Americans today pay an average of 19.1% more on grocery items than they did 10 years ago. Over the same time, the inflation rate was just 16.3%.

Several key factors generally affect food prices in the long run. High oil prices increase the cost of shipping; droughts and floods cause shortages of certain crops; and a growing appetite for more expensive food from an increasingly affluent world population drives up overall demand — and prices — of food. Americans may also feel the effects of recently imposed tariffs on goods traded between China and the United States in the checkout aisle. This is particularly true of certain items like canned goods.

In the short run, the supply and demand of food is subject to factors such as weather, disease outbreak, and changing consumer preferences. In recent years, the California drought, the 2015 avian flu outbreak, and an increasing appetite for higher priced items such as organic foods in the United States and meat and dairy products in developing countries have caused some goods to appreciate in price far faster than most food items.

Click here to see the 20 groceries driving up your food bill the most.

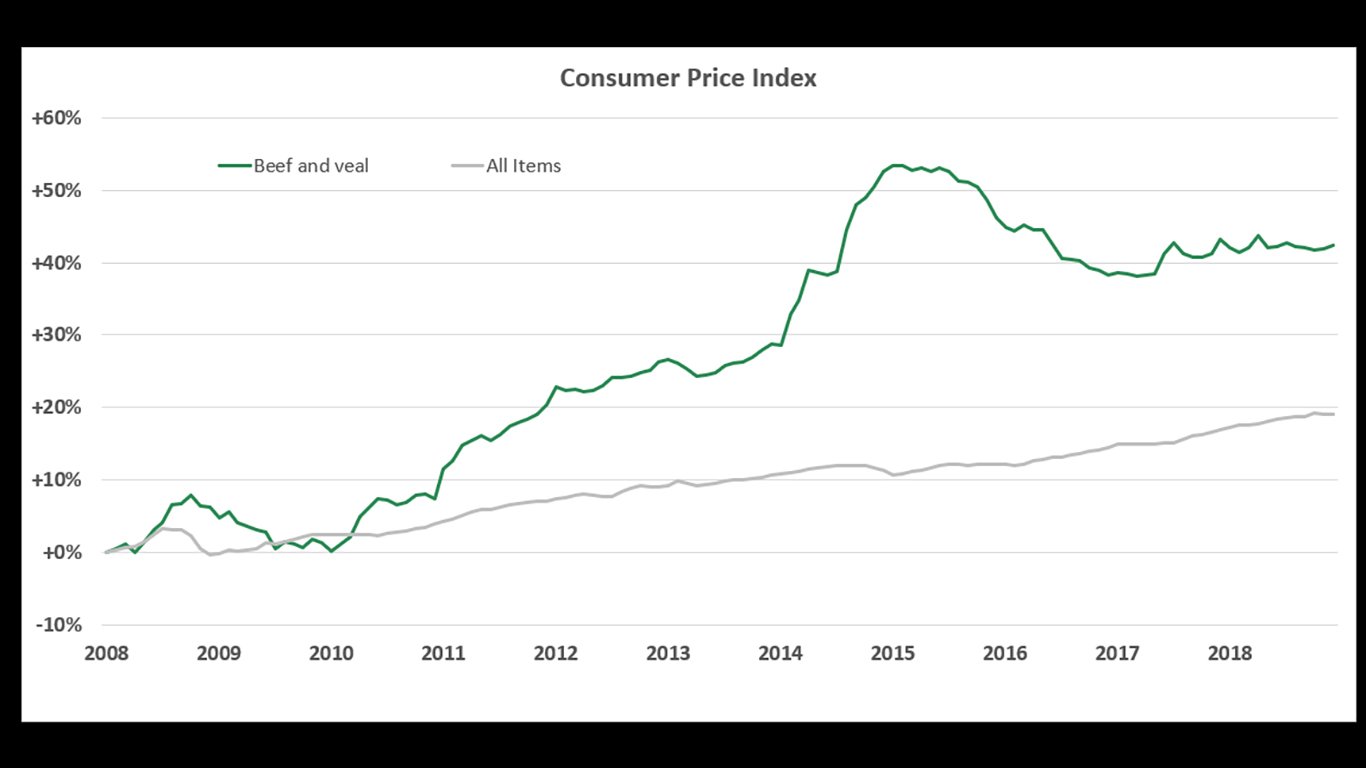

To determine the groceries driving up food bills the most, 24/7 Wall St. analyzed changes in the consumer price index from 2008 to 2018 for over 300 goods using data from the Bureau of Labor Statistics. To avoid repetition, we excluded certain items from the list when a similar product had a larger increase. For example, two items classified on the CPI — uncooked ground beef and beef and veal — each had substantial price increases. Only beef and veal, which had the larger 10-year increase, remained on the list. The prices of 20 grocery items increased by at least 21% over the last 10 years.

Correction: In a previous version of this story, several grocery items listed fell into multiple categories. To address this issue and avoid double counting, we only included the item or item category with the largest price increase.

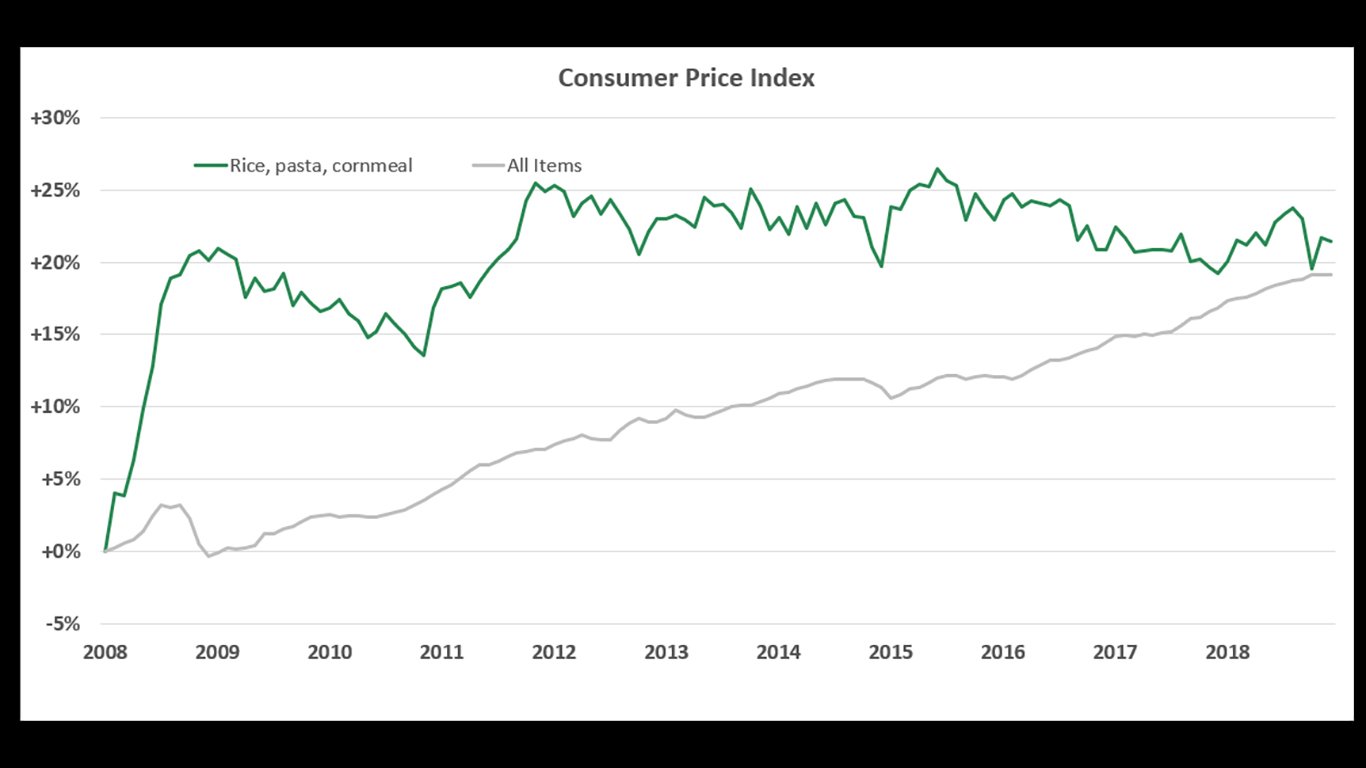

20. Rice, pasta, cornmeal

> 10-yr. price increase: 21.5%

Many crops are feeling the effects of climate change. Major heat waves across the world have made growing and harvesting crops like rice and wheat more difficult. The cost of rice has increased and, for the first time in six years, there was a global wheat deficit in 2018, according to Bloomberg. The price increase has likely had a profound effect on American grocery bills, as Americans consume 19.4 pounds of pasta per capita annually.

[in-text-ad]

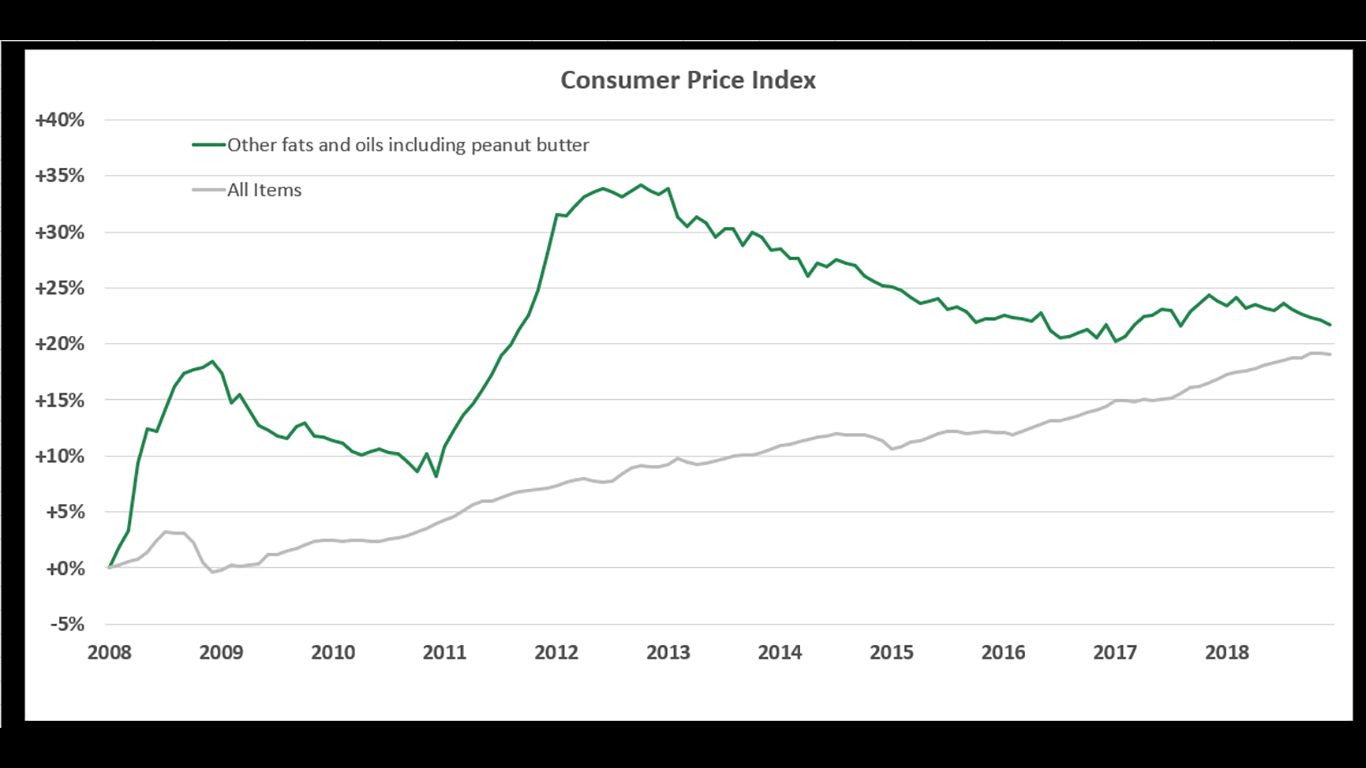

19. Other fats and oils including peanut butter

> 10-yr. price increase: 21.7%

One driving force behind the rising price of other fats and oils like peanut butter was likely the rising price of peanuts. As more farmers are switch from peanuts to more profitable crops like cotton, the amount of land used to grow peanuts in the United States shrunk by an estimated 18% in 2018. In recent years, peanut butter consumption has spiked in the United States. Partially as a result, In the last 10 years, the price of other fats and oils by climbed 21.7%.

