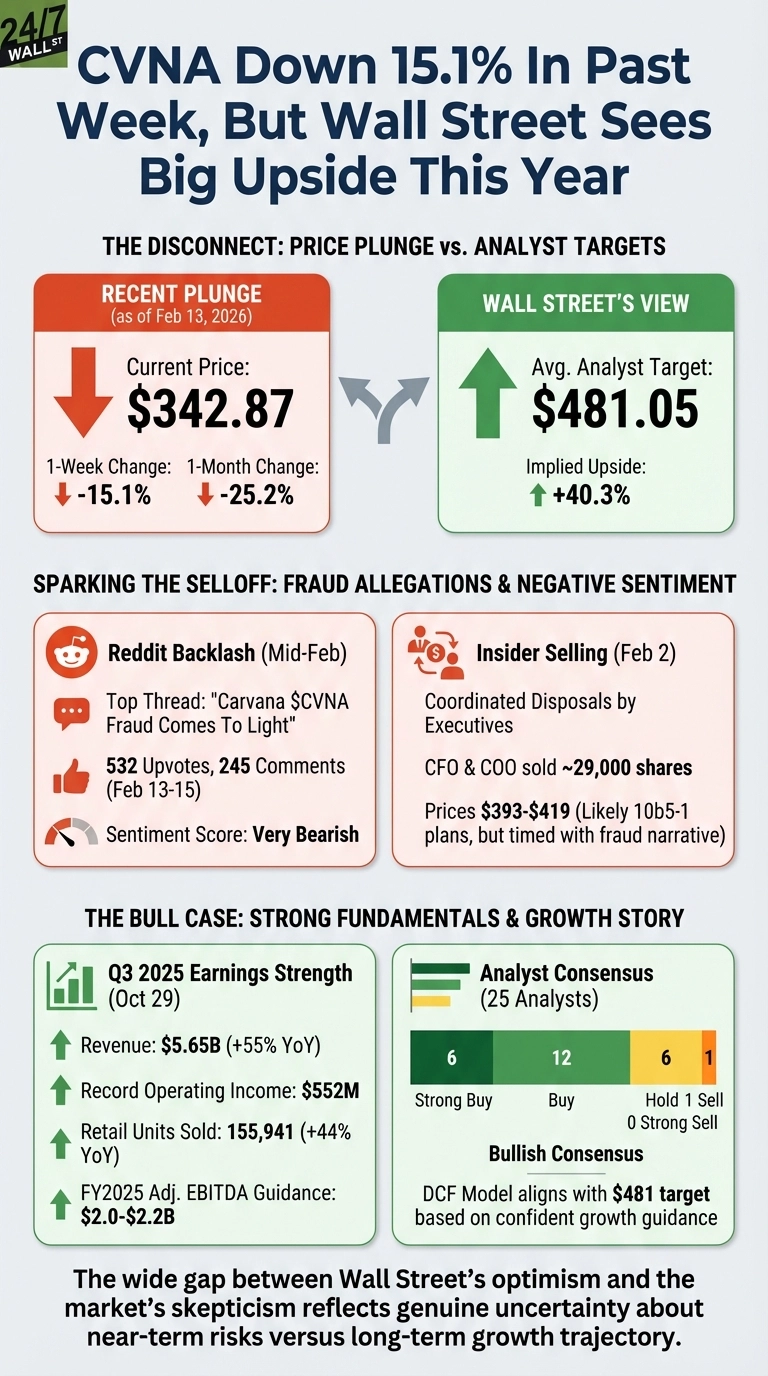

Carvana (NYSE: CVNA) is down 15.1% over the past week, extending a brutal month that has seen shares fall 25.2% since mid-January. Yet Wall Street analysts still see the online used car retailer climbing to an average target of $481.05, implying 40.3% upside from current levels. That gap between price and target is now one of the widest among major consumer stocks, and it raises an obvious question: is the market pricing in risks that analysts are missing, or is this selloff creating real opportunity?

Carvana operates an e-commerce platform for buying and selling used vehicles, offering home delivery and a seven-day return policy. The company has been a Wall Street darling over the past year, with shares up 25.9% over the trailing twelve months despite recent weakness. But the stock peaked at $478.45 on January 22 before collapsing 28.3% to current levels. The catalyst for the decline appears to be fraud allegations that surfaced in late January, triggering a single-day volume spike of 19.8 million shares on January 28, the highest trading day in the dataset.

