Investing

These Companies Are Making Green From Plant-Based Diets

Published:

Last Updated:

By Kashif, Investment Analyst at PrivCo, a private company financial intelligence platform

When poultry giant Tyson Foods purchased a 5% stake in plant-based burger startup Beyond Meat last fall, the move was puzzling to many. How could America’s largest chicken factory–which earned over $40bn in revenue in 2015 and has long been criticized for its purportedly harsh treatment of animals–join investors such as The Humane Society in purveying a meatless meat that would undoubtedly cannibalize its core product?

The answer is that it’s all business. Plant-centric diets are catching on in the United States and companies, both public and private, as well as investors, are rushing to meet the growing demand. According to the Plant Based Foods Association, a new trade association representing the industry, sales of plant-based proteins grew at least 9% y/y in 2014 and 2015 (and that data was missing large retailers like Whole Foods), with total sales in 2016 exceeding $5bn.

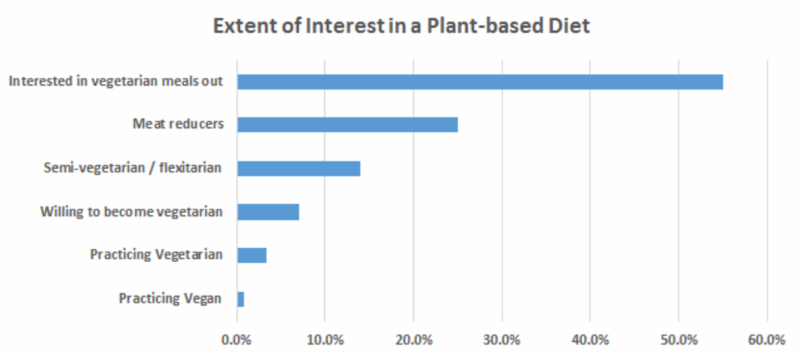

And that’s just for fake meat, which is a sliver of all the things you can replace with plants. While the entire market opportunity for plant-based substitutes of all animal products (not just proteins) is tough to measure, it’s clear that it’s big. Surveys show adult Americans are very interested in plant-based diets, enough to justify far greater investments than we’ve seen in the past.

There are a dozens of reasons why people choose to minimize animal product consumption–health, the environment, concern for animals, accessibility, food security, and simple economics. The spectrum of interest is incredibly wide. While a little over 3% of the U.S. population identifies as purely vegetarian, 55% at least sometimes order vegetarian meals out, and a quarter are working to reduce meat in their diets in any case. Taken together with the decline in meat consumption, it makes sense for businesses to cater to these evolving sensibilities.

Source: Vegetarian Resource Group

Moreover, using more plant-based inputs in food make sense from a purely business perspective. Animals are expensive to raise and process and consume a disproportionately high amount of natural resources, but at scale, vegan food is cheaper to produce and distribute than its animal-based counterparts. It’s likely that companies will follow Tyson’s lead to shed some of the growing costs of animal products.

We took a look through PrivCo’s private company database to identify some of the fastest growing companies involved in creating plant-based substitutes for animal products and bring them to you below.

What they make: A vegan burger that “bleeds”

