The American housing market took off during the early months of the COVID-19 pandemic. The homeownership rate – or the share of housing units occupied by their owner – jumped by 2.6 percentage points from the first quarter to the second quarter of 2020, by far the largest increase ever recorded. By the end of 2020, there were 2.1 million more homeowners in the United States than there were a year earlier.

The surge in home sales was fueled by several factors, including historically low mortgage rates, and, as some experts speculate, the pandemic, which led many Americans to re-evaluate where and how they live. Here is a look at the mortgage rate in America every year since 1972.

Nationwide, the homeownership rate stands at 64.4%, according to the latest American Community Survey data from the U.S. Census Bureau. This rate varies substantially across the country, however, and in some U.S. ZIP codes, the homeownership rate is well above the national average.

Using census data, 24/7 Wall St. identified the 50 ZIP codes with the highest homeownership rates. ZIP codes are ranked by the share of housing units occupied by their owners.

Among the ZIP codes on this list, homeownership rates range from about 97% to 100%. The ZIP codes on this list span the country, though New York state alone is home to six, more than any other state.

Homeownership can be expensive, especially in many of the ZIP codes on this list with higher than average home values. However, incomes in these areas also tend to be relatively high, making homeownership more affordable for larger shares of the population. In all but seven areas on this list, the median household income exceeds the national median of $64,994. Here is a look at the 20 cities where the middle class can no longer afford housing.

Click here to see the zip codes with the highest homeownership rates

Click here to read our detailed methodology

50. 14085

> Location: Wanakah, New York

> Homeownership rate: 97.3%

> Median home value: $206,700 — 7,734th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,653 — 5,991st highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $652 — 4,209th highest of 18,106 zip codes (tied)

> Median household income: $97,181 — 2,376th highest of 18,128 zip codes

[in-text-ad]

49. 44233

> Location: Hinckley, Ohio

> Homeownership rate: 97.3%

> Median home value: $329,600 — 3,756th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $2,132 — 3,160th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $696 — 3,561st highest of 18,106 zip codes (tied)

