Retirees watching their portfolios in early 2026 have reason to smile. While tech stocks stumble, dividend stalwarts are delivering steady cash flow and capital appreciation.

Consumer Staples (XLP) is up 13.3% year-to-date, while Technology (XLK) has dropped 2.1%. In a year when growth stocks are catching their breath, dividend payers are sprinting ahead.

We ranked three Dow components retirees love based on year-to-date performance, dividend reliability, and cash generation. These are blue-chip businesses with decades of dividend increases, fortress balance sheets, and predictable income streams. Here’s how they stack up as of February 18, 2026.

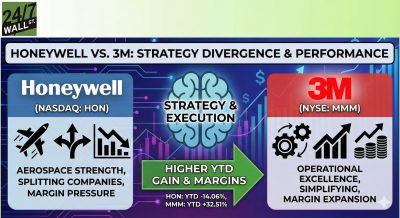

#3: Honeywell International

Honeywell International (NASDAQ:HON) is up 23.1% year-to-date, the strongest gain of the three. It lands at #3 because restructuring uncertainty makes it the riskiest choice for retirees. Honeywell is splitting into separate automation and aerospace businesses, a transformation that could unlock value but introduces near-term complexity.

The company beat Q4 earnings with adjusted EPS of $2.59 versus the $2.54 estimate, though revenue of $9.76 billion missed the $9.87 billion consensus. Free cash flow surged 33% year-over-year to $2.51 billion, and orders jumped 23% organically. CEO Vimal Kapur noted: “We concluded 2025 with strong results that exceeded the high end of our guidance for adjusted sales and adjusted EPS.”

Honeywell has raised its dividend for 23 consecutive years, with the 2025 annual payout reaching $4.58 per share, up 4.8% from 2024’s $4.37.

At a current yield of 1.9%, it’s the lowest yielder of the three, but 574% dividend growth since 1999 shows long-term compounding power. The forward P/E of 23x reflects restructuring optimism. The spin-off of business units is expected to complete over the coming quarters, adding complexity to the near-term outlook.

#2: Chevron Corporation

Chevron Corporation (NYSE:CVX) has delivered a 19.1% year-to-date return while pumping out industry-leading cash flow. The oil giant beat Q4 earnings with $1.52 per share versus the $1.44 estimate, and revenue of $46.87 billion topped $46.7 billion consensus estimates. Lower crude prices pressured profits, but free cash flow climbed 26% year-over-year to $5.5 billion.

CEO Mike Wirth summed up the year: “2025 was a year of significant achievement. We successfully integrated Hess, started-up major projects, delivered record production…industry-leading free cash flow growth and superior shareholder returns, despite declining oil prices.” Worldwide production jumped 12% year-over-year.

Chevron raised its quarterly dividend 4% to $1.78 per share in January 2026, marking decades of uninterrupted increases. At a 3.8% yield, it offers meaningful income without distress-signal levels. Chevron returned $12.1 billion via buybacks in 2025. The risk: oil prices remain volatile, and Chevron’s fortunes are tied to commodity markets.

#1: Verizon Communications

Verizon Communications (NYSE:VZ) takes the top spot with a 20.6% year-to-date gain and the highest yield at 5.9%. Verizon has raised its dividend for 19 consecutive years, with the current quarterly payout of $0.7075 per share, up from $0.6775 in early 2025.

Q4 results showed transformation in action. Verizon beat earnings with $1.09 per share in adjusted EPS. The headline: free cash flow exploded 285% year-over-year to $20.13 billion, driven by the Frontier acquisition that closed January 20, 2026. That deal expanded Verizon’s fiber footprint to over 30 million homes and businesses. The company added over 1 million total net customers in Q4, its strongest quarterly performance since 2019.

CEO Dan Schulman was direct: “Verizon will no longer be a hunting ground for our competitors. The closing of our Frontier acquisition on January 20 is another pivotal step in our turnaround.” For 2026, management projects adjusted EPS growth of 4% to 5% and free cash flow exceeding $21.5 billion. At a forward P/E of 10x, Verizon trades like a value stock with a growth catalyst.

How the Three Compare

Among the three, Honeywell posted the highest capital appreciation year-to-date but is navigating a restructuring. Chevron generated strong cash flow while managing commodity price exposure. Verizon reported the highest yield at 5.9% and closed its Frontier acquisition in January 2026, projecting free cash flow exceeding $21.5 billion for the year.