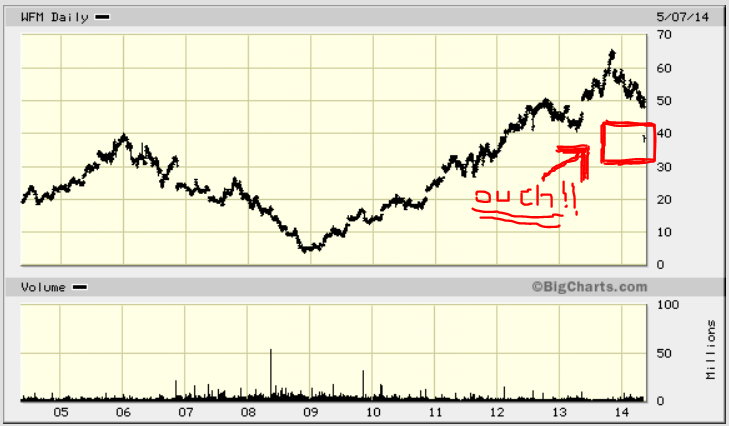

Whole Foods Market Inc. (NYSE: WFM) is so ugly in its post-earnings reaction that investors, new and old alike, will have to admit that the future is suddenly very different from the past. This organic and natural foods retail giant has grown and grown, and it seems safe to assume that the easy money has now been made by investors. Still, this drop is so large and so nasty that some long-term investors may finally decide in the days and weeks ahead that the baby has been tossed out with the bath water. Source: courtesy of Whole Foods Market

Source: courtesy of Whole Foods Market

The big question is whether Wall Street is being too harsh and backward looking here. Analysts and strategists are known for getting it wrong over and over, and the number of downgrades would only not be alarming to the most extreme market contrarian investors.

Make no mistake in understanding one thing: Whole Foods just took a serious damage to its investor credibility quotient. Whole Foods keeps adding stores and still has many growth opportunities ahead of it. It is also easy to see that it will now have to fight for new growth, and in a world where price matters it will have to fight to hang on to its grasp of existing markets and existing customers as well.

Do investors have to worry that the new Whole Foods is simply the same as investing in Kroger Co. (NYSE: KR)? Or what about The Fresh Market Inc. (NASDAQ: TFM)?

ALSO READ: Warren Buffett’s Nine Top Dividend Stocks

Admittedly, past investors wanted high growth here. Yet net income of $142 million, or $0.38 per share, for the second quarter was effectively flat against the same quarter a year ago. Total sales rose 10% to a record $3.32 billion, while the more important same-store sales rose by 4.5%. Where things go awry was that the Thomson Reuters consensus was $0.41 in earnings per share on revenue of $3.34 billion.

Again, it sounds sketchy to existing Whole Foods shareholders who have grown to expect more out of the company. And guidance will leave more questions for those same long-term investors who expected more. Guidance for 2014 is for earnings of $1.52 to $1.56 per share, with sales growth of 10.5% to 11%. The company’s prior guidance was for earnings per share of $1.58 to $1.65, and for sales growth of 11% to 12%. Prior to the guidance, Thomson Reuters was calling for $1.61 per share and closer to 11% revenue growth.

Our own take through time has been that its stock has been overvalued to those who used traditional metrics, and that it was to be evaluated as a luxury retail growth story rather than a low margin grocer. Just keep in mind that Whole Foods is likely to see ever lower margins ahead.

So, how is Wall Street’s reaction now, besides just being flooded with analyst downgrades?

Credit Suisse pointed out in its earnings preview at the end of April, when it still had a Neutral rating, that things were bad. Its team opined that emerging headwinds suggested that the share pullback may in fact not be a buying opportunity. Now Credit Suisse maintains that the days of easy growth is over and the company will have to shift its strategy to address intensifying competition.

The downgrades are coming on strong elsewhere. The following downgrades were seen on Wednesday morning: to Market Perform from Outperform at BMO Capital Markets, to Sell from Hold by Cantor Fitzgerald, to Hold from Buy at Deutsche Bank, to Neutral from Overweight by Piper Jaffray and to Neutral from Buy at Sterne Agee. Again, there is no way that any investor will think that this many downgrades is good news. Only extreme contrarians would like the news, and even then they may say to be patient.

Other analysts have remained positive in their ratings, with very tempered expectations. Canaccord Genuity said that the bloom has fallen off the organic rose. Still it maintained its formal Buy rating while slashing its analyst price target to $49 from $63. The independent research firm of Argus actually came out and raised its official Whole Foods rating to Buy from Hold, with a $48 price target, as it has said that investors can finally buy this stock at the price it wanted.

ALSO READ: How Alibaba Measures Up Against Amazon and eBay

Whole Foods shares were down a whopping 19.5% at $38.58 in early afternoon trading on Wednesday. The trading volume was also more than 32 million shares, with much time left in the day, more than six times a full day’s average volume. Put simply, this is a game changing day for Whole Foods.

And what about a value against rivals? The new target puts its value at a steep 25 times expected 2014 earnings.

Sterne Agee used the Whole Foods news to downgrade The Fresh Market Inc. (NYSE: TFM). Its new rating was cut to Underperform, with a sub-market stock price target of $29.

The Kroger Co. (NYSE: KR) sells many of the exact same goods that Whole Foods sells. Literally, the exact same products with the same SKU numbers. And for a whole lot less. Whole Foods did not exactly get the nickname “Whole Paycheck” by accident. What is so different here is that Kroger trades at less than 15 times expected 2014 earnings, an earnings multiple that is 40% lower than Whole Foods.

The big rub is that at $38.54, after a near-20% drop on Wednesday, the stock is down from a 52-week high and all-time high of $65.59. This puts its shares down more than 40%, and the stock even split two-for-one in the first half of 2013. Chartists and technicians will point out that Whole Foods is now on the right side of a long-term head and shoulders pattern, something that is deemed not exactly “right” for bullish stock moves ahead (see below).

Make no mistake that the parameters have changed for Whole Foods. There are quite simply fewer opportunities for it to keep growing, even if there are many opportunities for growth still out there.

ALSO READ: Deutsche Bank’s Five Top Stocks Dominating Internet of Things Growth

Still, new investors have profited handily each and every time that they bought into severe weakness in Whole Foods stock. One word of warning: it is very rare for stocks to drop 20%, even after a steady decline ahead of that news, and then to see a snapback recovery. If new investors are hoping that the stock will return to $60 any time soon, then they are likely very misguided and are likely very poor students of history.

Whole Foods has lost its status as a momentum stock. That status may be gone for good. If history is any judge in big stock drops on top of big stock drops, Whole Foods now may be in just the second of a series of very difficult quarterly earnings reports.

All caveats aside, long-term investors with a very long-term outlook (that would be years by the way!) are likely to start building a position in the days, weeks or months ahead. There is simply no reason to try catching a bunch of falling daggers, almost certainly not all at once.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.