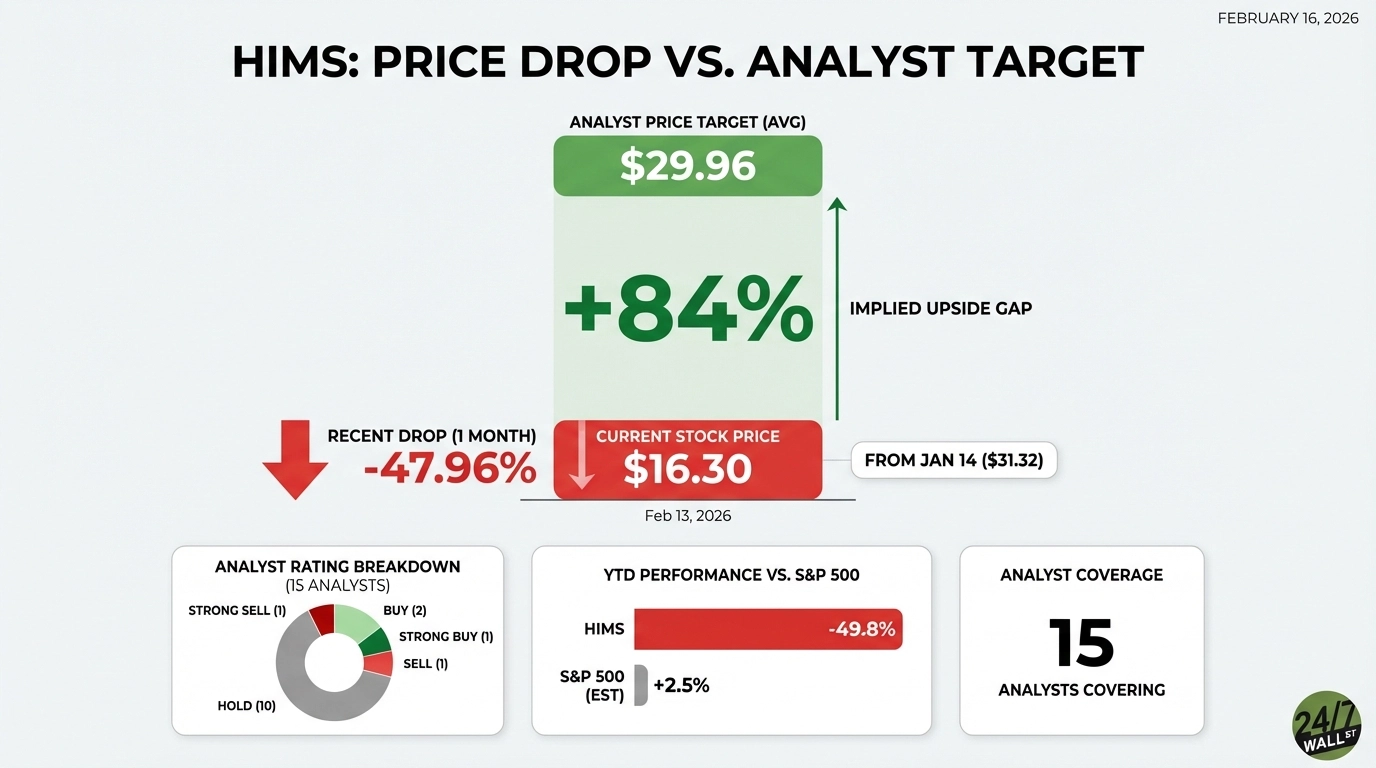

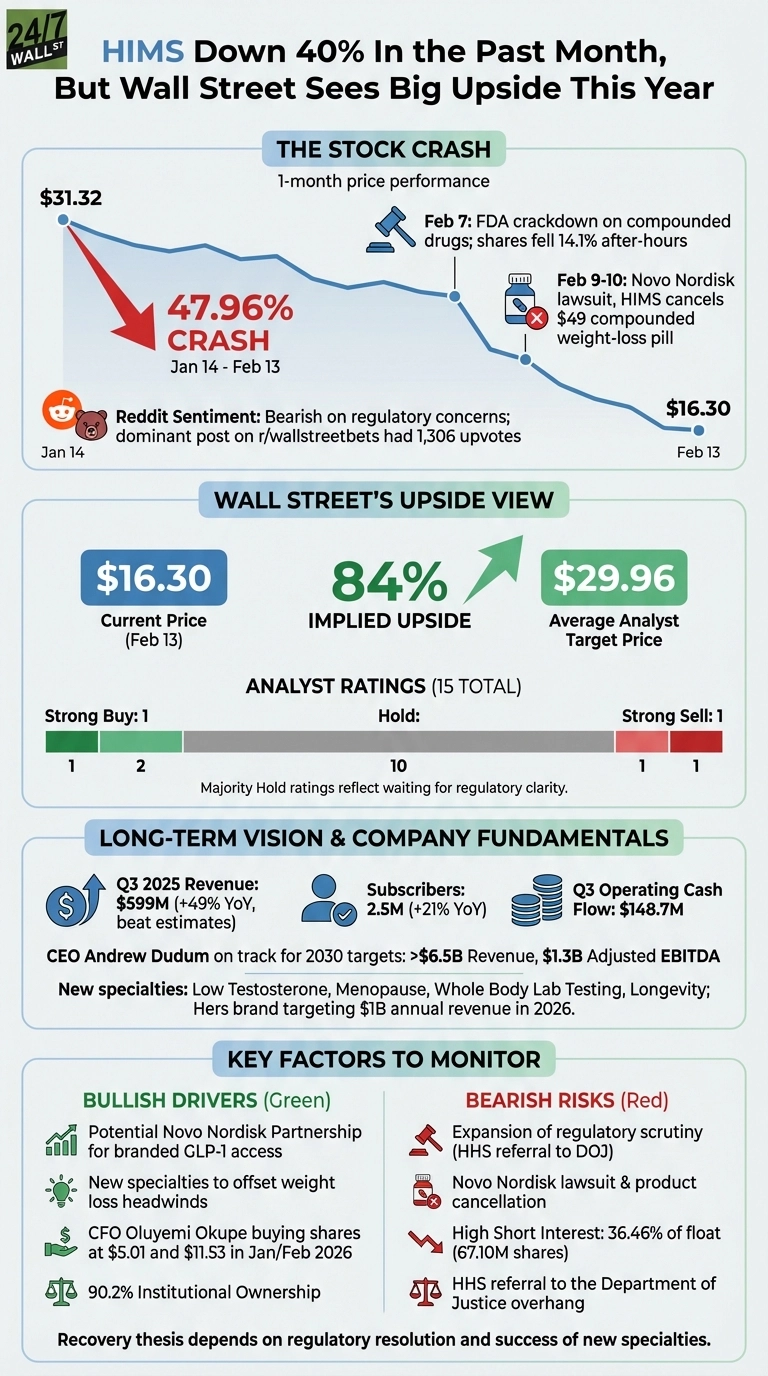

Hims & Hers Health (NYSE:HIMS) has crashed 47.96% over the past month, falling from $31.32 on January 14 to $16.30 as of February 13. Yet Wall Street analysts still see the telehealth platform reaching an average price target of $29.96, implying 84% upside from current levels. The disconnect raises a critical question about whether this represents a buying opportunity or a value trap.

Regulatory Crackdown Sparked the Selloff

The collapse began February 7 when the FDA announced action against Hims’ $49 compounded weight-loss pill, citing concerns over quality, safety, and federal law violations. Shares fell 14.1% in after-hours trading. The pain intensified February 9-10 when Novo Nordisk (NYSE:NVO) sued Hims for patent infringement over compounded semaglutide, forcing the company to cancel its newly launched Wegovy alternative.

This wasn’t a minor product hiccup. Hims had strategically positioned itself in the booming GLP-1 weight loss market, targeting patients who couldn’t afford or access branded alternatives like Wegovy. The regulatory crackdown and lawsuit strike at the core of that growth strategy. Reddit sentiment turned sharply bearish, with the dominant post on r/wallstreetbets attracting 1,306 upvotes and 236 comments discussing the FDA restrictions.

Wall Street Still Sees the Long-Term Vision Intact

Despite regulatory headwinds, analysts remain surprisingly optimistic. Of the 15 analysts covering the stock, 1 rates it Strong Buy, 2 rate it Buy, and 10 rate it Hold. Only 2 analysts have Sell or Strong Sell ratings. The bull case centers on Hims’ ability to expand beyond weight loss into new specialties while maintaining strong subscriber growth and cash generation.

The company reported Q3 2025 revenue of $599 million, beating estimates and growing 49% year-over-year. Subscriber growth remains robust at 21% YoY to 2.5 million. Management is hoping for a solution with Novo Nordisk to offer Wegovy injections and oral Wegovy once FDA approved, which could restore access to the branded GLP-1 market. CEO Andrew Dudum maintains the company is on track to hit 2030 targets of more than $6.5 billion in revenue and $1.3 billion in adjusted EBITDA.

