“What’s in a name?” Shakespeare’s Juliet asked that rhetorical question more than 500 years ago. This question still rings true today in 21st century America. Names tell a story – they can help shed light on heritage as well as on America’s population makeup.

For centuries, people have come to the U.S. to escape war, oppression, and poverty, or to pursue employment opportunities and success. Most Americans can trace their roots to immigrant ancestors. 24/7 Tempo reviewed Census data to find the 50 most common last names in the U.S.

Last names, also called surnames, can be traced to the early years of the Middle Ages, when most people in Europe were farmers and lived in small villages. Back then, everyone knew each other, and last names were unnecessary. That changed as the population began to grow.

Today, the vast majority of the most common surnames in the U.S. can be traced back to England and other European origins. Among the top 50 most common surnames, 12 have Spanish, Cuban, or Mexican heritage. All 12 Spanish-origin names found on this list have dramatically increased since they were last counted in 2000 — a stark contrast to English names that are mostly growing at a slower pace. The most common names in general in the United States all grew in numbers between 2000 and 2010, except one — Hall saw a 16% decrease. These are the most common last names in every state.

Do you think your last name made the list?

Click here to see the most common last names in the U.S.

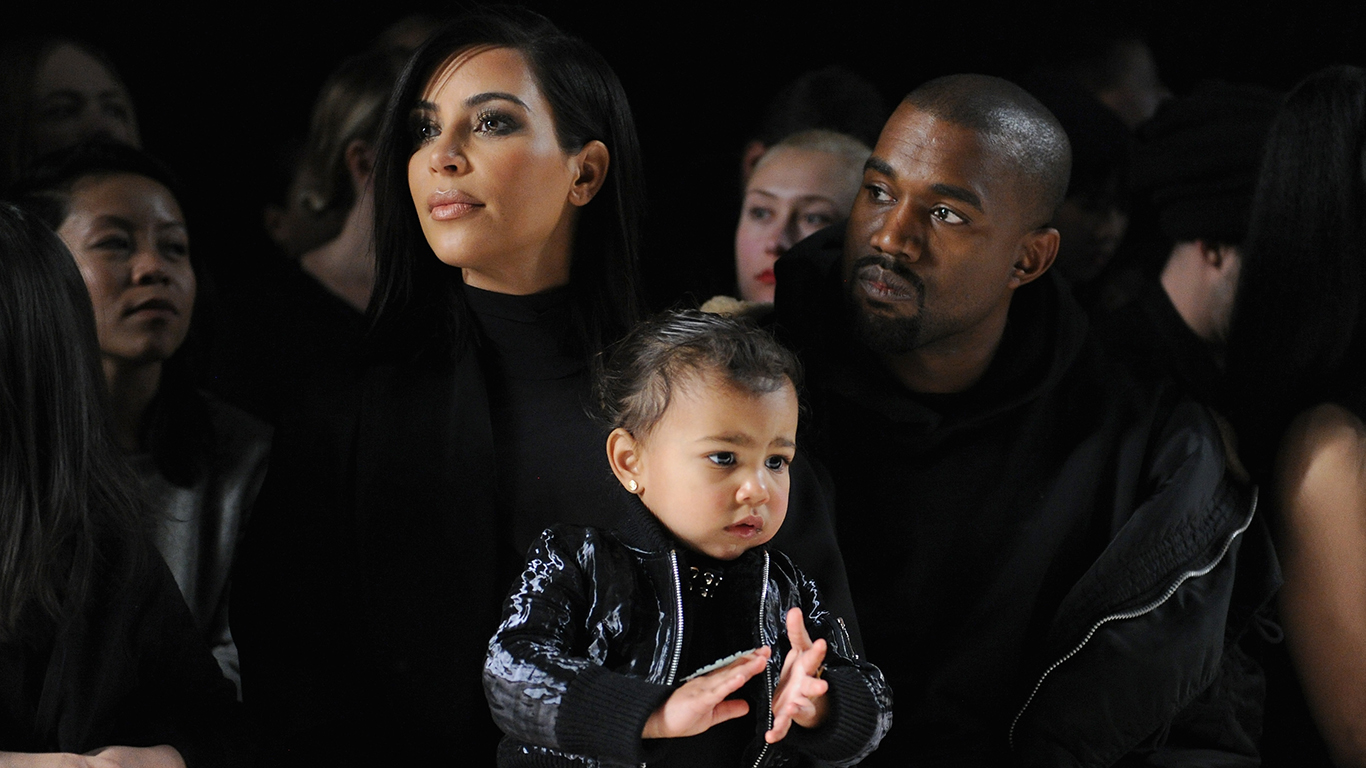

To determine the most common surnames in the United States, 24/7 Tempo analyzed past and present census counts to understand population diversity in America. The origin of each family name was obtained from open data on Ancestry.com. Photos of celebrities, well-known historical figures, areas of a name’s heritage, or imagery reflecting origin were used to represent each name.

50. Roberts

> Occurrences per 100,000 people: 127.7

> Total occurrences: 376,774

> Growth since 2000: 2.8%

> Heritage: England

[in-text-ad]

49. Carter

> Occurrences per 100,000 people: 127.8

> Total occurrences: 376,966

> Growth since 2000: 3.8%

> Heritage: England

48. Mitchell

> Occurrences per 100,000 people: 130.3

> Total occurrences: 384,486

> Growth since 2000: 4.4%

> Heritage: England, Ireland

47. Campbell

> Occurrences per 100,000 people: 130.9

> Total occurrences: 386,157

> Growth since 2000: 3.7%

> Heritage: Ireland, Scotland, England

[in-text-ad-2]