> Median household income: $107,656 — 1,563rd highest of 18,128 zip codes

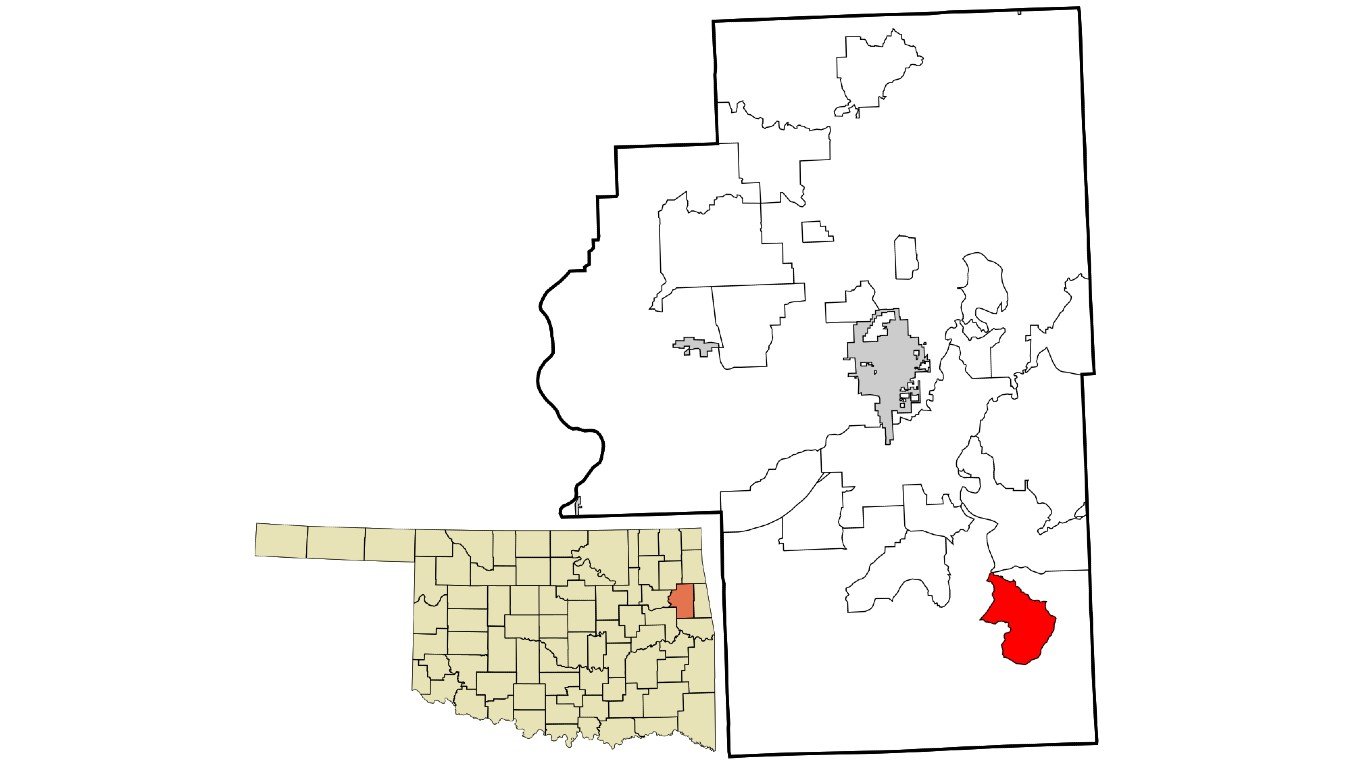

48. 73025

> Location: Edmond, Oklahoma

> Homeownership rate: 97.3%

> Median home value: $368,400 — 2,984th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,437 — 2,066th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $871 — 1,860th highest of 18,106 zip codes (tied)

> Median household income: $151,347 — 322nd highest of 18,128 zip codes

47. 22508

> Location: Lake of the Woods, Virginia

> Homeownership rate: 97.4%

> Median home value: $301,500 — 4,358th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $1,692 — 5,643rd highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $528 — 7,254th highest of 18,106 zip codes (tied)

> Median household income: $91,971 — 2,869th highest of 18,128 zip codes

[in-text-ad-2]

46. 68347

> Location: Eagle, Nebraska

> Homeownership rate: 97.5%

> Median home value: $206,800 — 7,726th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,531 — 7,112th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $626 — 4,684th highest of 18,106 zip codes (tied)

> Median household income: $81,979 — 4,130th highest of 18,128 zip codes

45. 21140

> Location: Riva, Maryland

> Homeownership rate: 97.5%

> Median home value: $472,200 — 1,828th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,402 — 2,160th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $631 — 4,589th highest of 18,106 zip codes (tied)

> Median household income: $124,671 — 833rd highest of 18,128 zip codes

[in-text-ad]

44. 20607

> Location: Accokeek, Maryland

> Homeownership rate: 97.5%

> Median home value: $397,400 — 2,572nd highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,707 — 1,434th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $774 — 2,635th highest of 18,106 zip codes (tied)

