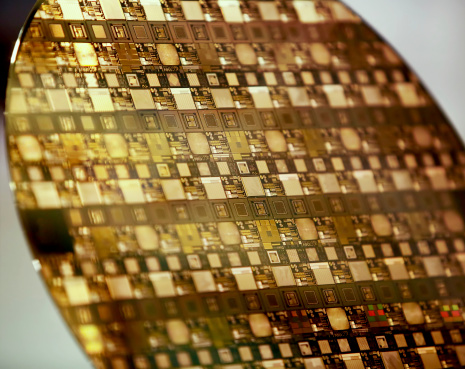

SunEdison Semiconductor Ltd. (NASDAQ: SEMI) has just announced the pricing for its secondary offering. Shares will be offered for $18.25 per share, for a total of roughly 15.94 million shares. The offering is valued at about $290 million. Source: Thinkstock

Source: Thinkstock

Deutsche Bank and Goldman Sachs are acting as lead book-running managers for the offering. Barclays, Credit Suisse and Morgan Stanley also are listed as book-running managers.

Note that the company will not receive any proceeds from the offering, only the selling shareholders.

The company primarily sells its products to the major semiconductor manufacturers throughout the world, including integrated device manufacturers, pure-play semiconductor foundries and, to a lesser extent, leading companies that specialize in wafer customization.

During 2014, SunEdison Semiconductor’s largest customers were Samsung, Taiwan Semiconductor and STMicroelectronics. It operates facilities in major semiconductor manufacturing regions throughout the world, including Taiwan, Malaysia, South Korea, Italy, Japan and the United States.

ALSO READ: Analyst Sees No Tech Bubble: 4 Stocks That Survive and Thrive

In its filing the company said:

The market for semiconductor wafers is large and growing. According to Gartner, Inc., or Gartner, the merchant semiconductor silicon wafer market in 2012 was approximately $9 billion, in 2013 was approximately $8 billion and in 2014 was approximately $9 billion worldwide and is expected to grow at a 5.5% compound annual growth rate, or CAGR, from 2013 to 2018, reaching approximately $10.4 billion by 2018. This growth in semiconductor wafer demand has been largely attributable to the proliferation of mobile devices such as smart phones and tablets. These devices require semiconductors that are energy efficient, low cost, high performance and highly integrated into a small footprint. Semiconductors offering those characteristics increasingly require EPI and SOI wafers. We believe that our process technology expertise in EPI and SOI wafer manufacturing combined with our capital efficiency provides us with significant opportunities as the markets for EPI and SOI wafers continue to grow.

Shares of SunEdison Semiconductor were down 3.2% at $18.59 Thursday morning. The stock has a consensus analyst price target of $25.20 and a 52-week trading range of $14.25 to $27.93.

Despite shares backing off after the pricing announcement, the stock is still up more than 3% year to date and over 12% higher in the past 52 weeks.

ALSO READ: Short Sellers Run for Cover in Semiconductors

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.