Health and Healthcare

FDA Accepts Merck's Keytruda for Review, Sets PDUFA Date

Published:

Last Updated:

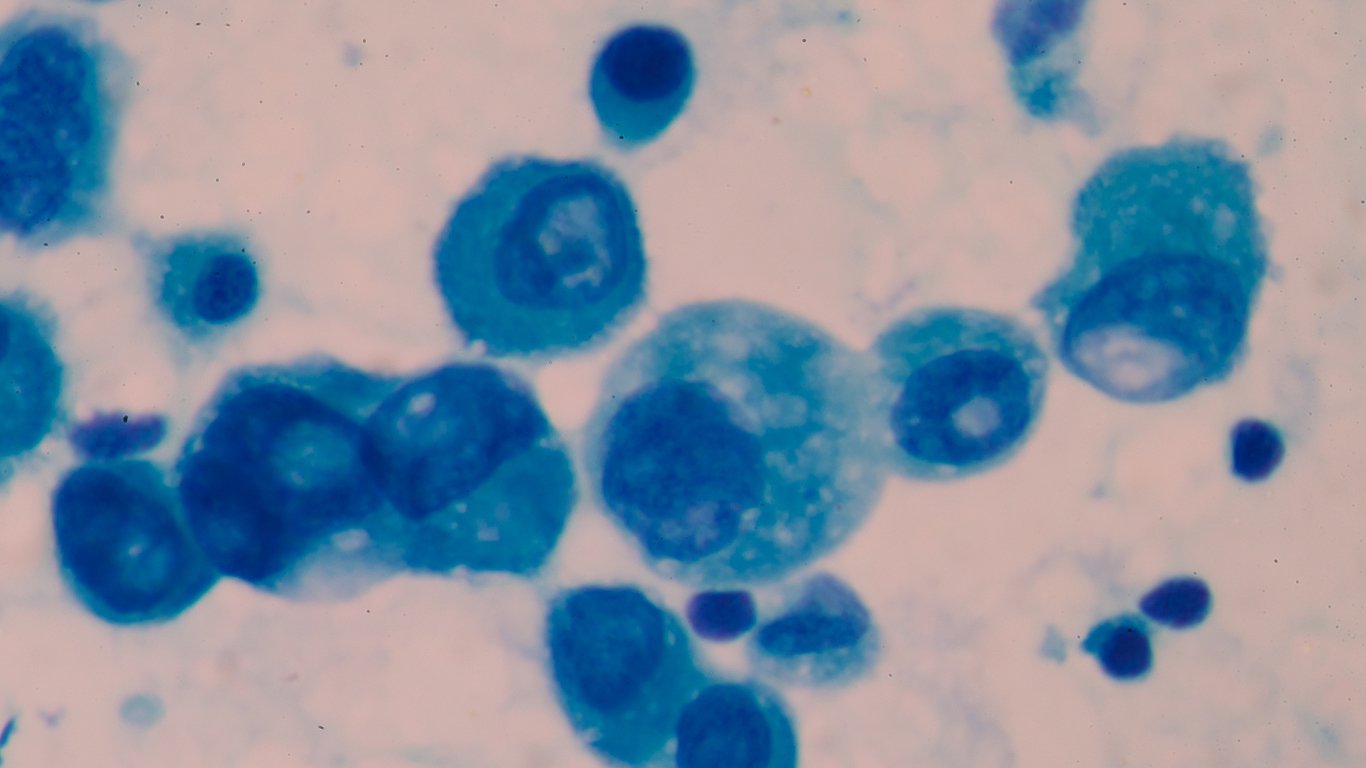

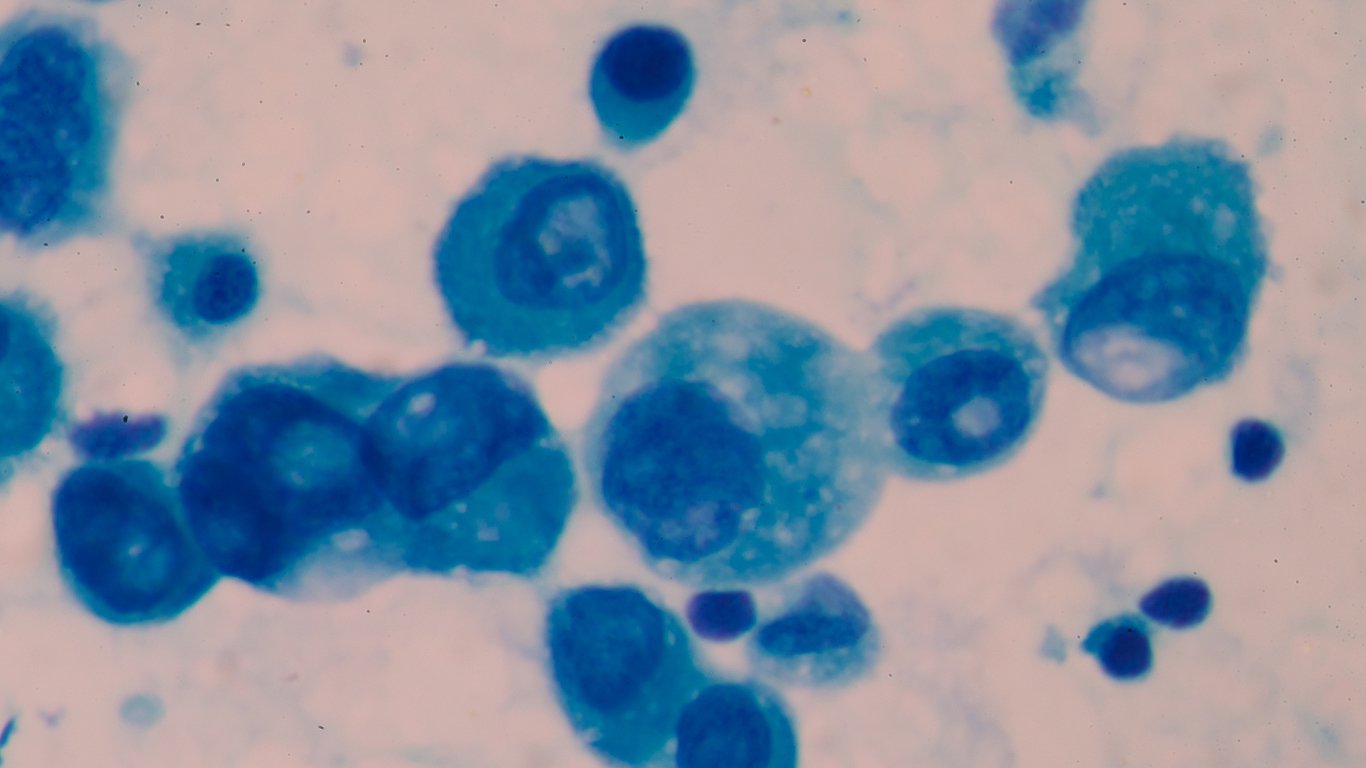

Merck & Co. Inc. (NYSE: MRK) shares retreated to start off the week after the firm announced that the U.S. Food and Drug Administration (FDA) has accepted Keytruda for review for a supplemental Biologics License Application (sBLA). This is Merck’s anti-PD-1 therapy, in combination with carboplatin-paclitaxel or nab-paclitaxel as a first-line treatment for metastatic squamous non-small cell lung cancer.

This sBLA, which is seeking accelerated approval for this new indication, is based on data from the Phase 3 KEYNOTE-407 trial, which were recently presented at the American Society of Clinical Oncology (ASCO) 2018 Annual Meeting.

Looking ahead, the FDA has granted Priority Review to this sBLA and set a Prescription Drug User Fee Act (PDUFA) date for October 30, 2018.

Dr. Roy Baynes, senior vice president, head of global clinical development and chief medical officer, Merck Research Laboratories, commented:

KEYTRUDA has already been established as an important treatment option for non-small cell lung cancer in the first-line setting, and with our broad development program in lung cancer, we are committed to improving survival for as many patients as we can. We are pleased that our application for squamous cell carcinoma – a historically challenging-to-treat disease – is under priority review with the FDA.

So far in 2018, Merck has outperformed the broad markets, with its stock up about 8%. Over the past 52 weeks, the stock is actually down about 6%.

Shares of Merck were last seen up down fractionally at $60.40, with a consensus analyst price target of $69.06 and a 52-week range of $52.83 to $66.41.

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.