Mastercard just distributed $0.87 per share to shareholders on February 9, 2026, marking the payment network’s latest quarterly dividend. While the 14.5% year-over-year increase from $0.76 continues an impressive growth streak, the dividend’s modest yield and conservative payout strategy reveal a company prioritizing buybacks over income generation.

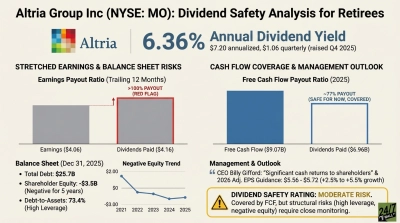

The Dividend Scorecard: Solid Growth, Minimal Yield

At the current price of $537.57, Mastercard’s annualized dividend of $3.48 translates to a yield of approximately 0.65%. That’s barely enough to offset inflation, let alone provide meaningful income. For context, the broader market offers yields closer to 1.5%, and even direct competitor Visa delivers 0.77% with its $0.67 quarterly payment.

The payout ratio tells a different story. Based on trailing twelve-month earnings of $16.45 per share, Mastercard distributes just 19.15% of profits as dividends. This ultra-conservative approach leaves substantial room for future increases, but it also signals management’s preference for returning capital through share repurchases rather than direct payments to shareholders.

![An infographic titled 'MA DIVIDEND SCORECARD' for Mastercard, featuring the Mastercard logo at the top left. It highlights a dividend payment of '$0.87 per share on Feb 9, 2026'. The scorecard details six metrics with their values and letter grades: Dividend Yield [0.65%] [D], Payout Ratio [19.15%] [A], Growth History [5 consecutive quarters] [A], Consistency [20+ years] [A], FCF Coverage [6.23x] [A], and Balance Sheet [Very High Safety] [A]. A large green circle on the right prominently displays 'A' as the 'OVERALL GRADE'. Below this, the 'WALL STREET CONSENSUS' section shows 'Current Price: $537.57', 'Price Target: $661.89', 'Upside: +23% (with a green upward arrow)', and 'Analyst Rating: Buy (32 Buy/Strong Buy, 7 Hold, 0 Sell)'. A 'KEY TAKEAWAY' text box summarizes Mastercard's dividend profile, while the bottom states 'Data as of Feb 12, 2026' and 'Not investment advice', alongside the '24/7 WALL ST' logo. The infographic uses a clean layout with white and light grey backgrounds, accented by green and orange circular grade indicators.](https://247wallst.com/wp-content/uploads/2026/02/ma-dividend-scorecard-infographic-1770916759078.webp)

Where the Real Money Goes: Buyback Dominance

The numbers clarify Mastercard’s capital allocation priorities. In fiscal 2025, the company paid $2.756 billion in total dividends while simultaneously executing $11.727 billion in share repurchases. That’s a 4-to-1 ratio favoring buybacks over dividends.

This strategy makes mathematical sense given Mastercard’s valuation. With free cash flow of $17.159 billion in 2025, the company generated 6x the cash needed to cover dividends. Rather than distribute that excess to all shareholders equally, management chose to reduce share count, concentrating ownership among remaining investors.

The Growth Trajectory: Accelerating Increases

Mastercard’s dividend growth deserves recognition. The company has raised its quarterly payment for five consecutive quarters, with the latest $0.87 distribution representing a 14.5% jump from the $0.76 paid in early 2025. Looking back further, the quarterly dividend has surged from $0.57 in Q4 2023 to today’s level, a 52.6% increase in just over two years.

The 10-year compound annual growth rate of approximately 22.5% significantly outpaces inflation and broader market dividend growth. For investors who purchased shares years ago, the yield-on-cost has expanded dramatically. Someone who bought at $331.45 five years ago now enjoys a 1.05% yield on their original investment, though that still trails many alternatives.

Earnings Power: The Foundation for Future Increases

Mastercard’s ability to sustain aggressive dividend growth stems from exceptional profitability. The company generated $14.968 billion in net income on $32.791 billion in revenue during fiscal 2025, producing a 45.7% net profit margin. Operating margins reached 59.2%, reflecting the asset-light nature of payment processing.

Recent quarterly results reinforce this strength. Q4 2025 earnings of $4.76 per share exceeded analyst estimates of $4.38, beating expectations by $0.38. Revenue growth of 17.6% year-over-year demonstrates continued business momentum despite economic uncertainty.

The company’s free cash flow generation provides the clearest picture of dividend sustainability. With operating cash flow of $17.648 billion and minimal capital expenditures of just $489 million, Mastercard converts virtually all operating cash into free cash flow. This 3% capital intensity ratio leaves enormous flexibility for shareholder returns.

Peer Comparison: Visa’s Similar Approach

Visa follows a nearly identical playbook. The payment giant’s $0.67 quarterly dividend increased 13.6% from $0.59 in its most recent raise, matching Mastercard’s aggressive growth trajectory. Visa’s net profit margin of 50.2% slightly exceeds Mastercard’s, though both operate with extraordinary profitability.

The key difference lies in dividend history. Visa has maintained a consistent pattern of annual increases, typically raising its dividend in Q3 (August) each year with increases ranging from 6.7% to 20%. Mastercard’s more frequent quarterly adjustments suggest a willingness to accelerate payout growth as earnings expand.

The Verdict: Growth Over Income

Mastercard’s dividend earns high marks for safety and growth potential, but falls short for income-focused investors. The 6x free cash flow coverage and 19.15% payout ratio provide an enormous cushion for future increases. Management has demonstrated commitment to raising the dividend at double-digit rates, with the five-quarter streak of increases suggesting this will continue.

However, the sub-1% yield makes this dividend irrelevant for anyone seeking current income. Even with 14.5% annual growth, it would take years for the yield to reach competitive levels. The company’s preference for buybacks over dividends, evidenced by the 4-to-1 spending ratio, indicates this won’t change soon.

For total return investors who reinvest dividends and benefit from share count reduction, Mastercard’s approach makes sense. The company trades at 33x trailing earnings, and repurchasing shares at elevated valuations concentrates ownership among remaining shareholders. But for retirees or income investors, the 0.58% yield simply doesn’t move the needle.

The next dividend, already declared at $0.87, goes ex-dividend on April 9, 2026 with payment scheduled for May 8, 2026. Based on recent patterns, another increase likely arrives in mid-2026, potentially pushing the quarterly rate toward $1.00 per share by year-end. That would represent impressive growth, but still leave the yield well below 1% at current prices.