Founded: 2009

Headquarters: Manhattan Beach, CA

Funding: >$17mn (Series E), others undisclosed

Employees: 120

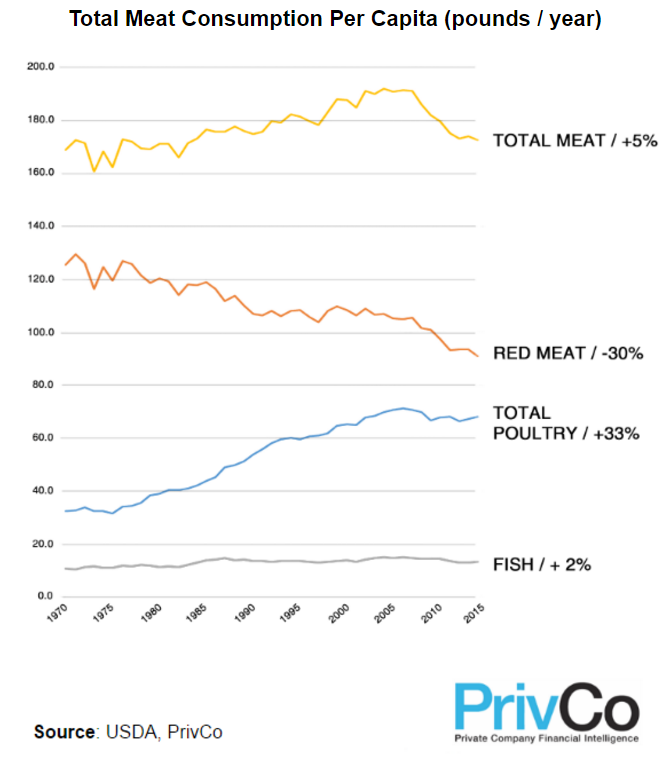

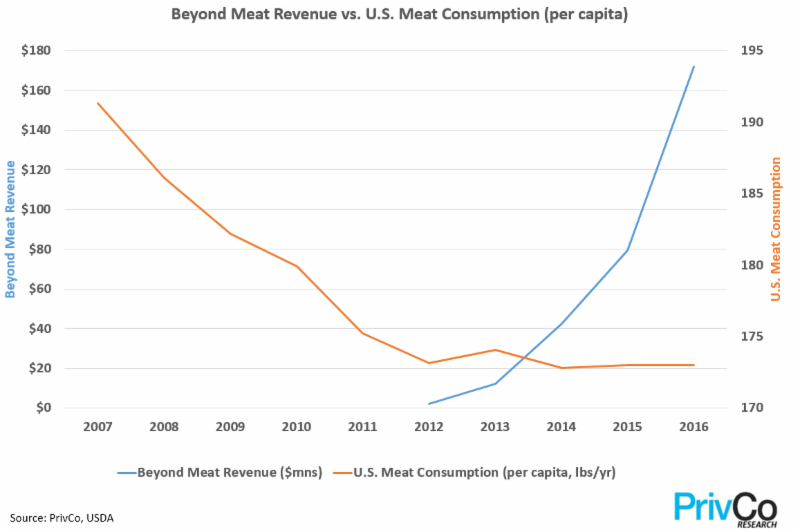

USDA figures show that meat consumption is down in the U.S., but something has to replace all those foregone calories. The U.S. hit a peak in per capita meat consumption sometime in the mid-2000s, at our “peak economy,” as shown in the chart below. But with societal awareness of health issues, environmental factors, as well as technological breakthroughs, there’s been a huge uptick in demand for plant-based proteins. In the period between 2007-14, per capita meat consumption has fallen almost 10%, ostensibly replaced by plant-based foods in consumers’ diets.

The soy protein slabs we’ve been reluctantly consuming for decades just don’t cut it anymore. Americans want their meat to “bleed,” which adds a more natural taste and mouthfeel, and satisfies the unexplainable human need for a sizzling animal carcass, even if it has no trace of an animal in it. After millions of dollars and years of human effort in R&D, we’re almost there, and Beyond Meat is just one of two companies that have beaten even the most well-heeled public companies to create a very realistic meat substitute. The other–Impossible Foods–is a younger company we’ll cover sometime later this year after we uncover more financials.

Retail channels are expanding rapidly for Beyond Meat. The company initially launched adjacent to the meat freezers of Whole Foods for over a year and became a best-seller. It’s found even more success in Walmart, Target, and several large grocery chains. It’s usually pretty tough to make it into these mainstream outlets, which seek products for mainstream audiences, but it’s clear that Beyond Meat has created a universal appeal.

What they make: Almond Breeze brand almond milk, and many other almond products

Founded: 1910

Member Farms: 230

Headquarters: Sacramento, CA

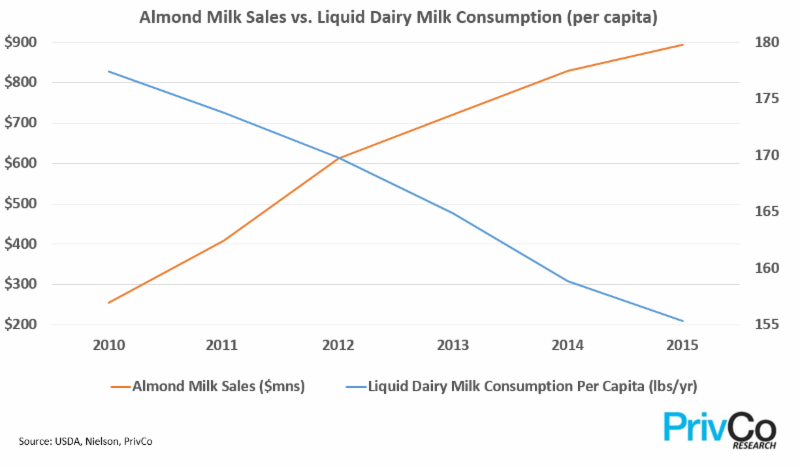

Despite all the milk-mustached “drink your milk” propaganda of our youth, liquid dairy milk consumption has been on the decline since the 1970s, falling over 40% on a per capita basis to its lowest level ever. While the dairy deficit in the U.S. has been partially filled by higher consumption of yogurt, butter, and other substitutes, the most notable trend has been the rise in liquid milk substitutes: soy, almond, and rice.

Almond milk is by far the favored milk alternative in the U.S. judging from its astronomical sales growth over the past half decade. The product is not without faults, having been criticized for its speculative health claims and resource intensity, with each almond taking over a gallon of water to produce in already drought-prone California. Much of the costs are likely passed onto the consumer, but as shown in the chart below, it doesn’t seem to matter to them at this point.

Blue Diamond, purveyor of the popular Almond Breeze milk alternative, is actually a cooperative that is owned by over half of California’s almond producers. It is massive, with its participant farmers producing a big chunk of global almond production. Blue Diamond assists its member farms in marketing and processing, providing common equipment and other resources as it distributes its farmers’ crops globally. The Almond Breeze almond milk line has experienced the fastest sales growth of all, currently contributing around $400mn to the top line and growing 50% y/y in the 2013-2014 period alone.

