Special Report

States With the Fastest (and Slowest) Growing Economies

Published:

Last Updated:

The U.S. economy grew 2.4% in 2015. This is the most the economy has grown in more than five years, and is a slight improvement on 2014’s 2.2% growth.

The economies of all but two states grew in 2015, some substantially more than others, and for a variety of reasons. California and Oregon each grew by 4.1%, more than any other state. Alaska and North Dakota contracted, while several states saw increases of less than 0.5%.

[in-text-ad]

The professional and business services industry, the information industry, and the real estate, rental and leasing industry contributed most prominently to the nation’s growth last year.

Click here to see the states with the fastest growing economies.

Click here to see the states with the slowest growing economies.

In an interview with 24/7 Wall St., Clifford Woodruff, an economist with the Bureau of Economic Analysis, explained that the biggest drain on state economies last year was the mining sector. Indeed, the mining sectors of 34 states declined last year, including declines of at least 10% in 20 of these. He went on to say that the national decline in oil prices has likely contributed to this drop in the sector.

The impact of a suddenly weak energy industry was most apparent in North Dakota. The state had been one of the fastest growing in the country, both in terms of population and GDP over the past few years, as the development of the Bakken shale oil formation led to a substantial boom. The state had the largest economic growth of any state in four of the five years through 2014, including a 21.7% increase in 2012. In 2015, the state economy contracted by 2.1%, more than any other state.

On the whole, populations grew substantially more in the states with the fastest-growing economies, and stagnated or declined in the worst performers. Population growth exceeded 0.4% in only one of the 10 states with the weakest economies in 2015. All of the 10 states with the strongest economies surpassed the national population growth rate of 0.8%.

Woodruff explained that population growth does not necessarily lead to GDP growth, as states can import goods from other states or countries without producing more goods locally. He added, however, that it makes sense that the two figures usually move in step. “Obviously, the more people that there are, the more products, the more food, the more houses they’re going to need.”

Based on figures published by the Bureau of Economic Analysis, 24/7 Wall St. reviewed 2015 real GDP growth rates in all 50 states. The real gross domestic product measurement accounts for the effects of inflation on growth. GDP figures published by the BEA for 2015 are preliminary and subject to annual revision. Real GDP figures for past years have already been revised. Population data are from the U.S. Census Bureau and reflect estimated growth between 2014 and 2015. We also used data on poverty from the U.S. Census Bureau’s American Community Survey (ACS). Both 2014 and 2015 unemployment rates are annual averages and are from the Bureau of Labor Statistics (BLS).

These are the states with the fastest (and slowest) growing economies.

The Fastest Growing Economies

10. North Carolina

>2015 GDP growth: 2.7%

> 2015 GDP: $442.5 billion (9th largest)

> 1-yr. population change: 1.0% (14th highest)

> 2015 unemployment: 5.7% (17th highest)

North Carolina’s economy grew at a 2.7% pace in 2015, the 10th fastest growing state economy. This was an improvement from 2014, when the state’s economy grew by 2.1%, which was 21st in the country that year. This economic growth pushed the state from the 10th largest economy in the country to the ninth, replacing Georgia. The finance, insurance, and real estate as well as the professional and business services industries contributed significantly to the state’s economic growth — expanding by 3.5% and 6.3%, respectively, in 2015. The state’s professional industry has recorded a 4% or higher growth rate in five of the past six years.

[in-text-ad]

9. Nevada

>2015 GDP growth: 2.8%

> 2015 GDP: $126.2 billion (18th smallest)

> 1-yr. population change: 1.9% (3rd highest)

> 2015 unemployment: 6.7% (2nd highest)

Nevada’s economy grew at a 2.8% pace in 2015, slightly faster than the national 2.4% growth rate. Growth was largely driven by the 7.4% expansion of the finance, insurance and real estate industry, the largest in the state by economic output. The mining industry, which contracted by 13.8%, was one of the biggest drags on the state’s economy. Like all states with rapid economic growth, the number of people who call Nevada home is going up. The state’s population increased by 53,000 in 2015, a 1.9% increase.

Despite relatively rapid economic expansion, Nevada’s economy remains relatively weak. The state’s 6.7% 2015 unemployment rate is the highest in the country and far higher than the 5.3% nationwide rate.