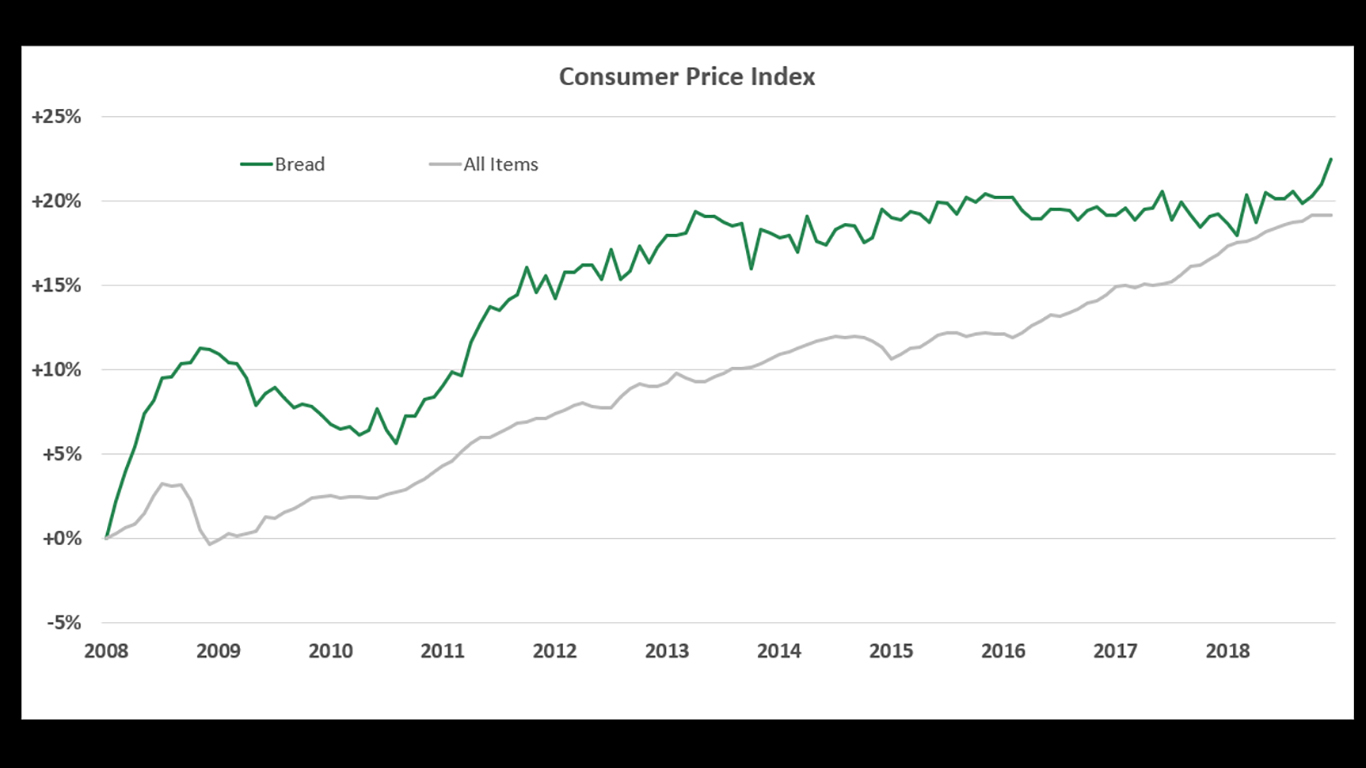

18. Bread

> 10-yr. price increase: 22.4%

A staple of the human diet dating back millenia, bread has become much more expensive over the past decade. Extreme weather across the world has affected wheat harvests. Major wheat producers like Australia and Russia have faced droughts and heatwaves. This has cut into supply, forcing bakeries to raise bread prices. In the last 10 years, the price of bread in the U.S. climbed 22.4%.

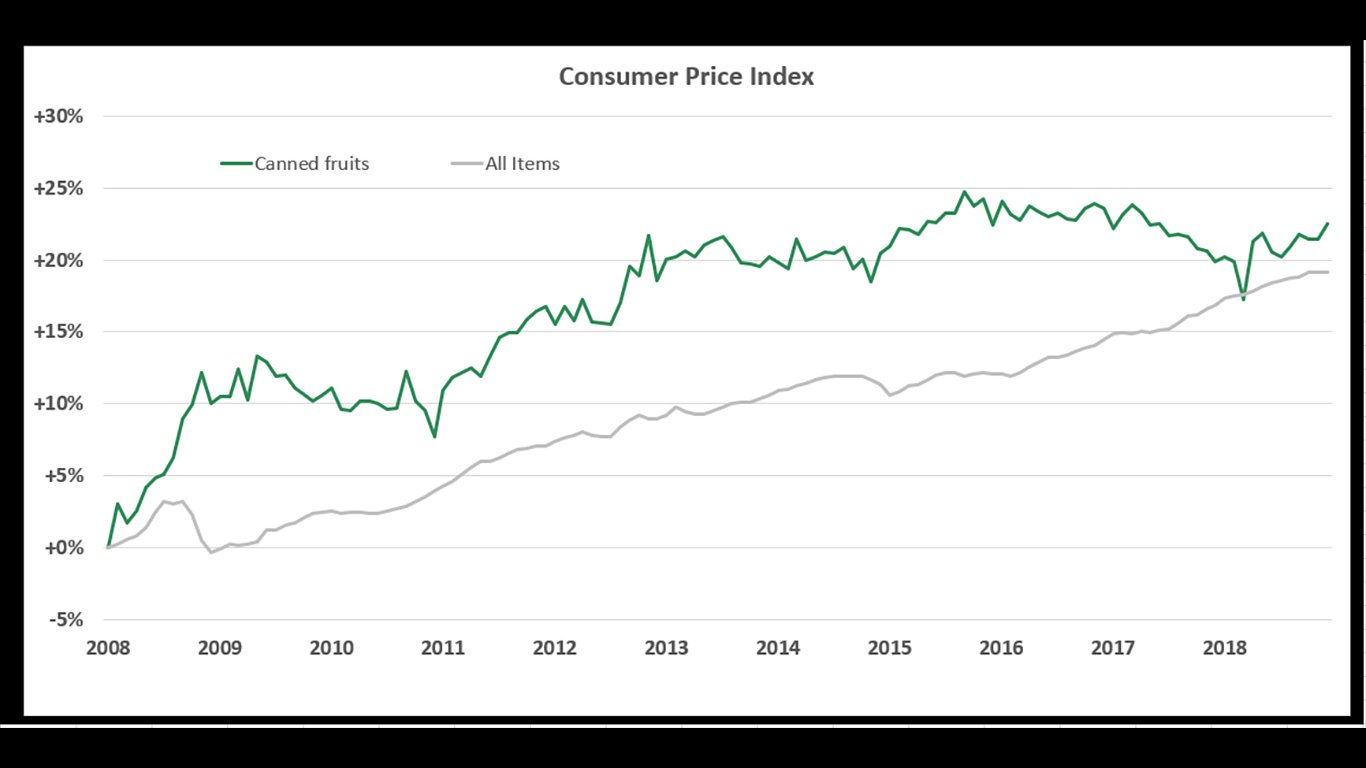

17. Canned fruits

> 10-yr. price increase: 22.5%

The yield of crops such as fruit, and therefore their price, is highly susceptible to unpredictable weather events like heatwaves and droughts. But canned fruits may be feeling the squeeze from newly imposed U.S. tariffs. New taxes on steel imported from China are raising packaging costs for makers of canned goods. In the last 10 years, the price of canned fruit climbed by 22.5%.

