The three major U.S. equities indexes closed Tuesday for a third straight day of solid gains. Stocks opened on the positive side and broke out of a pretty flat day in the last hour of trading. The Dow Jones industrials closed up by 0.78%, the S&P 500 up 0.69% and the Nasdaq up 0.75%. Strength in several big names, like Exxon Mobil (up 6.4% for the day), UPS (up 14.1%) and Netflix (up 7.0%), probably contributed to a FOMO spirit late in the day.

Among S&P 500 stocks, winners outnumbered losers by more than two to one in Tuesday trading. Eight of 11 sectors closed higher led by energy (up 3.6%), materials (up 1.5%) and financials (up 1.4%). Utilities (down 1.3%), real estate (down 0.7%) and consumer staples (down 0.1%) lagged.

At around 7:00 a.m. ET Friday morning, S&P 500 futures traded down about 0.2%, the Nasdaq was down nearly as much and the Dow was 0.1% lower.

Crude oil settled at $88.20 (essentially flat) on Tuesday and traded up about 0.2% in early morning trading Wednesday at $88.36. The 10-year/two-year U.S. Treasury note spread ended the day at 0.63%, two basis points higher than Monday’s settlement.

The U.S. Energy Information Administration (EIA) releases its weekly report on oil and gas inventories Wednesday morning. The consensus estimate calls for an increase of 1.83 million barrels. After markets closed on Tuesday, the American Petroleum Institute reported a decline of 1.65 million barrels from the prior week.

Here are the five S&P 500 stocks that closed with the biggest gains on Tuesday: UPS (up 14.1%), Mosaic (up 9.1%), CF Industries (up 8.1%), Netflix (up 7.0%) and Bio-Techne (up 6.7%).

Tuesday’s biggest losers among S&P 500 stocks were AT&T (down 4.2%), Broadridge Financial (down 3.7%), Trane (down 3.4%), Etsy (down 3.1%) and NRG Energy (down 2.9%).

