Special Report

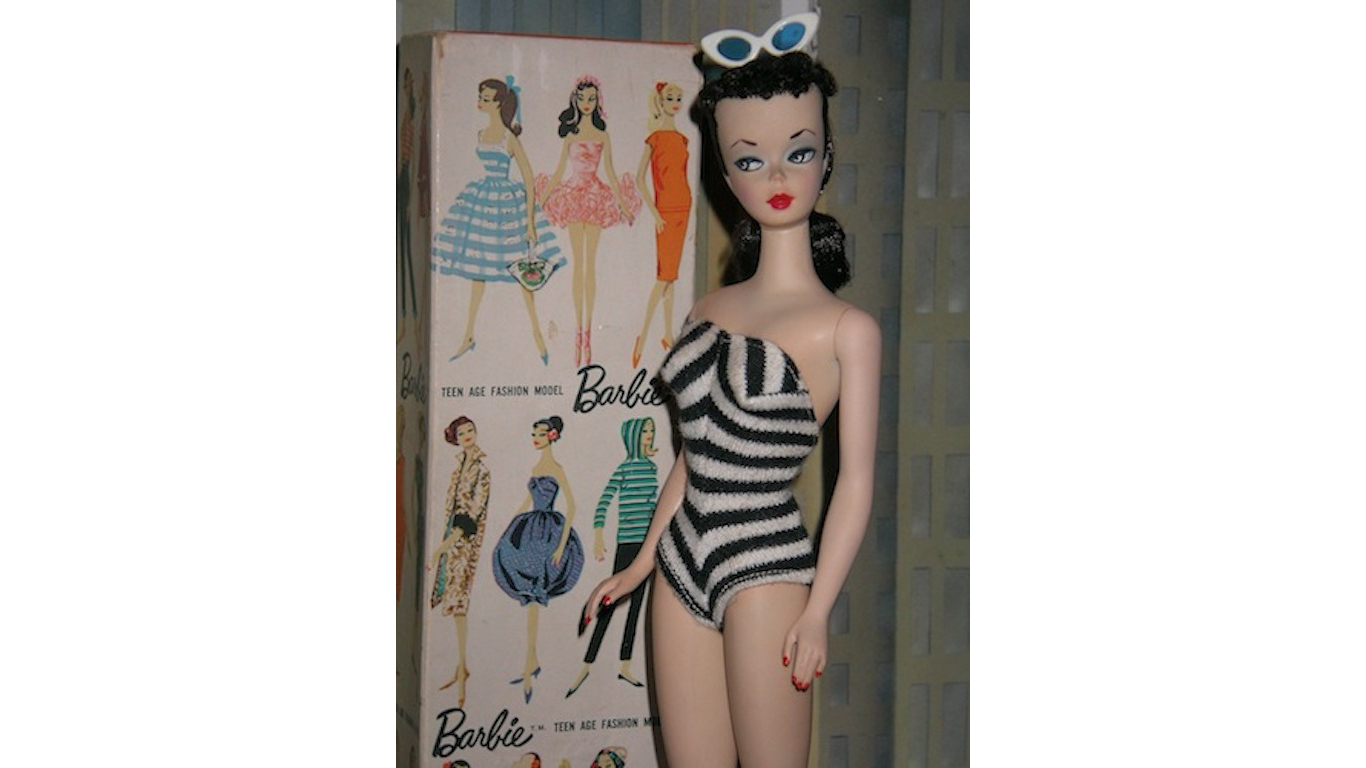

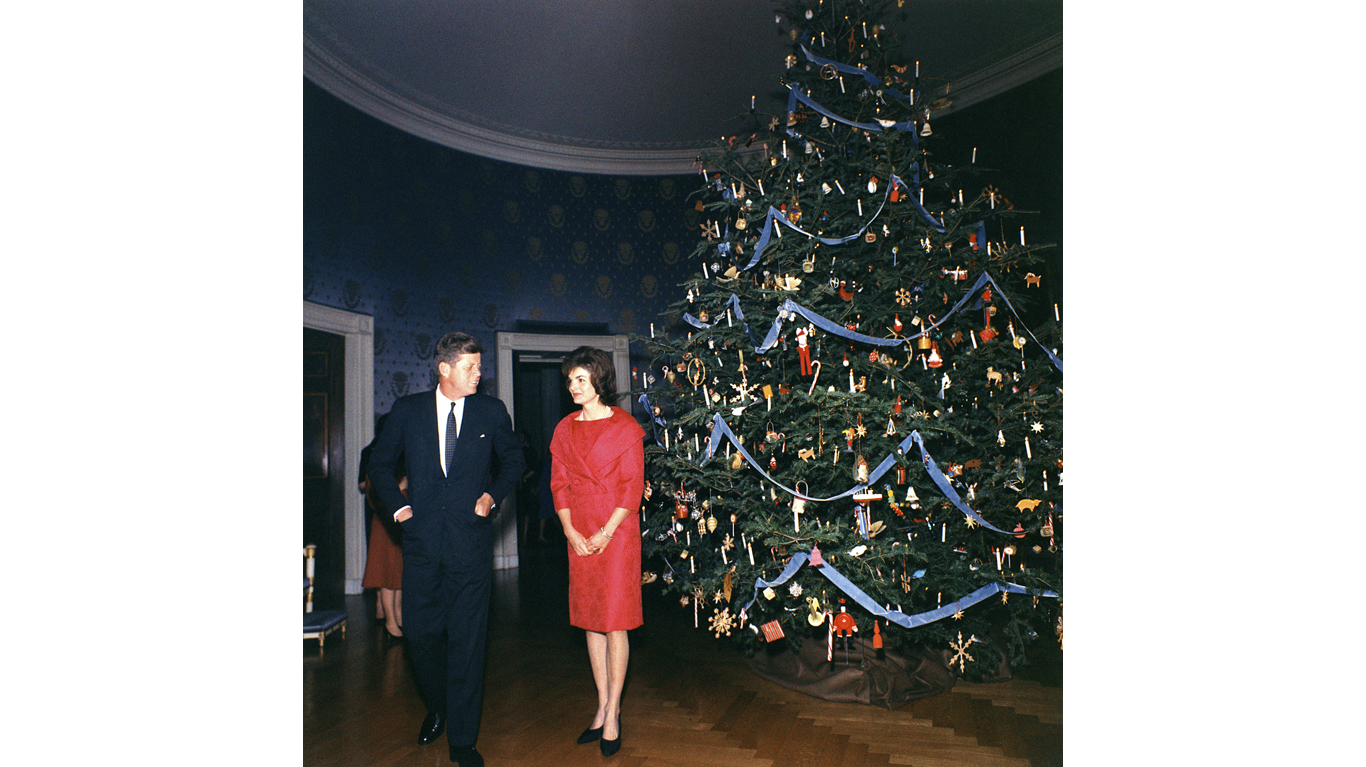

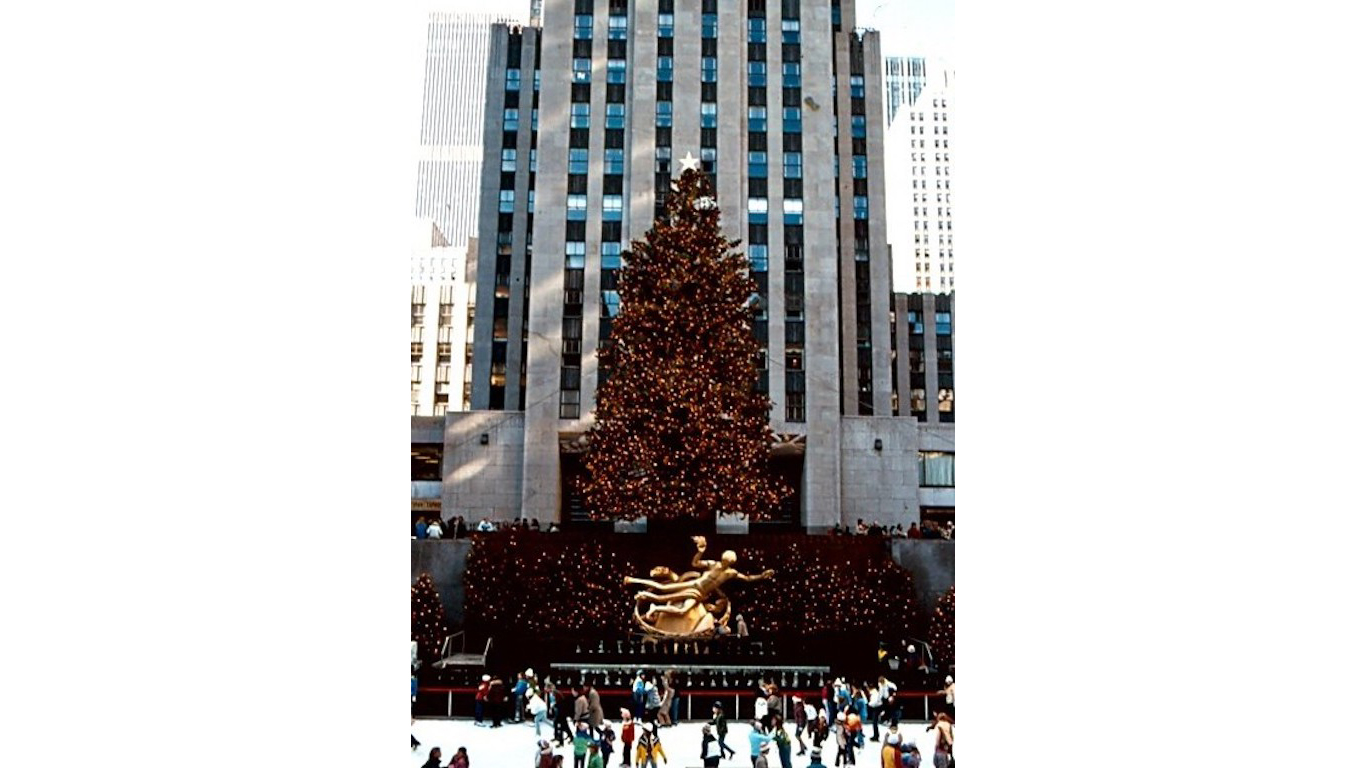

What Americans Spent on Christmas the Year You Were Born

Published:

Last Updated:

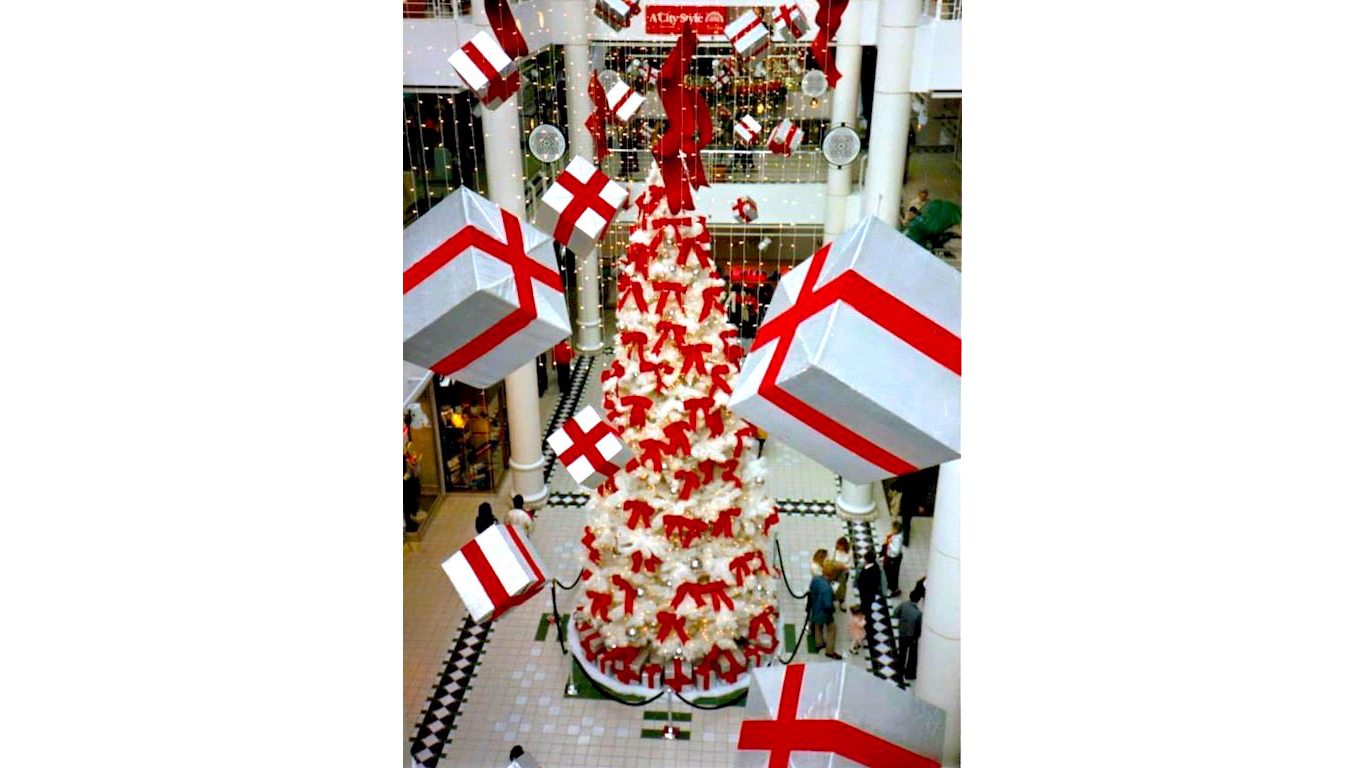

The vast majority of Americans celebrate Christmas with lights, carols, fir trees and wreaths, as well as, of course, by buying and exchanging gifts. For most people, the celebration means, above all, spending more money. With sales across virtually all retail areas increasing dramatically at the end of the year, the Christmas season is a reliable annual economic boost for many U.S. businesses.

Using a model based on the National Retail Federation holiday spending methodology, 24/7 Wall St. determined how much a person spent on average during the season — in November and December — of each year since 1940. Back then, Americans spent just over $27 billion during the Christmas season, or about $205 per person on average.

Since then, the U.S. population has more than doubled, and spending during the holidays has increased many times over. At a total of $631.7 billion, 2015 holiday spending is the highest on record. The average spending per person over November and December 2015 was almost $2,000, also the highest of any year for which data are available.

Click here to see what American’s spent on Christmas the year you were born.

Gifts, mostly for Christmas, will continue to account for a good chunk of the holiday spending. According to a Gallup poll conducted from November 9-13, 2016 the average American plans to spend approximately $750 on just gifts this holiday season.

For over a decade, U.S. jewelry stores have relied on the holiday season for between 25% and 30% of their annual revenue. Last year, 27.4% of jewelry sales occurred in November and December, the highest percentage of all industries. For reference, with no seasonality whatsoever, the average two months of sales would amount to 16.7% of annual revenue. For the jewelry industry specifically, an average two-month period outside the holiday season almost never brings in more than 15% of the year’s revenue.

To determine Christmas spending in each year, 24/7 Wall St. reviewed consumer spending in November and December published by the U.S. Census Bureau each year from 1992 through 2015. Using a model based on the National Retail Federation holiday spending methodology, we estimated spending levels in each year since 1940. In line with figures published by the NRF, average spending over November and December includes all purchases except spending on restaurants, cars, and gas. Personal income per capita, adjusted for inflation, in each year came from the Bureau of Economic Analysis.

Here is what Americans spent on Christmas each year since 1940.

1940

> Holiday spending per capita: $205.26

> Personal income per capita: $7,621.53

> Total holiday spending: $27.12 billion

> Population: 132,122,446

1941

> Holiday spending per capita: $212.94

> Personal income per capita: $8,762.62

> Total holiday spending: $28.41 billion

> Population: 133,402,471

1942

> Holiday spending per capita: $220.94

> Personal income per capita: $9,975.54

> Total holiday spending: $29.80 billion

> Population: 134,859,553

1943

> Holiday spending per capita: $228.26

> Personal income per capita: $11,107.73

> Total holiday spending: $31.21 billion

> Population: 136,739,353

1944

> Holiday spending per capita: $234.80

> Personal income per capita: $11,275.21

> Total holiday spending: $32.50 billion

> Population: 138,397,345

1945

> Holiday spending per capita: $240.95

> Personal income per capita: $11,108.39

> Total holiday spending: $33.72 billion

> Population: 139,928,165

1946

> Holiday spending per capita: $247.18

> Personal income per capita: $10,680.97

> Total holiday spending: $34.95 billion

> Population: 141,388,566

1947

> Holiday spending per capita: $251.44

> Personal income per capita: $10,133.64

> Total holiday spending: $36.24 billion

> Population: 144,126,071

1948

> Holiday spending per capita: $256.52

> Personal income per capita: $10,352.30

> Total holiday spending: $37.61 billion

> Population: 146,631,302

1949

> Holiday spending per capita: $259.82

> Personal income per capita: $10,134.31

> Total holiday spending: $38.76 billion

> Population: 149,188,130

1950

> Holiday spending per capita: $263.99

> Personal income per capita: $10,866.39

> Total holiday spending: $40.20 billion

> Population: 152,271,417

1951

> Holiday spending per capita: $269.52

> Personal income per capita: $11,311.41

> Total holiday spending: $41.74 billion

> Population: 154,877,889

1952

> Holiday spending per capita: $273.92

> Personal income per capita: $11,645.38

> Total holiday spending: $43.16 billion

> Population: 157,552,740

1953

> Holiday spending per capita: $278.23

> Personal income per capita: $11,979.42

> Total holiday spending: $44.57 billion

> Population: 160,184,192

1954

> Holiday spending per capita: $281.00

> Personal income per capita: $11,788.06

> Total holiday spending: $45.81 billion

> Population: 163,025,854

1955

> Holiday spending per capita: $285.10

> Personal income per capita: $12,374.17

> Total holiday spending: $47.31 billion

> Population: 165,931,202

1956

> Holiday spending per capita: $289.17

> Personal income per capita: $12,791.28

> Total holiday spending: $48.84 billion

> Population: 168,903,031

1957

> Holiday spending per capita: $292.71

> Personal income per capita: $12,895.04

> Total holiday spending: $50.34 billion

> Population: 171,984,130

1958

> Holiday spending per capita: $295.78

> Personal income per capita: $12,759.66

> Total holiday spending: $51.73 billion

> Population: 174,881,904

1959

> Holiday spending per capita: $299.74

