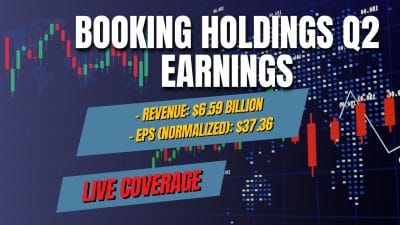

Booking Holdings (NASDAQ:BKNG) just reported fourth-quarter results that beat top and bottom line estimates, raised its dividend, and announced a 25-to-1 stock split. The company continues to show strength in its core travel booking operations amid a recovering global market.

However, Citi trimmed its price target, citing market volatility and slightly weaker-than-expected earnings and growth guidance. With shares down sharply in morning trading today, investors are questioning the outlook and asking if Booking Holdings is a buy.

A Strong Core Performance

Booking delivered solid results this morning, with key metrics highlighting the resilience in its primary business of online travel reservations. Gross bookings reached $43 billion, up 16% year-over-year, driven by favorable currency effects and steady demand for accommodations and flights. Room nights — a central indicator of booking volume — grew 9%, marking the fourth straight quarter of acceleration and exceeding the company’s own 4% to 6% guidance range. This growth was fueled by investments in Asia and improved marketing efficiency in the U.S.

Revenue climbed 16% to $6.35 billion, surpassing analyst estimates of $6.12 billion. Adjusted EBITDA also rose to $2.2 billion, with margins expanding to 34.6% from 33.8% a year ago, thanks to $250 million in savings from the company’s transformation program. Adjusted earnings came in at $48.80 per share, beating the consensus forecast by $0.30, while free cash flow surged 120% to $1.42 billion, underscoring Booking’s efficient operations in facilitating hotel, rental car, and restaurant reservations through brands like Booking.com, Priceline, and OpenTable.

These figures reflect Booking’s dominance in the online travel sector, where Booking.com alone accounts for about 90% of revenue. The company benefited from double-digit growth in alternative accommodations and connected trip features, which enhance user retention by bundling services.

Hiking Dividends, Guiding Cautiously

To reward shareholders, Booking raised its quarterly dividend by 9.4% to $10.50 per share, marking a continued commitment to capital returns, alongside $2.1 billion in stock buybacks, with $21.8 billion still authorized. For the full year 2025, the company returned $8.2 billion to shareholders through buybacks and dividends.

Guidance for 2026, however, tempered enthusiasm. The company projects Q1 revenue growth of 14% to 16% and full-year adjusted revenue growth in the low double digits. Adjusted EBITDA is expected to grow faster than revenue, with adjusted EPS advancing in the mid-teens. Management cited rising marketing costs and cautious consumer spending as headwinds, despite plans for $700 million in reinvestments to drive 100 basis points of faster revenue growth.

Based on that guidance, Citi analysts trimmed their price target on Booking’s stock from $6,500 to $6,250, while maintaining a Buy rating, as guidance fell slightly short of some expectations. Other firms like UBS also adjusted targets downward, though they maintained positive outlooks.

Booking stock is down 27% year-to-date and off 32% from its 52-week high.

A Historic Stock Split

The 25-to-1 stock split — the first forward split in company history (it did have a 1-for-6 reverse split in 2003) — will take effect on April 2, and aims to boost liquidity and attract retail investors, given the pre-split price above $3,900 per share.

Interestingly, it wasn’t all that long ago that CEO Glenn Fogel said that if you were looking for a stock split, he didn’t “want that kind of investor.” He did add, however, “ I’m not saying that we shouldn’t [split the stock]. Because what does matter is what do the shareholders want. I’m not saying we’d never do it. Maybe we would.”

In reality, Fogel’s comments were targeted at investors focused on short-term gains from events like splits; he was more interested in long-term value creation, a mindset investors should seek in executives. Notably, Booking Holdings trades around the same price as when Fogel made those remarks in 2024.

Key Takeaway

Investors shouldn’t buy a stock simply because it is splitting shares, as it alters nothing about fundamentals like earnings or cash flow, despite splits often seen as bullish signals of confidence. Yet Booking’s stock is trading down after the announcement, indicating investors might not be so enthused about it after shares lost a third of their value.

Still, with consistent booking growth, margin expansion, and shareholder returns, Booking Holdings appears to be a good long-term buy for those betting on sustained travel demand.