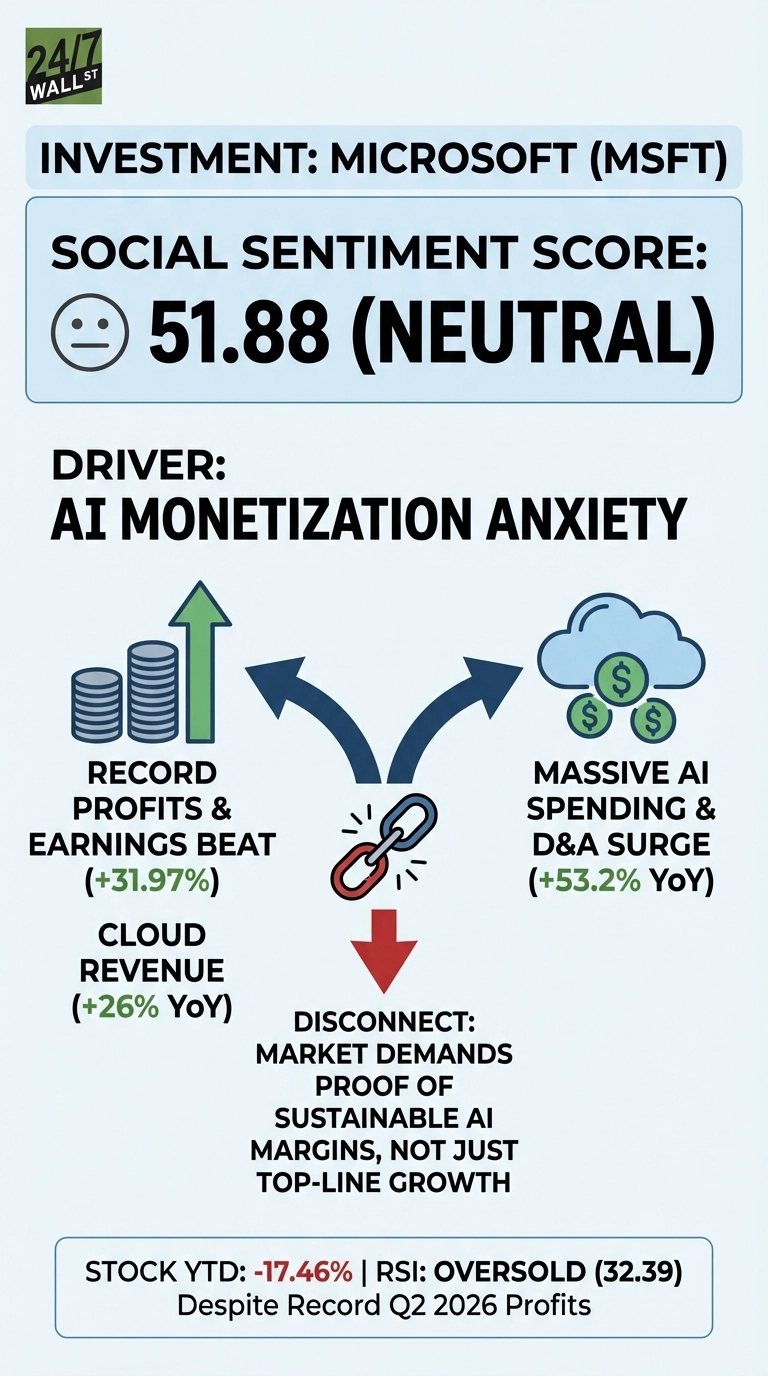

One of the biggest names in tech, Microsoft (NASDAQ:MSFT | MSFT Price Prediction) shares have plunged below $400 despite delivering the largest earnings beat in company history, as investors question whether the company’s massive AI infrastructure spending will ever translate into profitable product adoption. The stock has plunged nearly a fifth this year as investors rotate away from AI infrastructure plays toward companies demonstrating actual product monetization. Retail investor sentiment on Reddit remains neutral at 51.88, reflecting this confusion.

The disconnect highlights Wall Street’s AI monetization anxiety as Microsoft posted record operating margins above 47% and grew cloud revenue by double digits (26% year-over-year), yet shares have collapsed from their peak as Wall Street demands proof that massive AI spending translates to sustainable margins rather than just revenue growth. The market isn’t questioning Microsoft’s operational excellence, it’s demanding evidence that AI spending generates sustainable returns, not just top-line growth. Despite returning billions to shareholders and posting record quarterly revenue, the market is punishing Microsoft for failing to demonstrate that AI infrastructure spending will generate sustainable returns.

Copilot Skepticism Dominates Reddit

The most-engaged post on r/stocks captured the tension perfectly, with 407 upvotes and 386 comments. The author of this highly-engaged Reddit post argued Microsoft’s 1.5 billion+ Windows devices give Copilot an unmatched distribution advantage, and that current product weaknesses mirror early criticism of Google’s Bard, which preceded Google’s stock doubling.

Why are people so bearish on MSFT?

by u/HexadecimalCowboy in stocks

The post author wrote: “Microsoft has 1.5 billion+ Windows devices, and Copilot is integrated into all of them. This gives Microsoft an unmatched distribution advantage that no other AI company can replicate.” They further argued that current skepticism mirrors the early criticism of Google’s Bard, noting that “people said the same things about Bard being inferior to ChatGPT, yet Google’s stock doubled after they demonstrated AI integration across their product suite.”

Another popular discussion examined why Microsoft fell after beating earnings, highlighting the disconnect between operational performance and market reaction.

Here is the reason MSFT fell 10% after beating earnings

by [deleted] in stocks

But Wall Street isn’t buying it. The core concerns driving the selloff center on the gap between AI infrastructure investment and actual product monetization, with investors demanding concrete proof that spending translates to sustainable margins.

The Valuation Problem

The disconnect between analyst optimism and market pricing reveals Wall Street’s demand for concrete evidence of AI monetization. Microsoft trades at 25x trailing earnings with analysts projecting significant upside, yet the stock trades near bear-case levels as investors price in substantial AI monetization risk that 33 “Strong Buy” analysts collectively reject. The market is punishing Microsoft not for operational failures but for failing to demonstrate that billions in AI infrastructure spending will generate sustainable margin expansion rather than just revenue growth.

The contrast with other tech giants reveals Microsoft’s unique challenge. Google (NASDAQ:GOOGL) has declined just 1.2% year-to-date by integrating AI into existing profitable products, whereas NVIDIA (NASDAQ:NVDA) remains essentially flat for 2026 by selling the underlying infrastructure rather than promising future monetization. Microsoft is being punished specifically for the gap between AI infrastructure spending and product adoption. Investors want proof that the company’s “AI business is larger than some of our biggest franchises” claim translates to sustainable margins, not just revenue.