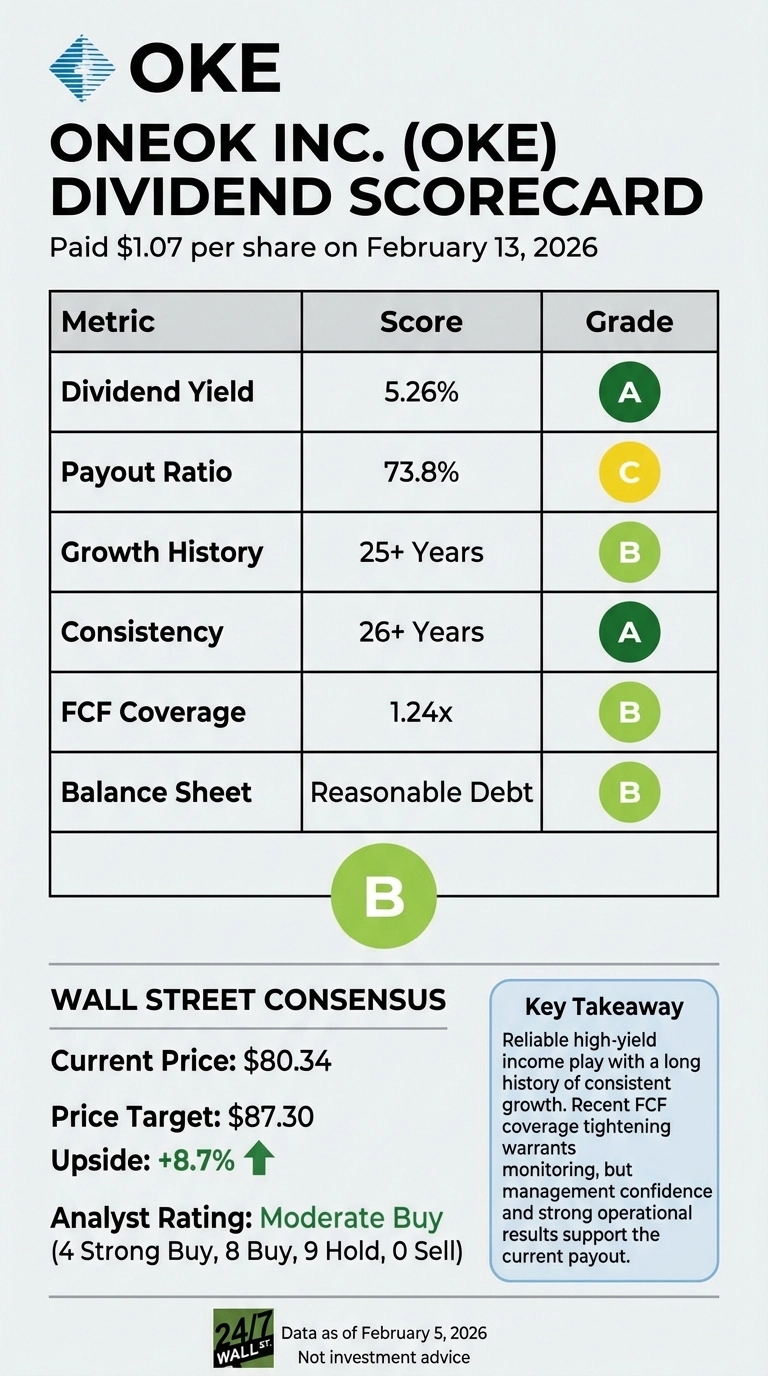

ONEOK Inc. (NYSE:OKE) just distributed $1.07 per share to shareholders on February 13, 2026, marking a 3.88% increase from the previous quarter’s $1.03 payout. This midstream energy infrastructure company now offers a 5.26% yield, well above market averages, but the sustainability picture requires careful examination.

Dividend Growth Trajectory

ONEOK has demonstrated consistent dividend growth over the past five years, with the annual payout climbing from $3.74 in 2021 to $4.12 in 2025. The company maintained its quarterly dividend through the challenging 2020-2021 period and has delivered a 2.47% annualized growth rate over the past five years.

The latest increase brings the annualized dividend to $4.28, representing 4.04% year-over-year growth. Over a 26-year period, the dividend has surged 232%, demonstrating long-term commitment to shareholder returns.

Cash Flow Coverage Analysis

The dividend’s sustainability hinges on free cash flow generation. In fiscal 2024, ONEOK generated $2.87 billion in free cash flow while paying out $2.31 billion in dividends, yielding a coverage ratio of 1.24x. This marks a significant improvement from 2022’s tight 1.02x coverage.

However, the first nine months of 2025 reveal tightening conditions. Year-to-date free cash flow of $1.87 billion barely covered dividend payments of $1.94 billion, resulting in 0.97x coverage—below the critical 1.0x threshold. Q1 2025 was particularly weak at just 0.43x coverage, though Q3 rebounded to 1.27x.

The 73.8% payout ratio based on trailing twelve-month earnings of $5.58 per share sits within the typical 70-85% range for midstream companies but trends toward the upper bound.

Operational Performance and Market Context

ONEOK’s recent operational results show strength. Q3 2025 earnings per share of $1.49 beat estimates of $1.47, while adjusted EBITDA reached $2.12 billion. The company generated $1.05 billion in free cash flow during the nine-month period.

Management confidence appears solid, with two newly appointed directors, Mark A. McCollum and Precious Williams Owodunni, each purchasing 727 shares at $78 on January 23, 2026.

The stock has delivered a 10.86% year-to-date return but remains down 12.47% over the past year. With WTI crude at $61.60 per barrel (down 13.7% year-over-year), the energy sector faces headwinds that could pressure upstream producer activity and midstream volumes.

Investors will get clarity on February 23, 2026, when ONEOK reports Q4 2025 results. The dividend appears sustainable for now, but the narrowing free cash flow coverage warrants close monitoring.