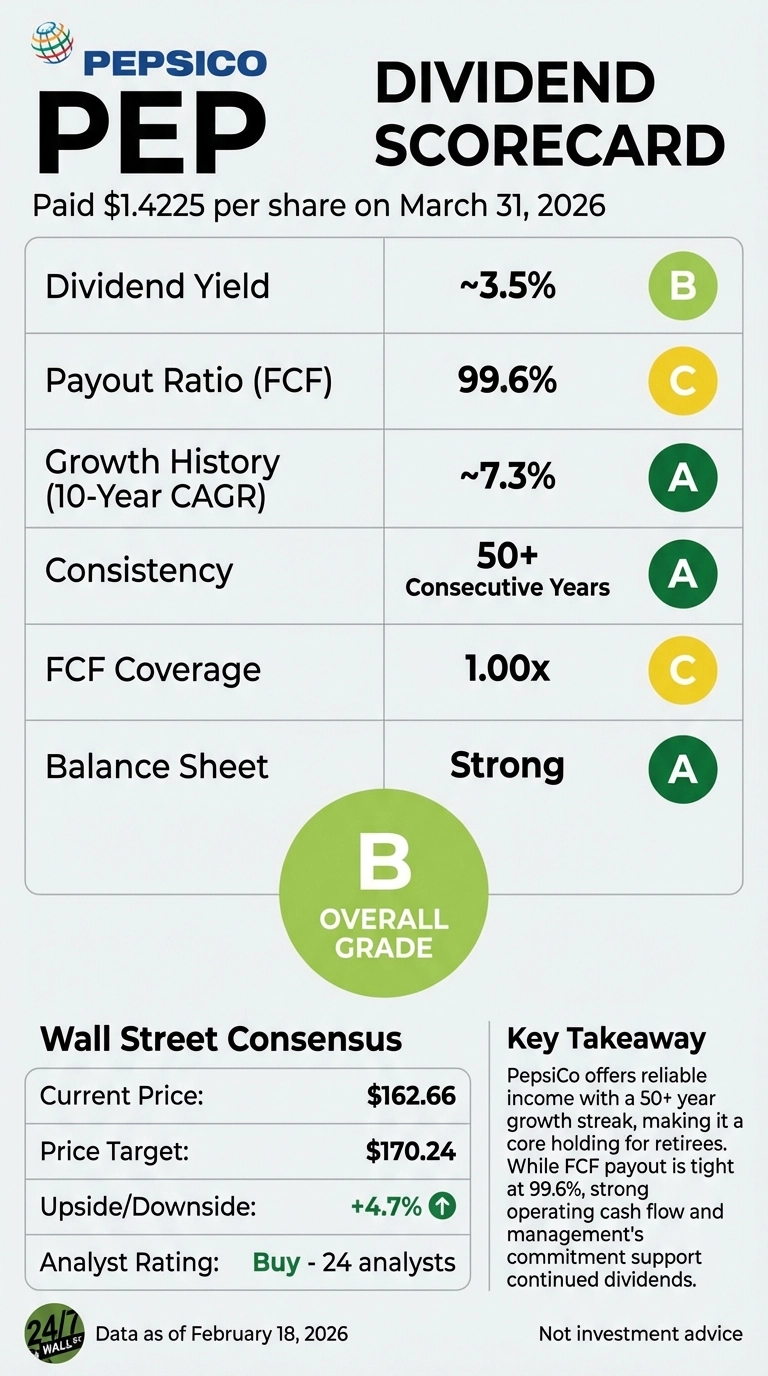

PepsiCo just paid its March 31, 2026 quarterly dividend of $1.4225 per share, marking another milestone in a streak that few companies can match. With 50+ consecutive years of dividend increases, PEP has earned Dividend King status—the gold standard for income investors seeking reliability in retirement portfolios.

At the current price of $162.66, the annualized dividend of $5.69 delivers a yield of approximately 3.5%. That trails the current 10-year Treasury yield of 4.04% by roughly 50 basis points, but the comparison misses the point entirely. Treasury bonds offer static income; PepsiCo offers income that grows.

The Growth Record Speaks for Itself

Over the past decade, PepsiCo’s quarterly dividend has climbed from $0.7025 in 2016 to $1.4225 in 2026, representing a compound annual growth rate of approximately 7.3%. The five-year CAGR sits at 6.8%, demonstrating consistent mid-to-high single-digit growth through multiple economic cycles.

The most recent increase of 5% year-over-year continues that trajectory. While not explosive, this measured approach reflects management’s commitment to sustainable growth rather than aggressive hikes that might prove unsustainable during downturns.

Cash Flow Coverage Tightens But Holds

The dividend’s sustainability hinges on free cash flow generation, and here the picture requires closer examination. In fiscal 2025, PepsiCo generated $7.67 billion in free cash flow while paying out $7.64 billion in dividends—a payout ratio of 99.6%.

That’s notably tighter than historical norms. From 2015 through 2021, PepsiCo’s free cash flow payout ratio averaged 60-85%, providing ample cushion for business reinvestment and unexpected challenges. The recent compression stems from elevated capital expenditures, which climbed to $4.42 billion in 2025 as the company modernizes its manufacturing footprint and expands capacity.

However, the dividend remains fully covered by free cash flow—not exceeding it—and operating cash flow of $12.09 billion provides substantial breathing room. The earnings-based payout ratio tells a more comfortable story at approximately 94%, using the trailing twelve-month EPS of $6.01.

Management Signals Continued Commitment

During the February 3, 2026 earnings call, CEO Ramon Laguarta emphasized the company’s balanced approach to capital allocation. “We expect Frito-Lay to grow volume, net revenue and operating margin this year,” he stated, pointing to operational leverage that should support continued dividend growth.

CFO Steve Schmitt reinforced the sustainability message: “You saw the productivity that we had in the fourth quarter. We expect a lot of that to carry over. That’s going to fund some of our investments.”

The company also announced a new $10 billion share repurchase program spanning 2026-2030, demonstrating confidence in its ability to return capital while maintaining dividend growth.

Insider Conviction Adds Credibility

Director-level insiders reinforced their confidence in December 2025, with five board members acquiring shares at $149.51. Director Susan M. Diamond purchased 535 shares, while Directors Segun Agbaje, Jennifer Bailey, Daniel Vasella, and Dave J. Lewis each acquired approximately 401 shares. These acquisitions occurred during a period of stock weakness, suggesting board-level conviction in the company’s long-term prospects.

The Retiree Calculation

For income-focused investors, PepsiCo offers a compelling proposition: current yield that’s competitive with investment-grade corporate bonds, backed by a half-century track record of annual increases. The stock has delivered 17.4% total return over the past year and 43% over five years, demonstrating that dividend reliability doesn’t require sacrificing capital appreciation.

The tighter free cash flow coverage warrants monitoring, but the company’s diversified portfolio of billion-dollar brands, consistent operating cash flow generation, and management’s demonstrated commitment to the dividend provide reasonable assurance that the streak will continue.