Founded in 1869, Goldman Sachs is the world’s second-largest investment bank by revenue and ranks 55th on the Fortune 500 list of the largest U.S. corporations by total revenue. The Wall Street white-glove giant offers financing, advisory services, risk distribution, and hedging for the firm’s institutional and corporate clients. In addition, it provides advice, investing, and execution for institutions and individuals across public and private markets.

It is always a good sign when the Goldman Sachs team starts raising price targets on Buy-rated companies. Typically, when a stock has been performing well, and its target price is raised, it usually means analysts are optimistic about what they see six to 12 months ahead. When we see significant price increases of 10% or more, it’s time to share this with our readers. Here are five that appear to be outstanding ideas for growth and income investors.

Why we recommend Goldman Sachs stocks

Goldman Sachs is the acknowledged leader in the investment landscape on Wall Street and worldwide. The firm’s top-notch research department continues to deliver the best ideas across the investment spectrum and is likely to do so for years to come.

Applied Materials

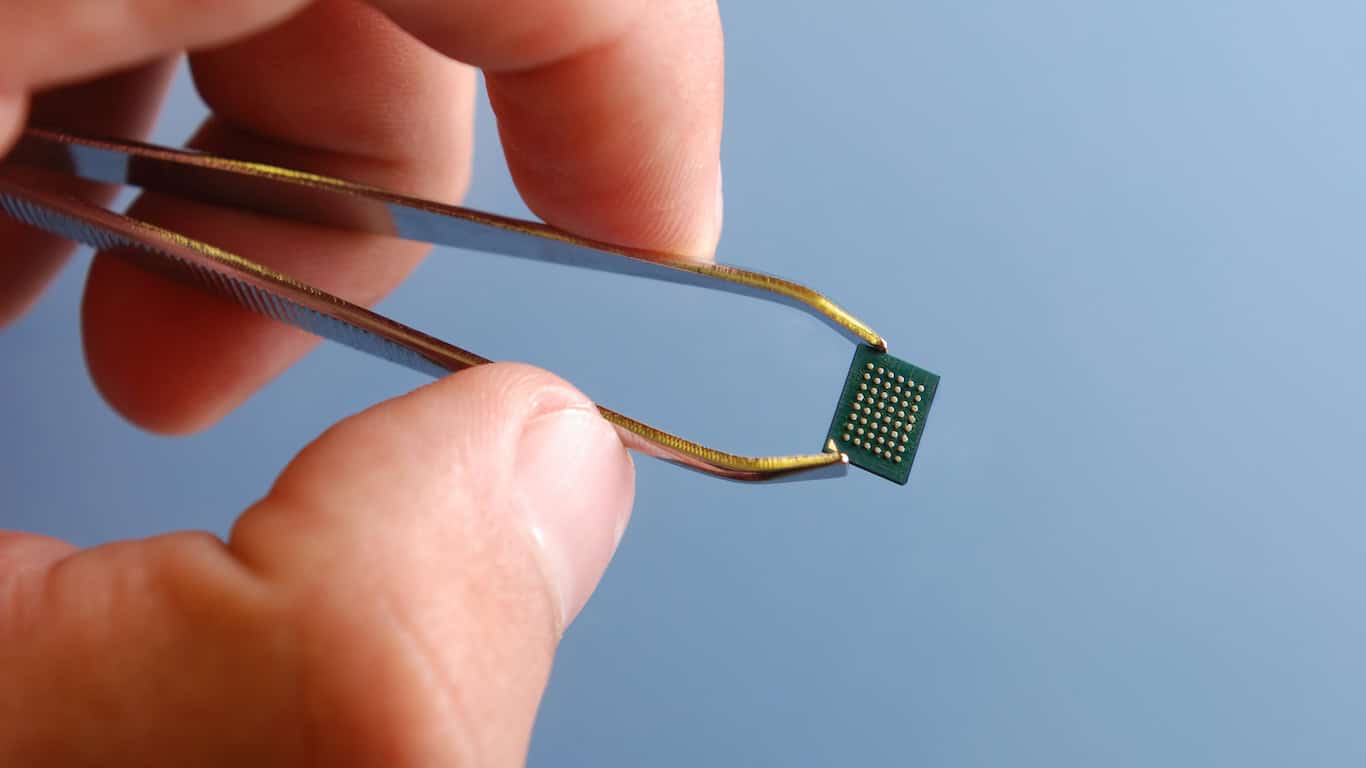

This legacy semiconductor capital equipment giant has been on fire, and still pays a small 0.56% dividend. Applied Materials Inc. (NASDAQ: AMAT) is a materials engineering solution company. The company provides equipment, services and software to the semiconductor, display, and related industries.

It operates in three segments:

- Semiconductor Systems designs, develops, manufactures, and sells a range of primarily 300 mm equipment used to fabricate semiconductor chips, also referred to as integrated circuits.

- Applied Global Services provides services, spare parts, and factory automation software to customer fabrication plants worldwide. This segment also manufactures and sells 200mm and other equipment.

- Display primarily comprises products for manufacturing liquid crystal displays (LCDs), organic light-emitting diodes (OLEDs), and other display technologies for televisions, monitors, laptops, personal computers, tablets, smartphones, and other consumer devices.

Goldman Sachs raised its $310 price target to $390.

Belden

This perfect AI/data center infrastructure play offers a small 0.13% dividend. Belden Inc. (NYSE: BDC) is a global supplier of complete connection solutions.

Its Smart Infrastructure Solutions segment provides network infrastructure and broadband solutions, as well as cabling and connectivity solutions for commercial audio/video and security applications.

The company’s vertical markets include:

- Data centers

- Government

- Healthcare

- Hospitality

The Broadband Solutions primarily serve broadband and wireless service providers.

Smart Infrastructure Solutions product lines include:

- Copper and fiber cable and connectivity solutions

- Interconnect panels

- Racks and enclosures

- Secure, high-performance signal extension and matrix-switching systems

Belden’s Automation Solutions segment provides network infrastructure and digitization solutions that enable customers to make data-driven business decisions.

The primary markets include discrete automation, process automation, energy, and mass transit.

Goldman Sachs raised its $144 target price to $175.

BorgWarner

Serving the auto industry and beyond, this company also pays a 0.84% dividend. BorgWarner Inc. (NYSE: BWA) is engaged in clean-technology solutions for combustion, hybrid, and electric vehicles. The company operates in four segments.

The technologies at Turbos & Thermal Technologies include:

- Turbochargers

- e-boosters

- e-turbos

- Emissions systems

- Thermal systems

- Gasoline ignition technology

- Smart remote actuators

- Powertrain sensors

The Drivetrain & Morse Systems segment’s products include control modules; friction and mechanical clutch products for automatic transmissions; torque-management products; and rear-wheel-drive (RWD) and all-wheel-drive (AWD) transfer case and coupling systems.

The PowerDrive Systems segment’s products include power electronics such as inverters, onboard chargers, DC/DC converters, combination boxes, and others.

The Battery & Charging Systems segment’s products include lithium-ion battery systems for electrified bus, truck, and off-highway applications, as well as DC fast chargers suitable for all types of electric vehicles.

The Goldman Sachs target price increased to $78 from $54.

Cameco

Based in Canada, this top company pays a small 0.15% dividend and supplies products to nuclear reactors used to generate electricity. Cameco Corp. (NYSE: CCJ) is a provider of uranium fuel for generating baseload electricity worldwide.

Its uranium segment involves the exploration for, mining, milling, purchase, and sale of uranium concentrate. Meanwhile, the fuel services segment includes the refining, conversion, and fabrication of uranium concentrate, as well as the purchase and sale of conversion services.

The Westinghouse segment reflects its earnings from this equity-accounted investment. Westinghouse is an original equipment manufacturer of nuclear reactor technology and a global provider of products and services to commercial utilities and government agencies.

The company provides:

- Outage and maintenance services

- Engineering support

- Instrumentation and control equipment

- Plant modifications

- Components and parts for nuclear reactors

Cameco operates two mines, Cigar Lake and McArthur River, and a mill at Key Lake. It also has ownership interests in Global Laser Enrichment.

The $115 Goldman Sachs target price increased to $131.