One might think that after the company you co-founded and currently lead has just demolished consensus estimates for your near-term future, you could do better than whine about how U.S. regulations restricting exports of your most advanced products to China are tying your hands behind your back. But, as William Blake once commented, “You never know what is enough unless you know what is more than enough. … Enough! or Too much!”

[in-text-ad]

In an interview with the Financial Times on Tuesday, Nvidia Corp. (NASDAQ: NVDA) co-founder and CEO Jensen Huang said the Biden administration’s export controls on the most advanced U.S. semiconductors have tied Silicon Valley’s hands because his firm cannot sell into one of the company’s biggest markets.

In fact, Nvidia is doing a booming business selling the restricted versions of its H100 and A100 products into China using H800 and A800 as product names. The chips are selling at around the same price as the company’s unrestricted version and in large quantities.

China comprises about one-third of the U.S. tech industry’s market, Huang told the Financial Times, and replacing it as both a source of components and an end-user market would be impossible. The piece of the $52 billion in the U.S. Chips Act that would go to building new semiconductor manufacturing plants (fabs) in the United States will be wasted:

If the American tech industry requires one-third less capacity [due to the loss of the Chinese market], no one is going to need American fabs, we will be swimming in fabs. If [the Biden administration] is not thoughtful on regulations, they will hurt the tech industry.

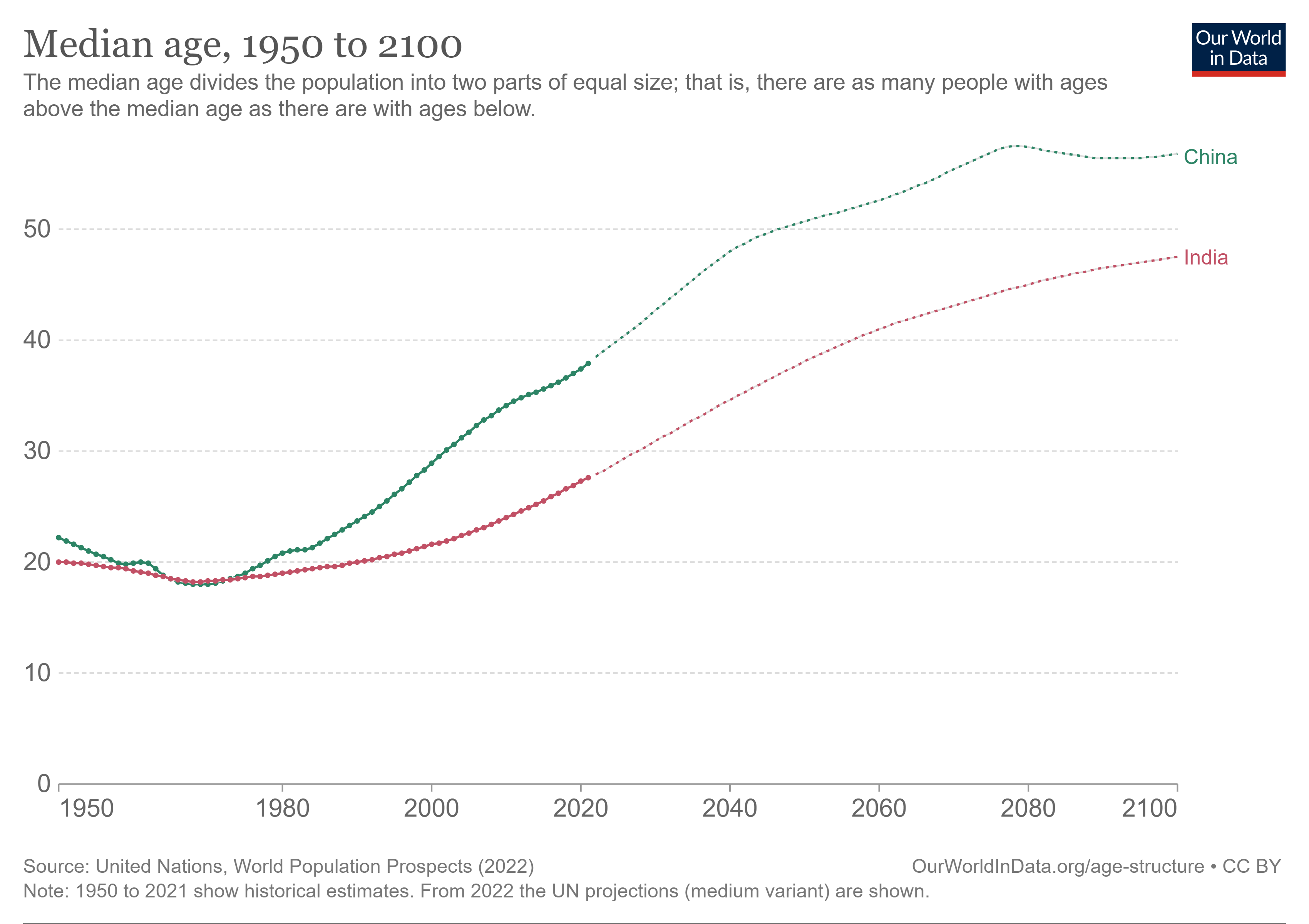

There is always another option. In this case, India, which has just passed China as the world’s most populous country. Not only is India’s population larger, it is also younger. The median age in India in 2021 was 27.6 years; in China, the median age was 37.9 years.