Analysts also point to the company’s expansion into low testosterone treatment, menopause care, whole body lab testing, and longevity specialties as diversification that reduces reliance on weight loss alone. The Hers brand is targeting over $1 billion in annual revenue in 2026.

The Numbers

Current Situation:

- Current Price: $16.30

- Average Analyst Target: $29.96

- Implied Upside: 84%

- Analysts Covering: 15

- One-Month Performance: Down 47.96%

- Year-to-Date Performance: Down 49.8%

Analyst Ratings:

- Strong Buy: 1

- Buy: 2

- Hold: 10

- Sell: 1

- Strong Sell: 1

The ratings breakdown shows limited conviction. Ten Hold ratings suggest analysts are waiting to see how regulatory issues resolve before committing to stronger recommendations. CFO Oluyemi Okupe has been aggressively buying shares during the dip, acquiring shares at $5.01 and $11.53 in January and February 2026, signaling management confidence at depressed valuations.

Key Factors to Monitor

The bull case strengthens if the company secures a clear partnership with Novo Nordisk for branded GLP-1 access and demonstrates that new specialties can offset weight loss headwinds. The underlying business fundamentals remain strong with $148.7 million in operating cash flow in Q3 and 90.2% institutional ownership suggesting sophisticated investors haven’t abandoned the thesis. The CFO’s insider buying adds credibility to the recovery narrative.

Risk factors include potential expansion of regulatory scrutiny beyond compounded weight loss drugs or failure of the Novo partnership to materialize. The HHS referral to the Department of Justice represents a serious overhang. Short interest has surged to 67.10 million shares, representing 36.46% of the float, far above the peer average, indicating institutional skepticism remains high.

The 84% implied upside assumes regulatory headwinds clear and the diversification strategy executes. Investors are likely waiting for at least one quarter showing weight loss stabilization and traction in new specialties before the recovery thesis gains broader support.