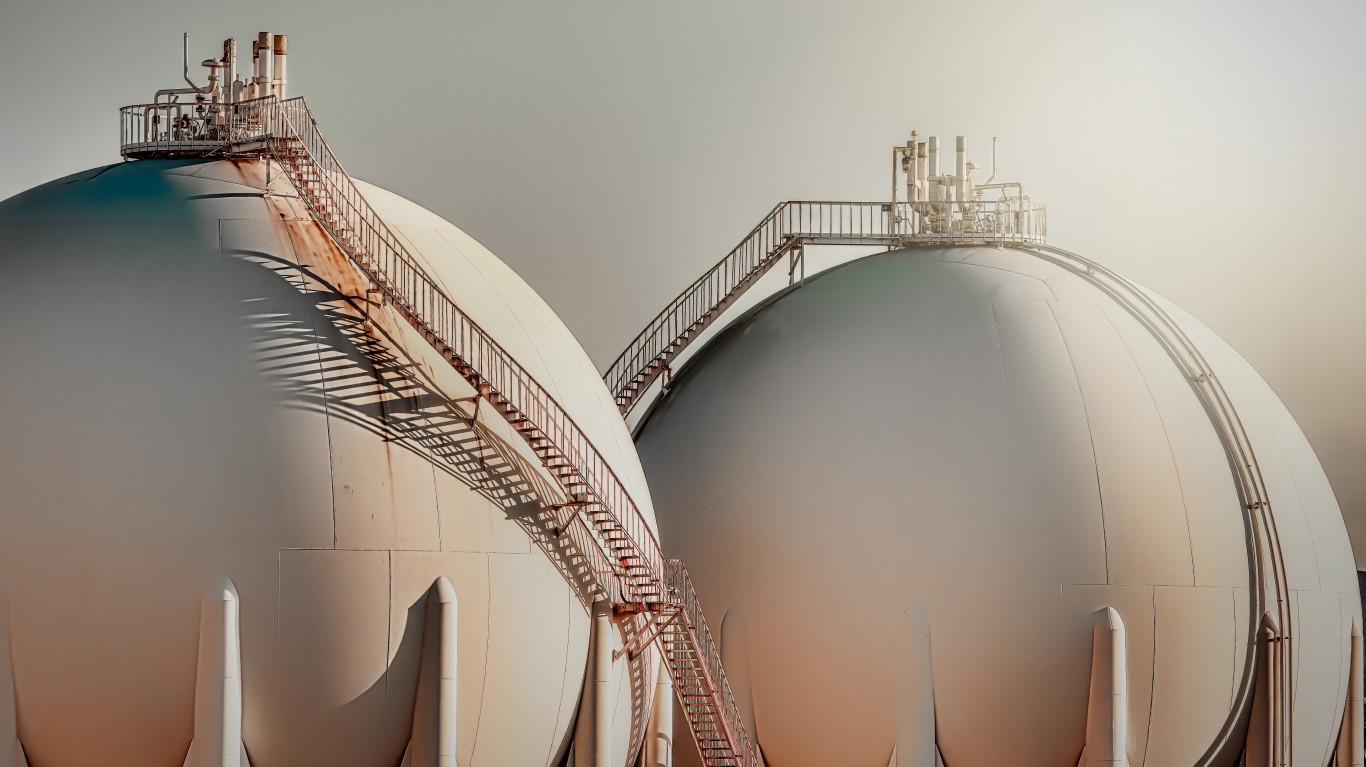

Oneok Inc

NYSE: OKE

$79.34

Closing price April 11, 2024

Investors love dividend stocks because they provide dependable income and a great opportunity for solid total return. Total return includes interest, capital gains, dividends, and distributions...

Published:

Investors love dividend stocks because they provide dependable income and a great opportunity for solid total return. Total return includes interest, capital gains, dividends, and distributions...

Published:

Could a huge energy master limited partnership merger signal more consolidation in the space? These five top MLPs could be in the sights of one of the larger players as the next buyout target, and...

Published:

Two mega-mergers in the materials sector get the week started on a positive note. A blizzard of Fed speakers may take some of the wind out of the market's sails, though.

Published:

Wednesday's top analyst upgrades and downgrades included American Express, Analog Devices, Boeing, Chevron, Chipotle Mexican Grill, Comcast, CSX, Etsy, Fastenal, ONEOK, Prudential Financial, RH and...

Published:

Shares of these seven natural gas production leaders have sold off, but as an unseasonably warm winter turns frigid, that may be about to change. They offer outstanding growth potential, reasonable...

Published:

Wednesday's top analyst upgrades and downgrades included Ally Financial, American Tower, Archer Daniels Midland, AT&T, Bank of America, Bloom Energy, Boeing, Diamondback Energy, D.R. Horton,...

Published:

These seven top energy picks with a focus on natural gas production and sales are perhaps off the radar for some investors but are offering outstanding growth potential and reasonable entry points as...

Published:

Monday's top analyst upgrades and downgrades included Brixmor Property, Dollar General, Delta Air Lines, Express, JD.com, ONEOK, Prudential Financial, Trip.com, United Airlines and Verizon...

Published:

The bear market rally has been stunning, but inflation is still high and interest rates are still rising. 24/7 Wall St. reveals five outstanding Buy-rated stocks with at least a 5% dividend that look...

Published:

While the bear market rally has been stunning, it may be smart to sell now and use the proceeds to buy stocks that pay good dividends and can act as a hedge against further downside. These seven hard...

Published:

Lower fuel prices could spur demand through the rest of the year and into the first quarter, and these six outstanding energy stocks have the biggest and most dependable dividends and are Buy rated...

Published:

The consumer and producer-price-index numbers for October seem to indicate that we may have hit "peak inflation," and are starting to come down. If that is indeed the case, brighter days may indeed...

Published:

A recession, if not here already, certainly is on the way and could be ugly. These eight blue-chip stocks offer income investors timely entry points, solid upside potential and dependable dividends,...

Published:

OPEC Could Cut Production 1 Million Barrels per Day: 6 Energy Stocks to Buy Now Yielding 6% and More

OPEC is expected to step up production cuts, which would have a huge impact on energy pricing and for energy investors going forward. These six oil and natural gas related stocks have at least a 6%...

Published: