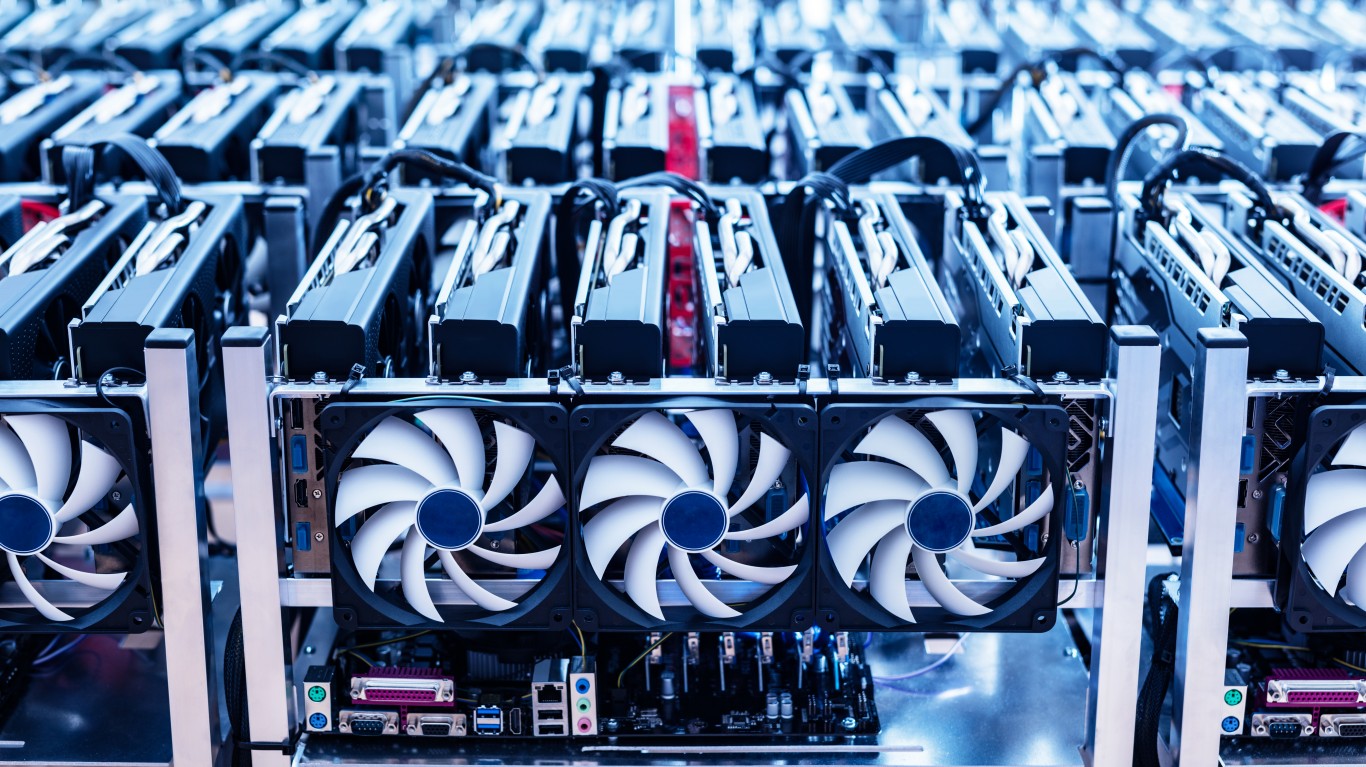

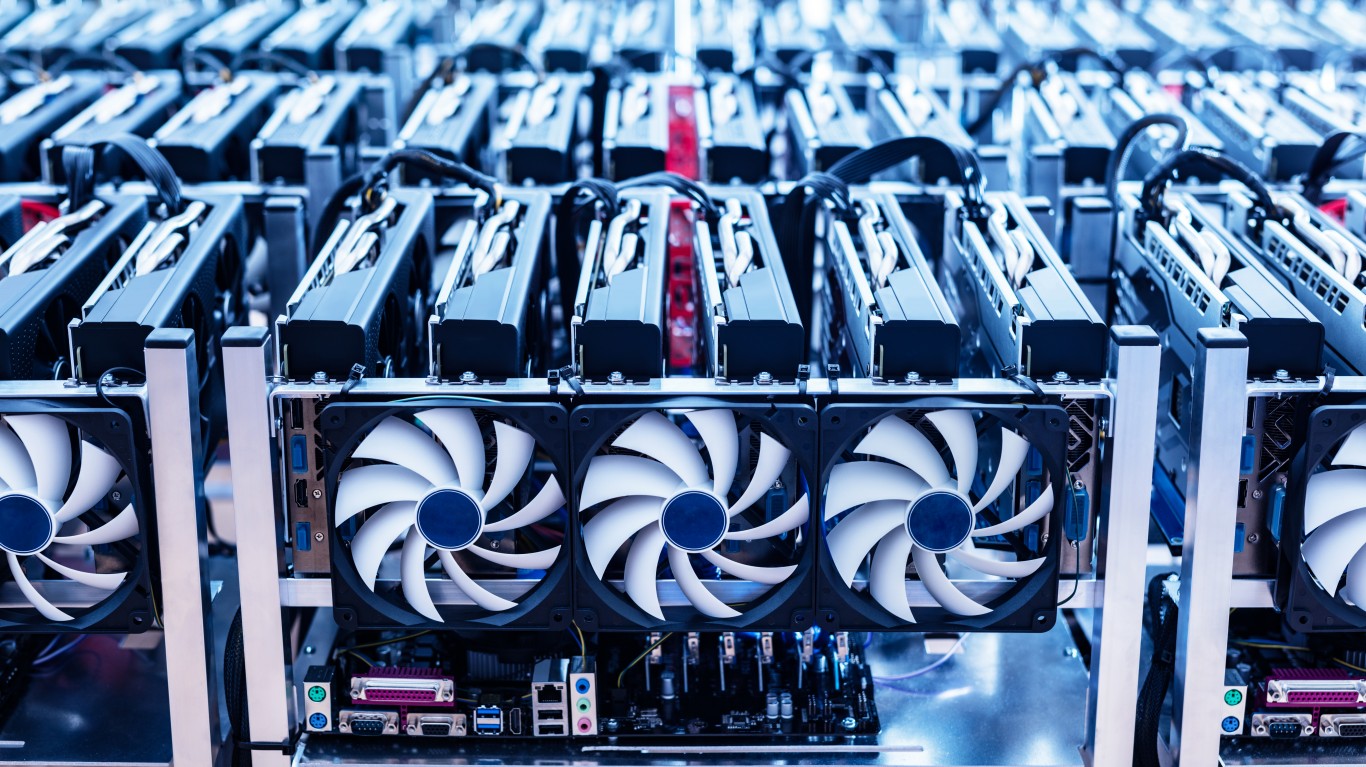

According to on-chain data, Bitcoin’s mining hash rate has hit an all-time high following a significant drop experienced over the summer. The network hash rate, the computing power needed to complete a block, rose 18% since August to 232 million TH/s (terahashes per second).

BTC’s Hash Rate Summer Decline Erased

The start of the year saw an inverse correlation between Bitcoin’s price and hash rate. While BTCs value decreased following its all-time high price in November 2021, the network’s hash rate surged to 200 million Th/s. However, both metrics consolidated somewhat towards the end of the first quarter of 2022. Bitcoin had its value range around $40,000, while the hash rate maintained the 200 million Th/s level.

Subsequently, the inverse relationship continued as Bitcoin declined further while the mining hash rate reached a high of 227 million Th/s. However, the summer saw both metrics correlate directly with the hash rate decreasing to around 200 million TH/s before its recent surge.

The latest surge in hash rate comes on the heels of a summer where a record-breaking heatwave in Texas forced a decline in mining operations. Large US mining companies were forced to dial down operations amidst the rising heat, declining BTC value, and growing energy costs. This summer’s drop in hash rate was the worst since the Chinese ban on mining in 2021 caused a similar fall.

Texas Heat Wave Forces Minners to Shut Down Operations

Following Beijing’s prohibition, the US became the foremost mining hub accounting for most global mining operations. Thanks to favorable crypto laws and relatively inexpensive electricity, Texas emerged as a suitable destination for miners.

However, the Texas summer heat has had a detrimental impact on mining activities this summer. The record heat wave strained the state’s electricity grid, forcing nearly all industrial-scale miners to shut off their machines. This led to several outfits reporting significant losses similar to the Argo blockchain, which saw mining profits drop by 20% in August.

Meanwhile, well-capitalized miners handled the slump better than others, with the industry seeing significant consolidation. Companies like Riot, which recently started a large-scale mining development in Texas, profited significantly from the shutdown. The company was able to resell previously purchased electricity back to the grid at a profit. However, the decline in energy costs, reduced temperatures, and the growing hash rate suggest miners are returning to the fold.

The implication of the Surging Hash Rate

As a proof-of-work (PoW) cryptocurrency, Bitcoin’s hash rate refers to the total computational power needed to process transactions and mine new coins. All transactions are recorded on the blockchain, a digital ledger in the Bitcoin network. To do so, miners using powerful computers must guess a hash—an alphanumeric code— representing the data from a transaction before it is added.

Consequently, since each hash is random and complex, it takes significant energy to power these computers. Once miners solve the hash, a new block is added to the blockchain, and a new unit of digital currency is rewarded to the successful miner.

Usually, hash rates serve as a gauge for the network’s miner participation rate. Additionally, because Bitcoin and other cryptocurrencies are decentralized, the security of the blockchain network is increased by the participation of more miners. Therefore, the surge in Bitcoin’s hash rate could cause a corresponding rise in BTC’s value as hash rates generally follow the price of their underlying assets.

Similarly, Bitcoin has seen a corresponding increase in value since the end of August. The foremost cryptocurrency has gained nearly 10%, rising from just above $20,000 at the end of August to its current $22,330 value.

According to Coinmarketcap, in the last 24 hours, BTC has increased by 3.4%. Its market capitalization is now $427 Billion, while its trading volume went up 44% to just over $50 billion. Its market dominance stands at 40.14%.

This article originally appeared on The Tokenist

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.