[in-text-ad-2]

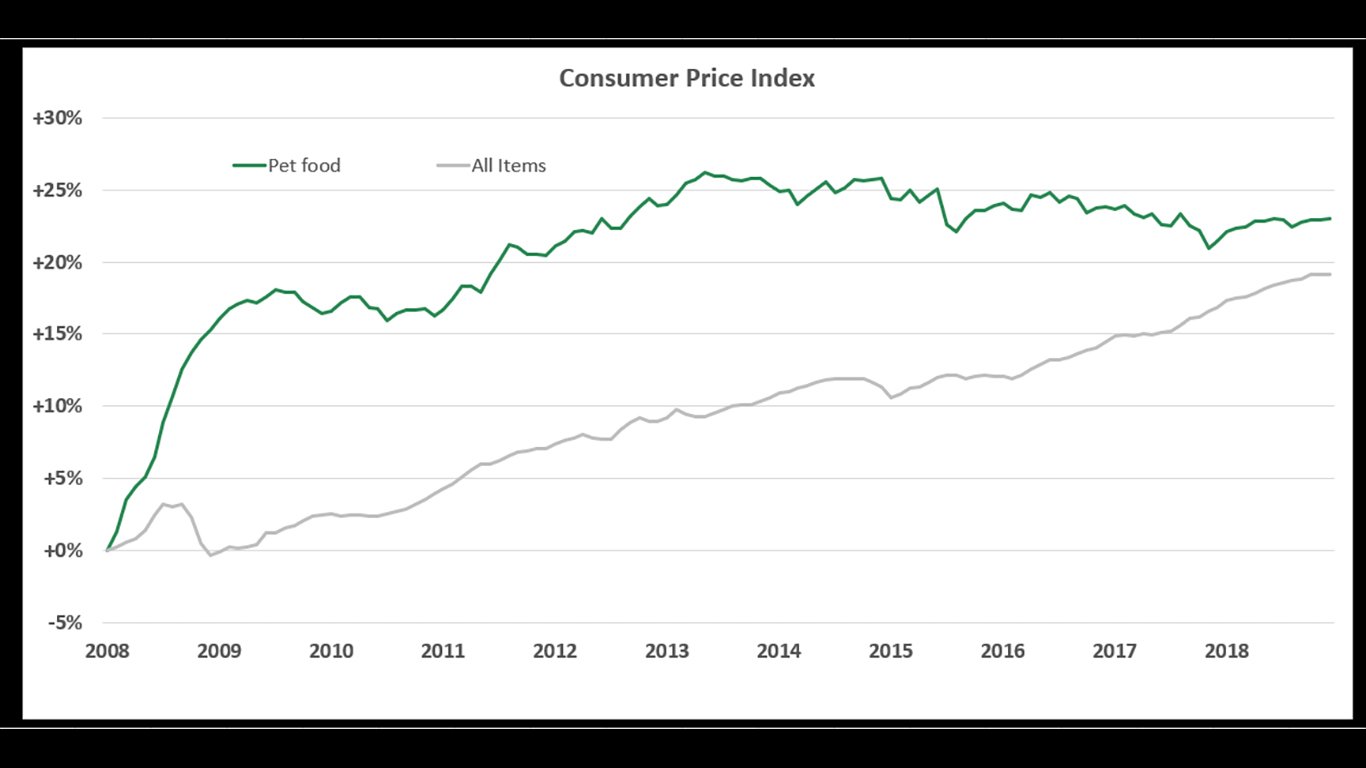

16. Pet food

> 10-yr. price increase: 23.0%

One of the likely contributors to the 23% spike in pet food prices is the greater demand for premium products. As millennials are delaying marriage and having children later in life compared to previous generations, they are getting pets instead and lavishing them with high-quality pet foods, according to a Business Insider report. Even though the total sales of pet food by volume declined in the U.S. from 2011 to 2016, the amount spent went up considerably.

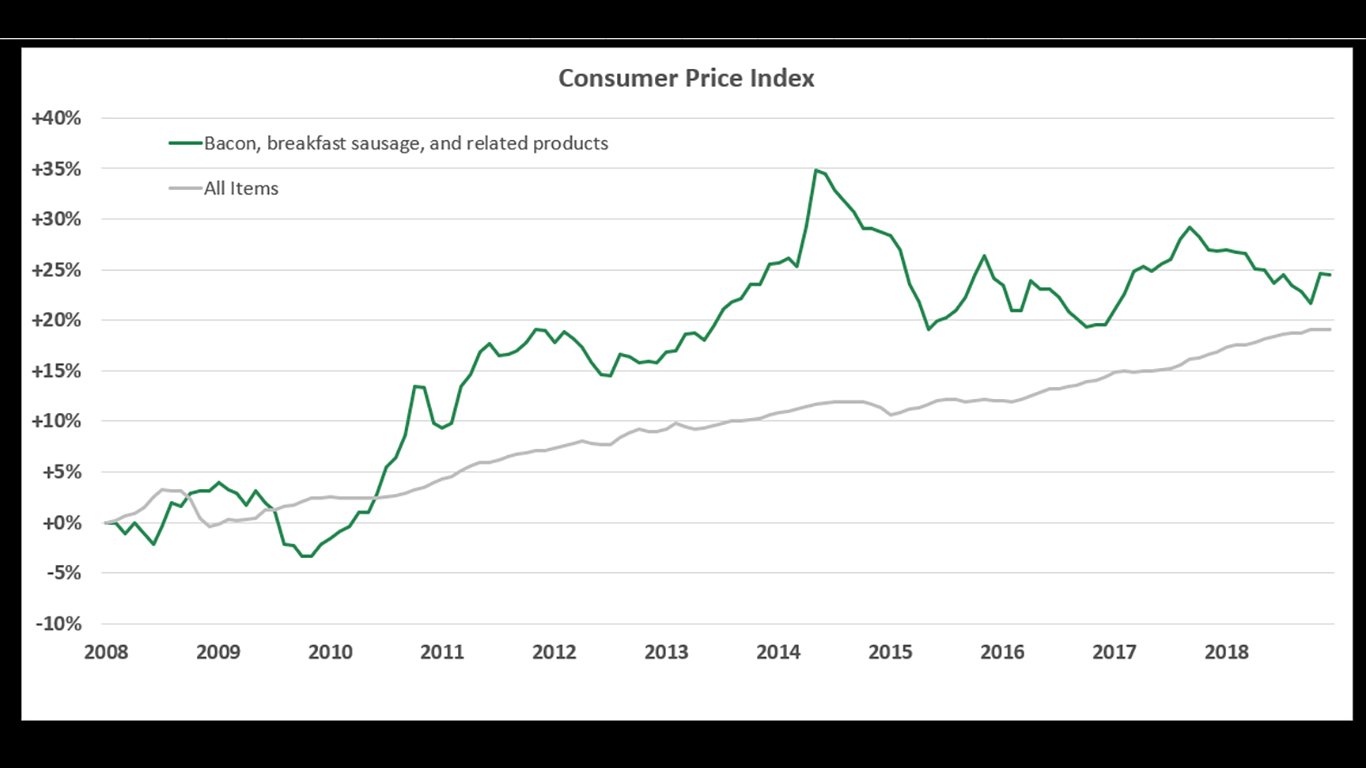

15. Bacon, breakfast sausage, and related products

> 10-yr. price increase: 24.5%

Bacon and sausage is about 25% more expensive now than 10 years ago. As is the case for many food items on this list, the climb in the prices of breakfast meat is partially attributable to growing demand. Americans are projected to consume in 2019 an average of 52.3 pounds of pork, the most commonly used meat for bacon and sausage, up 7% from 48.9 pounds per capita in 2008, according to the U.S. Department of Agriculture.

Pork prices in the United States will likely be affected by the recently imposed Chinese tariffs. American pork is now subject to a 25% tax in China, which will likely reduce demand in that country and lower profits for American hog farmers. Where pork prices go from here remains to be seen.

[in-text-ad]

14. Frozen fish and seafood

> 10-yr. price increase: 24.7%

The U.S. aquaculture industry largely consists of catfish, trout, salmon, tilapia, hybrid striped bass, sturgeon, walleye, and yellow perch. Shrimp, salmon, and canned tuna make up more than half of seafood consumed in the United States. The vast majority of seafood Americans eat is imported. The increase in the price of seafood likely stems from rising demand for fish worldwide, particularly in China.

13. Sauces and gravies

> 10-yr. price increase: 25.6%

Sauces and gravies cover a wide range of condiments that can go on anything from pasta to a sandwich. While prices for specific sauces and gravies may vary, on average, their prices have gone up by 25.6% over the last 10 years, faster than the 19.1% increase in prices across all grocery items.

The price increase is likely due in part to growing demand. Sauces and gravies are used to add flavor to food, and as such they are an unnecessary expense Americans today can better afford. Americans have more disposable income now than they did 10 years ago — the beginning of the Great Recession.

12. Fats and oils

> 10-yr. price increase: 25.6%

There was a 25.6% increase in the price of fats and oils in the last decade. As is the case for many foods on this list, the climbing price of fats and oils was driven largely by growing demand — particularly for olive oil. The United States consumed 339,512 tons of olive oil in 2015, up 250% from 1990. Over the same period, global olive oil consumption climbed by a lower 73%. Olive oil contains certain healthy dietary fats and antioxidants, it may lower the risk of heart disease. Because of its purported health benefits, consumption is projected to continue to climb in the future as Americans become increasingly health conscious.

[in-text-ad-2]

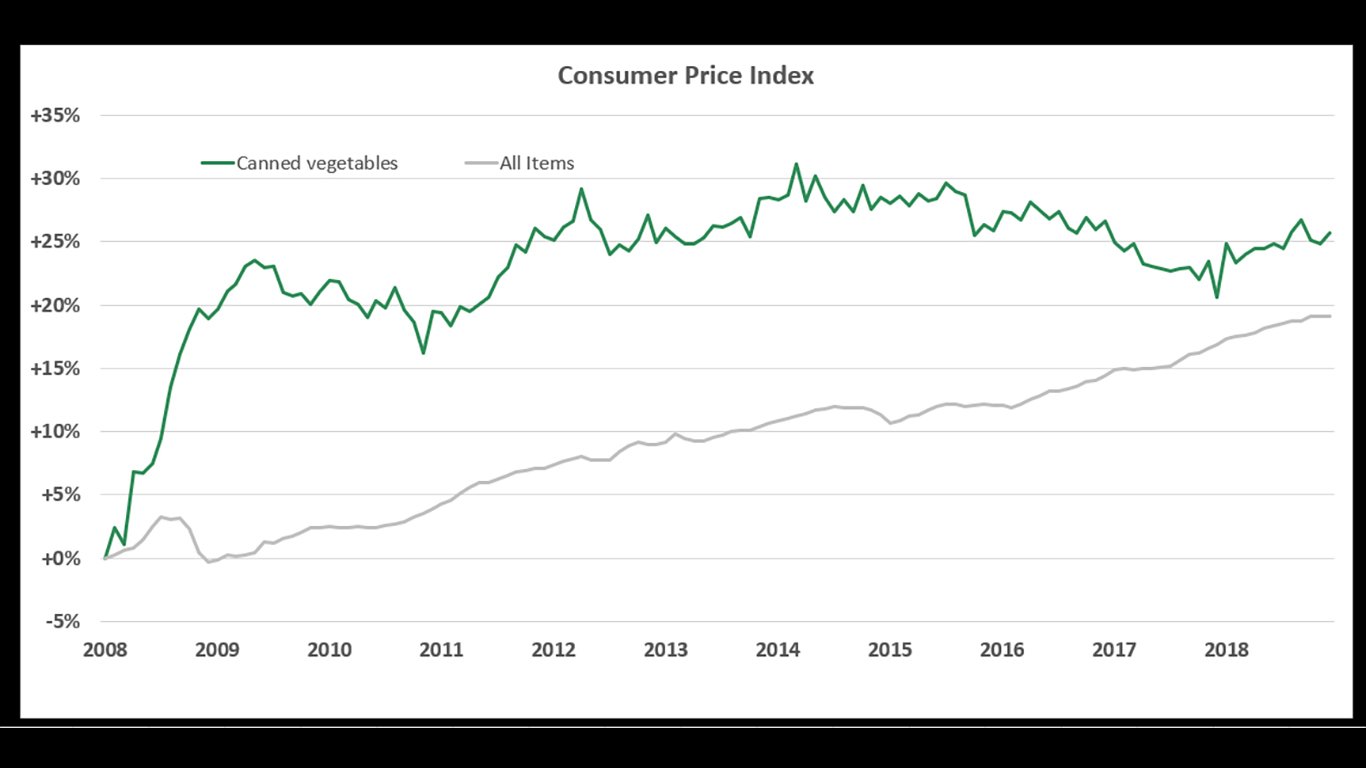

11. Canned vegetables

> 10-yr. price increase: 25.7%

Canned vegetables have a longer shelf life than fresh produce as well as lower shipping and handling costs. While these factors generally contribute to lower prices, the rising demand of canned vegetables seems to have contributed to rising prices. According to the USDA, canned vegetable consumption tends to rise with age. The considerable growth of the U.S. elderly population over the last decade likely led to an increased demand for canned vegetables overall, contributing to the product’s sharp rise in the price.

10. Fresh biscuits, rolls, muffins

> 10-yr. price increase: 27.2%

Traditional biscuits, rolls, and muffins share many of the same ingredients, but butter may be the one factor contributing most to their 27.2% price increase in the last 10 years. Over the last decade, butter prices have climbed 43.6% in the United States, driven by growing demand. Due in part to Americans’ awareness of benefits associated with natural fats found in butter that are more healthful than those in margarine, butter sales climbed by an annual average of 7% in North America from 2012 to 2017.

[in-text-ad]

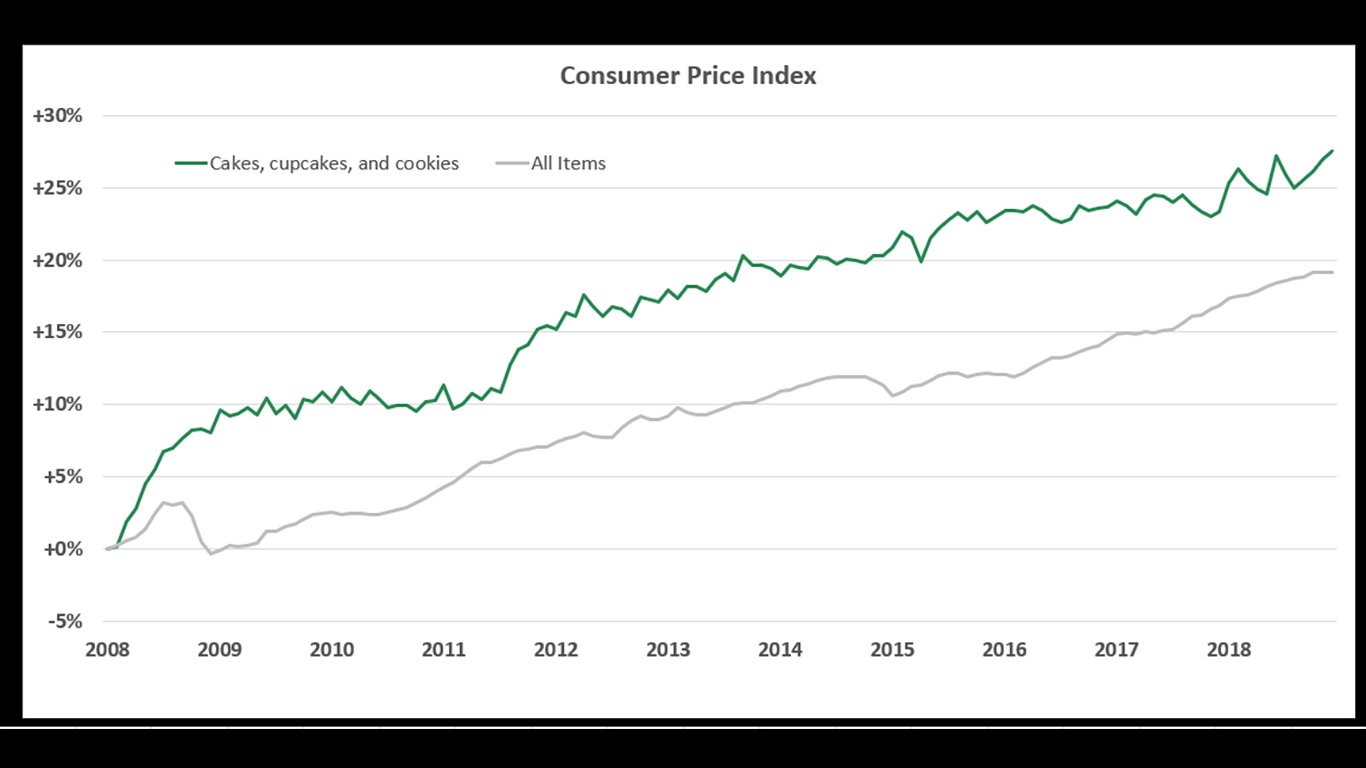

9. Cakes, cupcakes, and cookies

> 10-yr. price increase: 27.6%

The price of cakes, cupcakes, and cookies rose slightly faster than the price of flour, which is a main ingredient in many of these baked goods. The rising cost of butter has likely contributed to the increase in baked goods prices. The price of butter rose by 43.6% over the last decade, more than nearly any other food item.

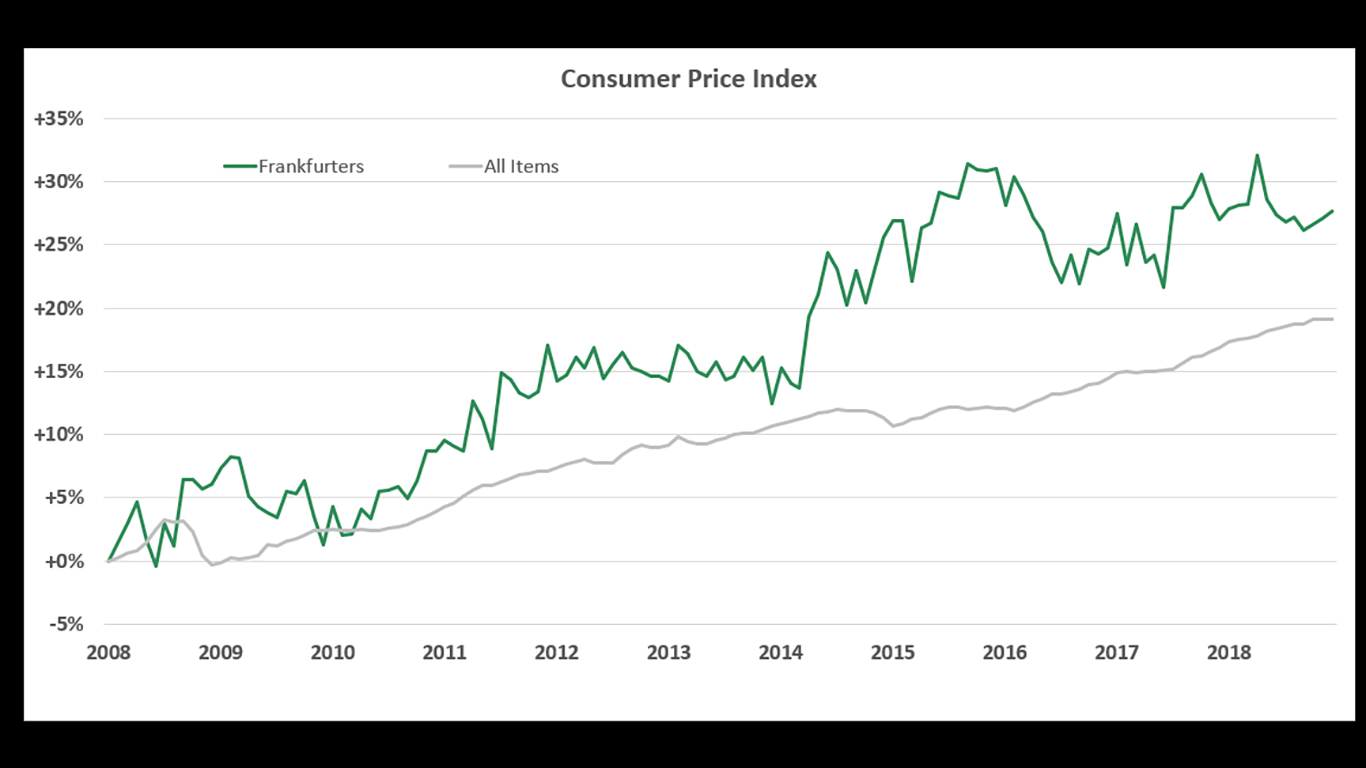

8. Frankfurters

> 10-yr. price increase: 27.6%

Perhaps no food is as iconically American as the hot dog. According to the National Hot Dog and Sausage Council, Americans consume an average of 70 hot dogs a year — despite the common belief that eating more than two per year is unhealthy.