What they make: Eggless Mayonnaise

Founded: 2012

Headquarters: San Francisco, CA

Funding: $120,000,000

Employees: 110

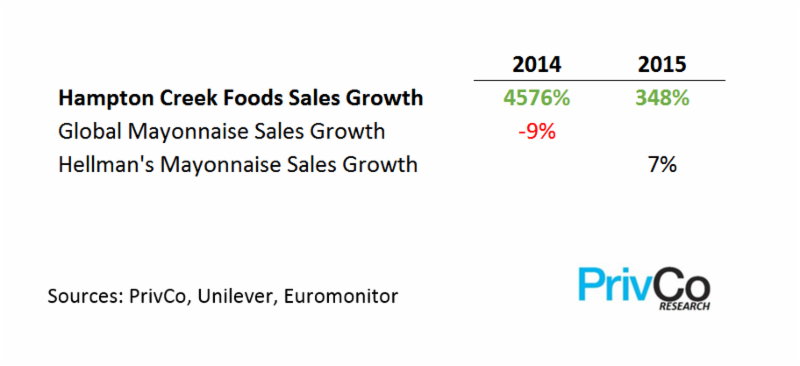

Not many people get excited about the mayonnaise business. Industry growth has been negative globally (yes, there are people who keep track of this), and this condiment has long been shunned for its heart-destroying properties.

But SF-based Hampton Creek is putting an end to the boredom with its popular eggless mayonnaise substitute, Just Mayo. The company was the target of a purported scandal in which the American Egg Board, an industry group alarmed by the potential drop in egg sales from vegan substitutes, attempted to take them off the shelves through a massive smear campaign to persuade the FDA to enforce a narrow definition of what constitutes “mayonnaise.” Hampton Creek has since become chummy with the regulator, which made an exception for eggless versions.

Not as flattering is Hampton Creek’s growth-at-all-costs culture that is so typical in the Bay. While initially famous for its sauce and the FDA ordeal above, the company gained notoriety after a recent report alleging that it purchased large amounts of its own product in retail stores in order to bolster sales ahead of a 2014 venture funding round.

Such a damning indictment would normally be a magnet for investor lawsuits, but the revenue growth that followed probably allayed most concerns. The Just Mayo brand became massively popular in Whole Foods, and that volume was soon exceeded by the nation’s largest retailer, Walmart, which carries the product in most of its 4,000 stores. It’s now featured by Compass, the country’s largest foodservice company, and dozens of grocers, creating astronomical growth as shown in the chart below.

What they do: Organic and Vegan/Vegetarian Packaged Foods

Founded: 1987

Headquarters: Petaluma, CA

Funding: NA, and they aren’t looking

Employees: 1,700

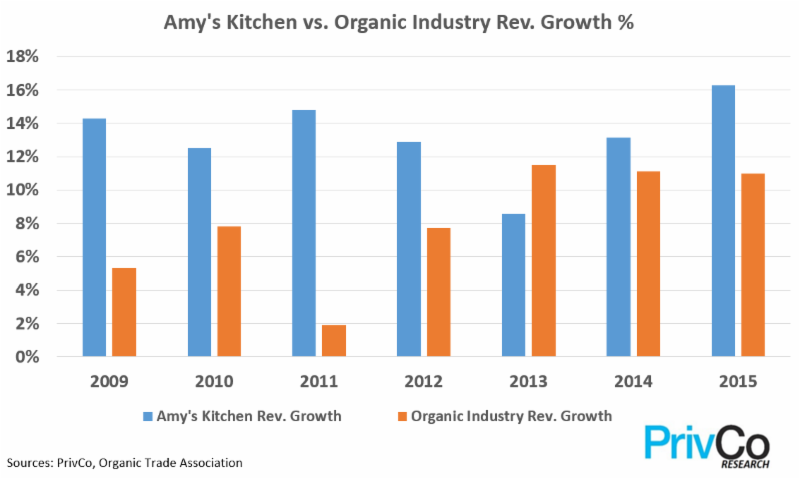

The organic food industry has been on a tear for two decades now, experiencing hardly a hiccup even through the depths of 2009’s recession. The Organic Trade Association (a major trade group) claims $43bn in 2015 sales and 75% household penetration in the U.S., and that the market is primarily driven by millennials in dense urban centers. While we’d normally advise caution on relying on such a narrow segment of the population for growth, organic food still only constitutes 5% of overall food sales, showing that there is a substantial market yet to be tapped.

Amy’s Kitchen is a veritable success story across two already rapidly-growing areas–its products are both vegetarian and organic. Notably, the company has handily exceeded organic food industry growth in six out of the last seven years. With products spanning frozen entrees, burgers, canned soups, snacks, and desserts, as well as international cuisines, it is diversified across evolving culinary sensibilities. Unfortunately, investors won’t be able to cash in on this success, for now. The family-run business prides itself on sacrificing margins to maintain quality and has been pretty vocal in interviews that the company is not for sale.

Special to 24/7 Wall St. From PrivCo

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.