46. Rivera

> Occurrences per 100,000 people: 132.6

> Total occurrences: 391,114

> Growth since 2000: 23.4%

> Heritage: Spain

45. Hall

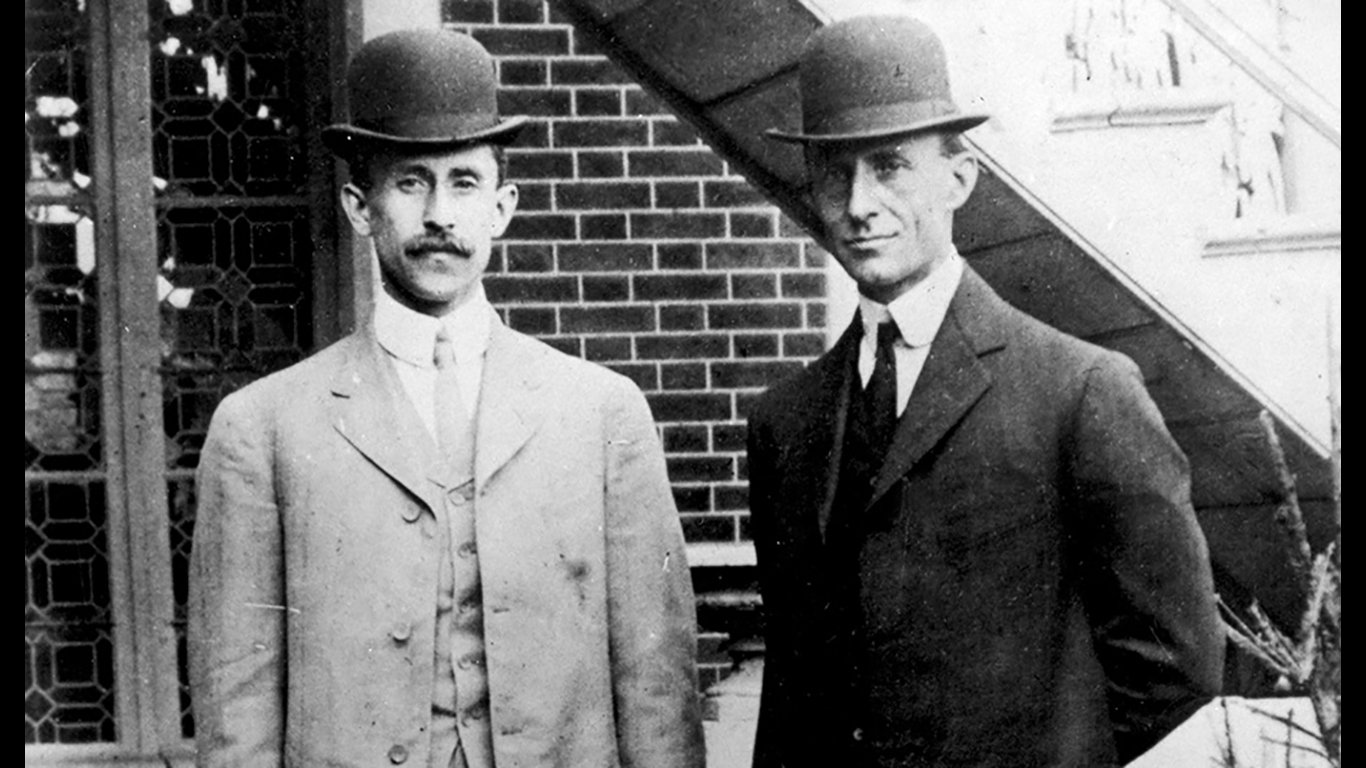

> Occurrences per 100,000 people: 138.0

> Total occurrences: 407,076

> Growth since 2000: -16.3%

> Heritage: England

[in-text-ad]

