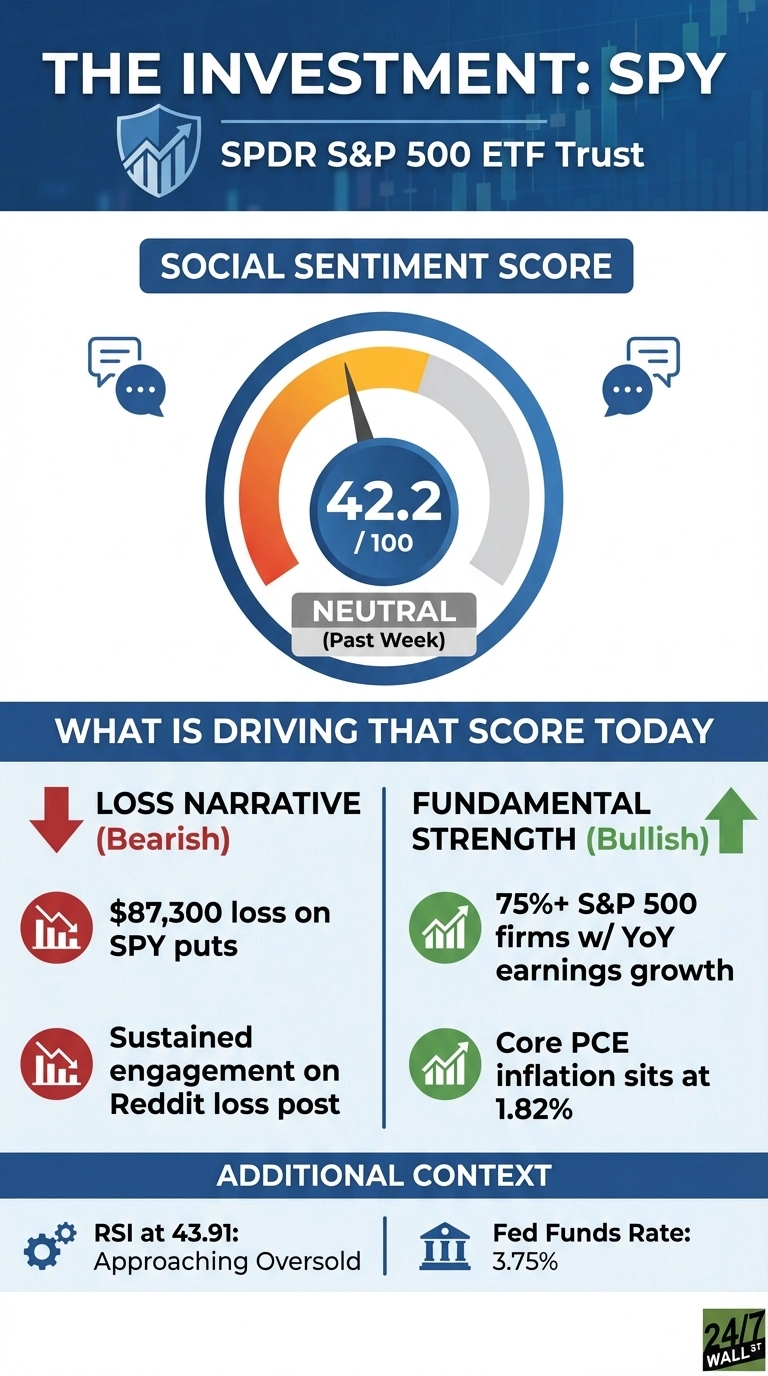

The SPDR S&P 500 ETF Trust (NYSEARCA:SPY) has traded essentially flat over the past month, slipping 1.13% as investors grapple with uncertainty regarding the Federal Reserve’s policy trajectory and concentration risk in mega-cap tech stocks. Retail investors have responded to the pullback with mixed sentiment on social media, with discussion shifting from bullish to bearish as traders debate whether current levels represent a buying opportunity or signal further downside.

The tension is palpable: SPY’s RSI sits at 43.91, approaching oversold territory but not yet at the extreme levels that historically signal capitulation. The ETF’s modest one-year gain of 11.95% reflects investor caution despite an increasingly accommodative Federal Reserve, which has cut rates by 75 basis points to 3.75% as inflation pressures have eased.

Retail Investors Caught Between Fear and Fundamentals

Reddit activity indicates a retail investor base caught off guard. The most engaged post over the past week came from r/wallstreetbets, where a user detailed an $87,300 loss on SPY puts, asking, “Should I quit my job?” The post generated sustained engagement with over 1,800 upvotes and hundreds of comments, dominating sentiment from February 12 through 17.

Bet everything but the house…should I quit my job? 87.3k Loss SPY Puts

by a user in wallstreetbets

Yet fundamentals tell a different story. Earlier in the week, discussions on r/stockmarket indicated that more than 75% of S&P 500 firms reported year-over-year earnings growth, and core PCE inflation is at just 1.82%, well below the Federal Reserve’s 2% target. These data points supported bullish sentiment scores in the 65-78 range early in the week before capitulation narratives took over.

Historical RSI Patterns Document Market Cycles

Over the past year, SPY’s RSI has dropped below 40 on several occasions, with the index subsequently recovering within weeks in each instance. During last spring’s market turbulence, RSI reached deeply oversold levels before the index rebounded. Current levels suggest consolidation rather than panic, but with SPY’s top three holdings, NVIDIA (NASDAQ:NVDA | NVDA Price Prediction), Apple (NASDAQ:AAPL), and Microsoft (NASDAQ:MSFT)—representing nearly 20% of the fund, concentration risk remains a concern for investors monitoring near-term performance.