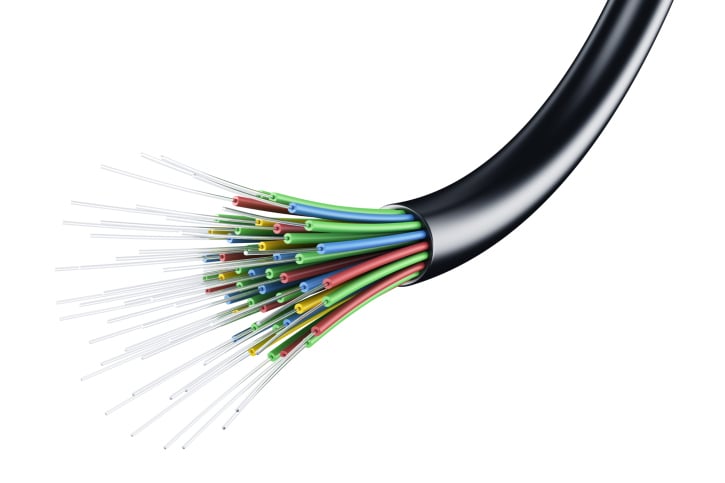

InnoLight Technology Corp. has filed an amended F-1 form to the U.S. Securities and Exchange Commission (SEC) for its initial public offering (IPO). No terms were given in the filing but the offering is valued up to $100 million. The company will list its American depository shares (ADSs) on the Nasdaq Global Market under the symbol INLT. Source: Thinkstock

Source: Thinkstock

The underwriters for this offering are Credit Suisse, Barclays, Raymond James and Stifel.

This company is a leading infrastructure enabler of cloud data center networks. Its optical transceivers connect computer servers by converting electrical signals into optical signals for transmission over fiber optic cables. InnoLight focuses on optical transceivers that handle data transmission at high speeds within and between cloud data centers, and its products have been adopted by some of the largest data center operators in the United States.

As a leader in the single mode 40G optical transceiver market, it had a 37% global market share in 2014 based on revenue, according to a research report commissioned from LightCounting, an independent market research company.

Forty gigabits per second, or 40G, is currently the fastest commercially viable speed for data center networks. By leveraging its proprietary expertise and know-how from developing 40G products, the company has developed new products for the cloud data center 100G optical transceiver market, which is expected to exceed the 40G market in terms of revenue by 2016, according to LightCounting.

ALSO READ: 3 Top Jefferies Chip and Chip Equipment Stocks With Gigantic Upside Potential

The company described its traffic and finances in the filing:

Annual global cloud IP traffic is expected to grow at a compound annual growth rate, or CAGR, of 32% per year from 2013 to 2018, according to the Cisco Global Cloud Index. Global mobile data traffic is expected to grow at a CAGR of 57% per year from 2014 to 2019, according to the Cisco Visual Networking Index. In turn, strong demand from the data center industry is expected to drive continued rapid growth in the optical transceiver market, particularly for the high-performance optical transceivers that we produce. Global sales volume for 40G or faster optical transceivers for use in cloud data centers is expected to grow from US$376 million in 2014 to US$2,249 million in 2019, according to LightCounting, representing a CAGR of 43%. Capital expenditure by companies whose primary business is the creation, storage and dissemination of digital information such as Google and Amazon doubled from US$23 billion in 2008 to US$46 billion in 2013 and is expected to grow to US$116 billion by 2019, according to Ovum Ltd., an independent market research company, representing a six-year CAGR of 17%.

The company intends to use the net proceeds from this offering to expand its production capacity and strengthen its research and development capability. Separately the company intends to use the proceeds for general corporate purposes and, pending use of the net proceeds, InnoLight intends to hold these net proceeds in demand deposits or invest them in interest-bearing government securities.

ALSO READ: 5 Stocks Warren Buffett Likely Bought More of During the Sell-Off

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.