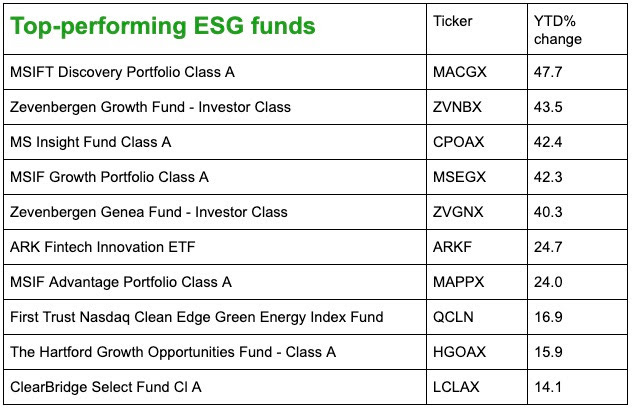

10 Best ESG Funds So Far in 2020

. . . . Small investment funds that focus on environmental, social and governance issues have outperformed through the Covid-19 pandemic and related economic chaos this year, but their future success is closely tied to technology shares.

As the Nasdaq leads the three major indexes heading into the end of the second quarter, investors should watch for the potential of a rotation of popular stocks as economies re-open, and monitor their ESG funds, accordingly.

Five of the 10 top performers are up more than 40% year-to-date, but in the category of largest ESG funds, only three of the 10 biggest are even in positive territory. In the emerging wild west of ESG investing, your returns might be tied to which letter you focus on. . . .

News briefs: PG&E pleads guilty manslaughter in California fire; youths fight plastic pollution

Editor’s picks:

- PG&E pleads guilty in deadly California Camp fire case

- BP slashes long-term forecast for oil prices

- How blockchain could get the world to act against the climate crisis

Free Callaway Climate Insights Newsletter

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.