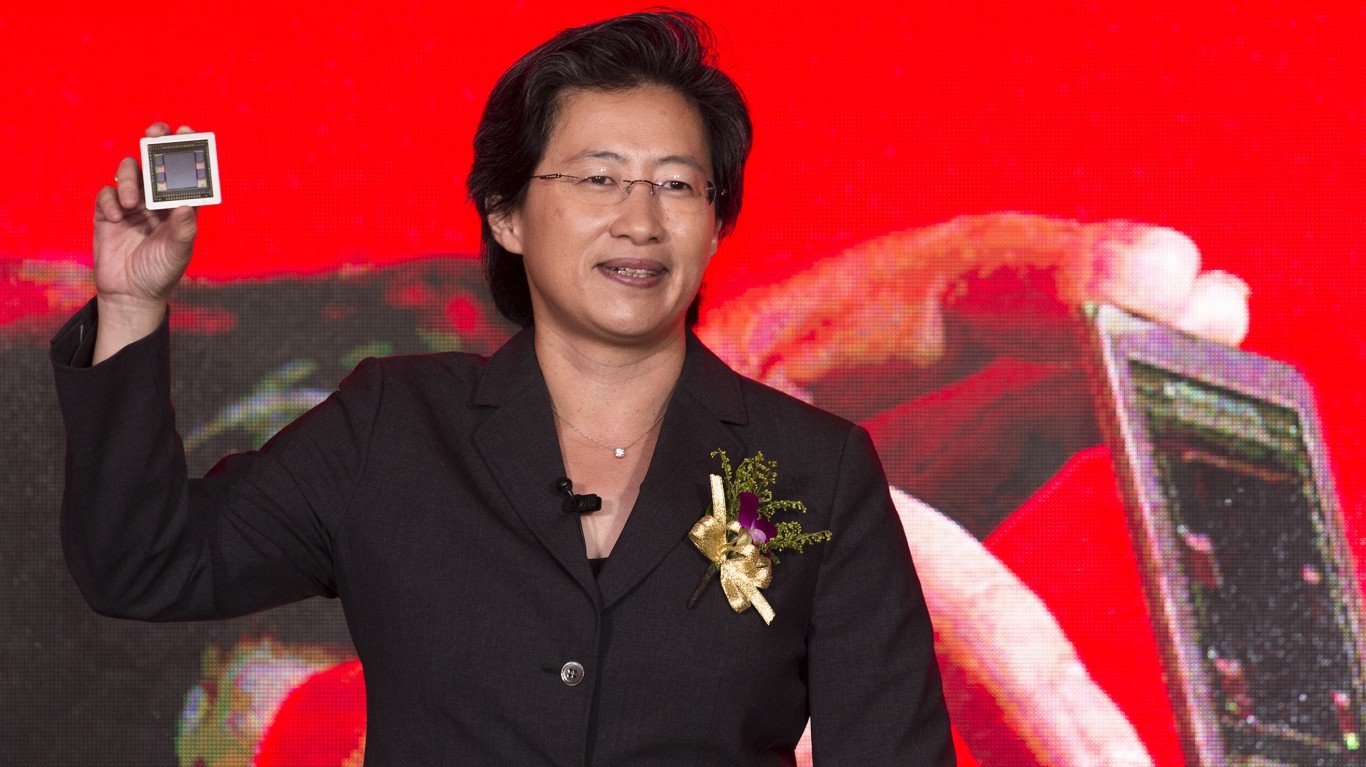

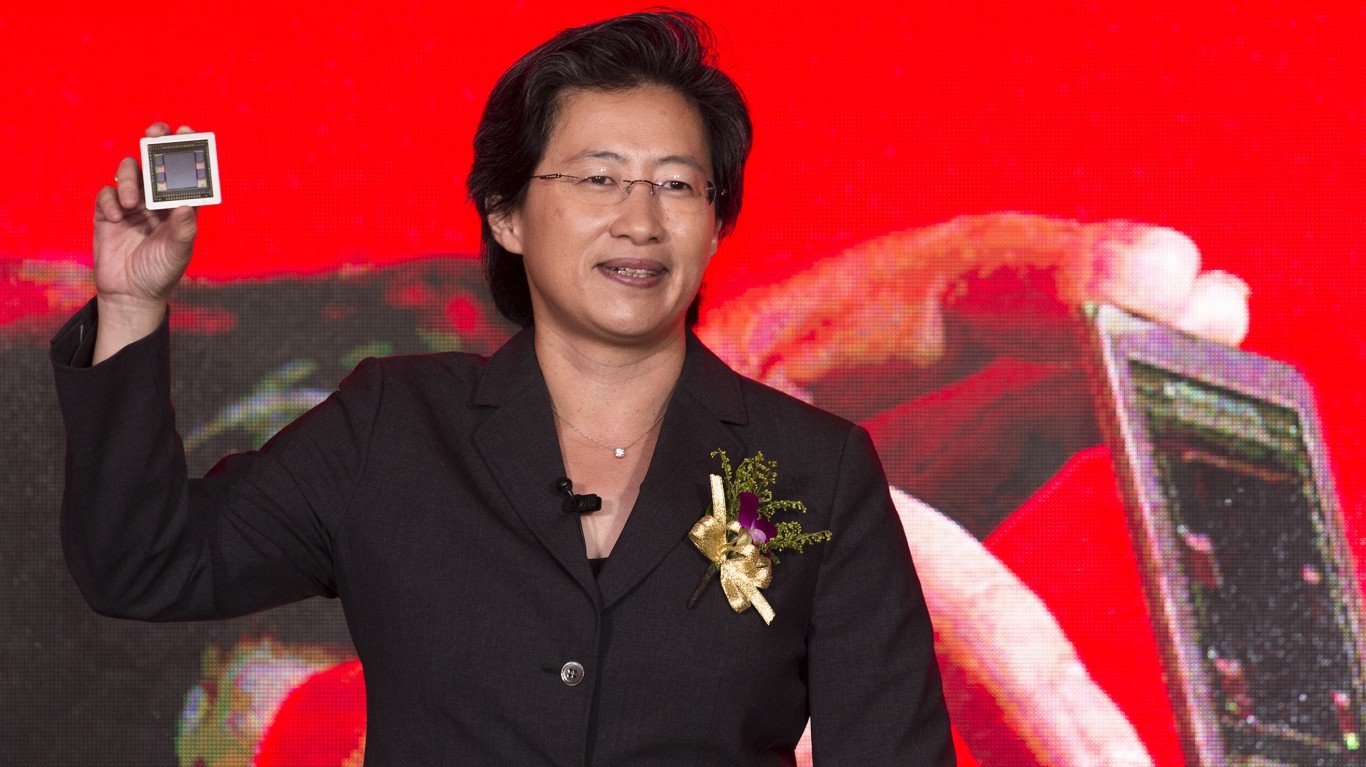

The leading gainer among S&P 500 stocks in Wednesday’s premarket trading was Advanced Micro Devices Inc. (NASDAQ: AMD), which traded up by about 11.7% at $130.40. The chipmaker reported quarterly results Tuesday that beat estimates for both profits and revenues. Year over year, revenue rose by nearly 49% and per-share earnings rose by almost 77%. To top it all off, the government of China has approved the company’s acquisition of Xilinx. This is the last of the required approvals, and the deal is expected to close this quarter.

Alphabet Inc. (NASDAQ: GOOGL) traded up about 10.7% at $3,047.44, above the current 52-week range of $1,990.23 to $3,019.33. Like AMD, Alphabet reported quarterly results late Tuesday, posting record Pixel phone sales and a 36% jump in search revenue. The company also announced a 20-for-1 stock split (its first ever) that will lower the per-share price to around $150. This could really roil the S&P 500 index. And wait until Thursday afternoon when Amazon reports. It could split its stock as well.

Xilinx Inc. (NASDAQ: XLNX) traded up more than 12% before markets opened Wednesday, at $222.27 in a 52-week range of $111.84 to $239.79. The share price is now tracking AMD.

Nvidia Corp. (NASDAQ: NVDA) traded up by about 5.7% to $260.35, in a 52-week range of $115.67 to $346.47. The chipmaker was tagging along on AMD’s coattails.

Meta Platforms Inc. (NASDAQ: FB) traded up 4.0%, at $332.00 in a 52-week range of $253.50 to $384.33. The company reports earnings after markets close and was following most tech stocks higher in premarket trading.