44. Baker

> Occurrences per 100,000 people: 142.2

> Total occurrences: 419,586

> Growth since 2000: 1.5%

> Heritage: England

43. Nelson

> Occurrences per 100,000 people: 144.1

> Total occurrences: 424,958

> Growth since 2000: 3.0%

> Heritage: Sweden

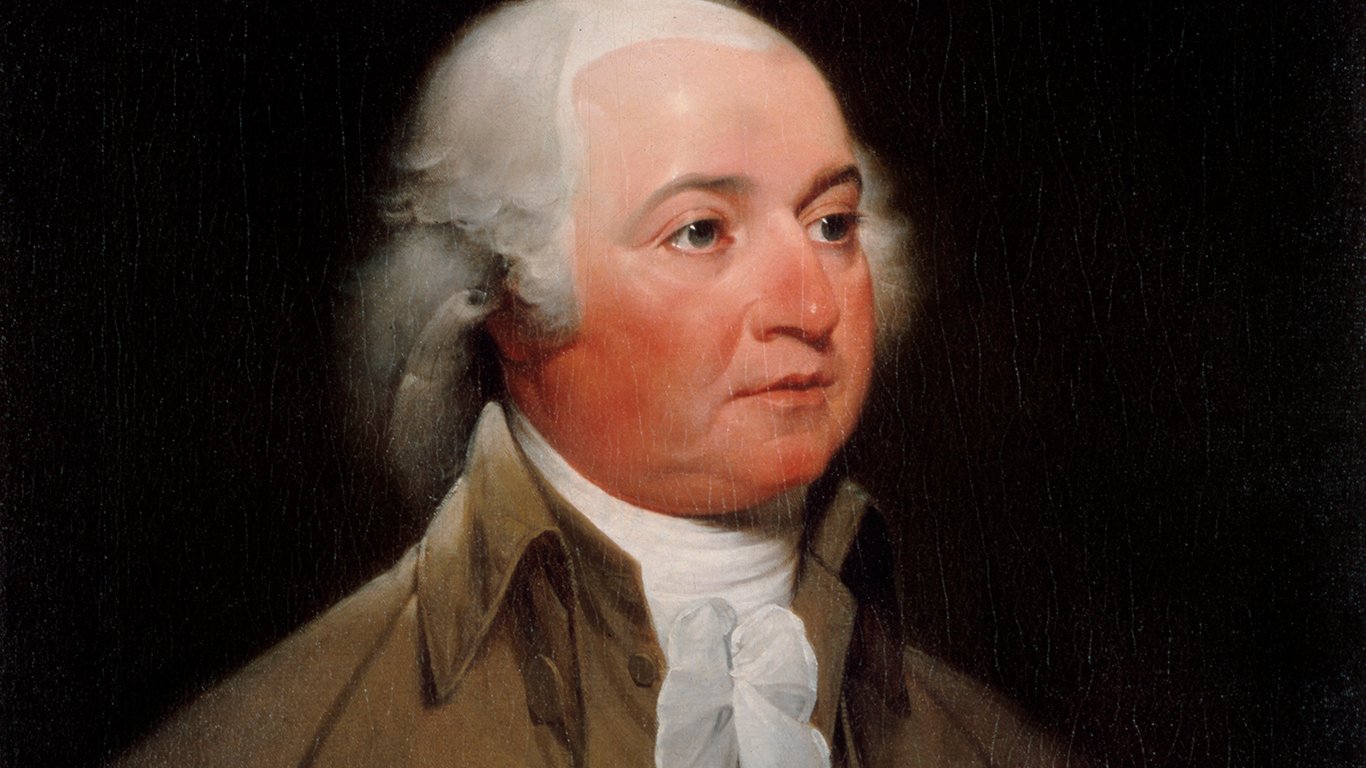

42. Adams

> Occurrences per 100,000 people: 145.1

> Total occurrences: 427,865

> Growth since 2000: 3.5%

> Heritage: England

[in-text-ad-2]

41. Green

> Occurrences per 100,000 people: 145.8

> Total occurrences: 430,182

> Growth since 2000: 3.9%

> Heritage: England, Ireland

40. Flores

> Occurrences per 100,000 people: 147.1

> Total occurrences: 433,969

> Growth since 2000: 28.0%

> Heritage: Spain, France, Mexico

[in-text-ad]

39. Hill

> Occurrences per 100,000 people: 147.4

> Total occurrences: 434,827

> Growth since 2000: 5.3%

> Heritage: England

38. Nguyen

> Occurrences per 100,000 people: 148.4

> Total occurrences: 437,645

> Growth since 2000: 29.1%

> Heritage: Vietnam

37. Torres

> Occurrences per 100,000 people: 148.4

> Total occurrences: 437,813

> Growth since 2000: 25.7%

> Heritage: Spain

[in-text-ad-2]

36. Scott

> Occurrences per 100,000 people: 149.0

> Total occurrences: 439,530

> Growth since 2000: 4.4%

> Heritage: England, Ireland, Scotland

35. Wright

> Occurrences per 100,000 people: 155.6

> Total occurrences: 458,980

> Growth since 2000: 4.1%

> Heritage: England

[in-text-ad]

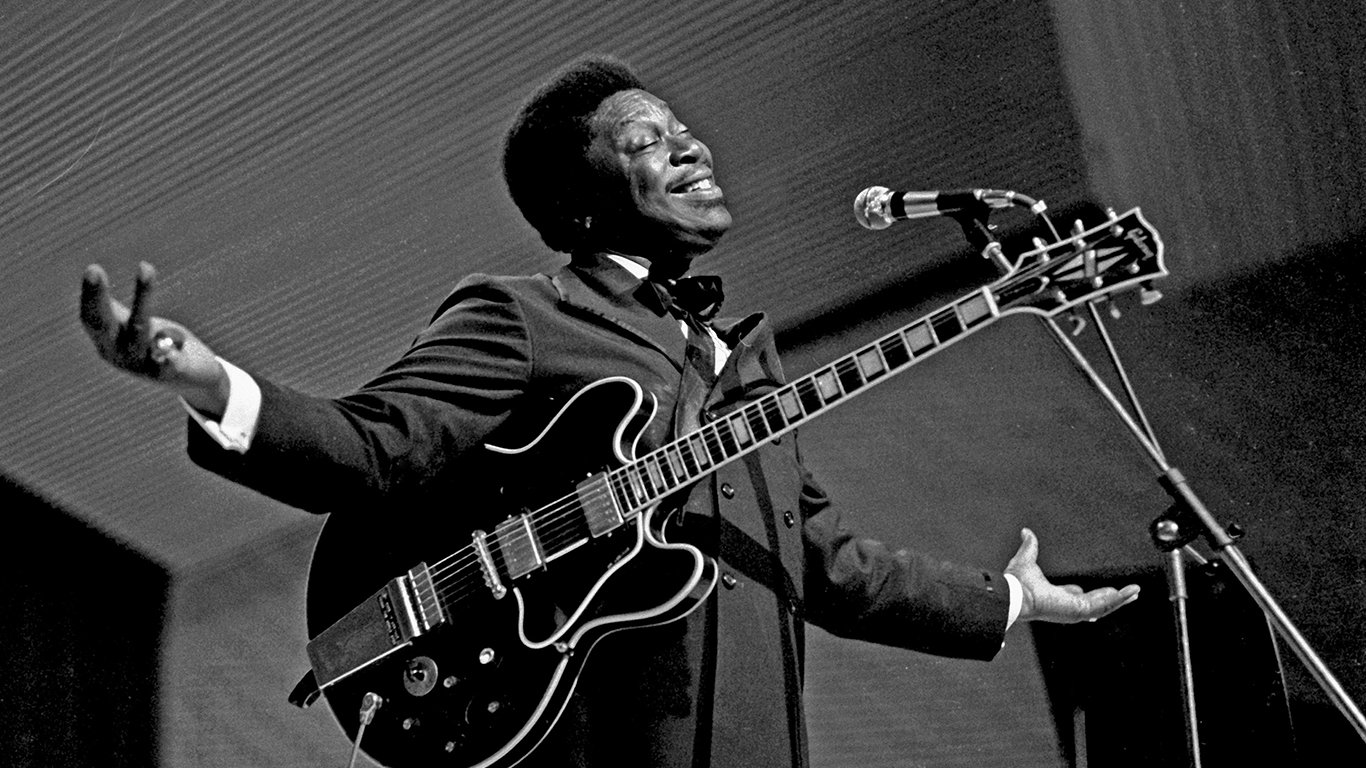

34. King

> Occurrences per 100,000 people: 157.8

> Total occurrences: 465,422

> Growth since 2000: 5.7%

> Heritage: Ireland, England

33. Allen

> Occurrences per 100,000 people: 163.6

> Total occurrences: 482,607

