The three major U.S. equities indexes closed flat to lower Monday, following a sharp sell-off in the last 45 minutes of trading. The Dow Jones industrials closed flat, the S&P 500 0.4% lower and the Nasdaq down by 0.58%. That was the final bounce in a day of bouncing. Among S&P 500 stocks, losers and winners were evenly divided (245 to 255, respectively) in Monday trading. Six of 11 sectors closed lower, led by communications services (down 1.7%) and technology (down 0.7%). Energy was the day’s big gainer, closing higher by 1.3%.

At around 7:00 a.m. ET Tuesday morning, S&P 500 futures traded down about 0.2%, the Nasdaq was down about 0.4% and the Dow traded essentially flat.

Crude oil settled at $91.32 on Monday and traded down by about 1.9% in early trading Tuesday at $89.57. The 10-year/two-year U.S. Treasury note spread ended the day at 0.63%, up three basis points from Friday’s settlement. The yield curve had narrowed by about one in premarket trading Tuesday.

Here are the five S&P 500 stocks that closed with the largest gains on Monday: Tyson Foods (up 12.23%), Royal Caribbean Cruise Lines (up 8.44%), Norwegian Cruise Lines (up 8.40%), Carnival Corp. (up 7.82%) and American Airlines (up 5.05%).

Monday’s biggest losers among S&P 500 stocks were Zimmer Biomet (down 9.09%), Constellation Energy (down 8.12%), Meta Platforms (down 5.14%), Avery Dennison (down 4.14%) and PayPal (down 3.70%).