> Personal income per capita: $13,134.86

> Total holiday spending: $53.30 billion

> Population: 177,829,628

1960

> Holiday spending per capita: $303.48

> Personal income per capita: $13,327.84

> Total holiday spending: $54.83 billion

> Population: 180,671,158

1961

> Holiday spending per capita: $306.81

> Personal income per capita: $13,543.76

> Total holiday spending: $56.36 billion

> Population: 183,691,481

1962

> Holiday spending per capita: $311.18

> Personal income per capita: $14,018.47

> Total holiday spending: $58.05 billion

> Population: 186,537,737

1963

> Holiday spending per capita: $315.40

> Personal income per capita: $14,349.11

> Total holiday spending: $59.69 billion

> Population: 189,241,798

1964

> Holiday spending per capita: $320.68

> Personal income per capita: $14,954.26

> Total holiday spending: $61.53 billion

> Population: 191,888,791

1965

> Holiday spending per capita: $326.91

> Personal income per capita: $15,725.50

> Total holiday spending: $63.52 billion

> Population: 194,302,963

1966

> Holiday spending per capita: $334.04

> Personal income per capita: $16,482.90

> Total holiday spending: $65.66 billion

> Population: 196,560,338

1967

> Holiday spending per capita: $340.95

> Personal income per capita: $17,060.01

> Total holiday spending: $67.75 billion

> Population: 198,712,056

1968

> Holiday spending per capita: $349.88

> Personal income per capita: $17,844.56

> Total holiday spending: $70.22 billion

> Population: 200,706,052

1969

> Holiday spending per capita: $359.30

> Personal income per capita: $18,515.65

> Total holiday spending: $72.82 billion

> Population: 202,676,946

1970

> Holiday spending per capita: $367.57

> Personal income per capita: $18,886.84

> Total holiday spending: $75.37 billion

> Population: 205,052,174

1971

> Holiday spending per capita: $375.72

> Personal income per capita: $19,285.78

> Total holiday spending: $78.02 billion

> Population: 207,660,677

1972

> Holiday spending per capita: $386.74

> Personal income per capita: $20,260.49

> Total holiday spending: $81.18 billion

> Population: 209,896,021

1973

> Holiday spending per capita: $400.37

> Personal income per capita: $21,178.63

> Total holiday spending: $84.84 billion

> Population: 211,908,788

1974

> Holiday spending per capita: $413.86

> Personal income per capita: $20,857.00

> Total holiday spending: $88.50 billion

> Population: 213,853,928

1975

> Holiday spending per capita: $427.73

> Personal income per capita: $20,854.84

> Total holiday spending: $92.38 billion

> Population: 215,973,199

1976

> Holiday spending per capita: $443.13

> Personal income per capita: $21,468.61

> Total holiday spending: $96.62 billion

> Population: 218,035,164

1977

> Holiday spending per capita: $460.63

> Personal income per capita: $22,037.29

> Total holiday spending: $101.45 billion

> Population: 220,239,425

1978

> Holiday spending per capita: $482.59

> Personal income per capita: $22,903.66

> Total holiday spending: $107.42 billion

> Population: 222,584,545

1979

> Holiday spending per capita: $505.69

> Personal income per capita: $23,251.67

> Total holiday spending: $113.81 billion

> Population: 225,055,487

1980

> Holiday spending per capita: $531.62

> Personal income per capita: $23,191.50

> Total holiday spending: $120.80 billion

> Population: 227,224,681

1981

> Holiday spending per capita: $561.40

> Personal income per capita: $23,619.05

> Total holiday spending: $128.82 billion

> Population: 229,465,714

1982

> Holiday spending per capita: $582.27

> Personal income per capita: $23,733.42

> Total holiday spending: $134.89 billion

> Population: 231,664,458

1983

> Holiday spending per capita: $604.22

> Personal income per capita: $24,094.68

> Total holiday spending: $141.26 billion

> Population: 233,791,994

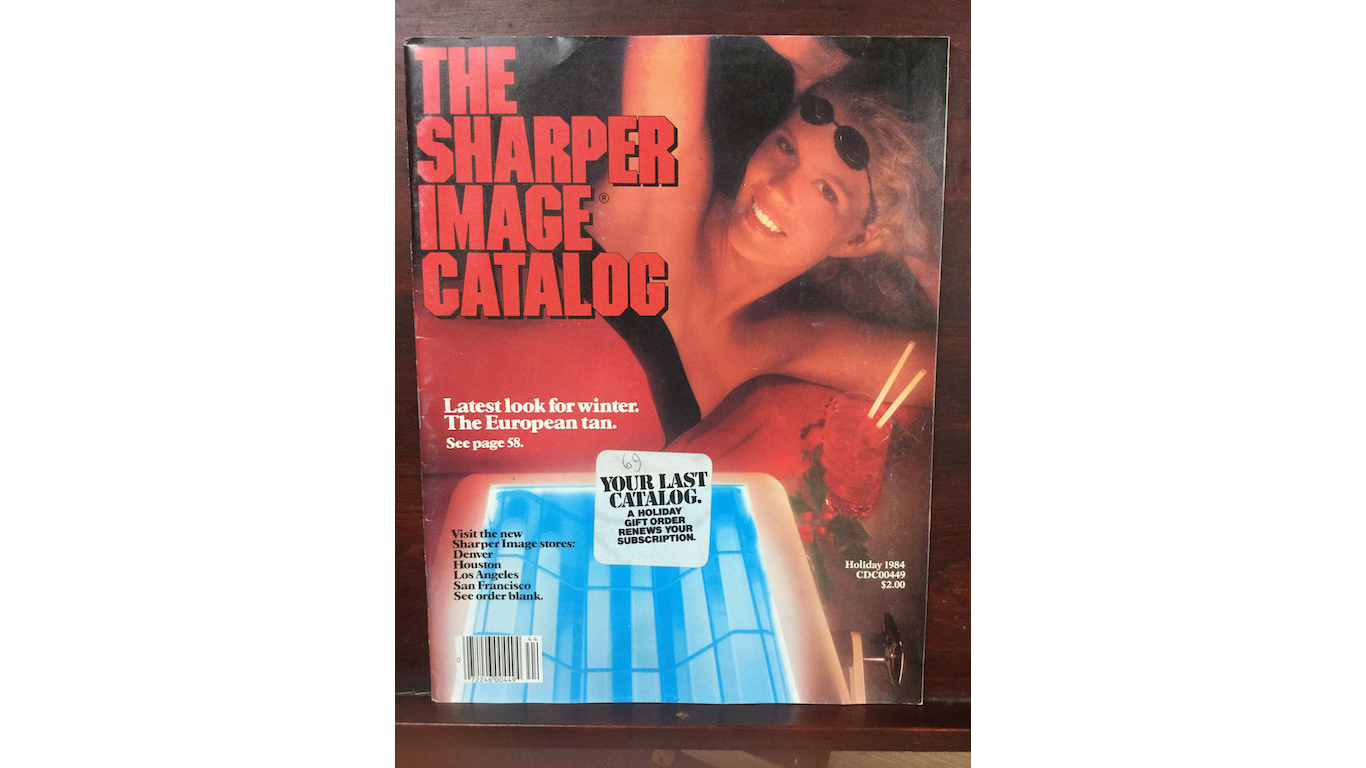

1984

> Holiday spending per capita: $638.35

> Personal income per capita: $25,429.90

> Total holiday spending: $150.54 billion

> Population: 235,824,902

1985

> Holiday spending per capita: $665.04

> Personal income per capita: $26,083.38

> Total holiday spending: $158.23 billion

> Population: 237,923,795

1986

> Holiday spending per capita: $689.13

> Personal income per capita: $26,802.49

> Total holiday spending: $165.48 billion

> Population: 240,132,887

1987

> Holiday spending per capita: $715.59

> Personal income per capita: $27,371.67

> Total holiday spending: $173.38 billion

> Population: 242,288,918

1988

> Holiday spending per capita: $751.04

> Personal income per capita: $28,221.60

> Total holiday spending: $183.63 billion

> Population: 244,498,982

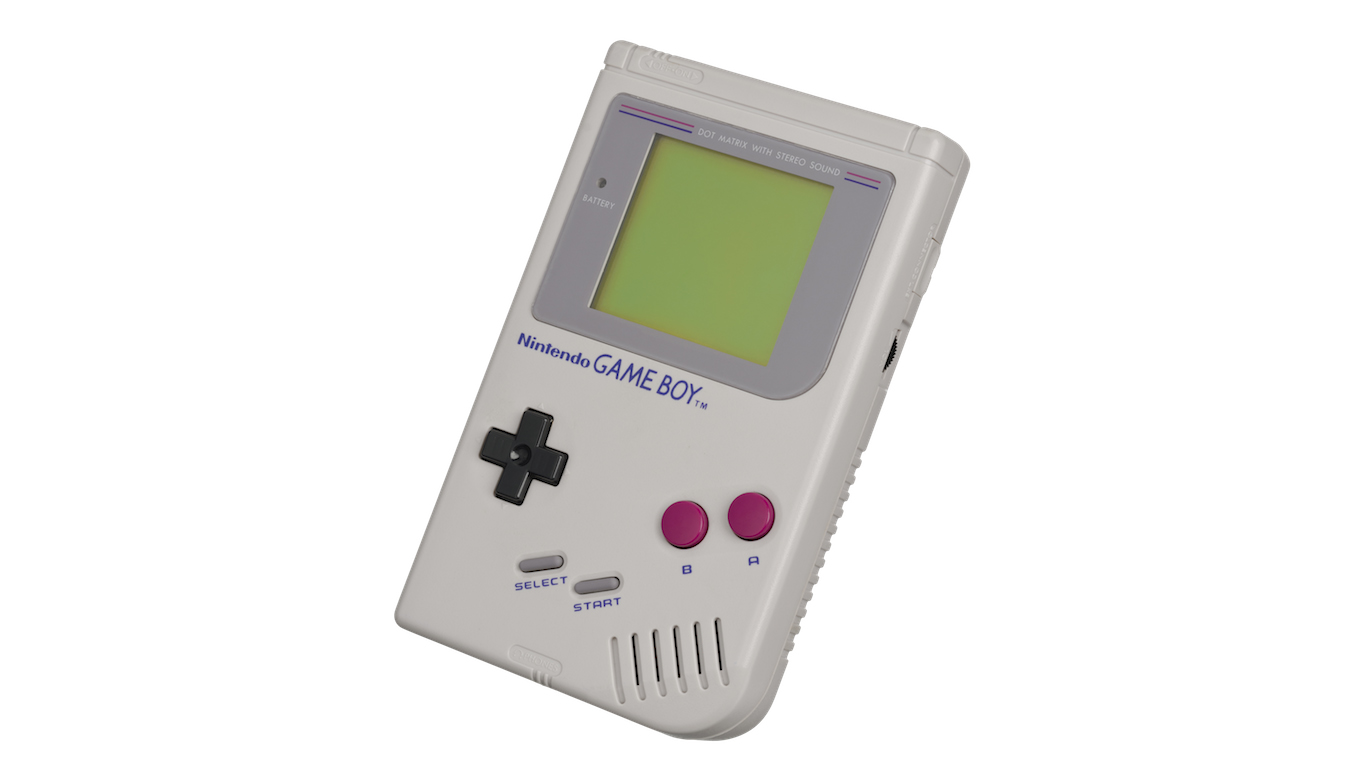

1989

> Holiday spending per capita: $788.71

> Personal income per capita: $28,956.46

> Total holiday spending: $194.67 billion

> Population: 246,819,230

1990

> Holiday spending per capita: $819.80

> Personal income per capita: $29,163.31

> Total holiday spending: $204.51 billion

> Population: 249,464,396

1991

> Holiday spending per capita: $838.83

> Personal income per capita: $28,886.92

> Total holiday spending: $211.51 billion

> Population: 252,153,092

1992

> Holiday spending per capita: $1,056.47

> Personal income per capita: $29,687.78

> Total holiday spending: $269.43 billion

> Population: 255,029,699

1993

> Holiday spending per capita: $1,116.09

> Personal income per capita: $29,904.63

> Total holiday spending: $287.71 billion

> Population: 257,782,608

1994

> Holiday spending per capita: $1,184.32

> Personal income per capita: $30,489.53

> Total holiday spending: $308.31 billion

> Population: 260,327,021

1995

> Holiday spending per capita: $1,216.51

> Personal income per capita: $31,300.76

> Total holiday spending: $319.70 billion

> Population: 262,803,276

1996

> Holiday spending per capita: $1,249.77

> Personal income per capita: $32,234.53

> Total holiday spending: $331.47 billion

> Population: 265,228,572

1997

> Holiday spending per capita: $1,291.51