Stocks trading lower in Wednesday’s premarket session include Exelon Corp. (NASDAQ: EXC), which was down by about 29% to $41.14, below the current 52-week range of $38.35 to $58.21. The utility company has completed its separation from Constellation Energy Group. Exelon will remain in the S&P 500.

PayPal Holdings Inc. (NASDAQ: PYPL) traded down about 16.7% to $146.41, below the current 52-week range of $152.08 to $310.16. The company missed the consensus earnings estimate by a penny and beat revenue estimates, but it gave downside guidance for the first quarter and for fiscal 2022. It did not take long for three brokerages to cut the stock from the equivalent of Buy to Hold.

Match Group Inc. (NASDAQ: MTCH) traded down by 3.6% in Wednesday’s premarket, at $108.00 in a 52-week range of $105.15 to $182.00. The company posted a loss of $0.60 per share, missed the revenue estimate and lowered guidance for the current quarter and full fiscal year.

Gilead Sciences Inc. (NASDAQ: GILD) traded down by about 3.0% to $66.40, in a 52-week range of $61.39 to $74.12. The company missed profit expectations when it reported results late Tuesday and then issued fiscal 2022 profit guidance that was a bit short of estimates.

Starbucks Corp. (NASDAQ: SBUX) traded down by about 2.9% Wednesday morning, at $95.93 in a 52-week range of $93.79 to $126.32. Starbucks missed the earnings estimate and issued guidance that was lower than expected. Goldman Sachs already has cut its rating on the stock from Buy to Neutral and cut the $112 per share price target to $106.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.