The decade from 2010 to 2020 has come with far less turbulence so far than the prior decade. Many investors might have grown to think all over again that they can just buy stocks and let it ride. After all, every single pullback has been bought heavily since 2012. Those trends cannot last forever, but getting past the noise and maybe even beyond the next recession and bear market is what long-term investors have to consider — maybe even out a full decade. Source: Thinkstock

Source: Thinkstock

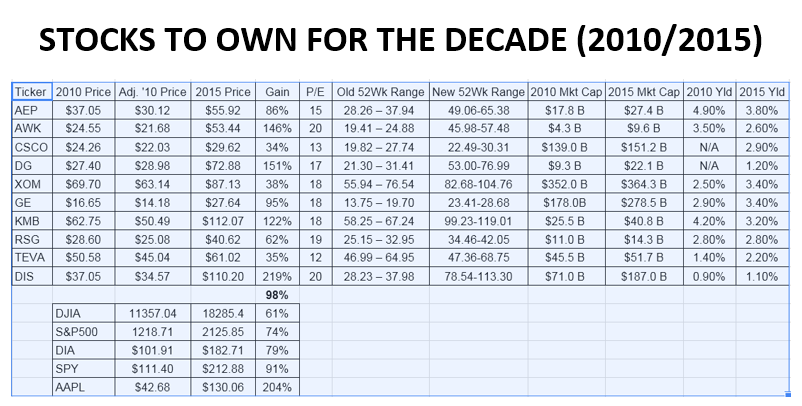

It was back in November of 2010 when 24/7 Wall St. first issued a list of stocks for true long-term investors: the Ten Stocks to Own for the Next Decade. Amazingly, the average gain of the 10 stocks had outperformed the broader Dow Jones Industrial Average (DJIA) and S&P 500 market indexes as of May 2015 with an average gain of 98% since November 10, 2010, without considering taxes on dividends and reinvestment costs. This was even a larger surprise, considering that the list outperformed the market without including Apple Inc. (NASDAQ: AAPL), which was still in a state of flux, paid no dividend and was not expected at the time to get into the dividend game for years. This list included some great wins and some unimpressive gains, considering the bull market strength.

Now that we are in mid-2015, we are nearing the half-way point of the decade cycle. 2015 is also widely expected to finally commence an interest rate hike cycle. 24/7 Wall St. has also said that investors should not panic at all about the coming Fed rate hike cycle. Still, even long-term investors need to assess their portfolios from time to time.

ALSO READ: Major Portfolio Changes for Warren Buffett and Berkshire Hathaway

Picking stocks for a decade is no easy task. It seems like a small lifetime in some cases. Most decades witness one or two recessions and one or two bear markets. That means that long-term investors have to think like a futurist and look through the next business cycle. They have to pick where they want to be and, perhaps even more importantly, they have to identify where they do not want to be.

When 24/7 Wall St. identified its stocks for a decade, it considered loads of economic and consumer data, business spending, what interest rates will do, what election cycles might bring, and potential changes in regulation and taxation. The stocks for a decade was not at all meant to identify the next 10-bagger. While it outperformed the major indexes on average, this list was not designed to try to outperform any meg-bull market. The idea was to pick steady-eddy companies that were not considered high-growth stocks. This ranged from utilities to services, to select retail and consumer trends, and to business spending, and it included one technology stock.

The 24/7 Wall St. stock list will change only modestly, with perhaps one or two real changes, but with many alternative companies named specifically. American Electric Power (NYSE: AEP) and American Water Works Company Inc. (NYSE: AWK) are in, along with the garbage stock Republic Services Inc. (NYSE: RSG). Cisco Systems Inc. (NASDAQ: CSCO) is the sole technology stock, and the secular trend behind Dollar General Corp. (NYSE: DG) does not seem over at all. In energy, Exxon Mobil Corp. (NYSE: XOM) remains the top pick if you have to consider a decade out. Kimberly-Clark Corp. (NYSE: KMB) remains in consumer products, General Electric Co. (NYSE: GE) in conglomerates and Walt Disney Co. (NYSE: DIS) in media and entertainment. Teva Pharmaceuticals Industries Ltd. (NASDAQ: TEVA) is the one that really felt like the mistake, but alternative health care picks have been provided.

