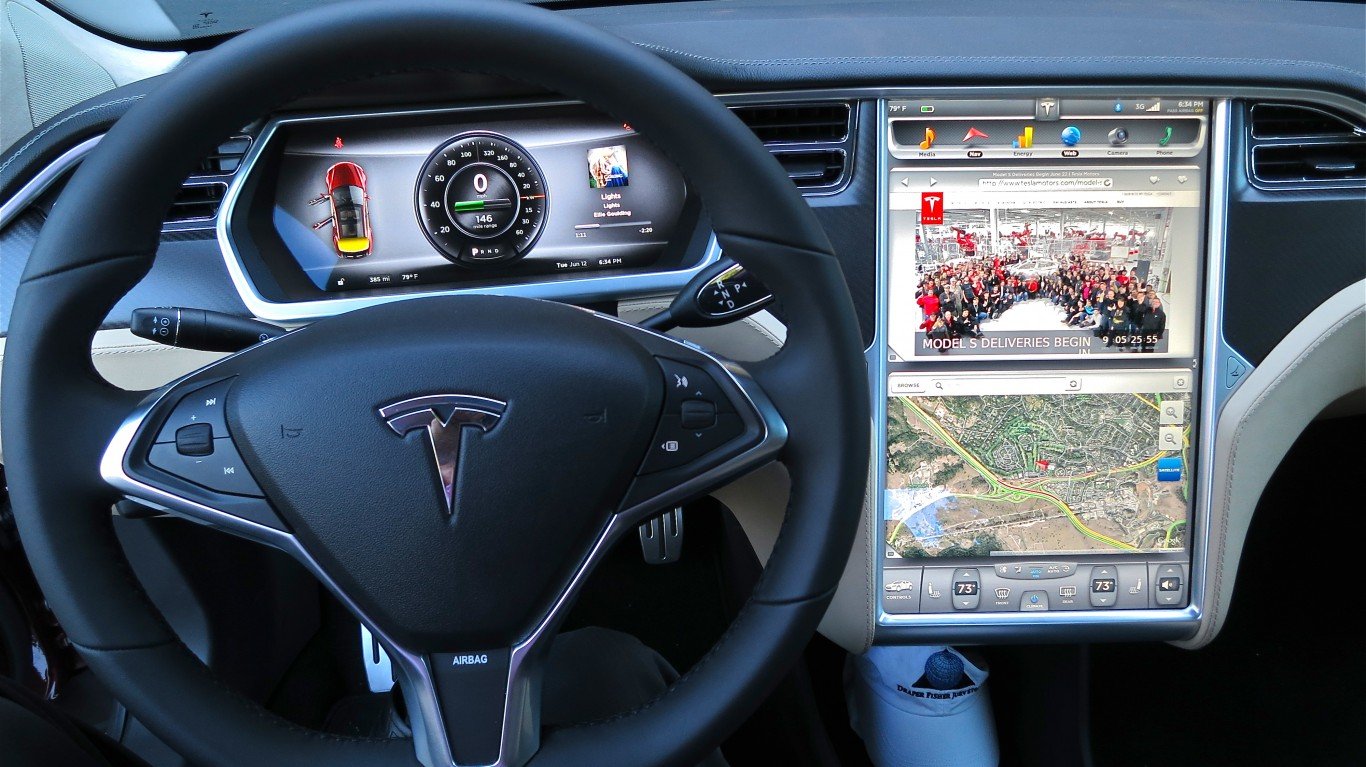

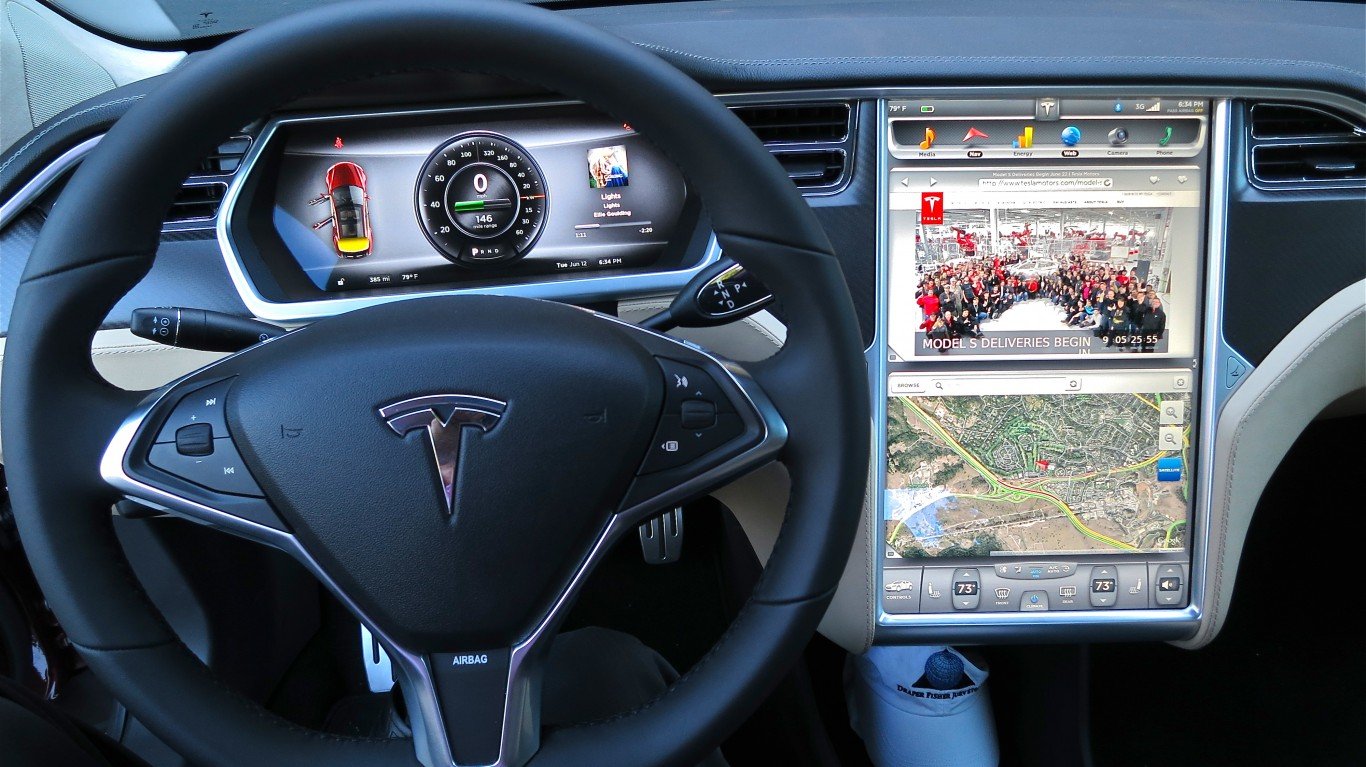

Tesla Inc. (NASDAQ: TSLA) is known as a pioneer in the auto industry, not just for its fully electric product lines, but also the tech that goes into them. In fact, Tesla tech just topped a Consumer Reports satisfaction survey, with the owners ranking Tesla highly in audio, calling and navigation.

Note that Tesla shares were also on the move Thursday, as the company is conducting a $2 billion capital raise.

One of the technological highlights that Consumer Reports noted was that in 2014, just 53% of vehicles sold in the United States had a dashboard touch screen, according to data from research and consulting firm IHS Markit. This year, that number has grown to 82%.

In data collected on more than 60,000 vehicles, only 56% of owners reported that they were very satisfied with their car’s infotainment system. However, Tesla’s was the top-rated system, with an 86% owner satisfaction rate, compared with a 46% satisfaction rate from users of the lowest-rated system.

Kelly Funkhouser, program manager for vehicle usability and automation at Consumer Reports, commented in the report: “A good system is one that’s easy to learn and easy to use every day. It should be responsive, not sluggish, and have straightforward controls that are easy to identify and operate.”

Shares of Tesla traded up more than 4% at $239.09 early Thursday, in a 52-week range of $231.13 to $387.46. The consensus price target is $296.16

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.