8. Washington

>2015 GDP growth: 2.9%

> 2015 GDP: $397.3 billion (14th largest)

> 1-yr. population change: 1.5% (7th largest increase)

> 2015 unemployment: 5.7% (17th highest)

Washington’s economy grew at a 2.9% pace last year, surpassing the 2.4% national growth rate. One of the biggest contributions to the state’s economy came from its retail sector, which expanded by 9.4%. According to the National Retail Federation, a retail trade association, the retail industry is Washington’s largest private sector employer, directly supporting about one in every five jobs in the state. Other major contributions to Washington’s economic growth came from its information sector and its finance, insurance, real estate, rental, and leasing industries.

7. Florida

>2015 GDP growth: 3.1%

> 2015 GDP: $789.8 billion (4th largest)

> 1-yr. population change: 1.8% (4th largest increase)

> 2015 unemployment: 5.4% (22nd highest)

Florida is one of just seven states where GDP grew by at least 3% in 2015. The Sunshine State’s GDP, which remains the fourth largest in the country, increased to approximately $790 billion. Population tends to increase more rapidly in states with more robust economic growth, and Florida is no exception. The state’s population increased by 1.8% in 2015, the fourth largest growth in the country.

6. Utah

>2015 GDP growth: 3.3%

> 2015 GDP: $131.2 billion (19th smallest)

> 1-yr. population change: 1.7% (6th largest increase)

> 2015 unemployment: 3.5% (5th lowest)

Utah’s economy grew at a 3.3% pace in 2015, faster than all but five other states. One of the largest contributions to the state’s GDP came from its finance, insurance, real estate, rental, and leasing sector, which expanded by 4.5% over the year. Nationwide, the sector expanded by a much slower 1.8%.

Utah’s rapid economic growth may have helped maintain low unemployment in the state. Just 3.5% of Utah’s workforce is unemployed, much less than the 5.3% national 2015 unemployment rate.

5. Montana

>2015 GDP growth: 3.5%

> 2015 GDP: $41.1 billion (4th smallest)

> 1-yr. population change: 0.9% (15th largest increase)

> 2015 unemployment: 4.1% (11th lowest)

Montana’s economy expanded from $39.7 billion in 2014 to $41.1 billion in 2015, a 3.5% growth rate. Over roughly the same time period, the state’s jobless rate dropped from 4.7% to 4.1%. Economic growth was largely spurred by expansion in many of the state’s largest industries, including manufacturing, which grew at a rapid 12.5% pace. The mining industry was the biggest drag on the economy, contracting by 6.1%.

[in-text-ad]

4. Colorado

>2015 GDP growth: 3.6%

> 2015 GDP: $288.8 billion (18th largest)

> 1-yr. population change: 1.9% (2nd largest increase)

> 2015 unemployment: 3.9% (10th lowest)

Colorado’s economy grew at a robust rate for the second straight year. The state’s GDP growth rate of 4.1% in 2014 was third in the country. In 2015, Colorado’s 3.6% GDP growth rate was fourth largest. While there are exceptions, larger economic expansions tend to coincide with greater population growth. Each new resident will consume more goods and generate more economic output. Not surprisingly, Colorado’s population grew by nearly 2% in 2015, second fastest in the country and well above the national population growth rate of 0.8%.

The state’s finance, insurance, and real estate industry as well as its professional sector contributed substantially to Colorado’s economic growth, expanding by 4.6% and 5.0%, respectively.

3. Texas

>2015 GDP growth: 3.8%

> 2015 GDP: $1.48 trillion (2nd largest)

> 1-yr. population change: 1.8% (5th largest increase)

> 2015 unemployment: 4.5% (18th lowest)

The Texas economy grew by 3.8% in 2015, faster than any state other than Oregon and California. Texas has nearly one-third of the nation’s crude oil reserves, and its economy is heavily dependent on the price of oil. As oil prices have fallen in recent years, the economies of many of the most oil-dependent counties in the state also suffered. While the statewide unemployment rate fell from 5.1% in 2014 to 4.5% in 2015, the jobless rate in many of the state’s top oil-producing counties increased. Still, economic growth in the state was led by the mining sector, which grew at a rapid 12.4% pace. By comparison, the U.S. mining sector as a whole grew at a 5.1% pace in the same period and actually declined in most states.

2. California

>2015 GDP growth: 4.1%

> 2015 GDP: $2.21 trillion (the largest)

> 1-yr. population change: 0.9% (16th largest increase)

> 2015 unemployment: 6.2% (7th highest)

California’s $2.2 trillion GDP is the largest in the country. Its 4.1% economic expansion in 2015 was also the fastest in the U.S., tied only with Oregon. Growth was driven primarily by the professional and business services industry as well as the information industry, which grew by 7.0% and 10.3%, respectively.

The size of the state’s economy may not be surprising — with 39.1 million residents, California is also the most populous state in the country. As it is, there are not enough jobs in the state to accommodate the workforce. California’s 2015 unemployment rate of 6.2% is nearly a full percentage point higher than the national jobless rate of 5.3%.

1. Oregon

>2015 GDP growth: 4.1%

> 2015 GDP: $199.4 billion (25th largest)

> 1-yr. population change: 1.5% (9th largest increase)

> 2015 unemployment: 5.7% (17th highest)

Oregon’s GDP expanded by 4.1%, at the same pace as its neighbor to the south. State economic output increased from $191.6 billion in 2014 to $199.4 billion in 2015. Despite rapid economic growth, unemployment in Oregon remains higher than it is nationwide. The state’s 5.7% jobless rate is nearly half a percentage point higher than the national 5.3% unemployment rate.

Manufacturing, Oregon’s largest industry, had among the greatest impacts on the state economic growth in 2015, expanding by 5.7%. Manufacturing is likely to have a continued positive effect on the economy. In May 2016, the state legislature pledged $7.5 million for a manufacturing innovation center to train the next generation of industry workers.

The Slowest Growing Economies

10. Mississippi

>2015 GDP growth: 0.7%

> 2015 GDP: $95.5 billion (15th smallest)

> 1-yr. population change: 0.0%

> 2015 unemployment: 6.5% (5th highest)

Mississippi’s population remained basically unchanged in 2015, even as the vast majority of state populations expanded that year. As is the case with most states with flat or declining populations, Mississippi’s economy was also relatively stagnant. The state’s GDP grew at just a 0.7% pace compared to the U.S. economy’s 2.4% growth rate. Last year’s tepid growth was at least a slight improvement over 2014, when the state’s economy actually contracted by 0.3%. Only Alaska’s economy contracted more than Mississippi’s that year. The state’s growth rate was most significantly curbed by its flagging government sector, which declined by at least 0.5% in each of the last six years, including a 0.9% drop in 2015.

[in-text-ad]

9. New Mexico

>2015 GDP growth: 0.7%

> 2015 GDP: $85.9 billion (14th smallest)

> 1-yr. population change: 0.0%

> 2015 unemployment: 6.6% (3rd highest)

Growth in New Mexico’s economy was relatively stagnant. The state’s economic output increased by less than a percent in 2015, far below the nationwide 2.4% growth rate. Government, the state’s largest industry, was the biggest drag on growth, contracting by 1.2% in 2015.

Far more rapid economic expansion is likely necessary to alleviate the state’s economic woes. The state’s annual jobless rate of 6.6% is nearly the worst in the country. Additionally, 21.3% of New Mexico’s residents live in poverty, the second highest poverty rate of any state.

8. Connecticut

>2015 GDP growth: 0.6%

> 2015 GDP: $230.3 billion (23rd largest)

> 1-yr. population change: -0.1% (4th largest decline)

> 2015 unemployment: 5.6% (19th highest)

Connecticut is one of many Northeastern states in which outbound migration may have hindered economic growth. Connecticut’s population declined by 0.1% between 2014 and 2015, one of only five states where the population fell over that time. In an interview last year with local newspaper Hartford Courant, economist and town manager Ron Van Winkle attributed the population loss to aging baby boomers retiring to warmer climates and a slowing stream of inbound young professionals moving to the area. The state’s economy grew at a tepid 0.6% pace in 2015, far slower than the 2.4% national growth rate.

Several key sectors were a drag on the economy. Manufacturing and government, two of the largest industries in the state, contracted by 4.2% and 0.7% respectively in 2015.

7. Maine

>2015 GDP growth: 0.4%

> 2015 GDP: $50.5 billion (7th smallest)

> 1-yr. population change: -0.1% (5th largest decline)

> 2015 unemployment: 4.4% (16th lowest)

Maine’s economy expanded by less than 0.5% in 2015, far less than the nationwide 2.4% growth rate. Many industries in the state actually contracted, including the real estate industry — one of the largest by economic output in the state. Despite lagging economic growth, the state’s unemployment rate of only 4.4% is far lower than the national unemployment rate of 5.3%. As in a number of states with relatively weak economic growth, Maine’s population declined in 2015, one of only five states with negative population growth.

