Premarket action on Friday had the three major U.S. indexes trading mixed. The Dow Jones industrials were up 0.07% and the S&P 500 up 0.08%, but the Nasdaq was 0.04% lower.

Walt Disney Co. (NYSE: DIS) on Thursday announced that it has scrapped plans to invest nearly $1 billion in an office park near its Disney World theme park in Florida. Not only does the announcement affect the construction jobs that would have been created, but also leaves some 2,000 Disney jobs in California instead of relocating them to Lake Nona, Florida.

[in-text-ad]

In a Thursday email, Josh D’Amaro, president of Disney’s Parks, Experiences and Products division, told affected employees that the move to Florida was off. Among those affected by the cancellation are several hundred who have already moved to Florida and who will be given the choice of remaining there or returning to California. In his email, D’Amaro noted:

Given the considerable changes that have occurred since the announcement of this project, including new leadership and changing business conditions, we have decided not to move forward.

The move to Florida was former CEO Bob Chapek’s idea. Robert Iger replaced Chapek late last year.

The “changing business conditions” include the battle between Florida Governor Ron DeSantis and the Republican-led state legislature on one side and Iger-led Disney on the other. The confrontation began almost as soon as Iger took charge. DeSantis criticized Disney for opposing the state’s “Don’t Say Gay” law and later tried to take control of the special tax district that was created for and run by Disney. The company has sued the state, the state has sued the company, and the beat goes on.

In addition to the canceled business park, Disney announced Thursday that it will close Disney World’s Star Wars: Galactic Starcruiser experience no later than October. The immersive experience opened in March of last year, but staff costs pushed prices way up and demand way down.

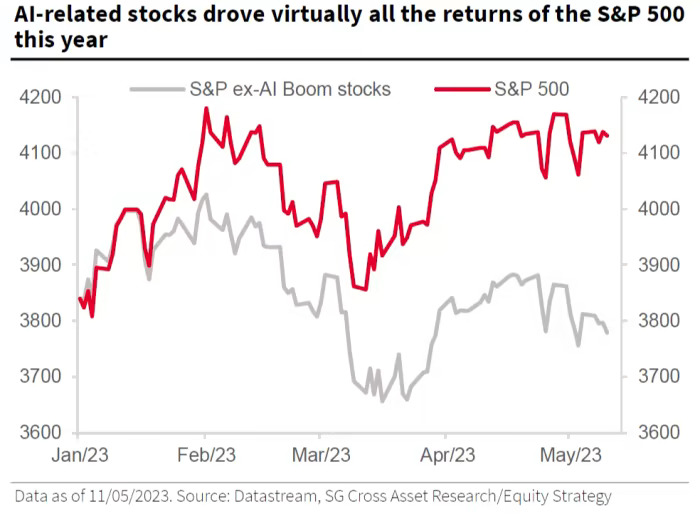

The rush to link whatever a business happens to be with the tsunami of artificial intelligence is reminiscent of the rush a few years ago to jump on the ESG bandwagon. Since Microsoft Corp. (NASDAQ: MSFT) announced the availability of ChatGPT in March, the S&P 500 has added 8.9% and topped 4,200 on Thursday for the first time in nine months. The Nasdaq Composite has added 13.4% and the Dow 5.4% over the same period.

According to a report from JPMorgan equity analysts, Microsoft and Apple Inc. (NASDAQ: AAPL), which together account for more than 13% of the S&P 500 index, accounted for 2.3% of the index’s gain this year. Excluding the AI-boom stocks, SocGen figures the S&P 500 is down for the year. Here is SocGen’s chart from the Financial Times:

On Thursday, Morgan Stanley weighed in with comments on what its clients are doing in the face of the rush to invest in the disruption expected to come from AI:

Most generalist investors we have met prefer to think about the market even more simply still: businesses driven by tangible assets vs businesses driven by intangibles. The latter requiring further analysis and possibly higher cost of capital than previously. And the former — whilst less scalable — could be relative outperformers over the short- to medium-term as the market assesses when and how these AI dynamics flows through to top line or EBIT across sectors and companies. Proprietary data and the quality thereof, will become a much more important metric in this new world of tangible vs intangible discussions, but one which — in the absence of companies giving more detail — will entail subjective determinations by investors. Tangible industries being leaned on most regularly include electrification/grid names, renewables and aerospace.

Here is a look at how the markets fared on Thursday.

Seven of 11 market sectors closed higher Thursday. Technology (2.06%) and communications services (1.79%) had the day’s largest gains. Real estate (−0.68%) and consumer staples (−0.44%) dipped the most. The Dow closed up 0.34%, the S&P 500 up 0.94% and the Nasdaq up 1.51% on Thursday.

Two-year Treasuries added 12 basis points to end Thursday at 4.24%, and 10-year notes rose by eight basis points to close at 3.65%. In Friday’s premarket, two-year notes were trading at around 4.26% and 10-year notes at about 3.65%.

The next big economic data point comes next Thursday, when the second estimate of first-quarter gross domestic product is released. The report on personal consumption and expenditures is due Friday. The next meeting of the Federal Reserve’s Federal Open Market Committee (FOMC) begins June 13 and concludes the next day with an announcement of the change, if any, to the federal funds rate.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.