Vertiv Holdings Co (NYSE:VRT) delivered a 20% surge this week, closing at $234.63 on Friday while the S&P 500 slipped 1.29% and the industrial sector gained just 0.57%.

This data center infrastructure provider rocketed higher on three converging storylines that matter far beyond this week’s chart.

Vertiv Has Outperformed Across the Past Year

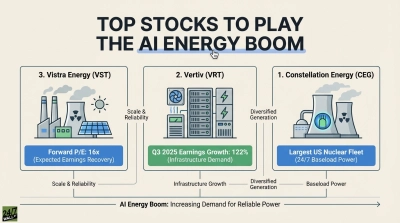

This week’s move extends an already extraordinary run. Vertiv is up 44.82% year-to-date and 115% over the past year. The stock trades at 69x trailing earnings, well above typical industrial valuations, but the forward multiple of 38x tells you the market expects explosive growth ahead. With 80% institutional ownership and an analyst target of $259.11, professional money is clearly betting on continuation.

Storyline One: Institutional Momentum Accelerates

The first catalyst driving this week’s move is raw institutional demand. According to FXEmpire analysis published February 13, Vertiv has seen substantial institutional inflows, with the stock climbing 1,360% since February 2023. This isn’t retail speculation. It’s systematic capital allocation by funds that see Vertiv as the purest play on AI data center infrastructure.

The company filed Q4 2025 earnings on Wednesday morning, beating EPS estimates by 5.4% with $1.36 per share. But the real story wasn’t the quarter. It was the order book.

Storyline Two: Record Orders Signal AI CapEx Acceleration

Vertiv reported orders growth of 252% year-over-year, pushing backlog to $15.0 billion, up 109% from last year. The book-to-bill ratio hit 2.9x, meaning they’re booking nearly three dollars of future revenue for every dollar they ship today. Morningstar noted this record order book growth indicates an acceleration in AI data center spending, given that over 80% of Vertiv’s revenue comes from data center infrastructure.

CEO Giordano Albertazzi framed it clearly: “Our fourth quarter performance demonstrates Vertiv’s leadership position in an increasingly complex and demanding data center market.” Translation: hyperscalers and enterprises are scrambling to build AI-capable infrastructure, and Vertiv sells the cooling and power systems that keep those chips running.

Storyline Three: 2026 Guidance Raises the Bar

The third driver is forward guidance that shocked even bullish analysts. Vertiv projected 2026 revenue of $13.25 to $13.75 billion, representing 27% to 29% organic growth. Adjusted EPS guidance of $5.97 to $6.07 implies 43% growth at the midpoint. The company expects to generate $2.1 to $2.3 billion in adjusted free cash flow, giving management substantial firepower after deploying roughly $1 billion on acquisitions in Q4.

Vertiv soared this week, but the gains were more than justified. We recently recommended Vertiv shares for $170.95 in our $500,000 AI Portfolio. That recommendation is already up 37%. With the AI boom continuing to expand, Vertiv looks like one of the leading stocks that benefits across hyperscaler spending.