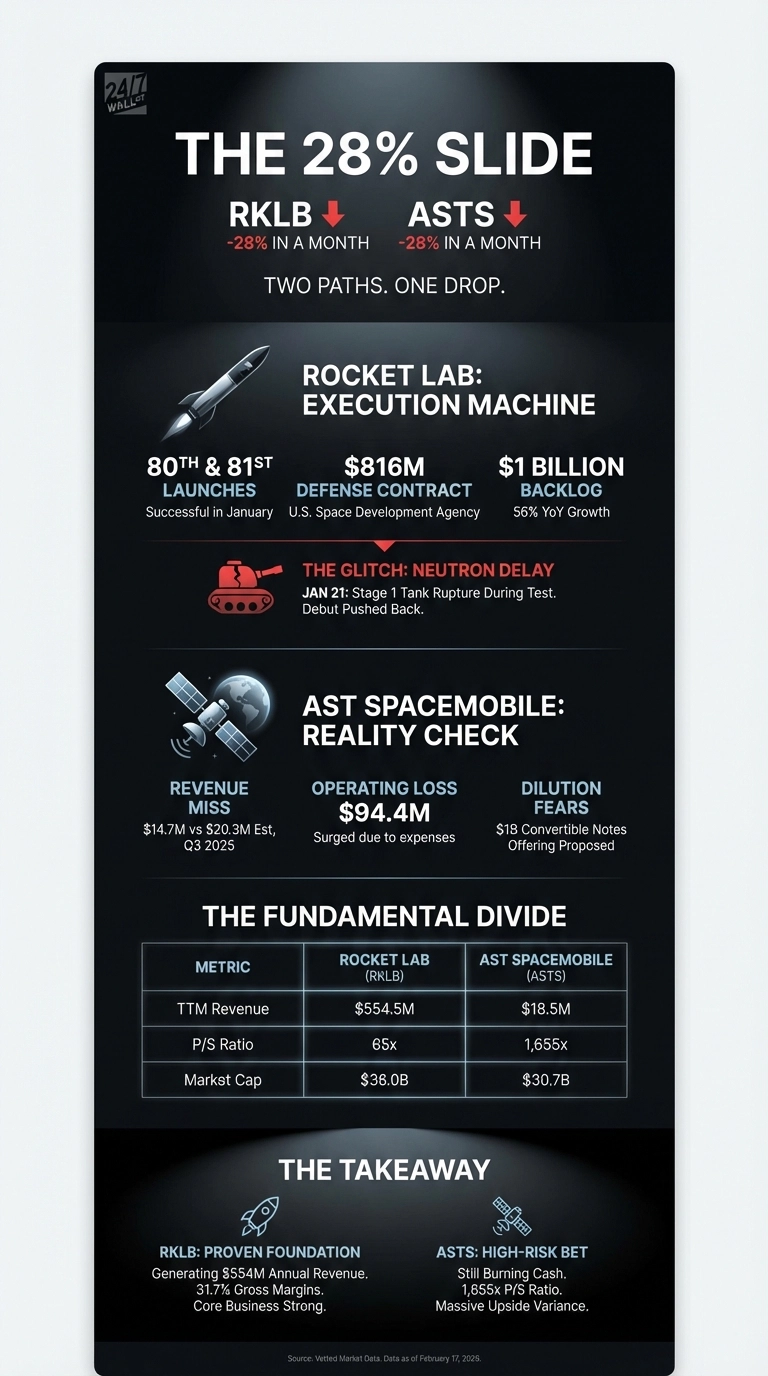

Rocket Lab (NASDAQ: RKLB | RKLB Price Prediction) and AST SpaceMobile (NASDAQ: ASTS) both shed between 26 and 27% over the past month, but the reasons behind each selloff tell very different stories about execution versus expectations.

Rocket Lab Delivers, Then Stumbles on Neutron

Rocket Lab’s operational track record remains flawless. The company launched its 80th and 81st Electron missions in January, demonstrating reliability that wins contracts. That momentum translated into an $816 million contract from the U.S. Space Development Agency for 18 satellites, expected to add $200 million in annual revenue over four years. The company’s $1 billion backlog grew 56% year over year in launch services alone.

The problem? Neutron. On January 21, Rocket Lab revealed that its Neutron rocket’s Stage 1 tank ruptured during hydrostatic pressure testing. Neutron represents the company’s bid to compete in SpaceX’s medium-lift market, and the failure has pushed back the rocket’s debut to the first half of 2026. Shares dropped more than 4% in after-hours trading and continued to slide as investors reassessed the timeline.

Meanwhile, Rocket Lab’s core business continues to perform well, as indicated by Q3 2025 revenue hitting $155 million, up 48% year-over-year, with 37% gross margins. The company guided Q4 revenue to $170 to $180 million, with CEO Peter Beck calling the momentum strong, and the numbers back that up. Electron remains the most frequently launched small orbital rocket after SpaceX.

Rocket Lab’s Stronger Execution Path

On the plus side, Rocket Lab has something AST doesn’t: a proven revenue engine. Electron’s launch cadence and the defense backlog provide visibility into near-term cash flows. The Neutron setback stings, but it doesn’t undermine the core business. Rocket Lab generates $554 million in annual revenue with a 31.7% gross margin. This is very much a foundation that can be built on well into the future.

Competitors like AST SpaceMobile are still burning cash to prove their satellite-to-cell concept works at scale. The 1,655x price-to-sales ratio leaves zero room for execution missteps. Rocket Lab demonstrates stronger execution fundamentals with proven revenue and a business model already delivering results despite the Neutron delay.