In a hot technology market it’s always good to follow the numbers, and Micron Technology Inc. (NASDAQ: MU) delivered big results this week that came in above Wall Street estimates. In addition, forward guidance for the next quarter was also above analyst expectations. In even more good news, the company’s capital expenditure guidance for fiscal 2018 was very positive. While Micron investors are probably thrilled, they aren’t the only ones who could benefit from the strong showing.

A new RBC research report breaks out the positives from the Micron report for six companies that are in the firm’s research coverage that look to benefit from Micron’s bullish earnings and commentary. All are industry leaders, and they make good sense for aggressive growth accounts.

Applied Materials

Some on Wall Street feel this semiconductor capital equipment leader has the broadest range of exposure to 3D NAND and foundry display. Applied Materials Inc. (NASDAQ: AMAT) is the global leader in precision materials engineering solutions for the semiconductor, flat panel display and solar photovoltaic industries. Applied Material’s technologies help make innovations like smartphones, flat screen TVs and solar panels more affordable and accessible to consumers and businesses around the world.

This is one of the semiconductor capital equipment stocks that could benefit the most from the capital expenditure plans at Micron. The RBC team said this in the report:

Micron also stated that industry NAND supply will be up high 30% in CY17 and approaching ~50% in calendar 2018 as well with underlying demand drivers remaining solid. Continued supply growth and technology transitions should bode well for semi cap companies.

Applied Materials shareholders are paid a small 0.85% dividend. The stock is rated Outperform at RBC and the price target is $55. The Wall Street consensus target price is $55.50, and the shares traded early on Friday at $51.25.

ASML

This is another top chip equipment company that looks to benefit. ASML Holding N.V. (NASDAQ: ASML) engages in designing, manufacturing, marketing and servicing semiconductor processing equipment used in the fabrication of integrated circuits worldwide. It provides the PAS 5500 family products that comprise wafer steppers and step-and-scan systems suitable for the i-line, krypton fluoride and argon fluoride processing of wafers.

This is a lithography intensive company that the analysts see as possibly getting a direct benefit from boost in spending.

The RBC analysts rate the stock Sector Perform, and they have a $155 price objective. The consensus target price is much lower at $142.85. The stock traded on Friday at $170.00 a share.

Ichor

This stock may be off-the-radar for some, but it also could be a beneficiary from the positive news on Micron. Ichor Holdings Ltd. (NASDAQ: ICHR) is engaged in the design, engineering and manufacturing of critical fluid delivery subsystems for semiconductor capital equipment. The company’s primary offerings include gas and chemical delivery subsystems, collectively known as fluid delivery subsystems, which are key elements of the process tools used in the manufacturing of semiconductor devices.

Ichor’s gas delivery subsystems deliver, monitor and control precise quantities of the specialized gases used in semiconductor manufacturing processes, such as etch and deposition. Its chemical delivery subsystems precisely blend and dispense the reactive liquid chemistries used in semiconductor manufacturing processes, such as chemical-mechanical planarization electroplating and cleaning.

The RBC team rates the stock Outperform and their $27 price target compares with the posted consensus target of $28.41. The shares were trading at $27.00 apiece.

Intel

This leader in semiconductors is working hard to scale away from dependence on personal computers, and the Internet of Things is a big part of the shift. Intel Corp. (NASDAQ: INTC) designs, manufactures and sells integrated digital technology platforms worldwide.

The company’s platforms are used in various computing applications comprising notebooks, two-in-one systems, desktops, servers, tablets, smartphones, wireless and wired connectivity products, wearables, retail devices and manufacturing devices, as well as for retail, transportation, industrial, buildings, home use and other market segments.

The analysts noted that personal computers were mid-20% of DRAM, and that bodes well for Intel as the PC business remains a big part of the company’s overall sales.

Intel offers investors a solid 2.93% dividend yield. RBC rates the shares Sector Perform and the price target is set at $37. The consensus price objective was last seen at $39.99, and the shares were trading recently at $37.80.

Lam Research

This company remains one of the top chip equipment picks across Wall Street and is the other one RBC feels will benefit the most from increased capex spending. Lam Research Corp. (NASDAQ: LRCX) designs, manufactures, markets, refurbishes and services semiconductor processing equipment used in the fabrication of integrated circuits. The company offers plasma etch products that remove materials from the wafer to create the features and patterns of a device.

Many Wall Street analysts have highlighted the company and its peers as having a significant equipment opportunity from the NAND evolution as well. Lam Research also appears well positioned to gain share in the wafer fab equipment market, driven by a strong focus on technology inflection spending over the next few years.

Shareholders of Lam Research are paid a 1.07% dividend. RBC rates the shares Outperform, and it has a price target of $185. That compares with a consensus price objective is $191.47. The stock traded Friday morning at $182.75 per share.

Western Digital

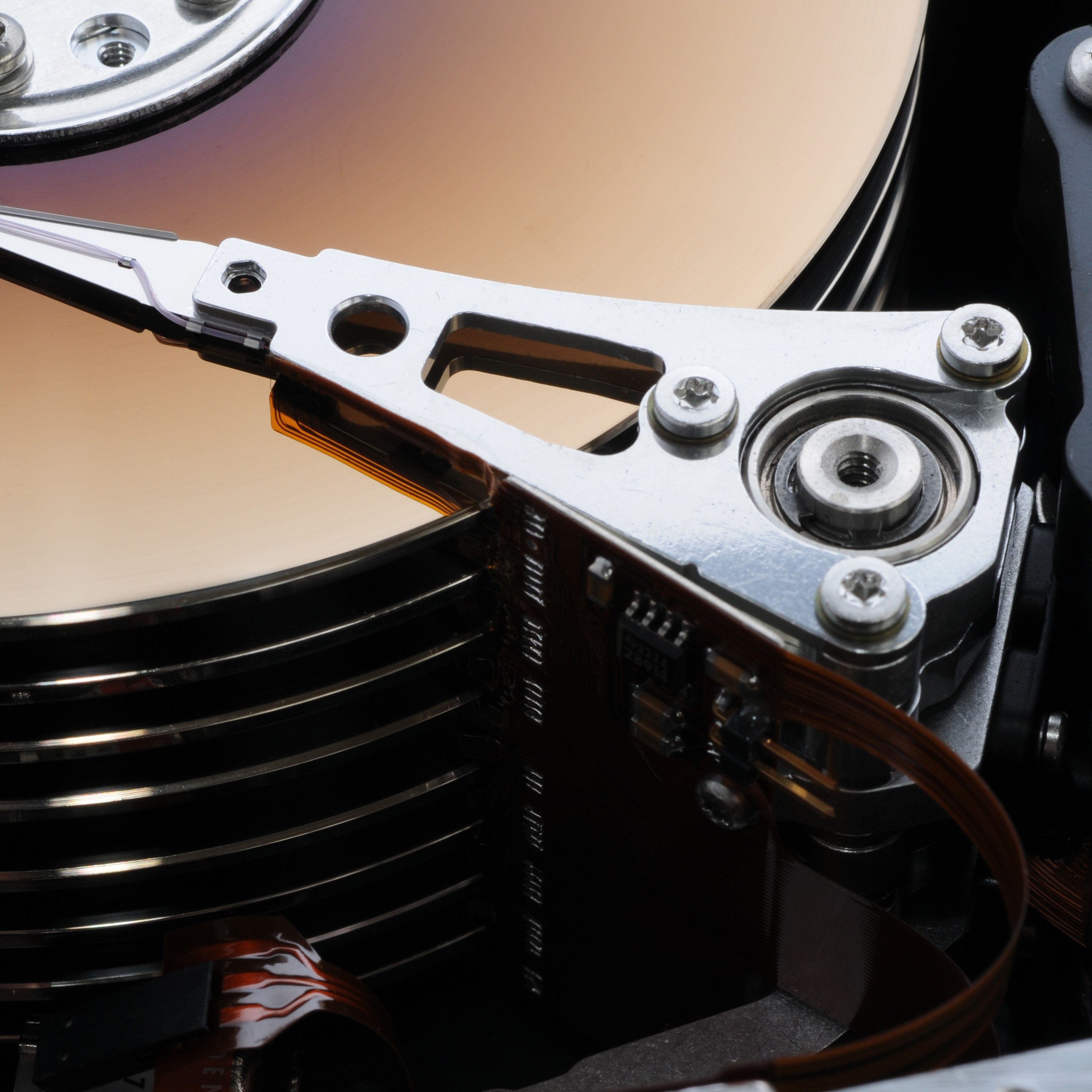

This long-time innovator in the storage industry is a leader in the total addressable HDD market. Western Digital Corp. (NASDAQ: WDC) is an industry-leading developer and manufacturer of storage solutions that help to create, manage, experience and preserve digital content.

The company is responding to changing market needs by providing a full portfolio of compelling, high-quality storage products with effective technology deployment, high efficiency, flexibility and speed. Its products are marketed under the HGST and WD brands to original equipment manufacturers, distributors, resellers, cloud infrastructure providers and consumers.

With NAND pricing up, that could mean that sales at the company are very positive. Shares have dipped after the company failed to come out the winner for Toshiba’s chip business, and investors have a much better entry level.

Western Digital shareholders are paid a 2.31% dividend. The RBC team has an Outperform rating and a $115 price target. However, the consensus price target is a whopping $117.84. The shares were trading on Friday at $86.40.

While there is no guarantee that these companies had quarters that will match the Micron numbers, the mere fact they presented such strong data is bullish. With earnings right around the corner for some of these stocks, investors may want to buy partial positions.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.