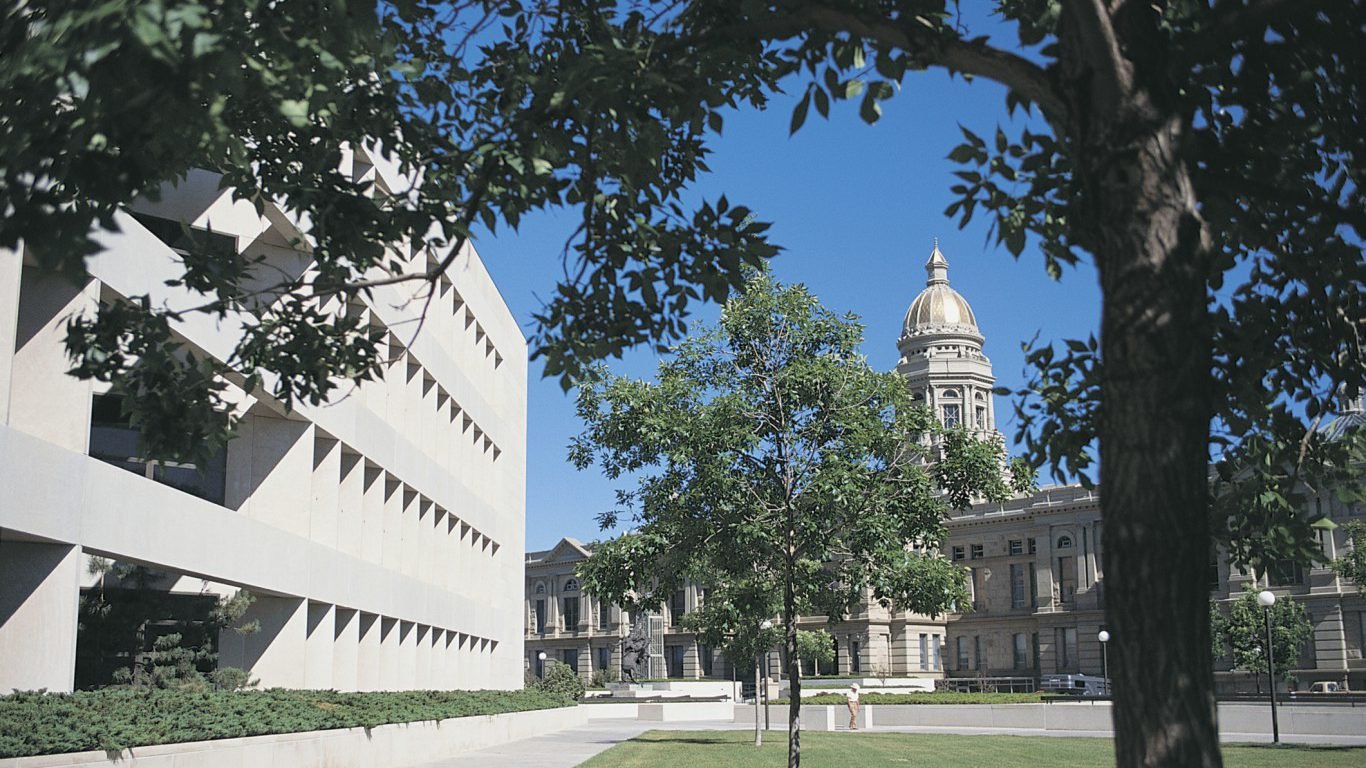

6. Wyoming

>2015 GDP growth: 0.4%

> 2015 GDP: $35.3 billion (2nd smallest)

> 1-yr. population change: 0.3% (19th largest increase)

> 2015 unemployment: 4.2% (13th lowest)

Wyoming’s GDP growth rate of just 0.4% in 2015 trailed the national growth rate of 2.4%. Housing-related industry activity presented a major drag on the state’s economy. Wyoming’s real estate and rental and leasing sector contracted by 4.0% in 2015, in contrast with the sector’s 2.0% growth nationally. Declining real estate activity is likely tied to Wyoming’s sluggish population growth. The state’s population grew by 0.3% between 2014 and 2015, slower than the nationwide population growth rate of 0.8%.

