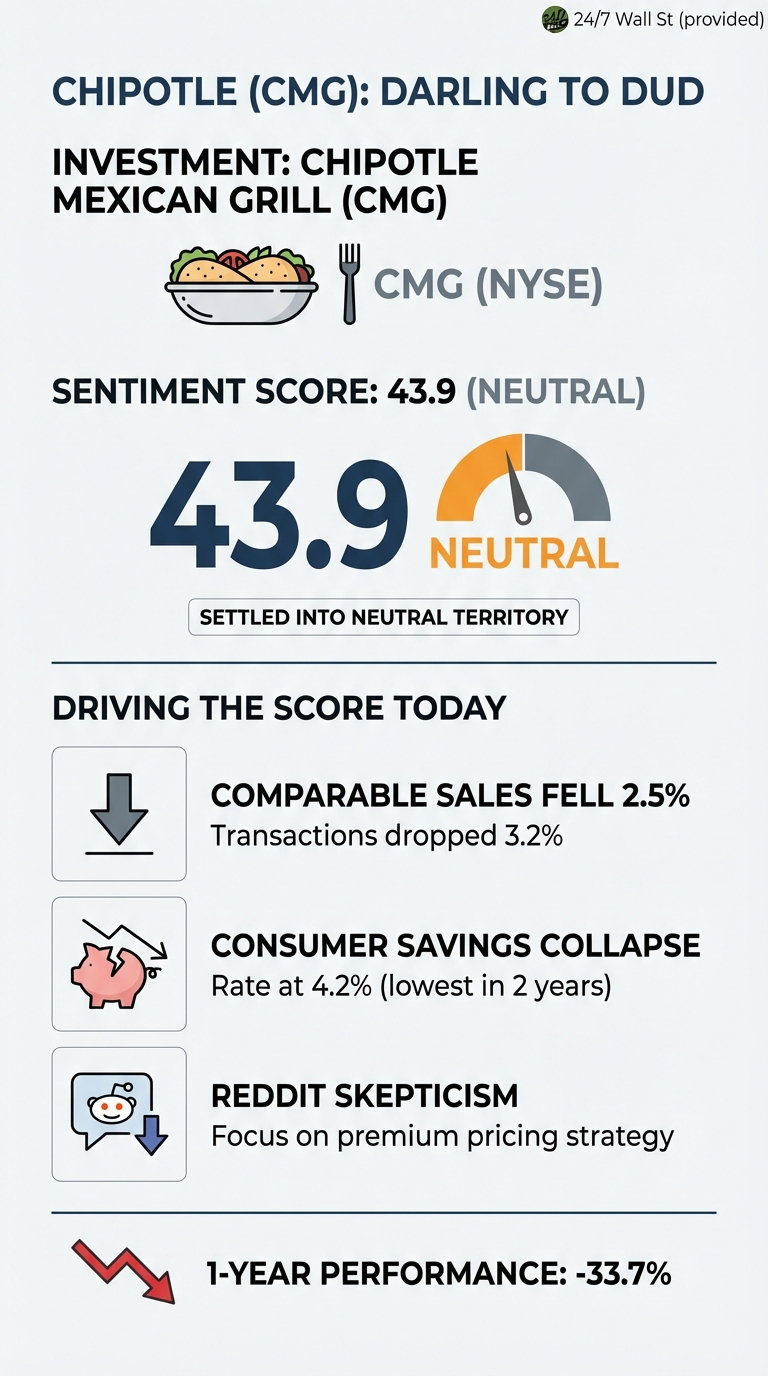

Shares of Chipotle Mexican Grill (NYSE:CMG) fell 6.7% over the past week, coinciding with a shift in retail investor sentiment on platforms like Reddit and X. Social sentiment for Chipotle has settled into neutral territory with a 43.9 score, down from the bullish enthusiasm that once surrounded the fast-casual chain. The shift comes as the company reported Q4 2025 earnings on February 3, 2026, revealing a 2.5% decline in comparable sales driven by a 3.2% drop in transactions. Over the past year, Chipotle shares have fallen 33.7%, erasing gains that once made it a market darling.

Reddit Turns Skeptical on Chipotle’s Premium Positioning

Mentions of CMG on Reddit’s r/stockmarket surged following the CEO’s statement that 60% of users make over $100,000 a year in income. The post drew 1,646 upvotes and 618 comments, with sentiment turning bearish as investors questioned whether the company’s premium pricing strategy is sustainable in the current environment. View the full Reddit discussion.

Chipotle CEO: 60% of users make over $100,000 a year in income. 🌯💰

by a Reddit user in StockMarket

The concerns are grounded in real economic pressures facing consumers:

- The personal savings rate has collapsed to 4.2% in Q3 2025, the lowest level in two years

- Consumers are spending 92.1% of disposable income, up from 90.1% a year earlier

- Chipotle’s operating margin compressed to 14.1% from 14.6% a year ago due to rising labor costs

Starbucks Outperforms as Premium Dining Faces Headwinds

The struggles extend beyond Chipotle. Analysts are calling this a “slop bowl recession,” where fast-casual brands face pressure as consumers trade down. Yet not all premium chains are suffering equally. Starbucks (NASDAQ:SBUX) is up 16.8% year-to-date, despite its own challenges with a 62.5% decline in quarterly earnings growth. For Chipotle investors, the company’s guidance of flat comparable sales for 2026 suggests management sees continued consumer pressure ahead.