Since 2004, Boeing Co. (NYSE: BA) has tripled its annual adjusted earnings per share, nearly doubled its revenues and reduced its number of shares outstanding by more than 14%. Operating cash flow has risen from $3.5 billion in 2004 to $9.4 billion in 2015 and is targeted at $10 billion in 2016.

None of this is particularly big news from Boeing, which held its investor day meeting on Wednesday. The big message from CEO Dennis Muilenburg is growth: revenue growth, margin growth and cash flow growth. The company also plans to accelerate innovation, which we take to mean speed up product design and development.

Commercial airplanes CEO Ray Conner pointed to a backlog of nearly 5,800 orders split 55%-45%, wide-bodies to narrow-bodies, and five planned rate transitions between now and 2020 that would raise production from around 750 this year to more than 900. Operating margins that have hovered just under 10% for the past three years are expected to reach double digits in the near term and Conner has set an “aspirational goal” in the mid-teens.

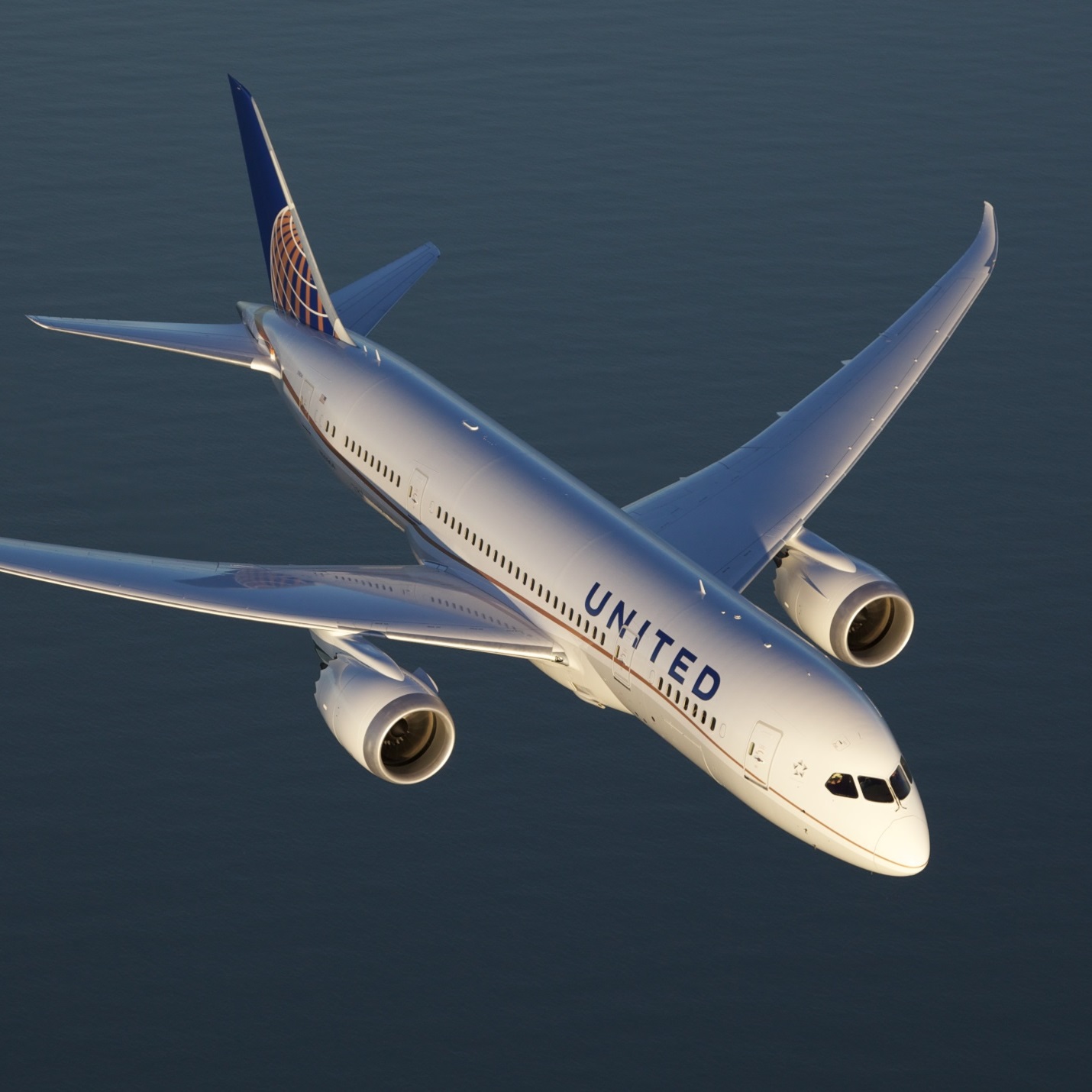

Chief Financial Officer Greg Smith noted that the production rate on the 787 Dreamliner has reached 12 per month and that major assembly of the 787-10 is ahead of schedule. The narrow-body 737 MAX had its first flight and Conner pointed out that the 737 and the Airbus A320 each have captured 50% of the narrow-body market since the 737 MAX was introduced five years ago.

Although Boeing did not put a number on it, cash flow is expected to rise between now and 2020 as a result of increasing profitability on the 787 program, higher production rates on the 737 and 787, productivity improvements, modest growth in defense systems and disciplined cash management.

The slides do not give the particulars, but Leeham News reports that Boeing expects to recover its $29 billion in deferred production costs on the 787 program by shifting deliveries to the larger and more expensive 787-9 and 787-10 and by raising pricing on the 900 or so Dreamliners in the backlog. CFO Smith said that would account for 70% of the deferred production recovery and another 25% will be down to higher production rates. Cost savings will account for the rest.

Investors have not reacted much to the presentations. The stock is trading essentially flat at $133.61, in a 52-week range of $102.10 to $150.59. The presentations are available on Boeing’s website.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.