If one retail and apparel player needs a comeback, it is none other than Lululemon Athletica Inc. (NASDAQ: LULU). One analyst on Wall Street drew the line in the sand this last week and said that the time to buy is now. This yoga and exercise themed apparel retailer has seen its shares cut in almost half. If the team is right then Lululemon could finally generate solid investor returns again. Source: Thinkstock

Source: Thinkstock

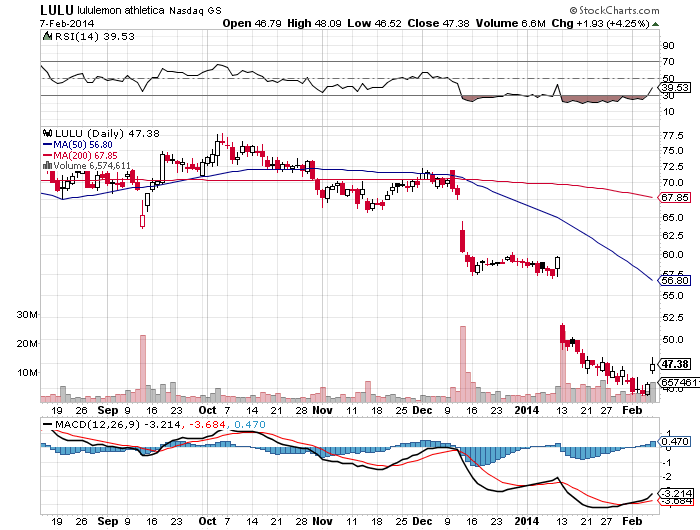

RBC Capital Markets raised Lululemon’s rating to Outperform from Sector Perform. The stock had fallen down to $45.45 prior to the analyst call, and the 52-week low is super close at $44.32.

RBC’s call is based somewhat on valuation and somewhat on fundamentals. The firm called it a unique and compelling growth story in the retail and apparel sector. RBC even said that most of the bad news from 2013 is behind it, and said that the current price represents a compelling entry point.

Lululemon shares had blown through RBC’s $56 price target, but we would point out that Lululemon’s consensus price target from analysts is higher and closer to $59.00.

Most analysts have still been downgrading this stock. Janney Capital Markets had just downgraded the stock on January 27, and Sterne Agee lowered its targets yet again on January 21 based upon a brand deterioration. It was also just on January 13 that the apparel retailer lowered its guidance yet again.

To prove how bad 2014 has been, shares closed out 2013 at $59.03 – making the drop a sharp 23% prior to this analyst rating upgrade. Still, the consensus is for growth to occur in 2014.

Lululemon trades at close to 25-times expected trailing earnings, and it trades at closer to 21-times the coming year’s earnings expectations. Despite all of its problems, the Thomson Reuters consensus estimates expect earnings growth to resume this coming year – up 17% to $2.21 per share – and they expect another 16% sales growth to $1.84 billion.

Shares of Lululemon closed up over 4% at $47.38 on Friday. Even at that price, shares are still down about 42% from its high. That implies that if the stock ever rose back to its high that the gain would be 74%.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.