Health and Healthcare

Spark Therapeutics Files For Secondary Offering

Published:

Last Updated:

Spark Therapeutics, Inc. (NASDAQ: ONCE) filed an S-1 form with the U.S. Securities and Exchange Commission (SEC) regarding a secondary offering. There were no pricing terms given regarding the offering but the company expects it to be valued up to $175 million. At the current price level, the offering would be around 3 million shares.

The sole underwriter for this offering is J.P. Morgan.

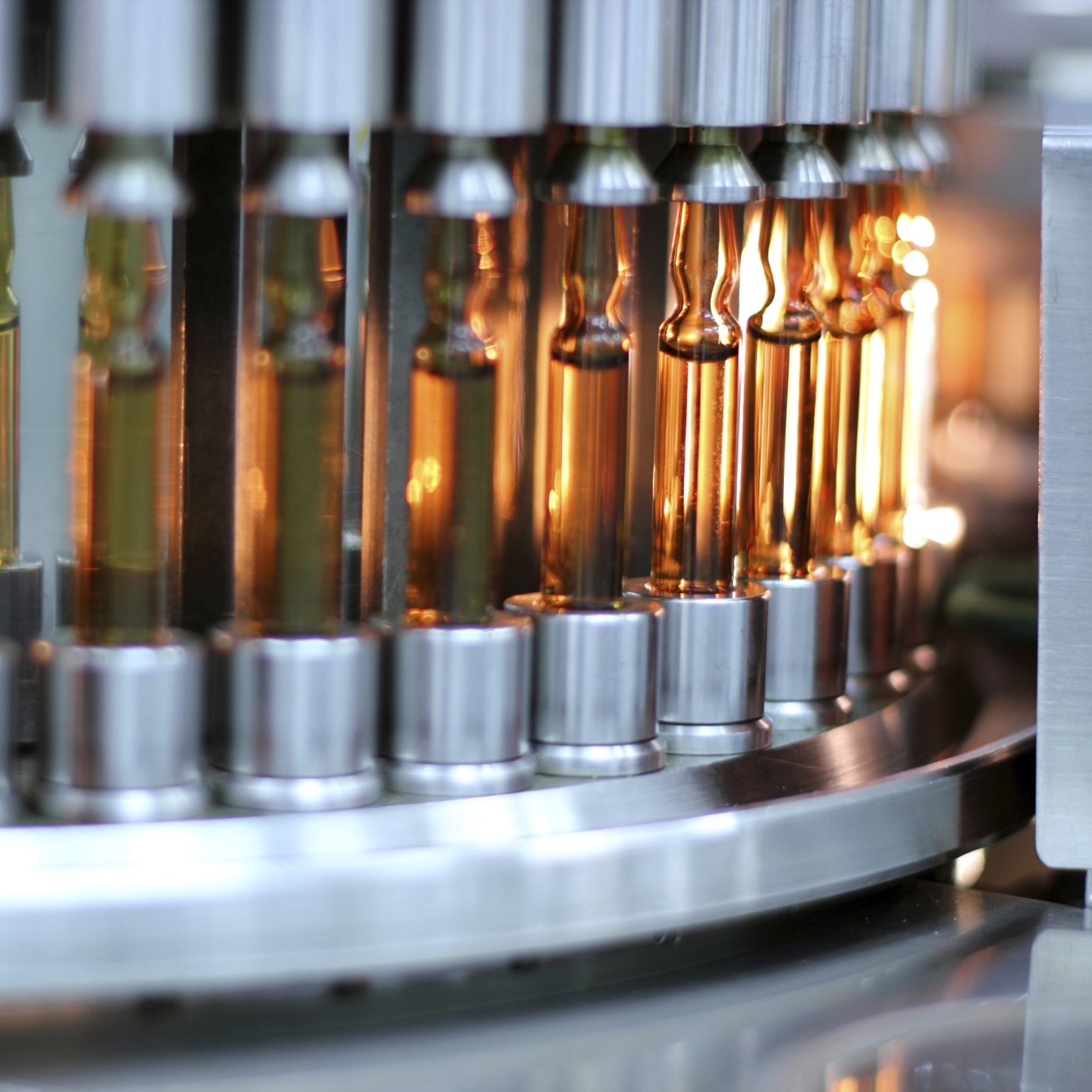

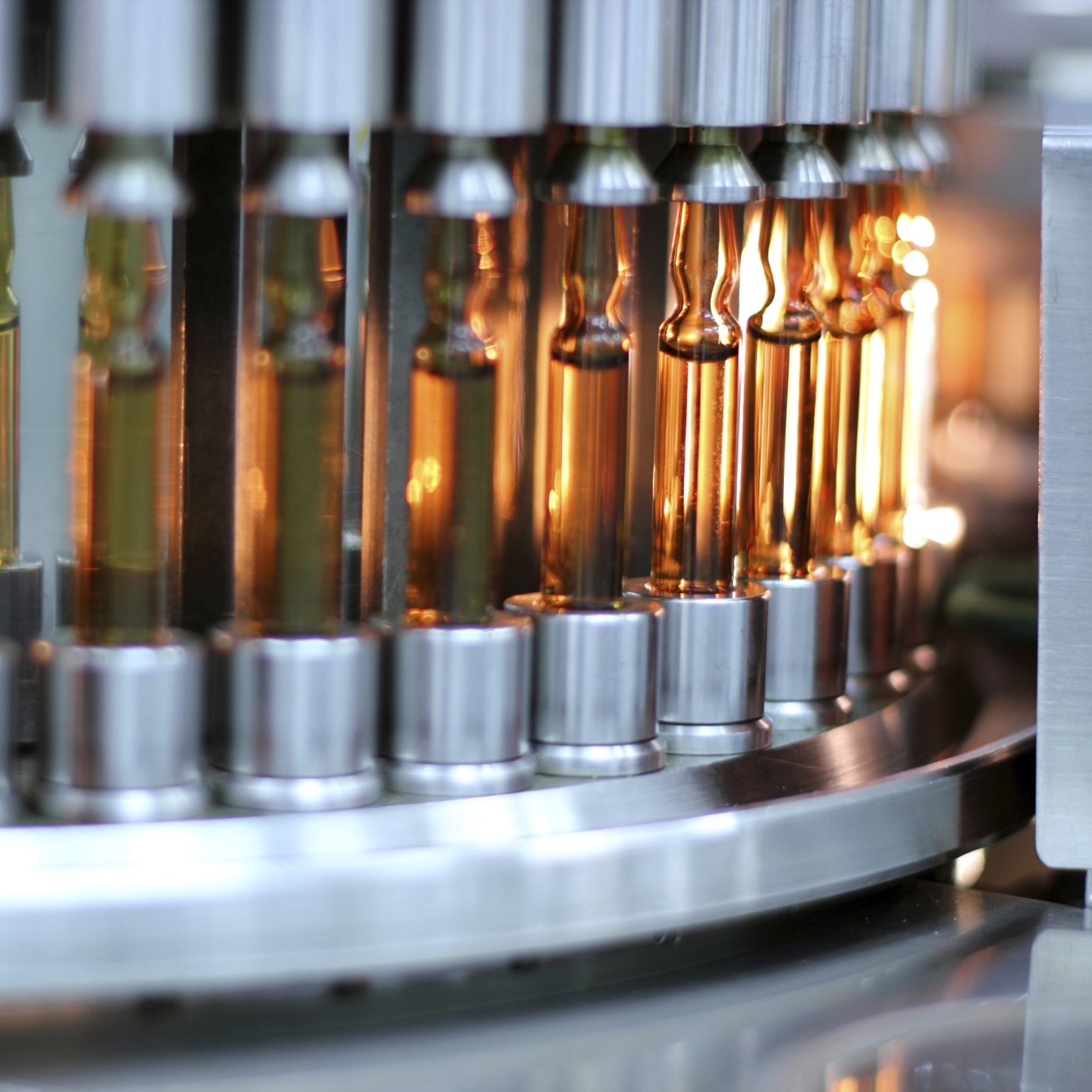

Spark is a leader in the field of gene therapy, seeking to transform the lives of patients suffering from debilitating genetic diseases by developing one-time, life-altering treatments. The goal of gene therapy is to overcome the effects of a malfunctioning, disease-causing gene by delivering a normal, functional copy of the same gene. Its product candidates have the potential to provide long-lasting effects, dramatically and positively changing the lives of patients with conditions where no, or only palliative, therapies exist.

The initial focus is on treating orphan diseases, and Spark recently reported statistically significant results in a pivotal phase 3 clinical trial of its first product candidate targeting rare genetic blinding conditions, which has received both breakthrough therapy and orphan product designation. Based on these positive results, the company intends to file a Biologics License Application (BLA) for this product candidate with the U.S. Food and Drug Administration (FDA) in 2016 as the first step in executing a global regulatory and commercialization strategy.

In the SEC filing the company said:

We also have built a pipeline of product candidates targeting multiple rare blinding conditions, hematologic disorders and neurodegenerative diseases. Our pipeline includes: a second product candidate targeting another rare genetic blinding condition currently in a Phase 1/2 clinical trial; product candidates for the treatment of hemophilia with a hemophilia B product candidate currently in a Phase 1/2 clinical trial in collaboration with Pfizer Inc. and a preclinical product candidate for hemophilia A; a product candidate for the treatment of a form of Batten disease, for which we expect to commence Investigational New Drug application, or IND, enabling studies by the end of 2015; and other ophthalmic, hematologic and neurodegenerative disease programs.

Shares of Spark were last trading down about 4% at $56.85, with a consensus analyst price target of $82.33 and a 52-week trading range of $36.96 to $79.50.

ALSO READ: The Largest Employer in Each State

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.