IPOs and Secondaries

The IPO market is still on somewhat shaky ground, but recent action shows that investors are very interested in owning shares of these recently public companies at their lower entry points.

Published:

The Fed's interest rate decision was expected, but some of the consequences seem slightly out of whack.

Published:

A third IPO in less than five trading days launches Wednesday morning, after pricing above its expected range.

Published:

If, as expected, Klaviyo prices its IPO Tuesday and begins trading Wednesday, the last 7 days will have seen more than $6 billion raised in just 3 IPOs. Are there more on the way?

Published:

Two coming IPOs have both raised their initial price ranges following the blowout offering by Arm last week. Is this the start of the next IPO boom?

Published:

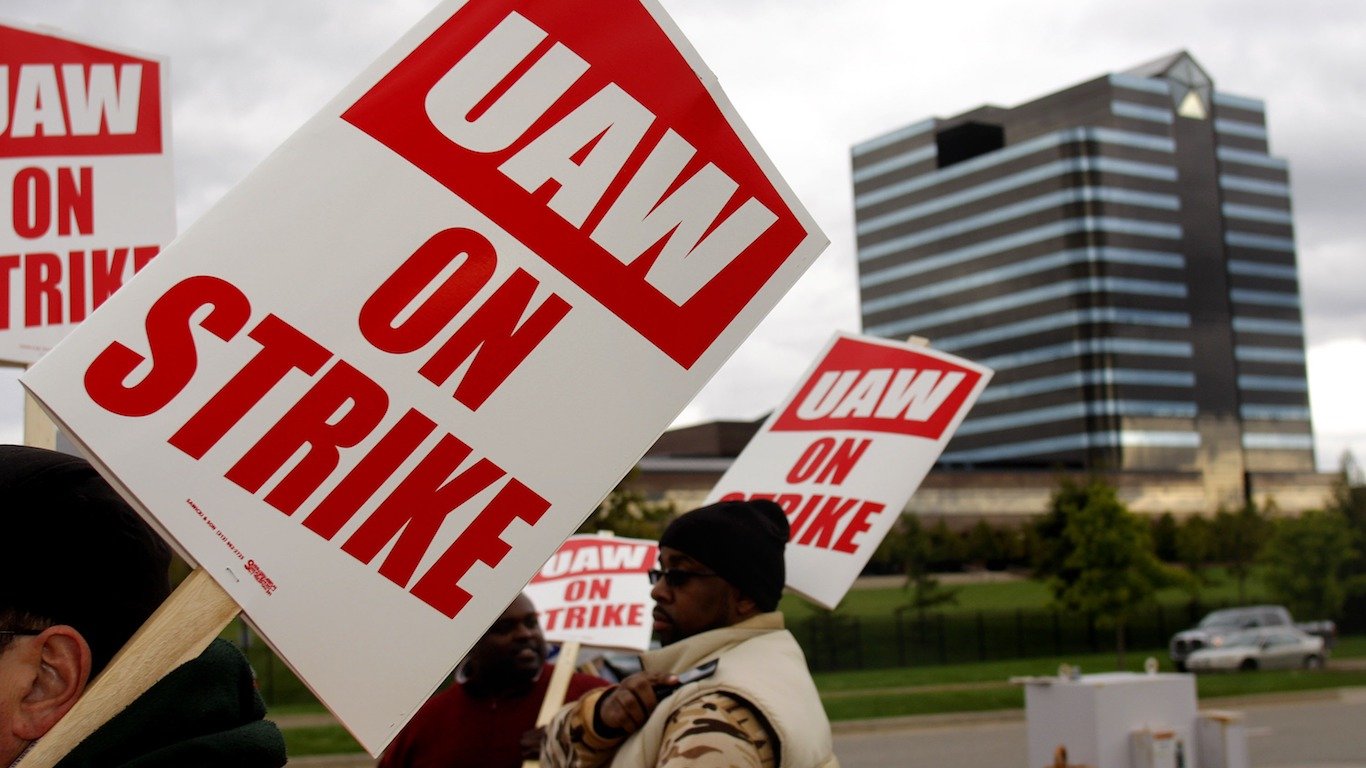

Disney may be looking to sell its linear TV channels, Arm's IPO investors should be wildly happy Friday morning, and the UAW walks out of three auto plants, one owned by each of Detroit's Big Three.

Published:

Chip designer Arm will begin trading Thursday after raising $4.87 billion in its IPO. AMC raised $325 million in a secondary stock sale, and it looks like autoworkers and automakers are headed for a...

Published:

Wednesday brings the monthly consumer price index report, the weekly U.S. oil inventories report and the continuing inflation saga.

Published:

Chip designer Arm Holdings is beginning its roadshow this week, and investors are expecting an IPO pricing on Sunday with trading in the stock to begin Monday.

Published:

Arm has filed preliminarily for an IPO that owner Softbank hopes will value the company north of $60 billion and raise up to $10 billion in cash. Also, Elon Musk gets the New Yorker treatment.

Published:

Silicon Valley Bank reportedly up for sale.

Published:

Another oil & gas producer, Bounty Minerals, has filed for an initial public offering. Bounty operates mainly in the Appalachian Basin and is primarily a natural gas producer.

Published:

Intel's spin-off of Mobileye has investors and investment banks looking at resuscitation of the IPO market.

Published:

Volkswagen completed its spin-off of Porsche Thursday morning with an IPO in Frankfurt that values the sports car maker at around $73 billion.

Published:

The blank-check company trying to take former President Trump's media company public has just changed its address to a UPS store in Miami.

Published: