The top investing story of the day is Nvidia Corp.’s (NASDAQ: NVDA) solid first-quarter results, accompanied by a hard-to-believe second-quarter revenue outlook that was 50% higher than the Wall Street estimate. Given some comments from CEO Jensen Huang on the conference call following the earnings release, the AI revolution is about to pour $1 trillion into the pockets of suppliers to data centers.

These include chipmakers like Intel, software providers like ServiceNow and semiconductor equipment makers like ASML, but there are a few companies that investors believe are going to benefit more than others. Here is a look at four of them, plus one that is likely on the way.

Super Micro Computer Inc. (NASDAQ: SMCI) traded up about 19% Thursday morning, trailing only Nvidia’s 25% uptick. The company manufactures high-performance servers and storage solutions for data centers. If there is anything that AI applications need as much as processing power, it is a place to keep and from which to retrieve the massive amounts of data generated by the large language models AI requires. Super Micro fits the bill here.

Over the past year, Super Micro has added 325% to its share price. Nvidia’s 137% gain pales in comparison. The consensus estimates call for June-quarter revenue to rise 40% sequentially and about 10% year over year. The price-to-earnings multiple for the next 12 months is 18.7, compared to Nvidia’s 84.1 multiple. By nearly every valuation measure, Super Micro is undervalued.

Analyst coverage is sparse, with just six brokerages covering Super Micro. Four of them have a Buy or Strong Buy rating, and the other two rate it at Sell. At around $203.50 Thursday morning, shares traded above the average price target of $167.50. Expect more coverage of Super Micro, along with higher expectations.

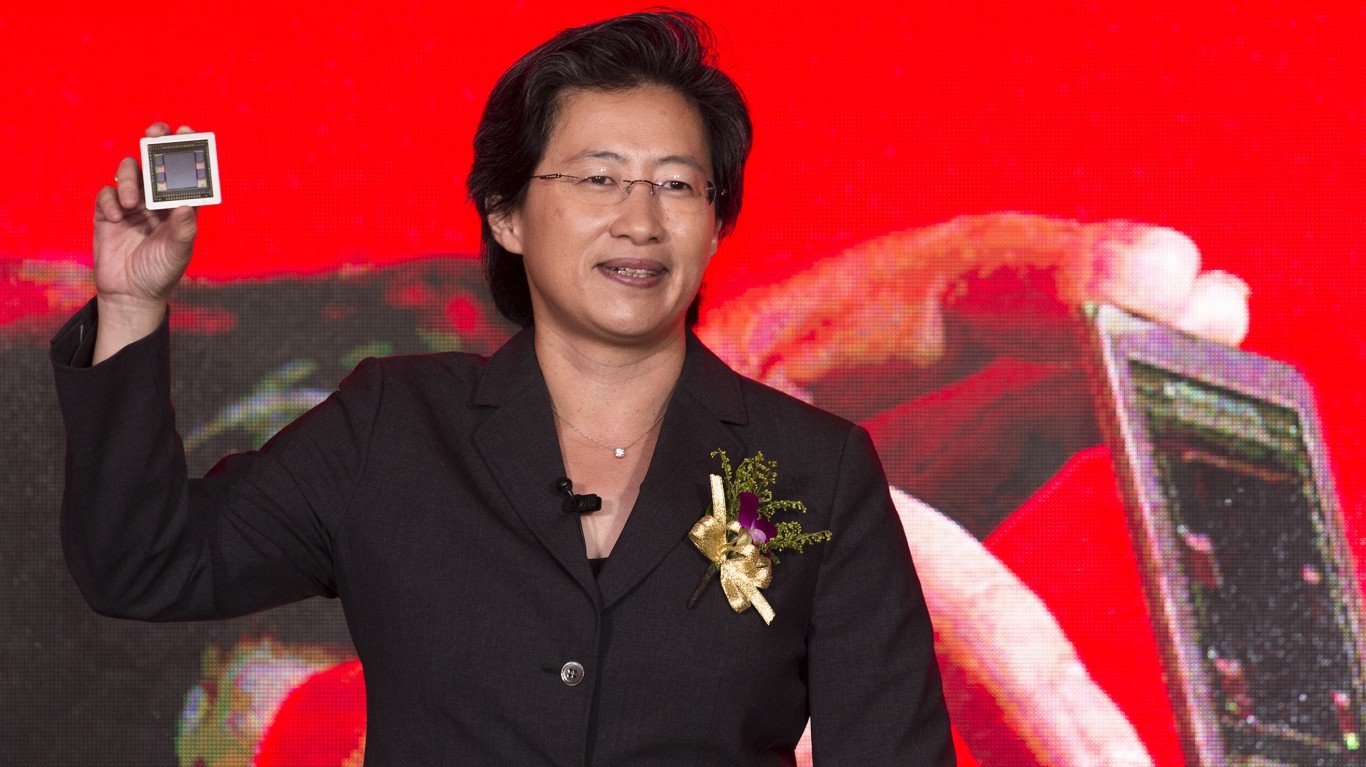

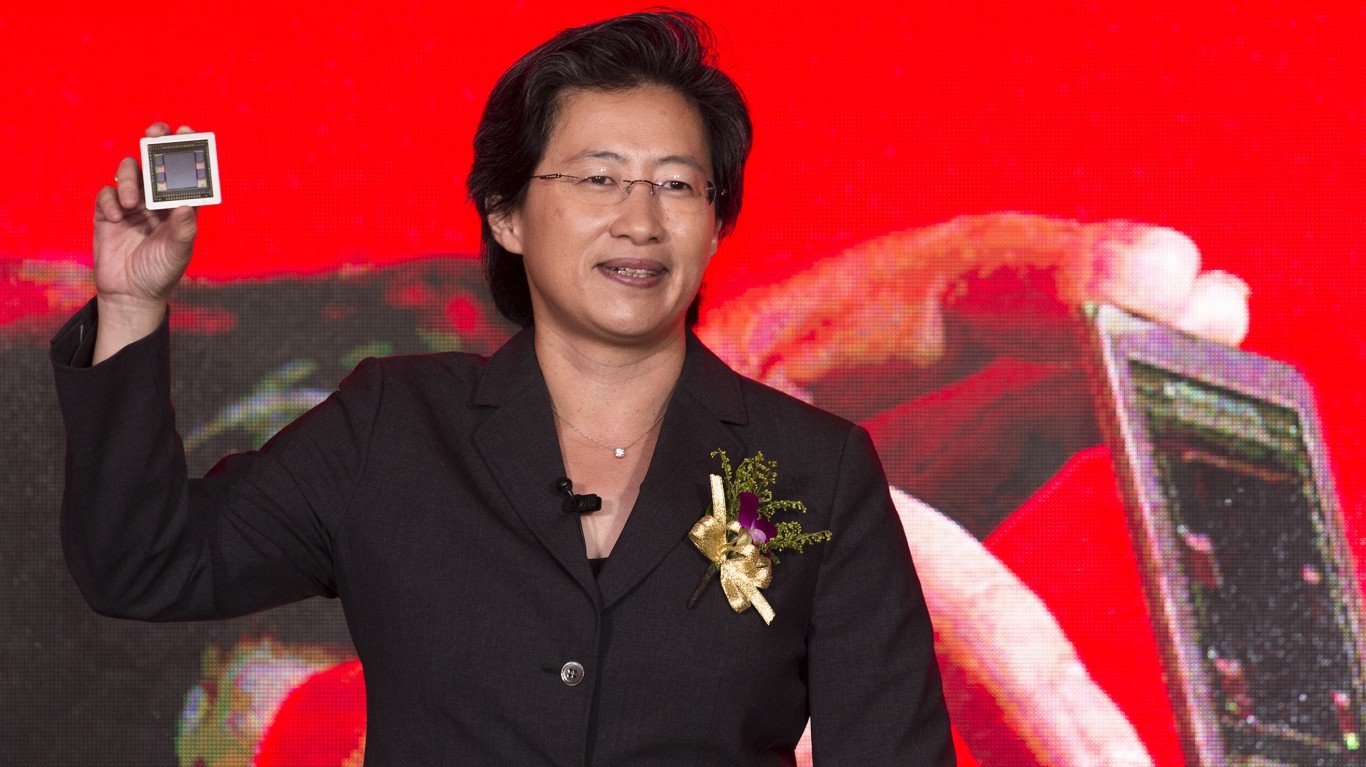

Advanced Micro Devices Inc. (NASDAQ: AMD) competes with Nvidia and Intel in the graphics processor market and with Intel in the CPU market. AMD is Nvidia’s only significant challenger in GPU sales, and it is a distant second. But investors are betting that if Nvidia is right about the growth prospects for data center AI, then AMD stands to benefit.

AMD stock has added 30% over the past year, far less than either Nvidia or Super Micro. The consensus revenue estimate indicates that Wall Street expects a relatively flat second quarter and a revenue decline of 3% for AMD’s 2023 fiscal year. The company’s price-to-earnings multiple is 41.4, about halfway between Nvidia and Super Micro.

Many more analysts (42 in all) pay attention to AMD. By a margin of more than 2 to 1, the stock is rated a Buy or Strong Buy, rather than a Hold. No analyst recommends that the stock be sold. Like Super Micro, shares traded above their average price target Thursday morning at around $119, compared with a target of around $106. AMD’s reliance on the PC market, which is expected to be down this year, cannot all be met by more shipments into data centers.

Monolithic Power Systems Inc. (NASDAQ: MPWR) added more than 10% to its share price after a solid earnings beat earlier this month. The chipmaker’s stock rose to a six-month high after Monolithic issued in-line guidance and raised its dividend payment. The stock’s share price is up about 24% over the past 12 months and traded up more than 15% Thursday morning.

A relatively modest 13 analysts cover the stock, and 12 rate the shares at Buy or Strong Buy. The second-quarter earnings estimate calls for a 2% sequential decline, and the full-year estimate calls for a 2.8% increase. Profits are expected to slip by more than 6% sequentially and by nearly 4% for the full year. As is the case with AMD, Monolithic’s exposure to the faltering PC market is not going to be overcome easily or quickly.

The stock traded up more than 15% Thursday morning at around $480, still below its average price target of $510. By fundamental measures, the stock is near the bottom of the tech sector. It has been, however, a top performer over the long haul, with a share price increase of nearly 1,900% over the past 10 years and a total return of nearly 2,100%.

Taiwan Semiconductor Manufacturing Company Ltd. (NYSE: TSM), or TSMC as it is known, has added about 16.5% to its share price over the past 12 months. The company is the world’s largest manufacturer of computer chips and the primary producer of Nvidia’s products. While the 12-month gain is quite modest by the standards in play here, over the past three years, TSMC’s share price has risen by nearly as much as AMD’s. The massive investments of capital and time needed for building new fabs do not lend themselves to massive multiples.

TSM’s trailing 12-month price-to-earnings multiple ranks the company near the bottom of the tech sector. Its total return over five years or 10 years, however, ranks the company near the top of the sector.

Shares traded Thursday morning near the average price target of around $102.50, but still below it. Of 28 analysts covering the stock, 27 recommend the shares with a Buy or Strong Buy rating.

One final note. There is probably not much question that the so-far confidential IPO filing from British chip designer Arm will get a boost as well from Nvidia’s strong view of the AI-driven demand for computing power. Arm licenses its designs and software to Nvidia, Apple and a host of other high-end computing firms. The company’s current owner, Softbank, is said to be looking for around $10 billion for some percentage of the company that has been valued at as much as $70 billion. Details remain scarce, but at least one report said Arm is looking at a September initial public offering.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.