Corporate Governance

At its initial public offering in September 2014, Alibaba Group Holdings Ltd. (NYSE: BABA) was valued at $167.7 billion. The company raised $21.7 billion in the IPO, a record at the time. Only Saudi...

Published:

EV charging station provider ChargePoint replaced two top executives Thursday and said Q3 revenue will fall far short of expectations.

Published:

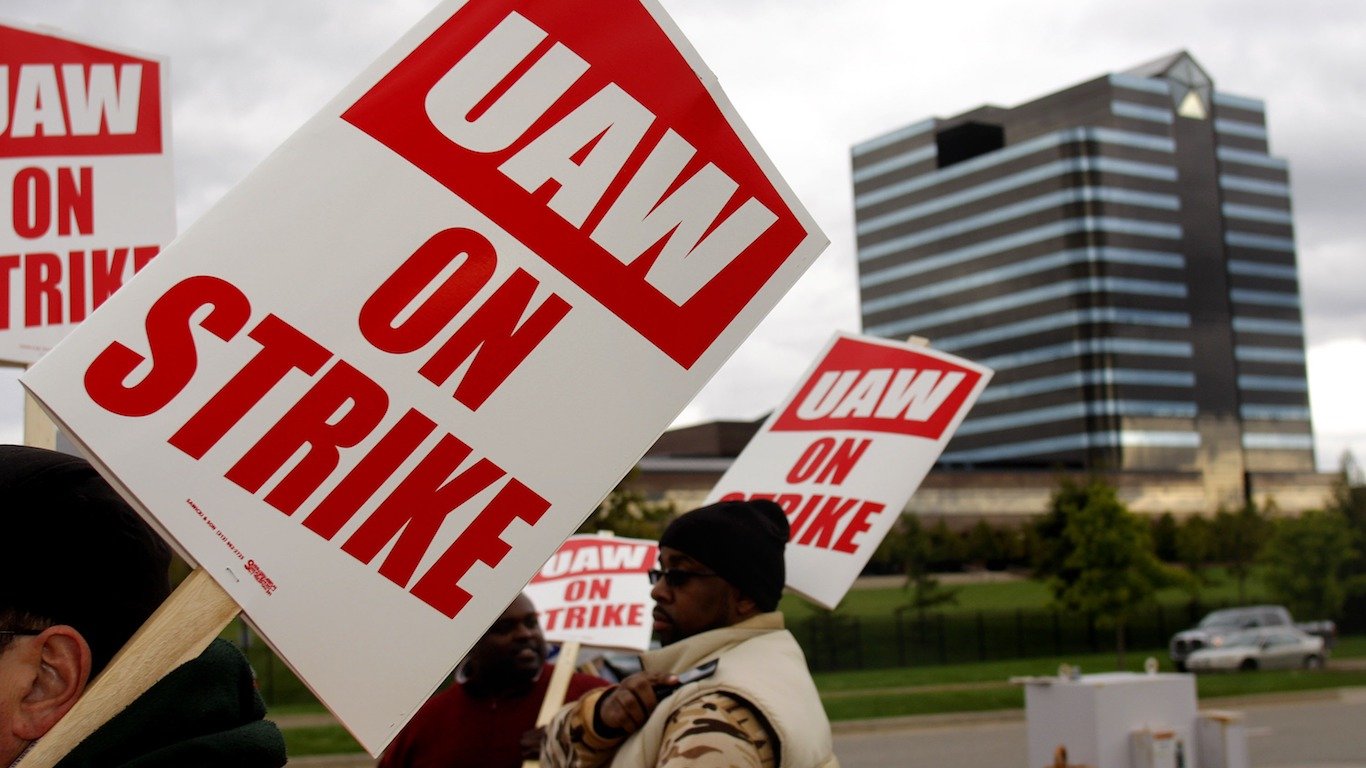

The UAW's next move, an alternative bid for the PGA Tour, Disney refocuses, and more Friday morning headlines.

Published:

How much does the Ford family make from the dividends on the shares they own? Does it matter to the UAW?

Published:

Lululemon and Peloton strike a five-year deal that lets both companies dump losing products. But is there a winner?

Published:

The wealth of Ford Executive Chair Bill Ford is almost beyond imagining.

Published:

A strike is coming. The two sides are too far apart to agree on a new contract.

Published:

Two of the country's largest drug store chains have received warning letters from the FDA for selling unapproved eye drops.

Published:

A Delaware Chancery Court has approved a settlement between AMC and disgruntled shareholders that clears the way for the company to proceed with plans for a new stock issuance.

Published:

Driverless vehicles from Cruise and Waymo have been approved to pick up paying passengers in San Francisco. There is a big merger in the luxury goods space, and Amazon wants to save money by using...

Published:

French soccer star Kylian Mbappé reportedly has been offered a deal worth around $775 million to play in Saudi Arabia for one year.

Published:

Disney will retain CEO Bob Iger for two years beyond the 2024 end of his current contract. Disney's board has made a mistake.

Published:

May saw a record number of CEOs leave their jobs. When the going gets tough, the tough ...

Published:

An exploding number of lawsuits have been filed claiming that AI chatbots should compensate content creators for using their work to train AI models. Now big media firms are talking with AI firms to...

Published:

Chris Licht has been shown the door at CNN after just over a year at the head of the news organization.

Published: