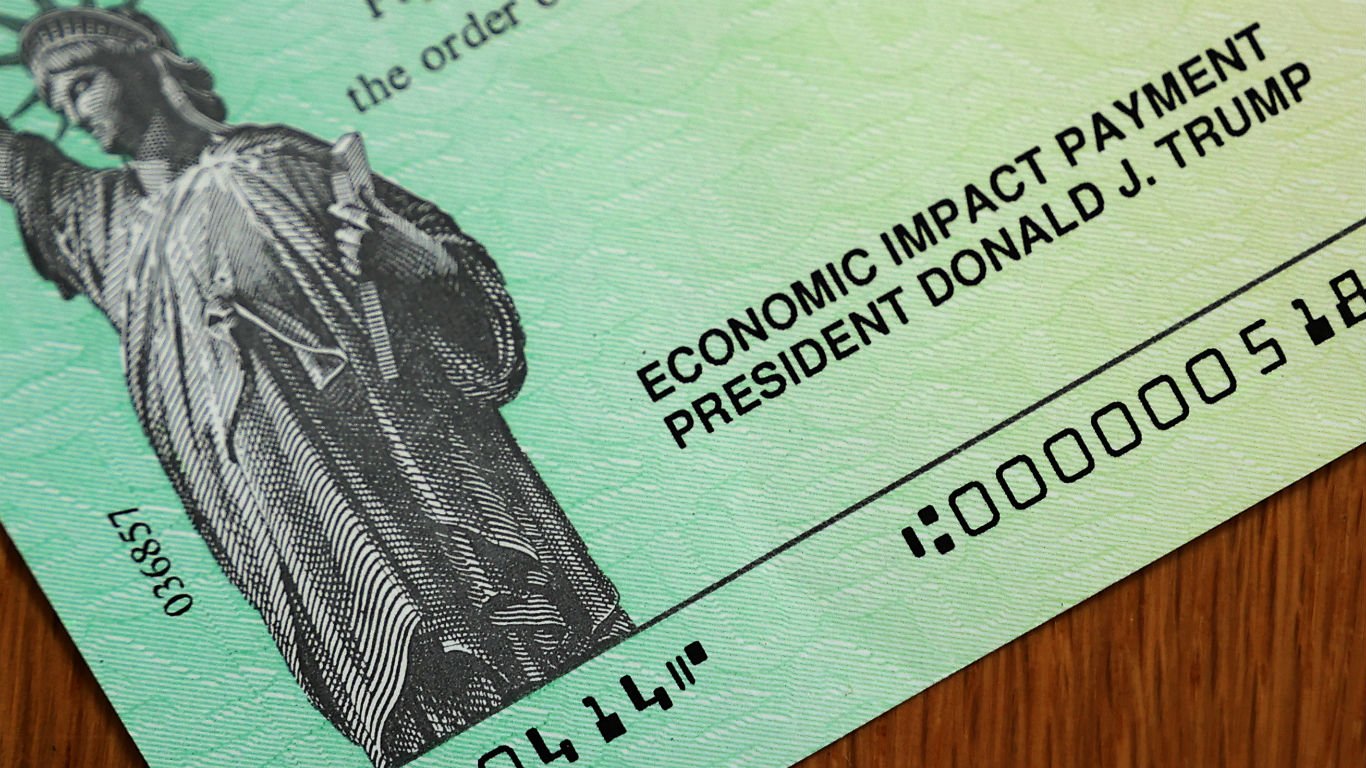

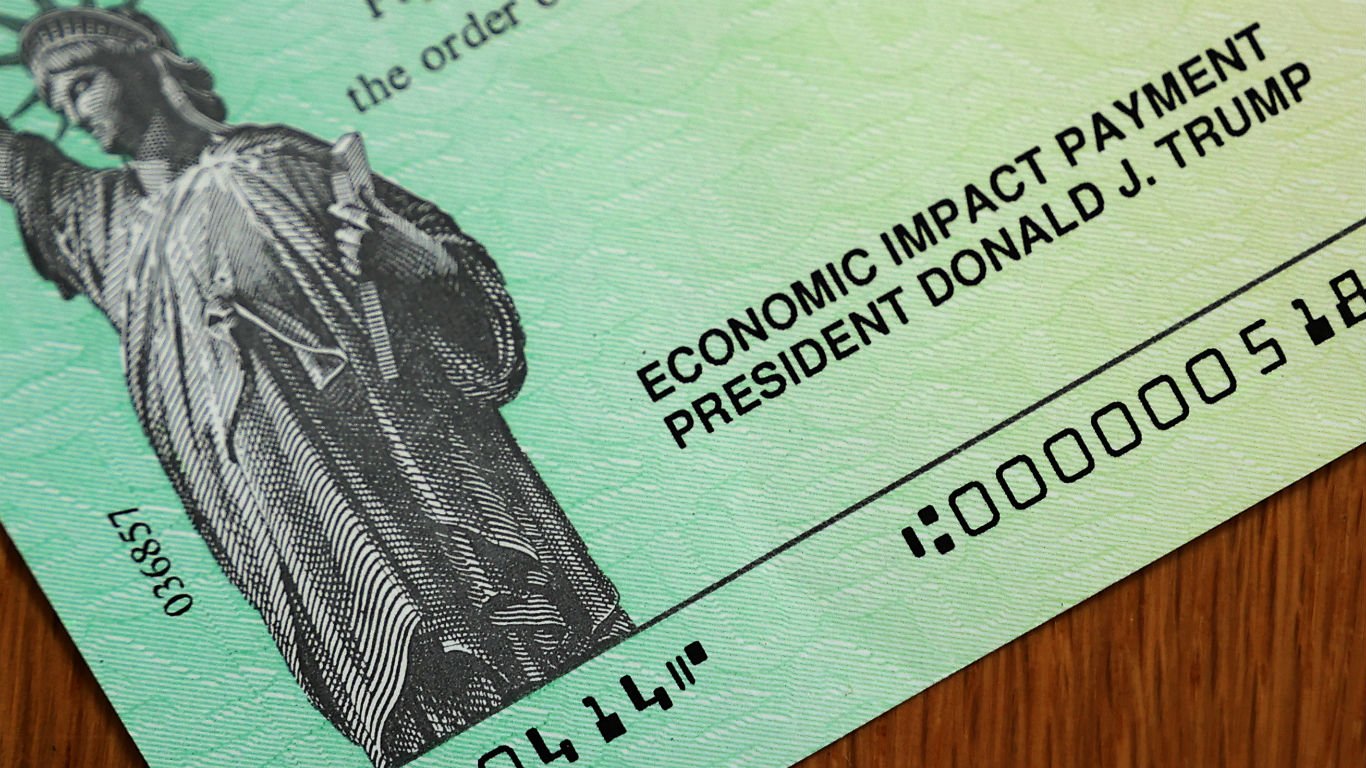

President Donald Trump, on March 27, 2020, signed into law the Coronavirus Aid, Relief, and Economic Security (CARES) Act. The $2 trillion relief bill provides direct support to individuals, businesses, and local governments struggling as a result of the COVID-19 pandemic and is considered the largest stimulus package in U.S. history.

While the CARES Act is the largest stimulus measure in history, it is hardly the first time the U.S. government has used non-traditional tools of fiscal policy to intervene in an economic crisis. Throughout its history, the United States has used public spending, corporate bailouts, and direct payments to individuals to stimulate the economy in times of crisis. Here’s how many people will get $1,200 in every state.

24/7 Wall St. reviewed 11 U.S. economic crises that triggered massive government stimulus spending. We concentrated on times the government’s response was unprecedented in size, reach, or implementation. Because economic crises frequently involve multiple rounds of government intervention, we discussed the various stimulus packages associated with each economic crisis.

The history of economic stimulus packages helps provide some context for the recent coronavirus relief legislation. According to the Congressional Research Service, there are only four notable precedents in which direct payments were made to individuals to address economic fallout.