> Median household income: $140,810 — 462nd highest of 18,128 zip codes

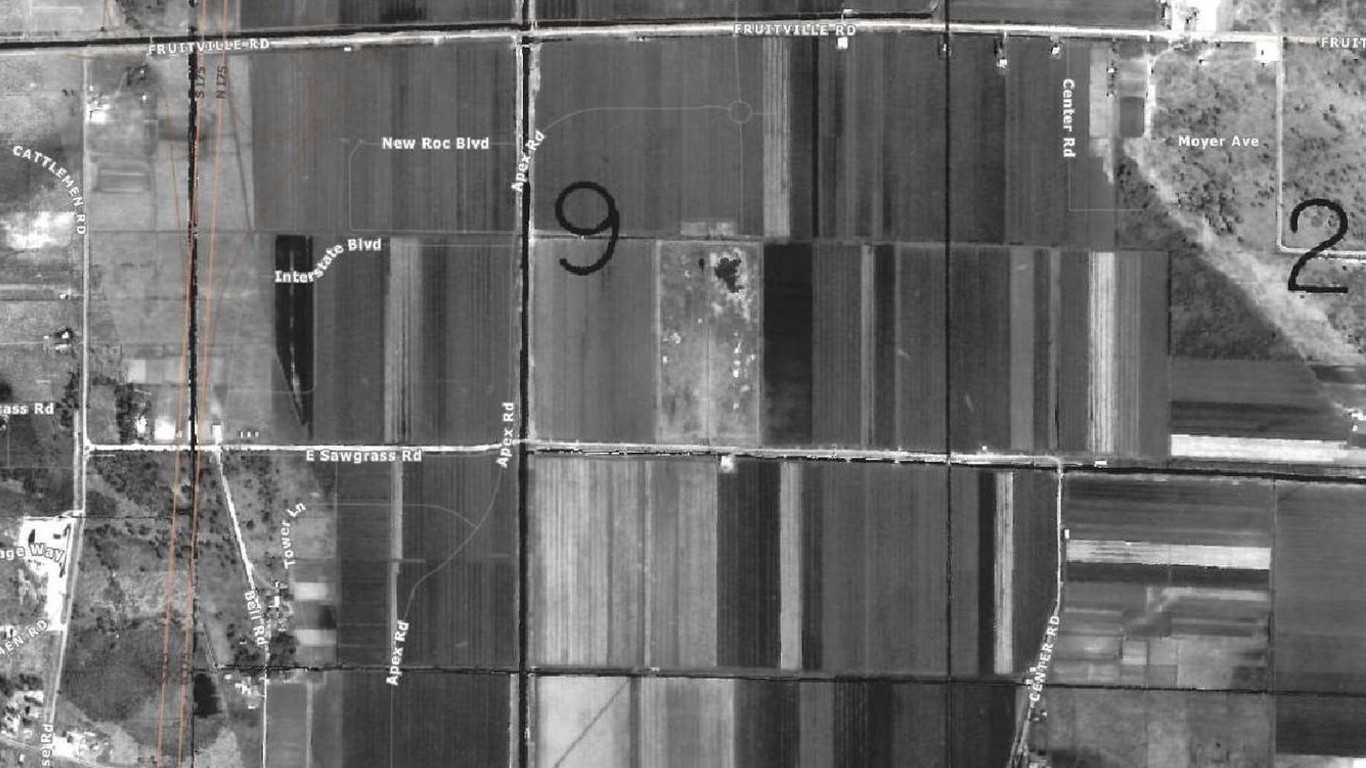

43. 34240

> Location: Fruitville, Florida

> Homeownership rate: 97.5%

> Median home value: $419,200 — 2,350th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,266 — 2,620th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $697 — 3,552nd highest of 18,106 zip codes (tied)

> Median household income: $94,046 — 2,652nd highest of 18,128 zip codes

42. 18438

> Location: Lakeville, Pennsylvania

> Homeownership rate: 97.6%

> Median home value: $254,500 — 5,775th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,608 — 6,384th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $398 — 4,959th lowest of 18,106 zip codes (tied)

> Median household income: $41,261 — 2,231st lowest of 18,128 zip codes

[in-text-ad-2]

41. 24435

> Location: Fairfield, Virginia

> Homeownership rate: 97.6%

> Median home value: $241,700 — 6,273rd highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,398 — 8,692nd highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $400 — 5,078th lowest of 18,106 zip codes (tied)

> Median household income: $51,115 — 5,521st lowest of 18,128 zip codes

40. 48022

> Location: Emmett, Michigan

> Homeownership rate: 97.6%

> Median home value: $178,800 — 8,879th lowest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,315 — 8,139th lowest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $493 — 8,551st highest of 18,106 zip codes (tied)

> Median household income: $79,074 — 4,605th highest of 18,128 zip codes

[in-text-ad]

39. 55011

> Location: East Bethel, Minnesota

> Homeownership rate: 97.6%

> Median home value: $279,400 — 4,941st highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,805 — 4,832nd highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $524 — 7,405th highest of 18,106 zip codes (tied)

> Median household income: $110,203 — 1,406th highest of 18,128 zip codes

38. 60558

> Location: Western Springs, Illinois

> Homeownership rate: 97.6%

> Median home value: $609,600 — 1,089th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $3,379 — 521st highest of 18,109 zip codes

> Median monthly housing costs (no mortgage): $1,148 — 734th highest of 18,106 zip codes (tied)

> Median household income: $184,412 — 103rd highest of 18,128 zip codes

37. 58047

> Location: Horace, North Dakota

> Homeownership rate: 97.7%

> Median home value: $427,200 — 2,275th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,421 — 2,116th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $814 — 2,295th highest of 18,106 zip codes (tied)

> Median household income: $136,806 — 538th highest of 18,128 zip codes

[in-text-ad-2]

36. 02779

> Location: Berkley, Massachusetts

> Homeownership rate: 97.7%

> Median home value: $367,900 — 2,997th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,168 — 2,997th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $778 — 2,592nd highest of 18,106 zip codes (tied)

> Median household income: $106,515 — 1,650th highest of 18,128 zip codes

35. 74427

> Location: Dry Creek, Oklahoma

> Homeownership rate: 97.8%

> Median home value: $115,200 — 3,722nd lowest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,053 — 3,203rd lowest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $333 — 1,764th lowest of 18,106 zip codes (tied)

> Median household income: $55,784 — 7,356th lowest of 18,128 zip codes

[in-text-ad]

34. 48028

> Location: Harsens Island, Michigan

> Homeownership rate: 97.8%

> Median home value: $304,600 — 4,294th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,702 — 5,552nd highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $560 — 6,281st highest of 18,106 zip codes (tied)

> Median household income: $68,553 — 6,820th highest of 18,128 zip codes (tied)

33. 12514

> Location: Clinton Corners, New York

> Homeownership rate: 97.8%

> Median home value: $330,700 — 3,733rd highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $1,930 — 4,040th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $808 — 2,339th highest of 18,106 zip codes (tied)

> Median household income: $108,125 — 1,534th highest of 18,128 zip codes (tied)

32. 37014

> Location: Arrington, Tennessee

> Homeownership rate: 97.8%

> Median home value: $549,700 — 1,372nd highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,815 — 1,217th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $590 — 5,484th highest of 18,106 zip codes (tied)

> Median household income: $123,137 — 870th highest of 18,128 zip codes

[in-text-ad-2]

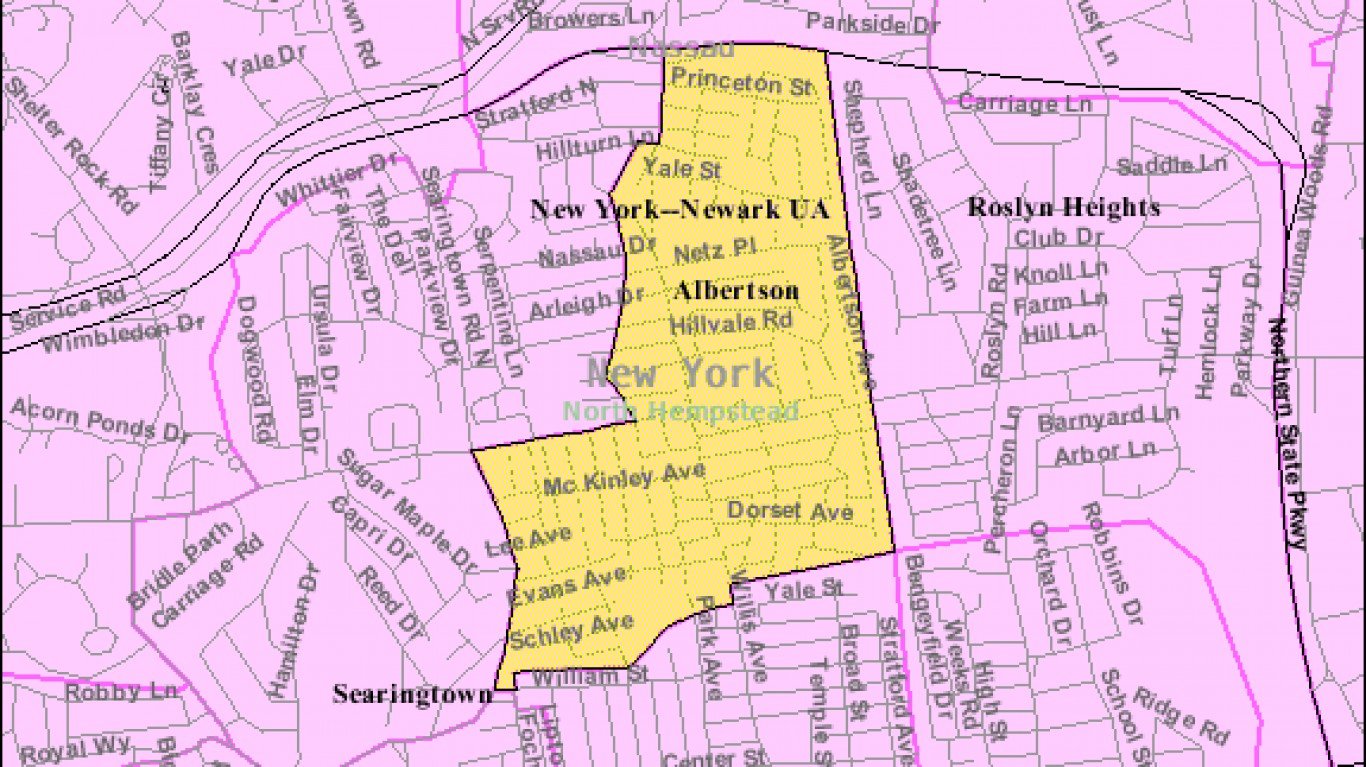

31. 11507

> Location: Albertson, New York

> Homeownership rate: 97.8%

> Median home value: $702,400 — 731st highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $3,867 — 285th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $1,500+ — the highest of 18,106 zip codes (tied)

> Median household income: $121,861 — 916th highest of 18,128 zip codes

30. 10994

> Location: West Nyack, New York

> Homeownership rate: 97.8%

> Median home value: $502,500 — 1,591st highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $3,072 — 816th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $1,472 — 242nd highest of 18,106 zip codes

> Median household income: $154,970 — 282nd highest of 18,128 zip codes

[in-text-ad]

29. 80512

> Location: Bellvue, Colorado

> Homeownership rate: 97.9%

> Median home value: $410,900 — 2,430th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $1,465 — 7,817th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $392 — 4,631st lowest of 18,106 zip codes (tied)

> Median household income: $66,324 — 7,387th highest of 18,128 zip codes (tied)

28. 73173

> Location: Oklahoma City, Oklahoma

> Homeownership rate: 97.9%

> Median home value: $310,000 — 4,188th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,946 — 3,972nd highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $719 — 3,267th highest of 18,106 zip codes (tied)

> Median household income: $123,104 — 873rd highest of 18,128 zip codes

27. 20777

> Location: Highland, Maryland

> Homeownership rate: 97.9%

> Median home value: $728,100 — 676th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $3,738 — 334th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $933 — 1,502nd highest of 18,106 zip codes (tied)

> Median household income: $198,111 — 66th highest of 18,128 zip codes

[in-text-ad-2]

26. 06883

> Location: Georgetown, Connecticut

> Homeownership rate: 97.9%

> Median home value: $840,700 — 467th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $4,000+ — the highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $1,500+ — the highest of 18,106 zip codes (tied)

> Median household income: $207,863 — 40th highest of 18,128 zip codes

25. 80542

> Location: Mead, Colorado

> Homeownership rate: 98.0%

> Median home value: $384,600 — 2,730th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,208 — 2,834th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $648 — 4,288th highest of 18,106 zip codes (tied)

> Median household income: $101,042 — 2,045th highest of 18,128 zip codes

[in-text-ad]

24. 20882

> Location: Damascus, Maryland

> Homeownership rate: 98.0%

> Median home value: $568,600 — 1,271st highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,803 — 1,240th highest of 18,109 zip codes

> Median monthly housing costs (no mortgage): $806 — 2,355th highest of 18,106 zip codes (tied)

> Median household income: $140,428 — 469th highest of 18,128 zip codes

23. 11762

> Location: Massapequa Park, New York

> Homeownership rate: 98.0%

> Median home value: $497,200 — 1,626th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $3,178 — 705th highest of 18,109 zip codes

> Median monthly housing costs (no mortgage): $1,342 — 371st highest of 18,106 zip codes (tied)

> Median household income: $145,321 — 388th highest of 18,128 zip codes

22. 19930

> Location: Bethany Beach, Delaware

> Homeownership rate: 98.1%

> Median home value: $610,500 — 1,080th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $2,267 — 2,617th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $556 — 6,401st highest of 18,106 zip codes (tied)

> Median household income: $100,278 — 2,107th highest of 18,128 zip codes

[in-text-ad-2]

21. 48363

> Location: Oakland, Michigan

> Homeownership rate: 98.1%

> Median home value: $409,400 — 2,443rd highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $2,457 — 2,013th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $704 — 3,462nd highest of 18,106 zip codes (tied)

> Median household income: $136,317 — 548th highest of 18,128 zip codes

20. 33478

> Location: Jupiter Farms, Florida

> Homeownership rate: 98.1%

> Median home value: $435,000 — 2,187th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,348 — 2,338th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $791 — 2,474th highest of 18,106 zip codes (tied)

> Median household income: $121,275 — 938th highest of 18,128 zip codes

[in-text-ad]

19. 48042

> Location: Macomb, Michigan

> Homeownership rate: 98.1%

> Median home value: $291,900 — 4,611th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $1,807 — 4,818th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $598 — 5,272nd highest of 18,106 zip codes (tied)

> Median household income: $109,364 — 1,450th highest of 18,128 zip codes

18. 03810

> Location: Alton Bay, New Hampshire

> Homeownership rate: 98.2%

> Median home value: $514,900 — 1,538th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,718 — 5,412th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $1,331 — 390th highest of 18,106 zip codes (tied)

> Median household income: $98,858 — 2,218th highest of 18,128 zip codes

17. 77441

> Location: Weston Lakes, Texas

> Homeownership rate: 98.2%

> Median home value: $462,600 — 1,905th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $3,324 — 561st highest of 18,109 zip codes

> Median monthly housing costs (no mortgage): $1,352 — 358th highest of 18,106 zip codes (tied)

> Median household income: $159,618 — 237th highest of 18,128 zip codes

[in-text-ad-2]

16. 18038

> Location: Danielsville, Pennsylvania

> Homeownership rate: 98.3%

> Median home value: $165,400 — 7,840th lowest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,982 — 3,795th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $519 — 7,605th highest of 18,106 zip codes (tied)

> Median household income: $85,524 — 3,614th highest of 18,128 zip codes

15. 19951

> Location: Harbeson, Delaware

> Homeownership rate: 98.4%

> Median home value: $298,000 — 4,441st highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,608 — 6,384th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $423 — 6,158th lowest of 18,106 zip codes (tied)

> Median household income: $84,799 — 3,727th highest of 18,128 zip codes

[in-text-ad]

14. 18954

> Location: Richboro, Pennsylvania

> Homeownership rate: 98.4%

> Median home value: $394,000 — 2,613th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $2,359 — 2,311th highest of 18,109 zip codes

> Median monthly housing costs (no mortgage): $910 — 1,631st highest of 18,106 zip codes (tied)

> Median household income: $131,421 — 645th highest of 18,128 zip codes

13. 21132

> Location: Pylesville, Maryland

> Homeownership rate: 98.5%

> Median home value: $412,200 — 2,415th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $2,692 — 1,478th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $612 — 4,957th highest of 18,106 zip codes (tied)

> Median household income: $127,865 — 729th highest of 18,128 zip codes

12. 19060

> Location: Chester Heights, Pennsylvania

> Homeownership rate: 98.5%

> Median home value: $432,400 — 2,224th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $2,758 — 1,321st highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $946 — 1,427th highest of 18,106 zip codes (tied)

> Median household income: $145,682 — 382nd highest of 18,128 zip codes

[in-text-ad-2]

11. 39108

> Location: McCool, Mississippi

> Homeownership rate: 98.6%

> Median home value: $65,900 — 368th lowest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,004 — 2,417th lowest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $283 — 408th lowest of 18,106 zip codes (tied)

> Median household income: $41,250 — 2,221st lowest of 18,128 zip codes (tied)

10. 24328

> Location: Fancy Gap, Virginia

> Homeownership rate: 98.6%

> Median home value: $137,700 — 5,560th lowest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $907 — 962nd lowest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $356 — 2,771st lowest of 18,106 zip codes (tied)

> Median household income: $44,853 — 3,282nd lowest of 18,128 zip codes

[in-text-ad]

9. 52411

> Location: Cedar Rapids, Iowa

> Homeownership rate: 98.6%

> Median home value: $328,800 — 3,774th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,203 — 2,855th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $687 — 3,681st highest of 18,106 zip codes (tied)