> Personal income per capita: $33,332.75

> Total holiday spending: $345.85 billion

> Population: 267,783,607

1998

> Holiday spending per capita: $1,357.30

> Personal income per capita: $35,151.88

> Total holiday spending: $366.81 billion

> Population: 270,248,003

1999

> Holiday spending per capita: $1,455.29

> Personal income per capita: $36,117.27

> Total holiday spending: $396.84 billion

> Population: 272,690,813

2000

> Holiday spending per capita: $1,453.36

> Personal income per capita: $36,821.87

> Total holiday spending: $410.08 billion

> Population: 282,162,411

2001

> Holiday spending per capita: $1,475.35

> Personal income per capita: $37,236.72

> Total holiday spending: $420.43 billion

> Population: 284,968,955

2002

> Holiday spending per capita: $1,474.70

> Personal income per capita: $37,061.47

> Total holiday spending: $424.16 billion

> Population: 287,625,193

2003

> Holiday spending per capita: $1,530.86

> Personal income per capita: $37,358.69

> Total holiday spending: $444.12 billion

> Population: 290,107,933

2004

> Holiday spending per capita: $1,613.43

> Personal income per capita: $38,274.14

> Total holiday spending: $472.42 billion

> Population: 292,805,298

2005

> Holiday spending per capita: $1,690.32

> Personal income per capita: $38,929.52

> Total holiday spending: $499.52 billion

> Population: 295,516,599

2006

> Holiday spending per capita: $1,735.11

> Personal income per capita: $40,310.66

> Total holiday spending: $517.72 billion

> Population: 298,379,912

2007

> Holiday spending per capita: $1,755.80

> Personal income per capita: $41,026.11

> Total holiday spending: $528.90 billion

> Population: 301,231,207

2008

> Holiday spending per capita: $1,658.25

> Personal income per capita: $41,086.24

> Total holiday spending: $504.27 billion

> Population: 304,093,966

2009

> Holiday spending per capita: $1,649.16

> Personal income per capita: $39,426.08

> Total holiday spending: $505.92 billion

> Population: 306,771,529

2010

> Holiday spending per capita: $1,709.81

> Personal income per capita: $39,677.81

> Total holiday spending: $528.93 billion

> Population: 309,346,863

2011

> Holiday spending per capita: $1,771.34

> Personal income per capita: $40,826.78

> Total holiday spending: $552.16 billion

> Population: 311,718,857

2012

> Holiday spending per capita: $1,801.55

> Personal income per capita: $41,745.86

> Total holiday spending: $565.87 billion

> Population: 314,102,623

2013

> Holiday spending per capita: $1,831.24

> Personal income per capita: $41,361.52

> Total holiday spending: $579.46 billion

> Population: 316,427,395

2014

> Holiday spending per capita: $1,913.06

> Personal income per capita: $42,545.92

> Total holiday spending: $610.09 billion

> Population: 318,907,401

2015

> Holiday spending per capita: $1,965.37

> Personal income per capita: $43,909.15

> Total holiday spending: $631.71 billion

> Population: 321,418,820

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.