Again, alternative companies have been provided that will fit the bill for an outlook in the next five years to 10 years. No hyper-growth companies are included, and we would be surprised yet again if this list outperforms the S&P 500 and DJIA if a runaway bull market remains in place.

ALSO READ: The 10 Most Popular Stores in America

The list intentionally had no food companies due to changing trends in 2010, although the battle of the bulge and the fight against Frankenfoods now seems set. In technology, consumers ebb and flow and valuations in high-growth stocks can cripple long-term gains. That means no internet and data security stocks. While biotech has been hot and while Big Pharma is considering split-ups and even higher dividends, there are big risks in picking the wrong “winners.” Most retail and apparel companies are effectively new companies with new products once or twice a year. The financial sector was also avoided, even if some giants should do well.

24/7 Wall St. again wants to remind readers that there are many runners up that could have been considered for the list. We have informally included some alternative picks in 2015 by name. All these companies are highly established. They should weather coming economic cycles and should still fit within the secular trends that are in place.

When the list of stocks for the decade was created, it was meant to be geared toward novice and conservative investors. It was intended to be a list of go-to stocks to consider whenever buying opportunities arose and was mean to challenge the notion that “buy and hold is dead.”

24/7 Wall St. has included a table at the end of this report to show the market gains in the DJIA and S&P 500, also versus the key DJIA and S&P 500 exchange traded funds, as well as the gain of each. We have included earnings multiples for a blended 2015/2016 timeframe in our outlook for most companies. You will notice a keen focus on dividends here, but less of a focus on stock buybacks, mainly because we expect many companies to have to slow dividend and buyback growth in the coming years.

ALSO READ: The 9 Most Misleading Product Claims

1. American Electric Power

Still one of the 10 largest publicly held electric utilities in America, power generator, transmission and distribution giant American Electric Power Co. (NYSE: AEP) serves over 5.3 million customers in 11 states. While it has diverse sources of generation from natural gas, hydro, wind and solar, AEP saw a marginal increase in coal-fueled generation in 2014.

AEP aims for cost-maximization and if there is one utility that lobbies and aims to protect investors and dividends it is AEP. It has raised dividend payouts for years, and its 60% payout rate generates a yield of 3.8% (that yield was almost 5% in 2010). We consider AEP one of the safest utility dividends and its old “Defend My Dividend” campaign from years back (now under American Gas Association) lets you know where this company stands. As of mid-2015, AEP and utilities pulled back handily from their highs due to interest rate hike concerns and due to valuations being excessive. AEP is valued at 15 times a blended 2015/2016 earnings estimate.

Alternative Utility Pick: Duke Energy Corp. (NYSE: DUK) has finally gotten back on track, and it is narrowing its aim despite being America’s largest utility by market cap. Duke is valued at about 16 times a blended 2015/2016 earnings estimate, and Duke’s dividend yield is a solid 4.1%. Duke’s shares are up about 75% since 2010, versus just over 85% for AEP.

2. American Water Works

This remains a top defensive stock that should be a core holding for moderate and conservative long-term investors. It has the defensive characteristics of being a utility, but it has no way to be replaced because it is a water utility. American Water Works Co. Inc. (NYSE: AWK) is simply the best-run water pure-play out there. With a market now close to $10 billion, it serves some 15 million people in 47 states, and the California Am-Water unit is only 600,000 of its base.

This stock is so defensive that it just never really pulls back by 10%. American Water is now many years past the RWE spin-off, and both Moody’s and S&P raised its credit ratings in May of 2015. American Water offers its investors a whole portfolio of virtual monopolies and it can grow via acquisitions and negotiations. New investors have to pay just under 20 times a blended 2015/2016 earnings to buy shares now. Its yield was closer to 3.6% in 2010, but the dividend was just raised again and now yields closer to 2.6%. The company remains committed to dividend growth for years ahead.

ALSO READ: 9 States Running Out of Water

Alternative Water Pick: American Water Works remains the best water pick tied to utilities with the best future with a market cap that is defensive enough. Xylem Inc. (NYSE: XYL) has a solid future in water infrastructure and numerous wastewater applications. Still, its growth has become very choppy. Xylem trades at about 18 times a blended 2015/2016 earnings estimate and comes with a yield of about 1.5% that has room to grow once it gets its revenue and earnings growth back on track.

3. Cisco Systems

Cisco Systems Inc. (NASDAQ: CSCO) is now entering the post-John Chambers era, at least as far as Chambers being CEO. Cisco remains the unchallenged leader in networking and communications equipment now, just like it was five years ago, and that is almost certain to be the case in the years ahead. It was picked in 2010 for its dominance in the enterprise market, with hardly any serious exposure to the trends of consumers and retail.

Cisco will find growth in routers, switching, data, wireless, security and more. Cisco is always competitive in major telecom carrier upgrade cycles, and it has even been able to mostly get past the negative NSA cloud that was there in 2014. Cisco remains the king of share buybacks so far versus its peers. It did not pay a dividend in 2010, but it has been aggressive enough in dividends that it now yields almost 3% (much better than most tech giants). Cisco’s cash has grown from about $40 billion in 2010 to over $53 billion in 2015. Cisco trades at about 13 times a blended 2015/2016 earnings.

ALSO READ: 5 Big Oil Stocks to Buy for the Rest of 2015

Alternative Tech Picks: Back in 2010, the technology landscape was not as certain nor as stable with industry leaders knowing their place compared to mid-2015. Apple Inc. (NASDAQ: AAPL) was still fighting vast competition, and BlackBerry was a close to a $50 stock then. Apple is now the largest stock by market cap and by profitability. Still, it is going to take more than just the watch and future iPhone upgrades to lead the next generation of growth, even if buybacks should act as a key stabilizer. Another alternative tech leader for the next decade is Oracle Corp. (NYSE: ORCL), with Larry Ellison’s giant CRM software player being embedded in many enterprises around the globe. Oracle’s 1.4% dividend has much more room to improve at not even a 25% payout rate, and it is valued at less than 15 times blended 2015/2016 earnings.

4. Dollar General

Dollar General Corp. (NYSE: DG) remains the king of dollar stores. Back in 2010 the theme under a “new normal” and “post-new normal” that we expected to remain was the rise of the dollar stores against Wal-Mart and other giants. Dollar stores have continued to reach up beyond the one-dollar mark, and this trend will remain. Its shares were underperforming peers in 2010 because the private equity backers were still unloading stock. Those former owners are gone and shareholders now have complete control.

Dollar General had to back off a merger ambition, and now rivals Dollar Tree and Family Dollar are merging. While this is more firm competition, the real issue is that it levels the field when it comes to the post-dollar stores ahead. Dollar General is now worth over $22 billion, and while it had no dividend in 2010 it has recently started paying a dividend with an introductory yield of 1.2% that is almost certain to grow in time — and it is a winner from a strong dollar. In 2010 it had 8,900 stores in 70% of states, and had grown close to 12,000 stores in 43 states in early 2015.

Alternative Retail Picks: Retail remains jittery and risky, with anything tied to trends or apparel effectively being a new company more than once each year. The combined Dollar Tree Inc. (NASDAQ: DLTR) and Family Dollar Stores Inc. (NYSE: FDO) will be a formidable competitor. While this is geared toward food in retail, Whole Foods Market Inc. (NASDAQ: WFM) remains the envy of natural foods retailers and plain old grocers alike — just don’t expect that stock to do very well if and when the next recession comes.

ALSO READ: 5 Top Potential Biotech Buyout Candidates

5. Exxon Mobil

This may feel like a bumpy sore for oil patch investors who rode the $100 oil down to under $50, but Exxon Mobil Corp. (NYSE: XOM) remains the undisputed king of integrated oil giants, and it owes its formation back to the days of Standard Oil. Since 2010, Apple has passed it up as the largest company in America by market cap, but Exxon Mobil’s acquisition of XTO in natural gas gave it a future for that fuel as well, even if it is unattractive today.

Exxon Mobil was able to grow its dividend in 2015, and it will likely remain a large repurchaser of its own common stock in the years ahead if oil stabilizes. Exxon Mobil used to have a yield of 2.5% in 2010, but it now yields closer to 3.4% due to dividend hikes. Warren Buffett decided to exit his Exxon stake, perhaps too soon, after building it up in 2014, and Buffett successors almost certainly will go back to Exxon if they ever want to own a massive oil position. As we said in 2010, in energy trends, the one constant is that nothing lasts forever. If you know where oil prices will be in 2017, you can predict what Exxon will trade at on a price-to-earnings (P/E) ratio basis. Also, if one company can buy cheap, beaten up oil and giants it will be Exxon Mobil.

Alternative Oil Pick: Kinder Morgan Inc. (NYSE: KMI) has completed its transformation back to a corporation after rolling up all the partnership structures. Kinder Morgan has the infrastructure and toll road model, so it is less dependent (but not immune) to oil prices. Still, it is now worth over $90 billion. Richard Kinder wants to grow the dividend 10% each year from a 4.5% yield base out to 2020, if oil prices cooperate, although 24/7 Wall St. might warn investors that such aggressive dividend growth may be difficult.

6. Kimberly-Clark

Kimberly-Clark Corp. (NYSE: KMB) remains a key defensive stock and a leader in consumer products that dates back into the 1800s. With a $41 billion market cap, it remains a fraction of Procter & Gamble’s mega-cap size. With a product line of paper towels, tissues, diapers, sanitizers, surgical drapes and gowns, and more, the only issue that ever seems to come up is promotional competition from large rivals and from cheap generic brands. Still, Kimberly-Clark is a winner and has been restructuring.

Defensive stocks had a premium in the market in 2010 as well, and despite dividend growth its yield is now closer to 3.2%, versus just over 4% back in 2010. A strong dollar hurts Kimberly-Clark and its U.S.-based peers, but the reality is that emerging markets remain in place for growth potential in the years and decades ahead. With a payout ratio of about 60%, there is room for dividend growth and earnings are expected to grow despite revenue growth headwinds from what may remain a strong U.S. dollar ahead. The price of being in defensive stocks is not cheap at about 18 times a blended 2015/2016 earnings estimate, but that is an issue among all large consumer products players, and it was an issue in 2010 as well.

ALSO READ: 4 Stocks to Own in Case the Stock Market Crashes

Alternative Consumer Products Pick: The Procter & Gamble Co. (NYSE: PG) as it pares down its portfolio and jettisons Duracell to Warren Buffett’s Berkshire Hathaway. P&G is a mega-cap at $220 billion in market value, with a 3.3% yield, and valued at almost 20 times a blended 2015/2015 earnings.

7. General Electric

GE has recovered handily from the recession. While we chose General Electric Co. (NYSE: GE) as the top conglomerate pick in 2010 based in part on it having the highest snapback potential after the financial meltdown, the reality is that GE is still moving toward a post-financial conglomerate model. Its latest financial asset sale and the coming spin-off of the rest of Synchrony Financial will allow for massive share buybacks and an expected return to dividend growth in 2016.

Still, GE outyields its rival conglomerates handily with a 3.4% dividend yield. What has taken place since 2010 is that GE is becoming more focused on being an industrial conglomerate with less financial asset exposure. It has exited NBC Universal entirely, it has moved beyond appliances, it moved toward more energy operations and its acquisition ambitions now appear to be focused on opportunistic bolt-on and tuck-in companies. As noted in 2010: Its positions in health care, energy, water filtration, jet engines and rail engines will assure GE’s future growth.

Alternative Conglomerate Pick: 3M Co. (NYSE: MMM) has been stellar, but high valuations make it desirable if the stock goes on sale. 3M is up 110% or so since 2010, it trades at about 19 times the blended 2015/2016 earnings estimate and it has picked up its dividend game to a 2.6% yield, with roughly half of its normalized income going into dividend payouts.

8. Republic Services

Republic Services Inc. (NYSE: RSG) remains in what is close to a duopoly when it comes to large public garbage collectors, although they prefer to be called waste management service providers. Being in the waste management business is very profitable, but it comes with many pitfalls. Recycling efforts can harm these companies, but low commodity prices and resell prices have made recycling less economic, a potential boom for landfill owners, if they can work better deals on mandatory recycling efforts with cities and counties.