> Growth since 2000: 4.0%

> Heritage: England, Ireland

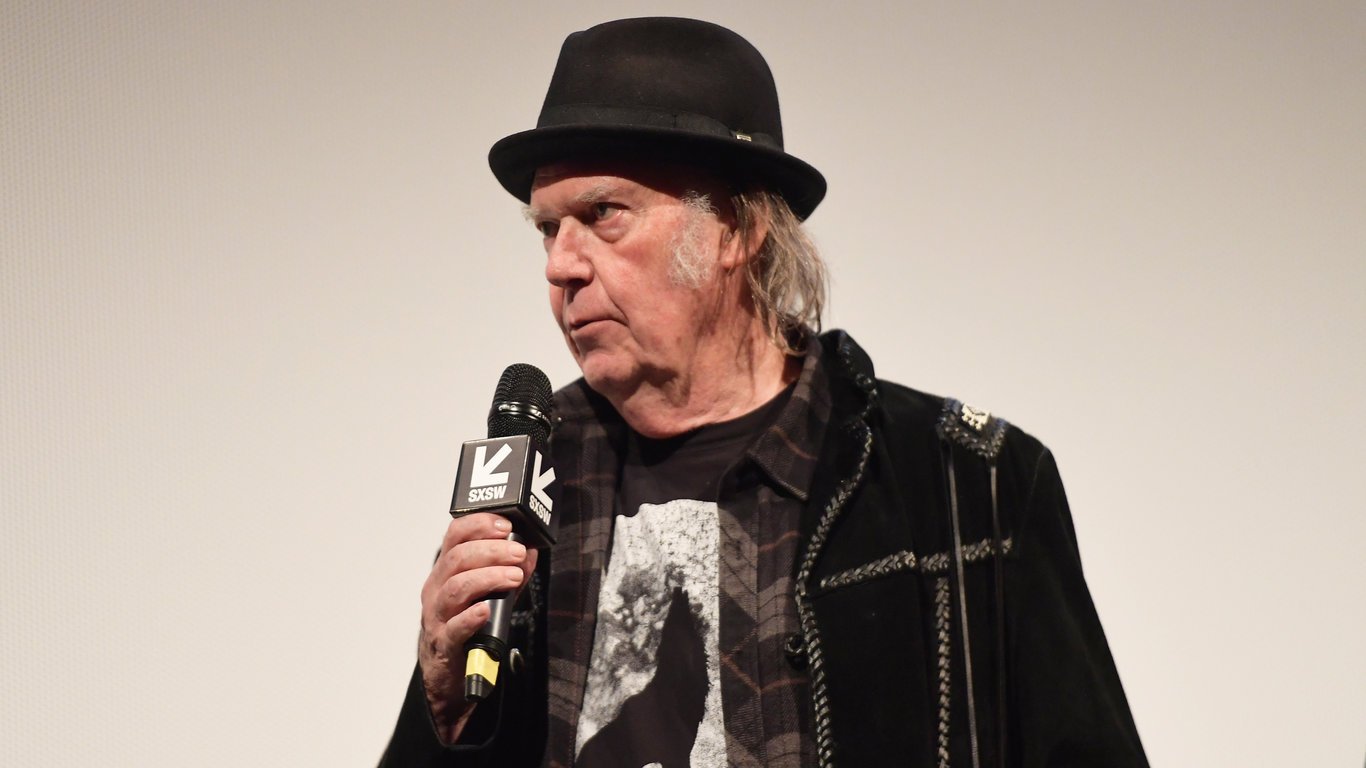

32. Young

> Occurrences per 100,000 people: 164.2

> Total occurrences: 484,447

> Growth since 2000: 3.8%

> Heritage: England, Scotland, Ireland

[in-text-ad-2]

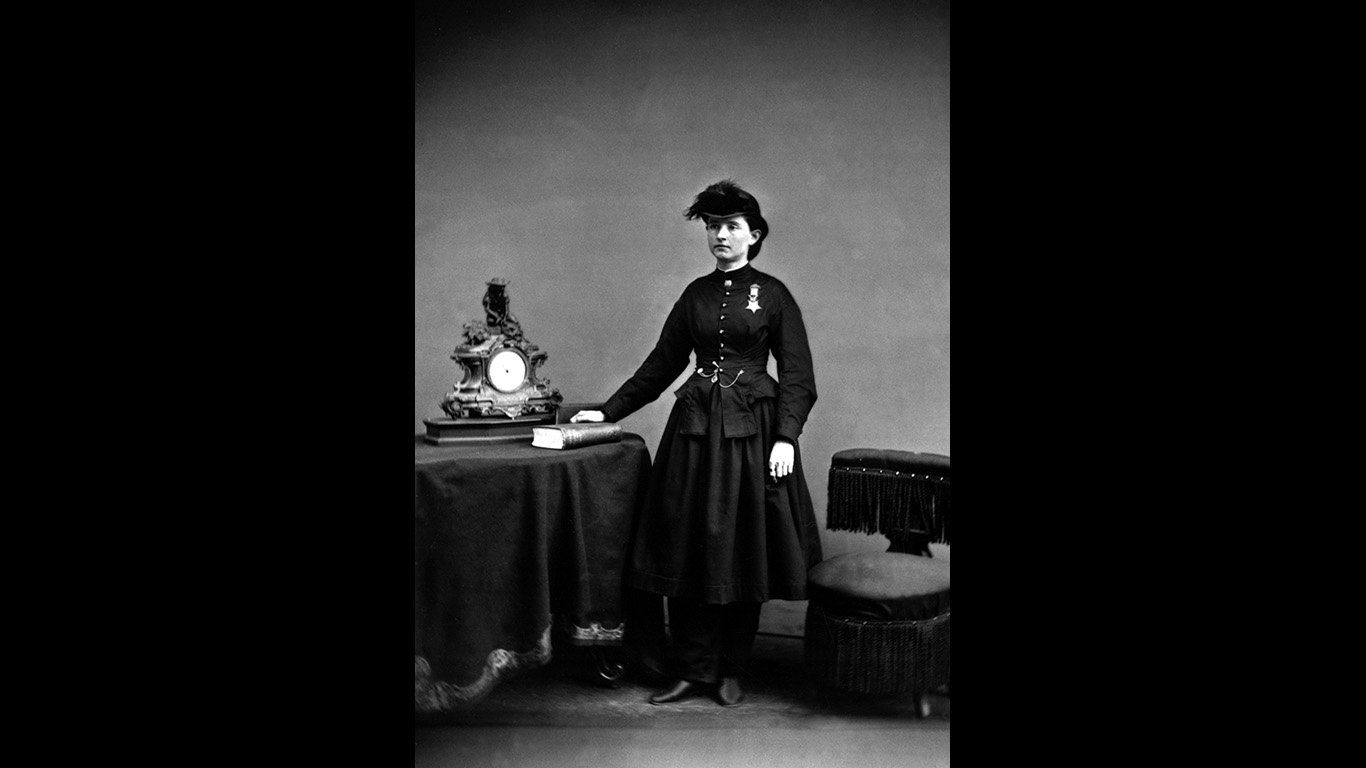

31. Walker

> Occurrences per 100,000 people: 177.3

> Total occurrences: 523,129

> Growth since 2000: 4.2%

> Heritage: England, Ireland, Scotland

30. Robinson

> Occurrences per 100,000 people: 179.6

> Total occurrences: 529,821

> Growth since 2000: 5.1%

> Heritage: England

[in-text-ad]

29. Lewis

> Occurrences per 100,000 people: 180.3

> Total occurrences: 531,781

> Growth since 2000: 4.1%

> Heritage: England

28. Ramirez

> Occurrences per 100,000 people: 189.0

> Total occurrences: 557,423

> Growth since 2000: 30.2%

> Heritage: Spain, Cuba

27. Clark

> Occurrences per 100,000 people: 190.8

> Total occurrences: 562,679

> Growth since 2000: 2.5%

> Heritage: England, Ireland

[in-text-ad-2]