Frankfurters are one of several meats to rank on this list. In the last decade, the average price of a frankfurter climbed by 27.6%. Frankfurters are traditionally made from pork and beef, the former of which has surged in demand — and price — in recent years. What effect that will have on demand for frankfurters remains to be seen.

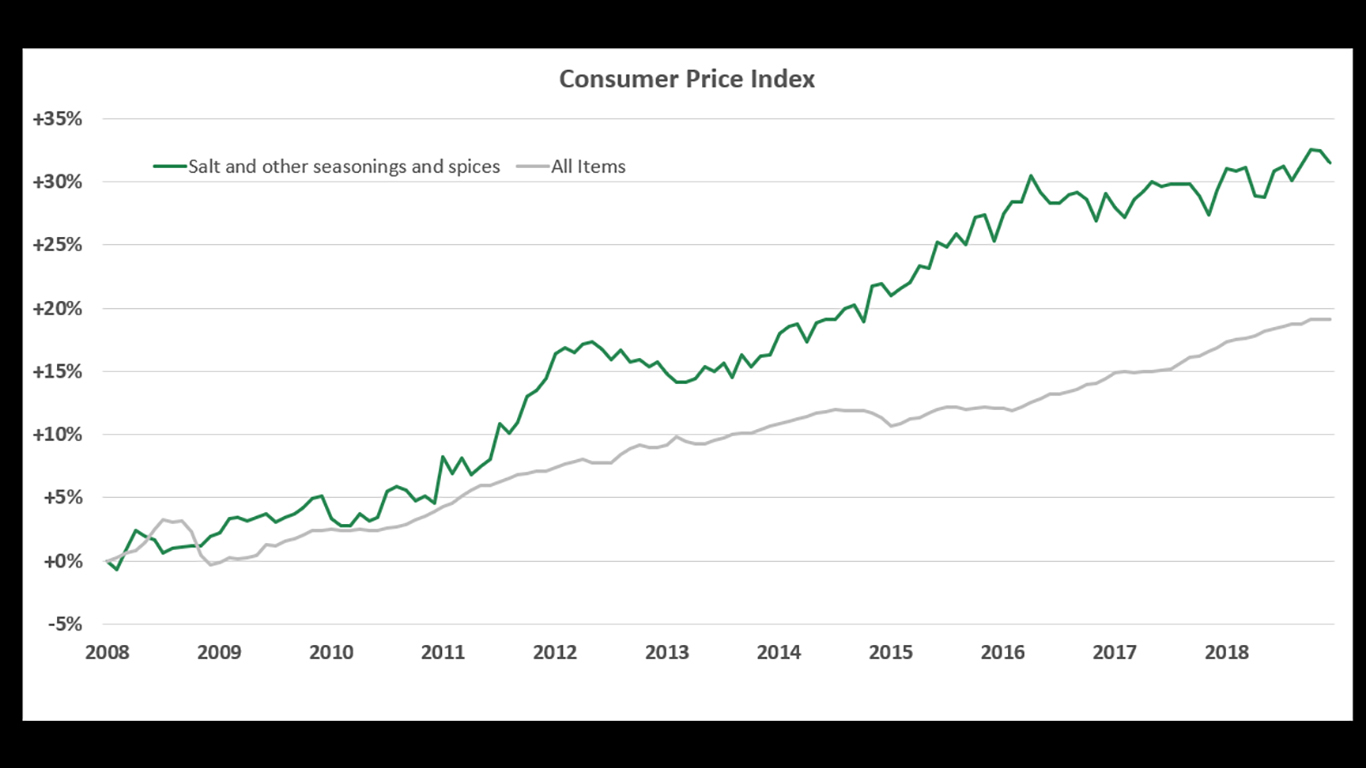

7. Salt and other seasonings and spices

> 10-yr. price increase: 31.5%

One factor contributing to the increase in the price of salt overall may be the rapid growth of the gourmet salt market, which includes products such as Himalayan salt, sel gris, and fleur de sel. While a rise in price can reduce demand for a consumer good, sodium consumption among Americans has remained largely unchanged over the past 10 years, according to the Centers for Disease Control and Prevention.

[in-text-ad-2]

6. Oranges, including tangerines

> 10-yr. price increase: 37.6%

Orange growers in Florida, the largest orange-producing state, have had to deal with several issues in recent years. The state was hit with an incurable disease in 2017 that depleted citrus trees. Hurricane Irma was also a destructive force that year. While Florida’s crops are recovering, the state is also facing now international competition from countries such as Brazil.

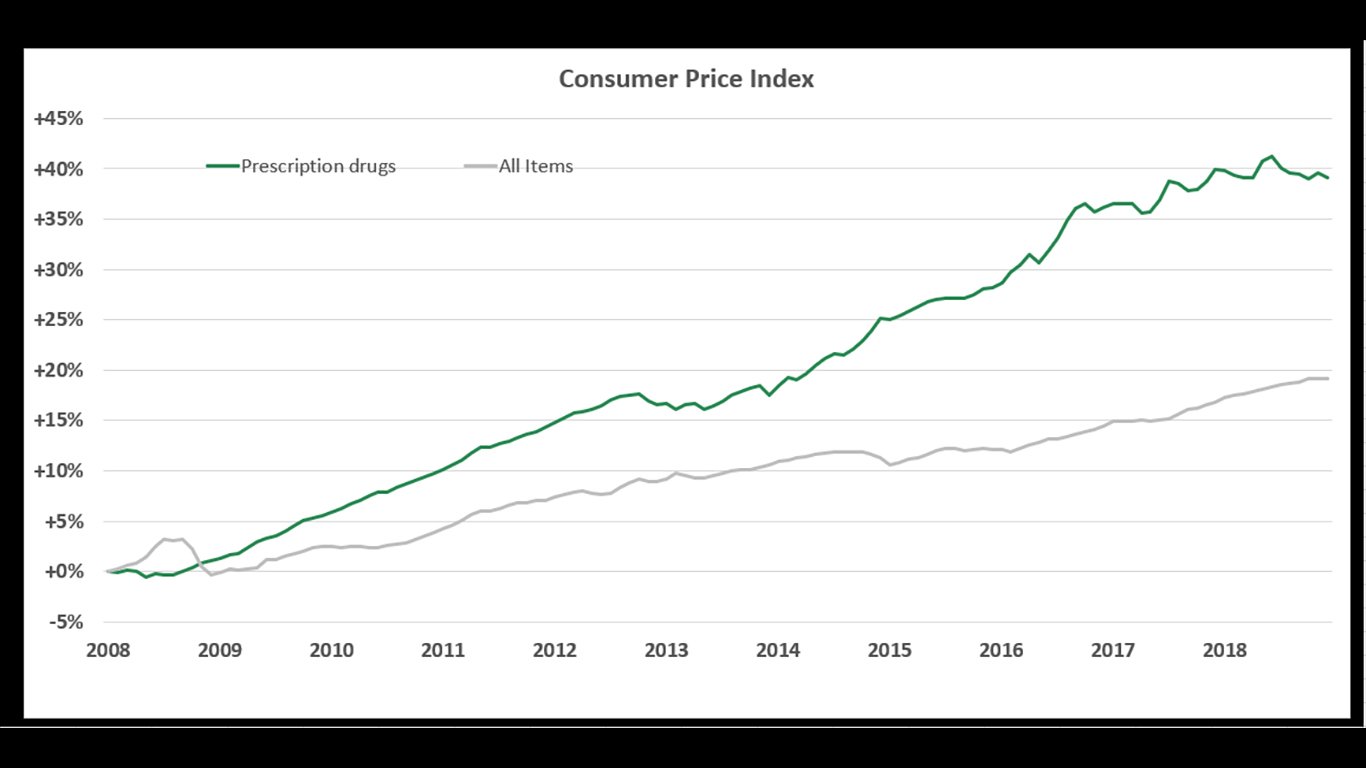

5. Prescription drugs

> 10-yr. price increase: 39.1%

Despite heavy competition, pharmaceutical companies have raised the prices of prescription drugs in recent years. The prices of four of the 10 most popular prescription drugs in the United States — including arthritis drugs Humira and Enbrel — have more than doubled since 2011. Despite the rising costs, demand for drugs has continued to grow in recent years. The share of Americans using at least one prescription drug a month has risen from approximately 38% two decades ago to nearly half of all Americans, according to the CDC.

[in-text-ad]

4. Beef and veal

> 10-yr. price increase: 42.4%

There is currently no shortage of meat in the United States. Meat’s high cost is primarily driven by strong demand, especially for beef and veal. Exports of these meats hit a record of 2.9 billion lbs in 2017 with Japan the top buyer. This demand has contributed to the increase of 42.4% in the price of beef and veal in the United States.

3. Shelf stable fish and seafood

> 10-yr. price increase: 42.5%

One factor affecting the cost of fresh fish is the rising cost of fishmeal, which has increased production costs of farmed seafood. Additionally, as the average consumer has become wealthier, demand for more expensive, high-end fish such as tuna and salmon increased, which drove the price of fresh seafood higher.

2. Margarine

> 10-yr. price increase: 50.2%

While butter and margarine are considered substitute goods — increased in demand (in this case butter) for one often coincides with a decline in demand for the other — the prices of both rose in the past decade. The increase in margarine prices, however, outpaced the increase in butter prices over the past decade, spiking by 50.2% — faster than nearly any other grocery product.

[in-text-ad-2]

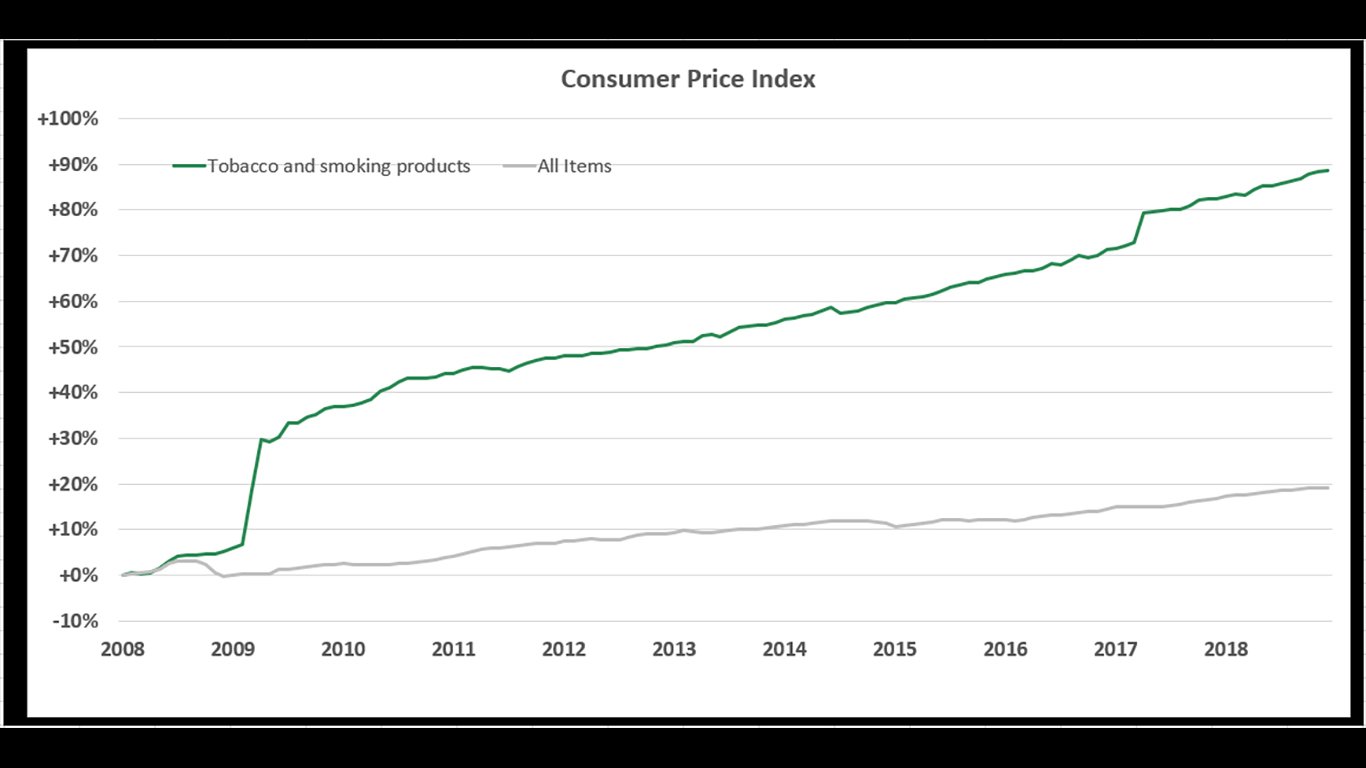

1. Tobacco and smoking products

> 10-yr. price increase: 88.7%

The price of tobacco and smoking products in the United States nearly doubled in the past decade, rising by 88.7% from 2008 to 2018 — the largest increase of any grocery item in the country. The rise was largely because of a federal tax hike implemented on April 1, 2009, that increased the tax on cigarettes by 61.7 cents per pack. As a result, cigarette sales declined by 8.3% in 2009 alone — the largest decline in nearly 80 years.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.