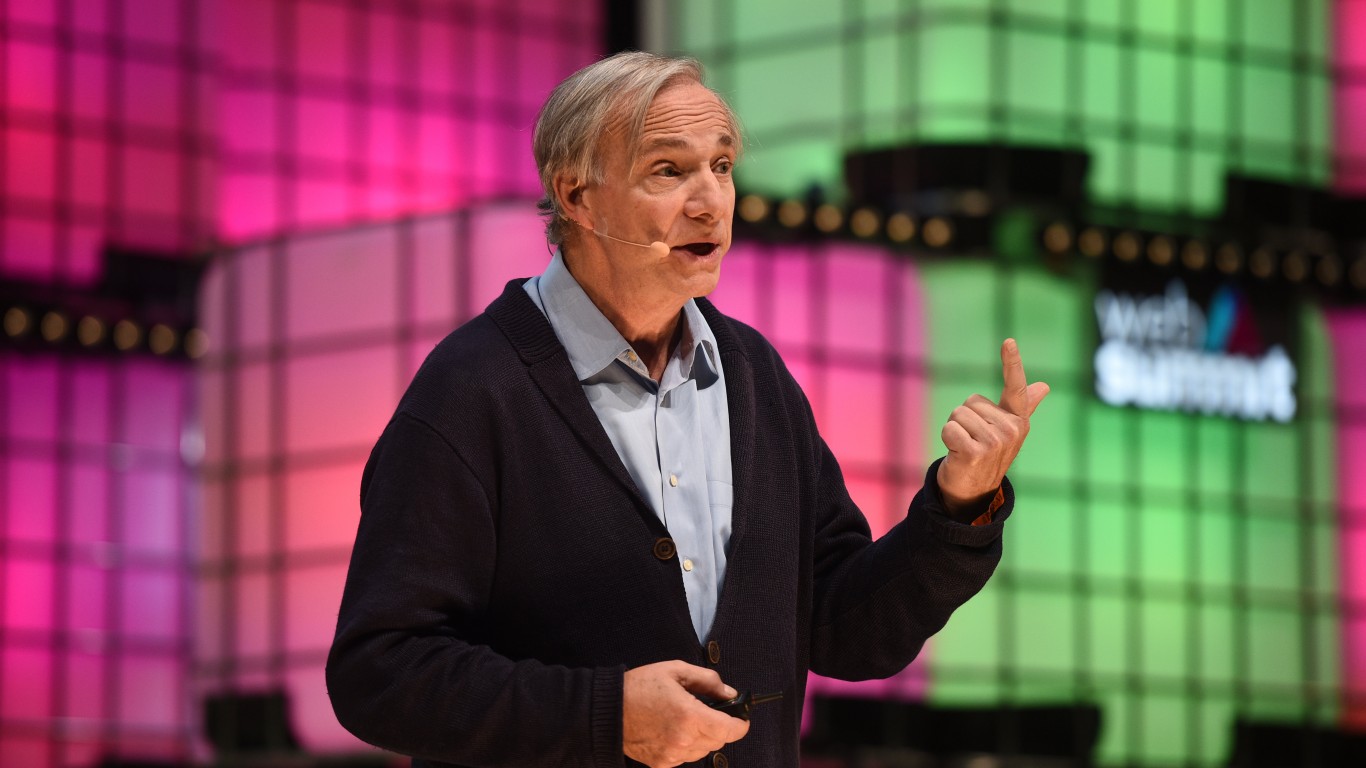

Legendary investor Ray Dalio has repeatedly expressed concerns about the U.S. economy. He’s discussed the unsustainable debt and geopolitical conflicts and is concerned about the long-term economic growth. In the fourth quarter, Bridgewater Associates reduced holdings in the major tech stocks, raising concerns about the future of artificial intelligence and increased capital spending.

Dalio sold some of the biggest tech stocks, including Microsoft Corporation (NASDAQ:MSFT), | MSFT Price Prediction Meta Platforms (NASDAQ:META) and Alphabet (NASDAQ:GOOG)(NASDAQ:GOOGL). These are some of the most prominent tech companies leading the AI race, but Dalio decided to offload these stocks. He has significantly reduced his position in all three companies. Let’s dive deeper into it.

Microsoft Corporation

Dalio offloaded 113,078 shares in Microsoft Corporation. The current holdings form 1.74% of the portfolio, down from 2.23%. MSFT stock has been volatile and dropped 4.25% in the past year. The stock has seen a pullback despite the strong financials. However, Wall Street remains bullish on the stock and expects a significant upside.

Microsoft has seen steady revenue growth, driven by Azure and the cloud segment. It has also seen strong Copilot adoption and record commercial bookings. One big reason investors are dumping Microsoft is the failure to justify the high AI spending.

There’s anxiety over AI margins versus the growing AI spending. This gap has led to a sell-off. There are also concerns surrounding high valuation and an expected market correction.

Meta Platforms

The hedge fund sold 193,218 shares of Meta Platforms. The stock had rallied earlier, driven by the strong fourth-quarter results and an upbeat first-quarter guidance. However, in the past year, META stock is down 7.20% and is exchanging hands for $644 today.

While analysts remain bullish on the stock, many investors think that Meta is spending more than required on AI. Its capex and expenses are set to rise due to heavy AI investment throughout 2026. However, faster revenue growth could help maintain a strong balance.

There’s skepticism surrounding the return on investment, and investors are concerned about the heavy spending, which exceeded $100 billion in a single year. If there’s an AI bubble burst, Meta stock could suffer more than expected. Additionally, Metaverse remains an unprofitable business and has continuously generated operating losses.

Dalio’s Meta holdings have gone from 1.20% to 0.54% of the portfolio now.

Alphabet Inc.

Alphabet forms 1.82% of the fund’s portfolio. Dalio trimmed his stake in the tech giant by 1,063,070 shares. The hedge fund started purchasing Alphabet stock in 2016 and has steadily increased its stake. GOOG stock has been on a rally and gained 62% in the past year, exchanging hands for $303. Investors are concerned about whether the stock still has room to run.

The bulls see an excellent opportunity in Google with steady cloud revenue growth, impressive backlog, and long-term profitability. On the other hand, the bears are concerned about the high capex spending and regulatory risks.

Key takeaway

I wouldn’t say Dalio has moved away from the tech sector completely. The reduction could be a part of the broader trend where Dalio sold major positions in AI stocks while adding emerging tech stocks to the portfolio.

He has added several tech stocks to his portfolio during the quarter. These include Nvidia (NASDAQ: NVDA), Broadcom Inc. (NASDAQ: AVGO), Oracle (NYSE:ORCL), Adobe (NASDAQ:ADBE), and Micron Technology (NASDAQ: MU). His largest holdings continue to remain SPDR S&P 500 ETF (SPY), iShares Core S&P 500 ETF (NYSEARCA:IVV), and Nvidia.

While investors shouldn’t follow any billionaire’s moves blindly, their decisions can help make a quick review of your portfolio.