> Median household income: $149,653 — 343rd highest of 18,128 zip codes

8. 55020

> Location: Elko New Market, Minnesota

> Homeownership rate: 98.7%

> Median home value: $378,900 — 2,812th highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,217 — 2,799th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $706 — 3,435th highest of 18,106 zip codes (tied)

> Median household income: $134,836 — 583rd highest of 18,128 zip codes

7. 71929

> Location: Bismarck, Arkansas

> Homeownership rate: 98.8%

> Median home value: $120,600 — 4,181st lowest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,088 — 3,891st lowest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $274 — 298th lowest of 18,106 zip codes (tied)

> Median household income: $55,283 — 7,185th lowest of 18,128 zip codes (tied)

[in-text-ad-2]

6. 53017

> Location: Richfield, Wisconsin

> Homeownership rate: 98.8%

> Median home value: $349,100 — 3,372nd highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,198 — 2,875th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $623 — 4,747th highest of 18,106 zip codes (tied)

> Median household income: $137,930 — 516th highest of 18,128 zip codes

5. 27814

> Location: Blounts Creek, North Carolina

> Homeownership rate: 98.9%

> Median home value: $129,900 — 4,933rd lowest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,208 — 6,349th lowest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $443 — 7,178th lowest of 18,106 zip codes (tied)

> Median household income: $70,078 — 6,452nd highest of 18,128 zip codes

[in-text-ad]

4. 75480

> Location: Scroggins, Texas

> Homeownership rate: 99.0%

> Median home value: $257,200 — 5,672nd highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $1,606 — 6,405th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $800 — 2,397th highest of 18,106 zip codes (tied)

> Median household income: $62,206 — 8,577th highest of 18,128 zip codes

3. 03036

> Location: Derry, New Hampshire

> Homeownership rate: 99.2%

> Median home value: $359,100 — 3,168th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $2,375 — 2,261st highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $737 — 3,058th highest of 18,106 zip codes (tied)

> Median household income: $133,214 — 615th highest of 18,128 zip codes

2. 22539

> Location: Reedville, Virginia

> Homeownership rate: 100.0%

> Median home value: $365,300 — 3,034th highest of 18,114 zip codes

> Median monthly housing costs (w/ a mortgage): $1,548 — 6,950th highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $486 — 8,837th highest of 18,106 zip codes (tied)

> Median household income: $81,985 — 4,129th highest of 18,128 zip codes

[in-text-ad-2]

1. 10916

> Location: Campbell Hall, New York

> Homeownership rate: 100.0%

> Median home value: $358,400 — 3,181st highest of 18,114 zip codes (tied)

> Median monthly housing costs (w/ a mortgage): $2,575 — 1,731st highest of 18,109 zip codes (tied)

> Median monthly housing costs (no mortgage): $920 — 1,576th highest of 18,106 zip codes (tied)

> Median household income: $100,556 — 2,084th highest of 18,128 zip codes

Methodology

To determine the ZIP codes with the highest homeownership rates, 24/7 Wall St. reviewed five-year estimates of the share of housing units that are occupied by their owners from the U.S. Census Bureau’s 2020 American Community Survey. ZIP codes were ranked based on the percentage of housing units that are occupied by their owners. To break ties, we used the number of housing units that are occupied by their owners.

We used ZIP code tabulation areas — a census geography type that defines areal representations of United States Postal Service ZIP codes (USPS ZIP codes do not define geographic boundaries but instead are a network of mail delivery routes in a service area). We refer to census ZCTAs as zip codes.

ZIP codes were excluded if homeownership rates were not available in the 2020 ACS, if there were fewer than 1,000 housing units, or if the sampling error associated with a ZIP code’s data was deemed too high.

The sampling error was defined as too high if the coefficient of variation — a statistical assessment of how reliable an estimate is — for a ZIP code’s homeownership rate was above 15% and greater than two standard deviations above the mean CV for all ZIP codes’ homeownership rates. We similarly excluded ZIP codes that had a sampling error too high for their population, using the same definition.

Additional information on median home value, median housing costs with and without a mortgage, and median household income are also five-year estimates from the 2020 ACS.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.