The first of these modern stimulus packages was issued in 1975, when President Gerald Ford passed legislation that provided tax rebates worth up to $200 to an estimated 55 million Americans during the 1973-1975 recession. Other direct payments were issued following the burst of the dot-com bubble in 2001 and during the Great Recession. These payments have been typically administered through the IRS and often excluded individuals who did not file taxes. While the coronavirus relief checks are being sent through the IRS, there are currently provisions for those who do not file taxes to receive the stimulus money.

While the CARES act is unprecedented in many ways, it has also been criticized for its flaws. Click here to see how federal relief fails to match each state’s COVID outbreak.

Great Depression

Most Americans are familiar with President Franklin Roosevelt’s New Deal programs following the Great Depression — one of the worst economic downturns in the history of the industrialized world, triggered by the stock market crash in 1929 and made worse by the Dust Bowl. However, it was President Herbert Hoover who made one of the first attempts to respond to the Great Depression, creating a government agency called the Reconstruction Finance Corporation in 1931. Congress gave the fledgling RFC an initial $2 billion and entrusted it with the power to determine which companies it provided with financial support.

The RFC was one of the first of many New Deal agencies established to address the unprecedented challenges of the nation’s worst economic downturn through increased federal spending on programs and public works projects. According to a 2015 study by economists Price Fishback and Valentina Kachanovskaya, the New Deal cost $41.7 billion at the time the programs were created.

[in-text-ad]

1971 Lockheed Martin insolvency crisis

After a series of poor business decisions throughout the 1960s, defense contractor Lockheed Martin was facing bankruptcy by 1971. Lockheed execs appealed to Congress for help, claiming that if the defense contractor went bankrupt, it could hurt national security. Also at stake were 25,000 jobs in the defense industry. A Lockheed insolvency would have had a severe impact on the economy of California.

To bail out the nation’s largest defense company, Congress in August 1971 passed the Emergency Loan Guarantee Act that provided financing for large companies in fiscal distress. Lockheed Martin was the first company to receive money as the result of the legislation, getting $250 million.

1973-1975 recession

A distant precedent to the individual stimulus checks sent out under the Coronavirus Aid, Relief and Economic Security Act (CARES) was the Tax Reduction Act of 1975, passed in response to the 1973-1975 recession. The downturn, a result of several factors that included rising oil prices and the collapse of the Bretton Woods system of currency exchange, began in 1973. It wasn’t until 1975 that the Tax Reduction Act was passed. The Act provided taxpayers with a rebate worth 10% of taxes paid in 1974.

The legislation provided for a maximum payment of $200 and also sent $50 to retirees and recipients of Social Security who did not file taxes. The Act was one of just two pieces of legislation prior to the coronavirus relief act that provided direct payments to individuals who did not pay taxes. According to one estimate, about 55 million payments worth a total of $8 billion were issued.

New York City 1970s fiscal crisis

New York City’s fiscal woes, which had been building all through the 1960s and early 1970s, reached a crisis point in 1975. With the city on the brink of default, the United Federation of Teachers stepped up on Oct. 17 and closed a $150 million shortfall with its pension funds. The immediate crisis was averted, but the city still needed federal aid. President Gerald Ford resisted, saying he would veto any bill that would bail out New York City — this was immortalized in the New York Daily News headline: “Ford to City: Drop Dead.” The president changed course the following month, proposing legislation calling for $2.3 billion in short-term loans that would help New York City avert insolvency. The loans were to extend through June 1978, and the city would pay an interest rate 1 percentage point above the federal rate of 7%.

The city had many rough patches following the loan deal, including a blackout in 1977 that led to looting. But New York City eventually found its footing, and the economy turned around in the 1980s.

[in-text-ad-2]

1979 Chrysler crisis

The American automobile industry was getting pummeled by foreign car manufacturers in the late 1970s, and that culminated in the near collapse of the smallest of America’s Big Three carmakers, Chrysler Corporation. In 1979, the company was saved from bankruptcy when Congress approved $1.5 billion in federal loan guarantees that became known as the Chrysler Loan Guarantee Act. In exchange, the company had to find $2 billion in cost savings and provide a detailed, three-year plan outlining the new products in its pipeline.

The company survived and turned around under the guidance and leadership of visionary Chairman and CEO Lee Iacocca by reducing labor costs and beginning to produce more fuel-efficient, front-wheel-drive vehicles. It wouldn’t be the first time Chrysler would need federal aid. The car company, along with Ford and GM, received federal funds as part of the Troubled Asset Relief Program in 2008-09.

The savings and loan crisis

Savings and loan institutions were created in the 19th century in Pennsylvania by people who pooled money in order to buy their homes when banks were not making residential mortgages. As loans were repaid, the funds were lent to other members. S&Ls were beset by problems in the 1970s and ’80s. The interest rates they paid on deposits were fixed by the federal government, putting them at a competitive disadvantage compared with other banking institutions. Another disadvantage was that S&Ls made long-term, fixed-rate mortgages their main area of business. As interest rates rose, mortgages lost value and lowered the net value of S&Ls.

The institutions faced insolvency by the early 1980s. In response, Congress created the Financial Institutions Reform, Recovery and Enforcement Act of 1989 that helped reform the industry. This act created the Resolution Trust Corporation that funded troubled S&Ls while closing 747 other institutions, at a total cost of $124 billion for taxpayers. The crisis led to significant reform and legislation in the financial industry.

[in-text-ad]

Aftermath of 9/11

The terrorist attacks on 9/11 halted the aviation industry. To address this concern, Congress passed the Air Transportation Safety and Stabilization Act, legislation that compensated the airline industry for the forced grounding of airplanes in the wake of the attack. The measure gave carriers $5 billion in direct assistance and $10 billion in loan guarantees to keep the airlines from collapsing.

Also contained in the bill was the provision that airlines that accepted the aid would not be allowed to give a raise to executives making more than $300,000 for the next two years from the period starting on Sept. 11, 2001.