5. Kansas

>2015 GDP growth: 0.2%

> 2015 GDP: $132.7 billion (20th smallest)

> 1-yr. population change: 0.3% (20th largest increase)

> 2015 unemployment: 4.2% (13th lowest)

Kansas’ economy was relatively dormant in 2015. With a 0.2% GDP growth rate, Kansas’ economic growth lagged behind that of nearly all states. The government sector, one of the largest in the state, was one of the largest drags on the state’s economy, contracting by 2.3%.

While last year’s growth was slow in Kansas, the state’s job market was relatively healthy to begin with. Only 4.6% of the state’s workforce was out of a job in 2014, far lower than the 6.2% nationwide rate. The state’s unemployment rate improved to 4.2% in 2015, lower than in all but a dozen other states.

[in-text-ad]

4. Vermont

>2015 GDP growth: 0.2%

> 2015 GDP: $27.3 billion (the smallest)

> 1-yr. population change: -0.1% (3rd largest decline)

> 2015 unemployment: 3.7% (7th lowest)

While the national economy grew by 2.4% in 2015, Vermont’s economy grew by just 0.2%. One primary reason for the sluggish growth was the contraction in the state’s two largest economic sectors — the finance, insurance, real estate, rental, and leasing sector, and the government sector. The decline in real estate activity may have been partially due to the state’s falling population. Vermont’s population declined by 0.1% between 2014 and 2015, the third largest decrease of any state. The state’s economy was helped, however, by growth in other key sectors. The educational services, health care, and social assistance sector, Vermont’s fourth largest by GDP, expanded by 1.9%. The professional and business services sector, the state’s fifth largest, expanded by 2.5%.

3. West Virginia

>2015 GDP growth: 0.1%

> 2015 GDP: $67.3 billion (12th smallest)

> 1-yr. population change: -0.3% (the largest decline)

> 2015 unemployment: 6.7% (2nd highest)

West Virginia’s economy expanded from $67.2 billion in 2014 to $67.3 billion in 2015, one of the slowest growths of any state in the country. Slow economic growth does not always mean a state’s workforce is struggling. West Virginia, however, has one of the slowest-growing economies, and one of the nation’s highest unemployment rates. West Virginia is one of only two states where unemployment worsened in 2015. The state’s 6.6% jobless rate in 2014 increased to 6.7% in 2015. Nationwide, unemployment dropped from 6.2% to 5.3% over the same time period.

2. Alaska

>2015 GDP growth: -0.5%

> 2015 GDP: $49.4 billion (5th smallest)

> 1-yr. population change: 0.2% (12th largest increase)

> 2015 unemployment: 6.5% (5th highest)

Alaska is one of only two states where the economy actually contracted in 2015. The state is heavily dependent on oil revenue and was among the hardest hit by the fall in oil prices. Alaska’s mining industry shrank by 4.5% in 2015, accounting for the bulk of the state’s economic decline. Alaska is one of multiple oil-dependent states facing budget deficits as a result of the price drop. To combat the budget deficit, Governor Bill Walker proposed last year a personal income tax in Alaska. The state has not had a personal income tax since it was repealed about 35 years ago. The tax bill is still in draft form and will likely not come into effect until 2019.

1. North Dakota

>2015 GDP growth: -2.1%

> 2015 GDP: $50.3 billion (6th smallest)

> 1-yr. population change: 2.3% (the largest increase)

> 2015 unemployment: 2.7% (the lowest)

In the last two years, North Dakota transitioned from being the nation’s fastest growing economy to the nation’s fastest shrinking one. Thanks to the exploitation of oil in the Bakken shale formation and new more efficient extraction techniques, North Dakota’s GDP growth rate of 6.0% in 2014 was the fastest of any state and nearly three times the national rate. In 2015, however, after falling oil prices helped put an end to the boom, North Dakota’s economy contracted by 2.1%, the worst economic performance of any state.

At the beginning of last year, some 31,000 North Dakota residents were employed in the mining and logging sector. Through April 2016, the industry’s workforce dropped precipitously to just over 17,000. North Dakota’s 2015 unemployment was still the lowest of any state, at 2.7%. North Dakota is now one of many oil-dependent states facing an extreme budget deficit.

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.