Technology

As Momentum Builds for Chip Equipment Makers, 3 Top Stocks to Buy Now

Published:

Last Updated:

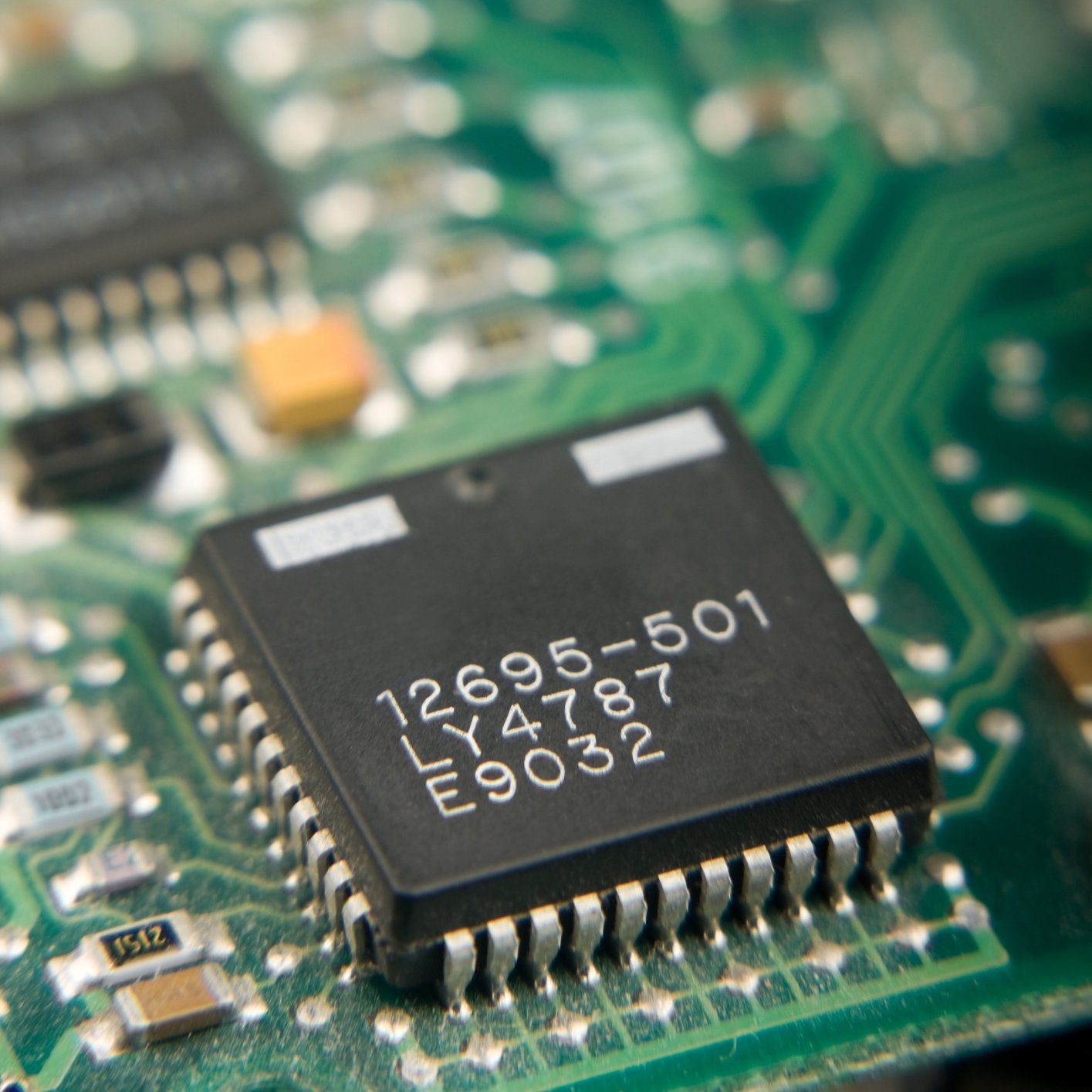

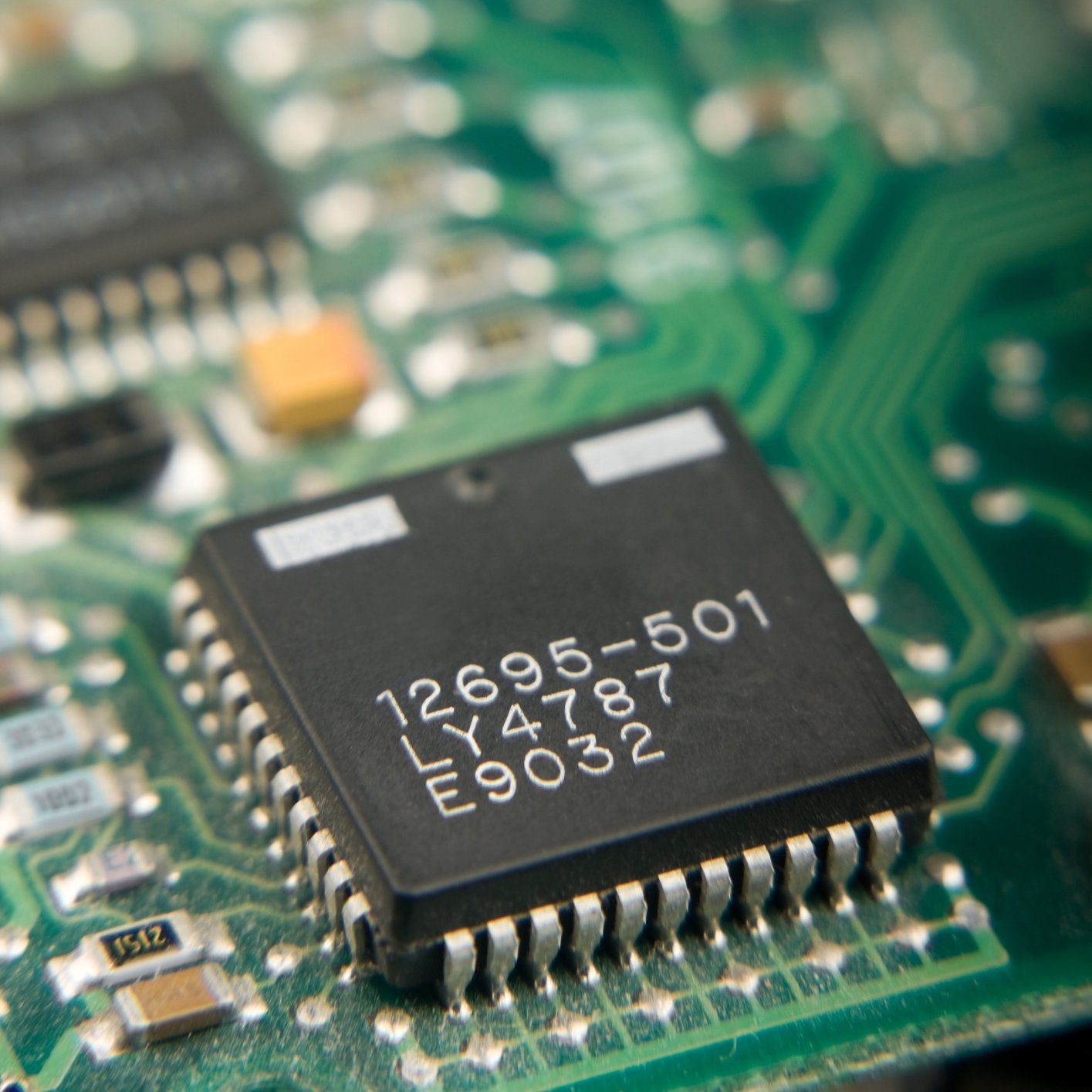

The semiconductor industry has had a rough ride over the past year, and some of the companies more leveraged to personal computer sales suffered the most, while the radio frequency leaders fared somewhat better. Typically when the chip stocks suffer, so do the semiconductor capital equipment stocks. One firm on Wall Street thinks that momentum at the foundries could be building and the rest of 2016 could perk up.

A new research report from Stifel cites the momentum at the foundries as a positive that could start to drive estimates for the top stocks higher. The Stifel team also thinks that front- and back-end trends and outlooks are tracking ahead of expectations that were set at the beginning of 2016. Toss in a pickup in smartphone demand in China, and the positives may continue to build.

The Stifel report includes six companies rated Buy, but here we focus on three of the biggest players.

Applied Materials

This is a semiconductor capital equipment leader that has lagged the overall tech market over the past year, but its shares have bounced smartly off lows printed in February and back in December. Applied Materials Inc. (NASDAQ: AMAT) is actually now finally trading above all the moving averages, and for patient investors may be a high-quality pick now.

The company is the global leader in precision materials engineering solutions for the semiconductor, flat panel display and solar photovoltaic industries. Applied Material’s technologies help make innovations like smartphones, flat screen TVs and solar panels more affordable and accessible to consumers and businesses around the world.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.