Investing

Meme Stock Movers for 12/1: AMC, GameStop, Newegg, Tesla, Xpeng

Published:

By now, everyone knows that U.S. equity markets tanked on Tuesday, with the major indexes closing down between 1.5% and 2.0%. Early morning concerns about the effectiveness of existing COVID-19 vaccines against the Omicron variant gave way later to investors’ reaction to a comment by Federal Reserve Chair Jerome Powell that it’s time to “retire the word ‘transitory'” in relation to the current spate of inflation. If the Fed reduces its bond-buying more quickly than expected, interest rate hikes are expected to follow more quickly as well. While money still will be historically cheap, it will be more expensive than it has been for the past few years.

Major indexes were indicating a higher opening to regular trading Wednesday, with the Nasdaq up nearly 1.5% in premarket action. Crude oil was up more than 4% to around $69 a barrel, while Bitcoin was up slightly at $57,231. Yields on 10-year Treasury notes were up about three basis points at around 1.48%.

Meme stocks mostly got clobbered on Tuesday, although only one stock in our watch list posted a double-digit loss. Newegg Commerce Inc. (NASDAQ: NEGG) dropped nearly 11% Tuesday. Over the past two trading sessions, the stock is down about 14%. That could be the result of Newegg’s intention to open a three-week trading window for nearly 1.6 million restricted shares. With about 365 million shares outstanding, that’s not a big dilution, but it came on a bad day. Shares traded up about 3% in Wednesday’s premarket.

Movie theater operator AMC Entertainment Holdings Inc. (NYSE: AMC) dumped nearly 8% of its value on Tuesday and was regaining more than 2% in Wednesday’s premarket. The company said that Monday was its second-busiest ticket sales day since reopening last summer. Advance sales for “Spiderman: No Way Home,” which opens only in theaters on December 16, came within 1.5% of the all-time single-day record set by “Avengers: Endgame” in 2019.

GameStop Corp. (NYSE: GME) dropped about 3% on Tuesday and traded up about 1.2% in Wednesday’s premarket. Tuesday was a weird day for the stock and the WallStreetBets apes that love it. Fidelity Investments reported Tuesday morning that there were about 13.8 million shares available to sell short, up from around 2 million available Monday. Turns out that Fidelity goofed and the apes went feral.

Chinese electric vehicle maker Xpeng Inc. (NYSE: XPEV) added about 7% Tuesday and traded up by around 3.6% Wednesday morning. Xpeng reported in the morning that November sales rose by 270% year over year to 15,613 units. The other two closely watched Chinese EV makers also reported solid sales growth in November. Li Auto’s sales were up 190% and Nio’s were up 106% year over year. Li Auto leaped Monday after reporting quarterly results and added another 2.8% on Tuesday. Shares traded up 5.6% in Wednesday’s premarket. Nio’s share price fell by 3.3% on Tuesday but the stock traded up by around 3.7% Wednesday morning.

Shares of Tesla Inc. (NASDAQ: TSLA) also closed a bit higher on Tuesday and traded up nearly 2% in Wednesday’s premarket. In response to several Twitter queries, CEO Elon Musk on Monday tweeted on Monday that he would personally deliver an updated product roadmap when Tesla reports quarterly results in January:

Oh man, this year has been such a supply chain nightmare & it’s not over!

I will provide an updated product roadmap on next earnings call.

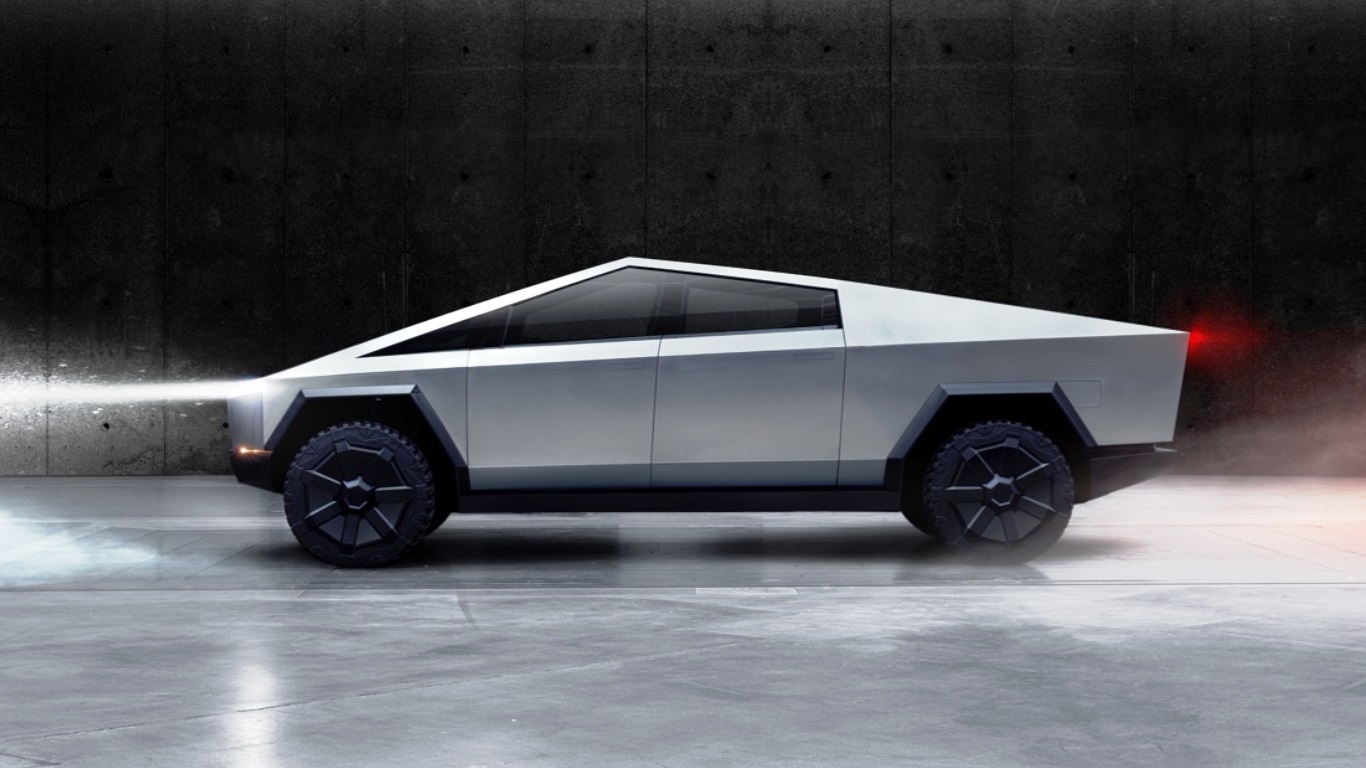

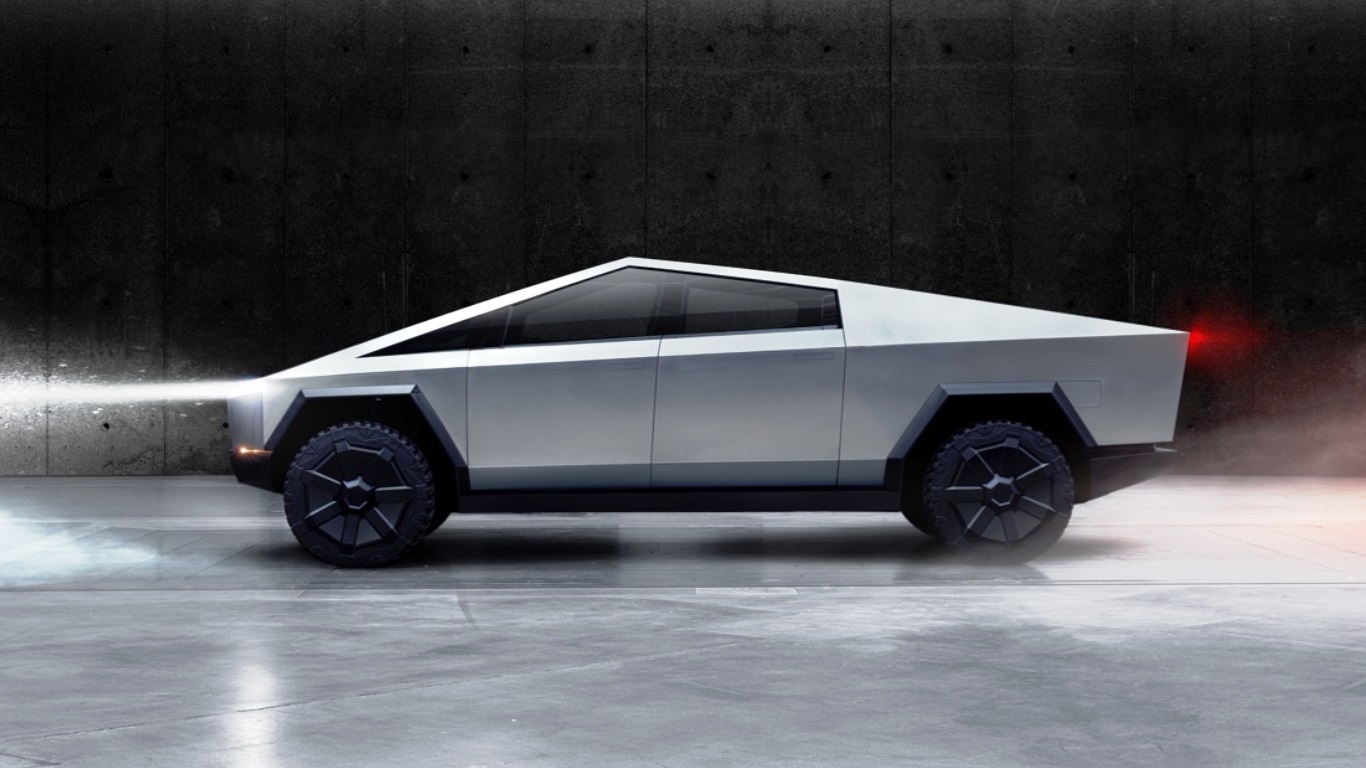

Not only that, Tesla sold out of a new product. The company added a limited edition $50 Cybertruck-shaped Cyberwhistle to its online store and it sold out in hours.

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.