The companies dominating this industry have long-term contracts, and there are a high cost barrier and a regulatory barrier to entry. Still, environmental remediation costs remain a risk and can date back many years. Republic was worth closer to $11 billion in 2010, and its market cap in mid-2015 is about $14.5 billion. One consideration here is that Bill Gates’ Cascade Investment arm owns just over 30% of Republic, with Gates eyeing this as a futurist with a protected market. Republic was recently valued at about 19 times a blended 2015/2016 earnings estimate, and its dividend yield is still roughly the same as it was in 2010 at about 2.8%.

ALSO READ: Companies With the Best (and Worst) Reputations

Alternative Garbage Pick: Waste Management Inc. (NYSE: WM), at 19 times a blended 2015/2015 earnings valuation and with a 3.1% yield. It may even look slightly more attractive than Republic today. Republic is up close to 60% and Waste Management is up about 68% since 2010.

9. Teva Pharmaceutical

This was our top defensive health care stock pick in 2010 due to its mix of branded drugs and leadership position in generic drugs. It turned out, as of mid-2015, that Teva Pharmaceutical Industries Ltd. (NASDAQ: TEVA) was among the dullest and most challenging of the stocks to own for a decade — almost to the point of regret. Biotech’s growth blew this out, and even Big Pharma giants have overcome the patent cliffs. Also, Teva has developed ambitions of large acquisitions again. Back in 2010 Teva gave 2015 targets of $31 billion in revenues and earnings of close to $6.8 billion, but that looks more like $20 billion and $4 billion in a more realistic scenario in 2015.

The view of 24/7 Wall St. is that the patent cliffs make for a huge generic opportunity and focus in the years ahead as governments want cheaper drugs, yet the cost of generics has been rising. Biosimilars are still at their infancy as of mid-2015 and could be a next wave of growth. Teva’s growth simply stalled, and it has had management changes, and that leaves many other potential decade-long holdings that can be found as well in 2015 (see below). Teva’s dividend has almost doubled since 2010 and yields about 2.2% in mid-2015, with only about a 30% payout ratio, and Teva is valued at a mere 12 times expected 2015/2016 blended earnings expectations.

ALSO READ: 15 Companies Losing the Most Money

Alternative Health Care Picks: Mylan N.V. (NASDAQ: MYL) in generics (with no dividend yet), or in broader health care there is United Health Group Inc. (NYSE: UNH), which is now a DJIA stock as the leader in health insurance. Johnson & Johnson (NYSE: JNJ) keeps growing earnings and keeps growing its dividend as well. Even Gilead Sciences Inc. (NASDAQ: GILD) has taken over biotech with better than a $150 billion market cap, and with a dividend recently introduced above a 1% yield. Health care valuations and ongoing share performance in subsectors make broader health care investing a very broad topic that is hard to make just one pick. Either way, alternative picks outside of Teva seem to be warranted, given the current layout and expectations.

10. Walt Disney

Walt Disney Co. (NYSE: DIS) has been as big of a winner, as expected in 2010, but then with about another 100% added on to it. The media and entertainment giant was picked for its extensive movie library, movie studios, merchandising, theme parks, vacation destinations, cruises, ESPN, Marvel, Pixar and ABC. In 2010, Star Wars was not even on the books nor was it even a known target with six planned films already, and Frozen was not even a known movie franchise at the time. These have been and will be game-changing winners for Bob Iger and his endless successes. Disney owns a piece of Hulu as well.

Back in 2010, Disney had not even gone above its highs from the late 1990s. We had suggested in 2010 that Disney needed to improve on its low dividend yield of 0.9%, and while it has almost tripled the payout, the massive share gain has kept the yield low at about 1.1%. Disney has quite simply surpassed all expectations and it had model earnings, but new investors have to pay 20 times the blended 2015/2016 earnings to buy Disney now.

Alternative Media Pick: Disney simply has the best-in-class position. In cable and media, Comcast Corp. (NASDAQ: CMCSA) has been building on content to maintain its relevance and lock in subscribers against the cord-cutters, and its NBC Universal owns a piece of Hulu. The rest of Disney’s operations are broad enough that Disney remains its own best replacement, particularly if its stock gets smacked down in the year or years ahead for some reason.

ALSO READ: 4 Stocks to Buy for the Coming Interest Rates Increases

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.