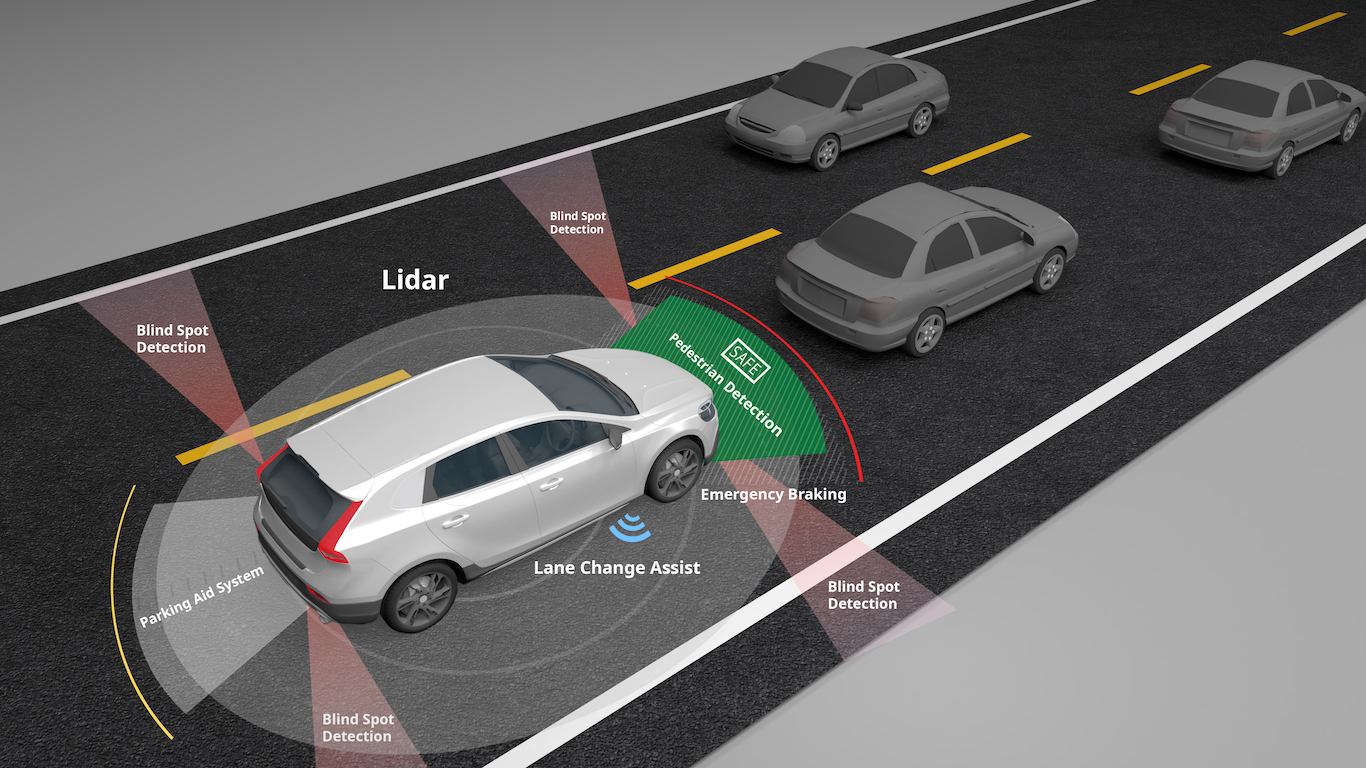

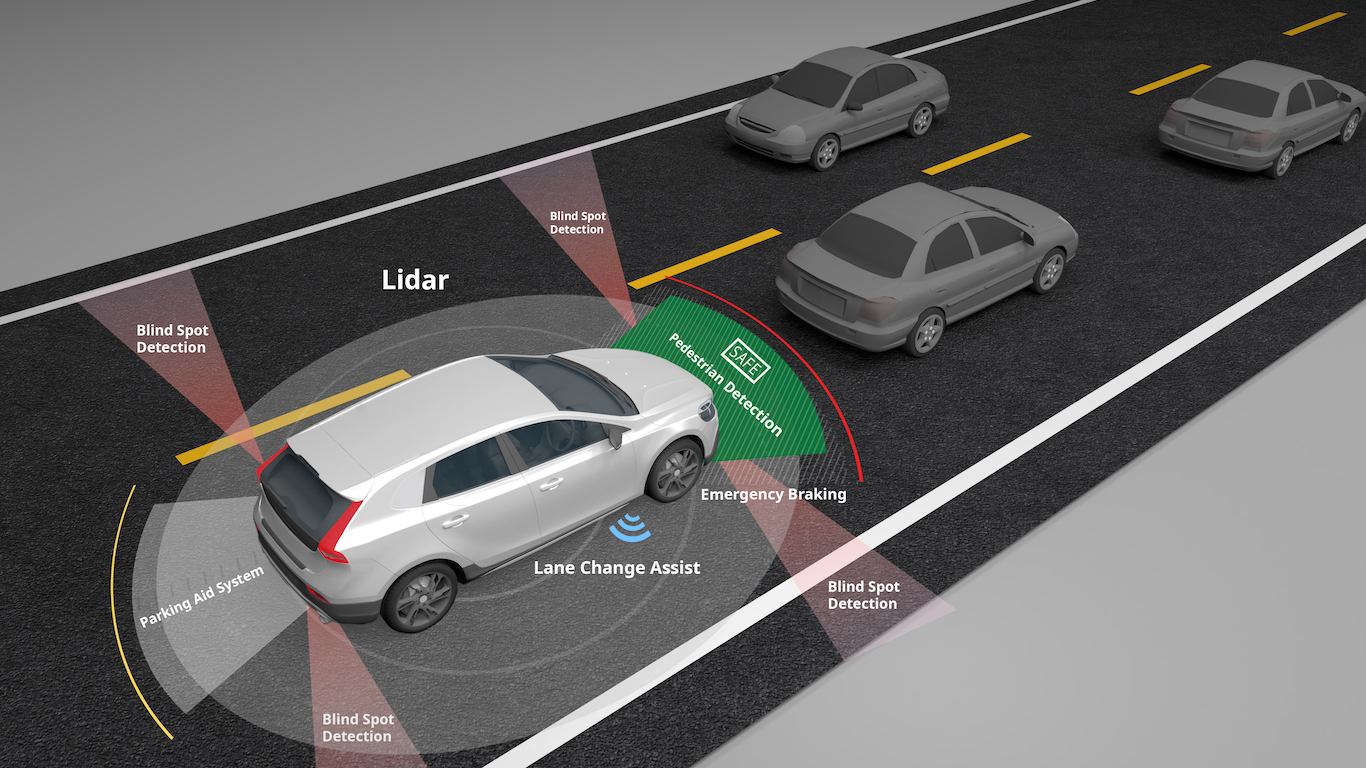

Among Tuesday’s leading gainers in the premarket was Velodyne Lidar Inc. (NASDAQ: VLDR), which traded up by nearly 44%, at $5.42 in a 52-week range of $3.13 to $24.70. The maker of lidar sensors for advanced autonomous driving systems concluded a deal with Amazon granting the e-commerce giant a warrant to purchase 39.6 million shares of company stock at $4.18 per share at any time between now and February 4, 2030. The stock closed at $3.77 on Monday and gained as much as 127% in after-hours trading.

Harley-Davidson Inc. (NYSE: HOG) traded up by around 9% before markets opened Tuesday, at $39.20 in a 52-week range of $32.13 to $52.06. The motorcycle maker reported quarterly results late Monday that roared past profit and revenue estimates. It also issued upside guidance for fiscal 2022 that included an increase of 5% to 10% in revenue.

Chegg Inc. (NASDAQ: CHGG) traded up by about 7.8% in the premarket session, at $29.40 in a 52-week range of $23.23 to $115.21. The online learning platform beat both profit and revenue when it reported quarterly results Monday afternoon and issued upside guidance for both the current quarter and the 2022 fiscal year.

Teradata Corp. (NYSE: TDC) traded up about 6.4% in Tuesday’s premarket to $42.85, in a 52-week range of $37.05 to $59.58. Although hybrid cloud software provider missed revenue estimates, it beat profit estimates soundly, and it issued upside guidance for the current quarter and raised guidance for full fiscal 2022.

Rexford Industrial Realty Inc. (NYSE: REXR) traded up about 5.7% in Tuesday’s early going to $76.02. The stock’s 52-week range is $45.90 to $81.68. The company had no specific news but is scheduled to report quarterly results after markets close on Wednesday.

Stocks trading lower in Tuesday’s premarket session include General Motors Co. (NYSE: GM), which traded down by 4.6%, at $48.37 in a 52-week range of $47.07 to $67.21. Morgan Stanley downgraded the stock from Overweight to Equal Weight Tuesday morning and cut the price target from $75 to $55.

Pfizer Inc. (NYSE: PFE) traded down by about 3.8% to $51.21, in a 52-week range of $33.36 to $61.71. The company missed the consensus revenue estimate and issued downside guidance Tuesday morning. Vaccine revenue accounted for $13.9 billion in fourth-quarter revenue, up from $2 billion in the December 2020 quarter.

Simon Property Group Inc. (NYSE: SPG) traded down by about 3.5%, at $143.69 in a current 52-week range of $101.35 to $171.12. The company beat both profit and revenue estimates but issued downside cash flow guidance.

Moderna Inc. (NASDAQ: MRNA) traded down by about 3.1%, at $155.30 in a 52-week range of $117.34 to $497.49. A new study suggests that an Omicron-specific booster shot may be unnecessary.

Meta Platforms Inc. (NASDAQ: FB) traded down about 2.1% to $220.15, below a 52-week range of $224.01 to $384.33. The low was posted Monday and, shares appeared to be on the way to sinking further Tuesday. Analysts at KGI Securities downgraded the stock in the morning, from Outperform to Neutral with a price target of $270.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.