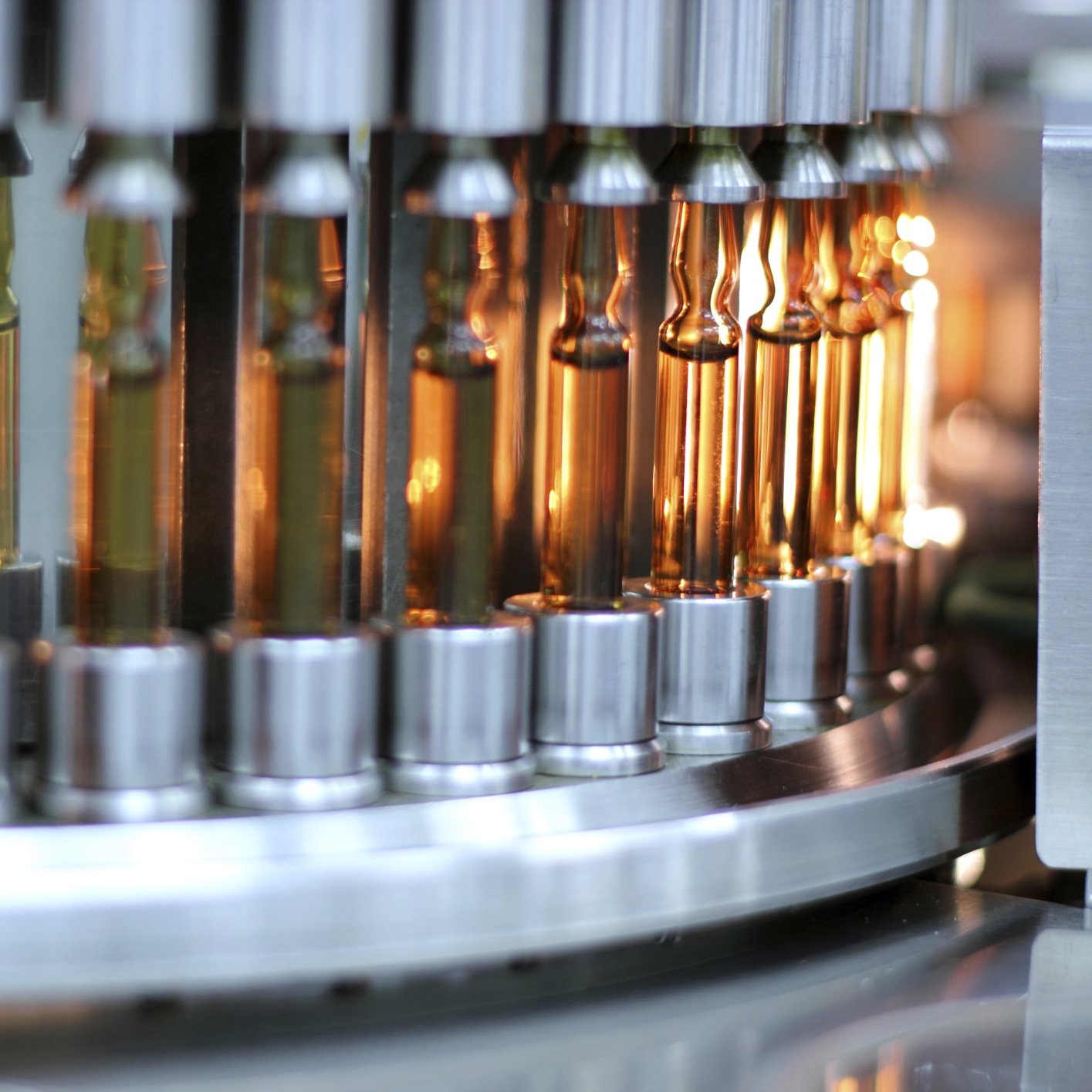

Gilead Sciences Inc. (NASDAQ: GILD) is set to report its third-quarter financial results after the markets close on Thursday. Thomson Reuters has consensus estimates that call for $2.89 in earnings per share (EPS) on $7.82 billion in revenue. The same period from the previous year had $1.84 in EPS on $6.04 billion in revenue. Source: Thinkstock

Source: Thinkstock

This company discovers, develops and commercializes medicines in areas of unmet medical need in North America, South America, Europe and the Asia-Pacific. Its products include Stribild, Complera/Eviplera, Atripla, Truvada, Viread, Emtriva, Tybost and Vitekta for the treatment of human immunodeficiency virus (HIV) infection in adults, and Harvoni, Sovaldi, Viread and Hepsera products for the treatment of liver disease.

It recently announced that the FDA has approved Letairis in combination with Eli Lilly’s Adcirca for reducing the risk of disease progression and hospitalization and improving exercise ability in patients suffering from pulmonary arterial hypertension. Both Letairis and Adcirca are approved in the United States, European Union and elsewhere as once-daily treatments for patients with pulmonary arterial hypertension.

Recently, the U.S. Food and Drug Administration (FDA) issued a warning that hepatitis C treatments Viekira Pak and Technivie can cause serious liver injury, mostly in patients with underlying advanced liver disease. The markets reacted very negatively to AbbVie Inc. (NYSE: ABBV) on this news, but Gilead came out on top because it produces a competing hepatitis C vaccine.

As a result, the FDA is requiring the manufacturer to include information about serious liver injury adverse events to the Contraindications, Warnings and Precautions, Postmarketing Experience and Hepatic Impairment sections of the Viekira Pak and Technivie drug labels.

ALSO READ: Short Sellers Become More Selective on Leading Biotechs

Ahead of its earnings report, a few analysts weighed in on Gilead’s position:

- JPMorgan reiterated a Buy rating with a $133 price target.

- Oppenheimer reiterated an Outperform rating but raised its price target to $124 from $120.

- RBC Capital reiterated a Buy rating with a $130 price target.

- Jefferies has a Hold rating but lowered its price target to $107 from $115.

So far in 2015, Gilead has outperformed the market, with the stock up 16% year to date, while over the past 52 weeks the stock is down 1%.

Shares of Gilead were last seen Tuesday trading up 1.1% at $109.80, with a consensus analyst price target of $124.25 and a 52-week trading range of $85.95 to $123.37.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.