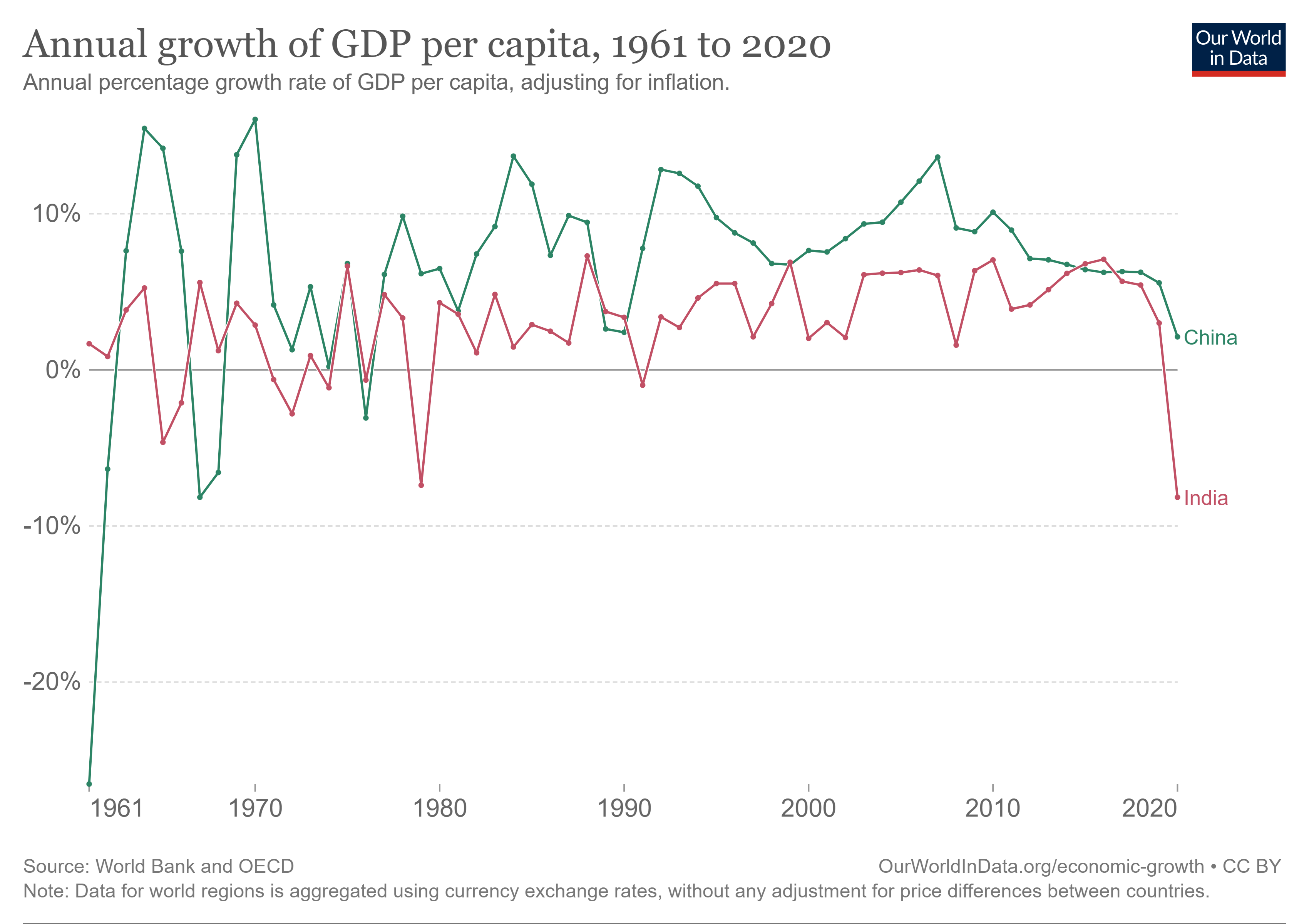

India’s economy is the world’s fifth largest, having just overtaken the United Kingdom to trail only the United States, China, Japan and Germany. Until the pandemic of 2020 absolutely clobbered India’s GDP per capita growth rate, China and India were growing at nearly the same pace.

[in-text-ad]

There may be good reasons for the United States to maintain friendly relations with China, but protecting Silicon Valley’s market share ought to be way down the list.

Nvidia did report a strong first-quarter performance after U.S. markets closed on Wednesday. The company then estimated that second-quarter revenue would come in at around $11 billion — some 52% above the consensus estimate. The increase is largely driven by demand for the company’s high-end chips and all the software that goes along with them to support the massive run into generative AI. CEO Jensen expects spending to amount to $1 trillion over the next several years, and he also expects Nvidia to get a big piece of that.

Shares of Nvidia opened Thursday morning at $385.24 (a new 52-week high), up nearly 21% from Wednesday’s close. The company’s market cap has soared to more than $917 billion.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.