Iraq is getting out of control, and with no U.S. presence there, the terrorists or insurgents (or whatever you want to call them) are making serious headway to capture cities and disrupt oil exports. With few U.S. people and assets on the ground, the question we would ask is what this means to the defense and warfare companies.

Iraq is getting out of control, and with no U.S. presence there, the terrorists or insurgents (or whatever you want to call them) are making serious headway to capture cities and disrupt oil exports. With few U.S. people and assets on the ground, the question we would ask is what this means to the defense and warfare companies.

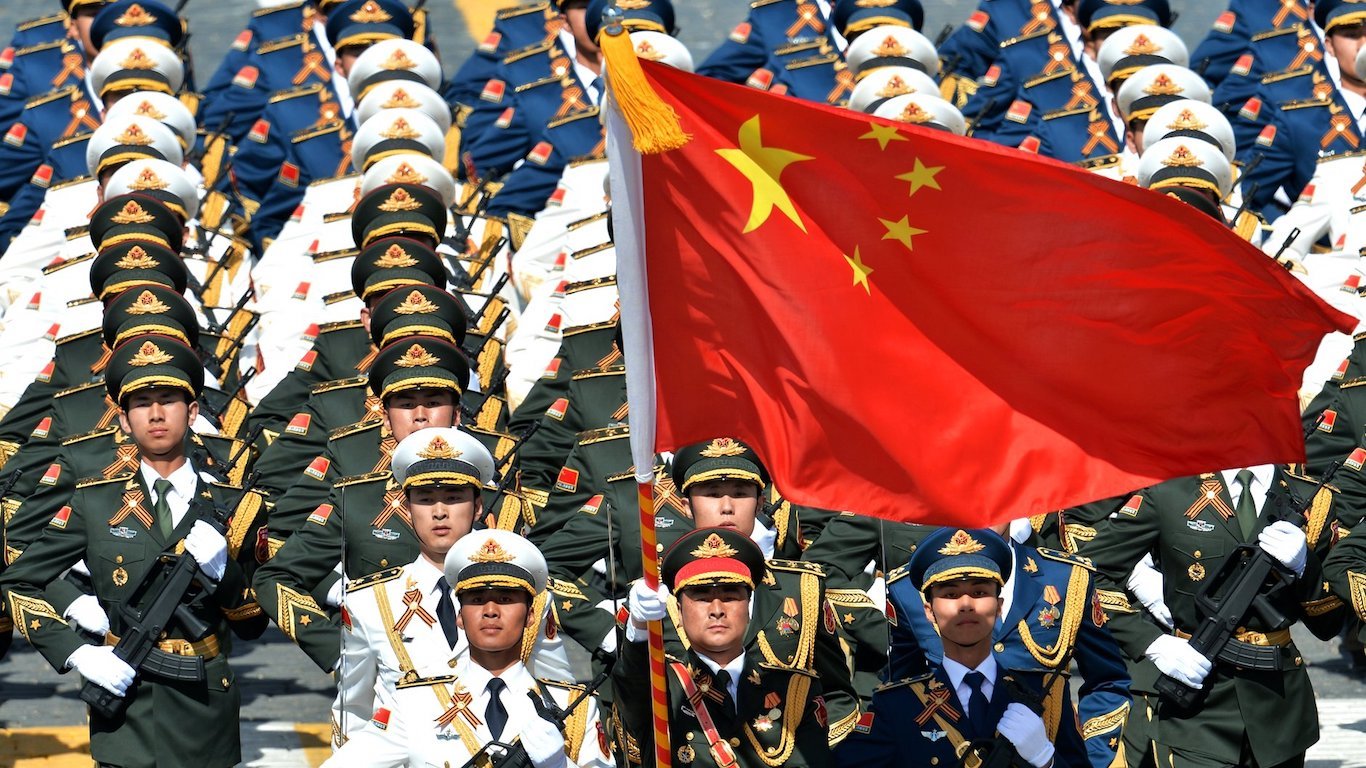

China, Russia and many other nations are not backing down on their future military spending. In fact, many nations are increasing their orders. We recently featured what seemed to be a fake aircraft carrier in Iran, but what is the opportunity for defense contractors in an all-out civil war in Iraq?

Most likely, the biggest opportunity here is for munitions, smart weapons and support airstrike jets and helicopters. It seems unlikely that President Obama would reinsert substantial numbers of boots on the ground in Iraq. If we have to go back in, we might not ever be able to leave again.

There are even reports that Obama rejected requests from Iraqi Prime Minister Maliki to bomb the insurgents and militants. If Obama leans more toward action after his brief press conference indicated that the “help needed from the U.S. and international community,” then there may be more for defense contractors to expect here.

So, oil prices are much higher due to supply disruption fears. Oddly enough, the defense stocks are not rallying at all. Most are down. Does that mean that there will be no business to be won if Iraq continues to escalate? Perhaps not, but of course it could mean that defense contractors get orders that never get paid. There are even reports that Iraqi soldiers are simply abandoning their posts and duties and trying to blend back into the civilian population.

ALSO READ: Does Iran Want an Aircraft Carrier?

There is the Lockheed Martin Corp. (NYSE: LMT) and General Dynamics Corp. (NYSE: GD) Littoral Combat Ships program. These were supposed to counter threats from small and fast-attack boats, likely from Iran, but what if that threat escalates around Iraq’s oil ports. Of course both companies have many other capabilities as well. Still, Lockheed Martin shares were down close to 1% in Thursday trading at $163.19, down more than $5 from its 52-week high. General Dynamics shares were also down almost 1% at the same time, at $118.85, versus a 52-week high of $121.68.

Raytheon Co. (NYSE: RTN) makes many precision weapons, for offensive and defensive capabilities. After a high of $102.33 in recent months, its afternoon trading on Thursday was at $95.85.

Alliant Techsystems Inc. (NYSE: ATK) might have been the most obvious winner as it is the largest U.S. munitions maker, as well as active in precision and strike weapons. Still, its stock was down more than 0.5% in Thursday’s session at $137.15 — down from a 52-week high of $158.13.

READ ALSO: U.S. Oil Companies With the Most Exposure to Iraq

The long and short of the matter is that it seems unlikely that the major U.S. defense contractors will get a flood of orders from the existing scenario in Iraq. If it escalates and the United States and allies end up having to recommit to boots on the ground, then that is a different matter entirely.

Meanwhile, West Texas Intermediate (WTI) crude hit $106 and briefly went higher on Thursday. That is a high not seen in a year and within a few dollars of the peak prices of 2013 and 2012.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.