Fraud Allegations and Reddit Backlash Sparked the Selloff

The recent drop wasn’t driven by disappointing earnings. In fact, Carvana’s Q3 2025 results filed October 29 showed revenue of $5.65 billion, beating the $5.18 billion consensus estimate by a wide margin. The company reported record operating income of $552 million and guided for $2.0 to $2.2 billion in adjusted EBITDA for full year 2025. CEO Ernie Garcia called it “another exceptional quarter” and emphasized the company still has “significant capacity for growth.”

But the market’s focus shifted in late January when fraud allegations emerged, centered on accounting practices related to subprime loans sold to Carvana’s Bridgecrest subsidiary. Reddit sentiment turned sharply negative, with the most engaged thread titled “Carvana $CVNA Fraud Comes To Light” accumulating 532 upvotes and 245 comments between February 13 and February 15. A second thread asked, “The Lemonade Stand: Carvana (CVNA) Sells Subprime Loans to Bridgecrest. How is That Against the Law?”, drawing 145 upvotes and 48 comments. Reddit sentiment scores remained in the “very bearish” range throughout the week, with activity spiking as retail traders positioned for further downside.

Adding fuel to the fire, insider selling data shows coordinated disposals by multiple executives on February 1 and February 2. On February 2 alone, CFO Mark W. Jenkins and COO Benjamin E. Huston sold approximately 29,000 shares across dozens of transactions at prices ranging from $393 to $419. While these sales appear to follow Rule 10b5-1 trading plans based on uniform pricing patterns, the timing coincided with the fraud narrative taking hold, amplifying retail investor concerns.

Analysts Still See the Growth Story Intact

Despite the selloff, Wall Street hasn’t abandoned Carvana. Of the 25 analysts covering the stock, 6 rate it Strong Buy, 12 rate it Buy, 6 rate it Hold, and just 1 rates it Sell. That’s a bullish consensus by any measure. The average price target of $481 reflects confidence that the company’s fundamentals remain strong and that recent concerns are either overblown or manageable.

Analysts point to several factors supporting their bullish stance. First, Carvana’s retail unit sales grew 44% year-over-year in Q3, reaching 155,941 units. Second, the company generated $637 million in adjusted EBITDA with an 11.3% margin, demonstrating improving profitability. Third, management is integrating additional ADESA locations and expanding same-day delivery capabilities, positioning the company for sustained market share gains in the fragmented used car market.

A recent analysis from Simply Wall St valued Carvana at $481 per share using a discounted cash flow model, aligning almost perfectly with the analyst consensus. The report noted Carvana’s “strong Q3 2025 results and confident growth guidance” as key support for the valuation. Analysts appear to be looking past near-term noise and focusing on the company’s trajectory toward $2 billion-plus in annual EBITDA.

The Numbers

Current Situation:

- Current Price: $342.87

- Average Analyst Target: $481.05

- Implied Upside: 40.3%

- Number of Analysts Covering: 25

- Recent Performance: Down 15.1% over the past week, down 25.2% over the past month

- YTD Performance: -18.8%

Analyst Ratings Breakdown:

- Strong Buy: 6

- Buy: 12

- Hold: 6

- Sell: 1

- Strong Sell: 0

The data shows a clear consensus among analysts that Carvana is undervalued, but the stock’s recent underperformance suggests investors are skeptical. The question is whether that skepticism is justified or whether it’s creating a buying opportunity for those willing to look past the noise.

What Investors Are Weighing

Investors favoring the bull case point to several factors that could drive the stock toward the $481 analyst target. The company is growing revenue at 55% year-over-year, generating record profitability, and guiding for continued strength. If the fraud allegations turn out to be accounting noise rather than a fundamental threat to the business model, and if management can address the subprime lending concerns transparently, the stock could recover quickly. The valuation also looks more reasonable on a forward basis, with shares trading at 50x forward earnings, down from a trailing PE of 78x. For a company growing this fast, bulls argue that multiple isn’t unreasonable if execution continues.

Those concerned about downside risk note that the market is clearly pricing in significant uncertainty, and for good reason. Carvana’s business model relies heavily on subprime lending, and any issues with how those loans are accounted for could trigger regulatory intervention or force changes that hurt profitability. The coordinated insider selling in early February, while likely following pre-planned Rule 10b5-1 trading plans, occurred at prices well above current levels. And the stock’s beta of 3.57 means it will amplify any broader market weakness. The 40% gap between current price and analyst targets could be a red flag that the market sees risks analysts may be underweighting.

The resolution of the fraud allegations will likely determine whether the stock moves toward analyst targets or faces further pressure. If Carvana can address the concerns head-on and deliver on its Q4 guidance of 150,000-plus retail units, the risk/reward profile could shift in favor of bulls. Until then, the wide gap between Wall Street’s optimism and the market’s skepticism reflects genuine uncertainty about the company’s near-term trajectory.