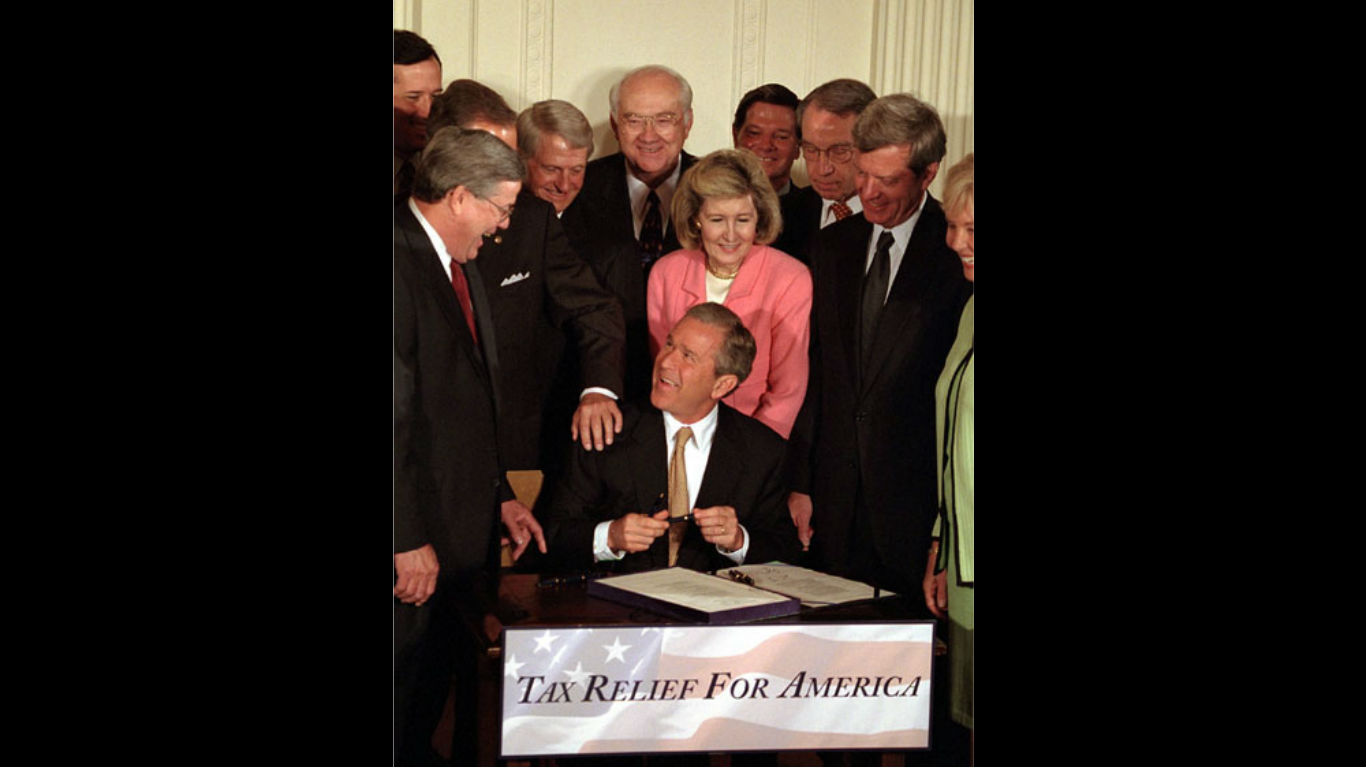

Post dot-com bubble burst

Passed during the aftermath of the early 2000s dot-com bubble crash, the Economic Growth and Tax Relief Reconciliation Act of 2001 provided U.S. taxpayers with an advanced rebate on a tax cut that took effect that year. The rebate was worth a maximum of $300 for individuals and $600 for married couples filing jointly and was sent out as a check during the months of July, August, and September.

The government sent approximately 92 million checks worth a total of $38 billion. While, at the time, approximately 64% of surveyed Americans stated they would spend their rebate check or use it to pay bills, many economists disagree over whether the rebates significantly stimulated consumption.

Subprime mortgage crisis

The federal government implemented in 2008 a series of corporate bailouts designed to address the subprime mortgage crisis. The largest of these was the Emergency Economic Stabilization Act, which created the $700 billion Troubled Asset Relief Program. Under TARP, the federal government pumped hundreds of billions of dollars into at-risk banks and automobile companies deemed too big to fail.

The subprime mortgage crisis also led to the Housing and Economic Recovery Act of 2008, which authorized the federal government to essentially take over the assets of government-sponsored mortgage entities Fannie Mae and Freddie Mac through conservatorship. According to the Federal Reserve Bank of New York, the bailout of Fannie Mae and Freddie Mac cost U.S. taxpayers approximately $187.5 billion.

[in-text-ad-2]

Great Recession

One of the stimulus packages most similar to the coronavirus relief act was passed amid the Great Recession. The Economic Stimulus Act of 2008 was a $152 billion stimulus package, which in addition to instituting several tax breaks, provided a $600 advanced rebate check to a majority of individual taxpayers and $1,200 to married couples filing jointly.

One year and one president later, the federal government passed the American Recovery and Reinvestment Act of 2009. While a majority of the $787 billion package went to tax cuts and tax credits for individuals and small businesses, as well as investment in infrastructure, energy, health care, and education, ARRA also provided direct payments of $250 to those receiving Social Security benefits, veterans’ pensions, and Supplemental Security Income benefits.

Coronavirus Recession

The federal government passed a $2 trillion aid package in March titled the Coronavirus Aid, Relief and Economic Security Act to accelerate relief to various areas of the American economy and make payments to individuals impacted by the coronavirus pandemic. About $650 billion of the stimulus money was targeted to individuals in the form of Treasury checks, with the rest targeted to corporations, small businesses, public health, and education.

Individuals earning $75,000 or less annually were to receive a one-time cash payment of $1,200. Married couples earning $150,000 or less would also each get a check for $2,400. The bill also provides an additional $500 for each child claimed as a dependent, and $600 a week for those laid off or furloughed because of the pandemic, on top of what they were receiving in unemployment benefits. The federal government is currently weighing subsequent measures to provide relief for those impacted by the coronavirus crisis.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.