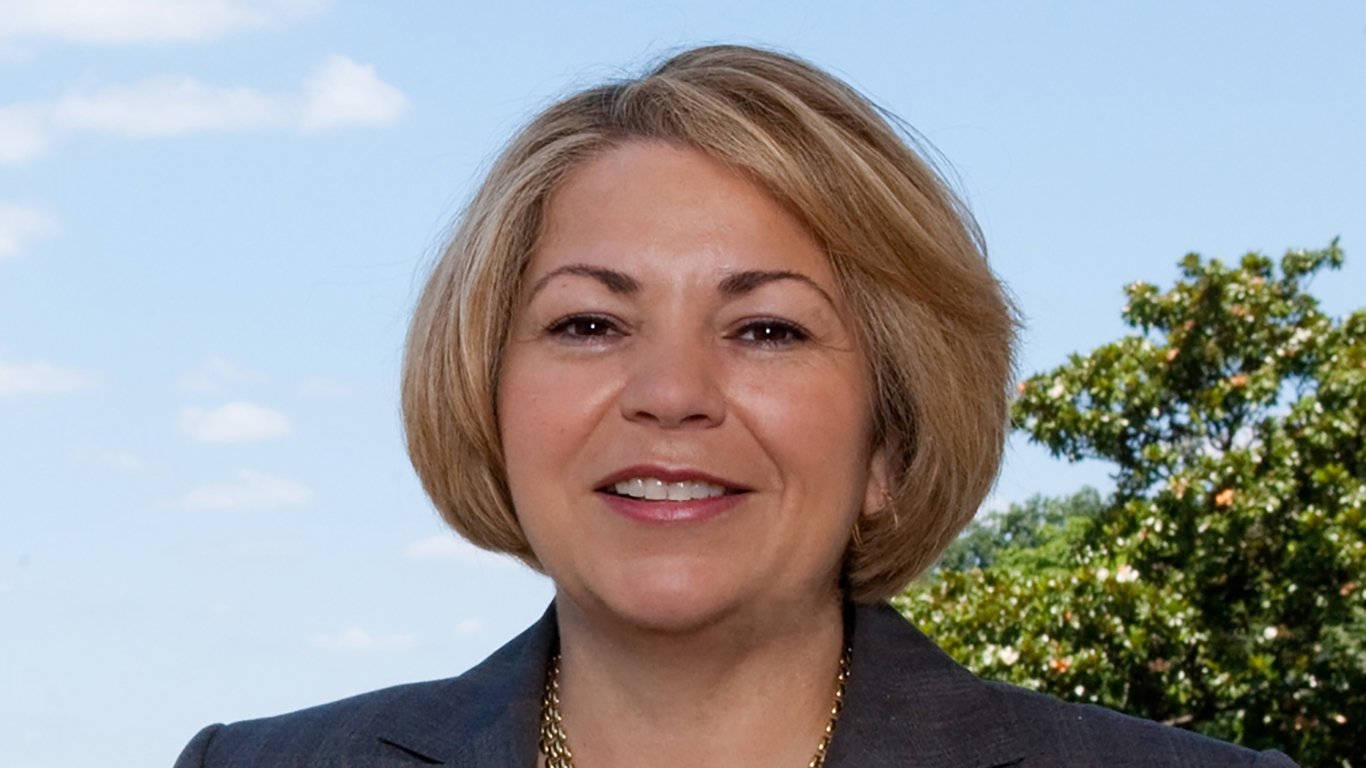

26. Sanchez

> Occurrences per 100,000 people: 207.7

> Total occurrences: 612,752

> Growth since 2000: 28.0%

> Heritage: Spain

25. Harris

> Occurrences per 100,000 people: 211.6

> Total occurrences: 624,252

> Growth since 2000: 4.9%

> Heritage: England

[in-text-ad]

24. White

> Occurrences per 100,000 people: 223.9

> Total occurrences: 660,491

> Growth since 2000: 3.2%

> Heritage: England, Ireland

23. Thompson

> Occurrences per 100,000 people: 225.3

> Total occurrences: 664,644

> Growth since 2000: 3.1%

> Heritage: England, Ireland, Scotland

22. Perez

> Occurrences per 100,000 people: 231.1

> Total occurrences: 681,645

> Growth since 2000: 28.3%

> Heritage: Spain

[in-text-ad-2]

21. Lee

> Occurrences per 100,000 people: 234.9

> Total occurrences: 693,023

> Growth since 2000: 12.6%

> Heritage: England, Ireland

20. Martin

> Occurrences per 100,000 people: 238.2

> Total occurrences: 702,625

> Growth since 2000: 4.3%

> Heritage: Ireland, England

[in-text-ad]

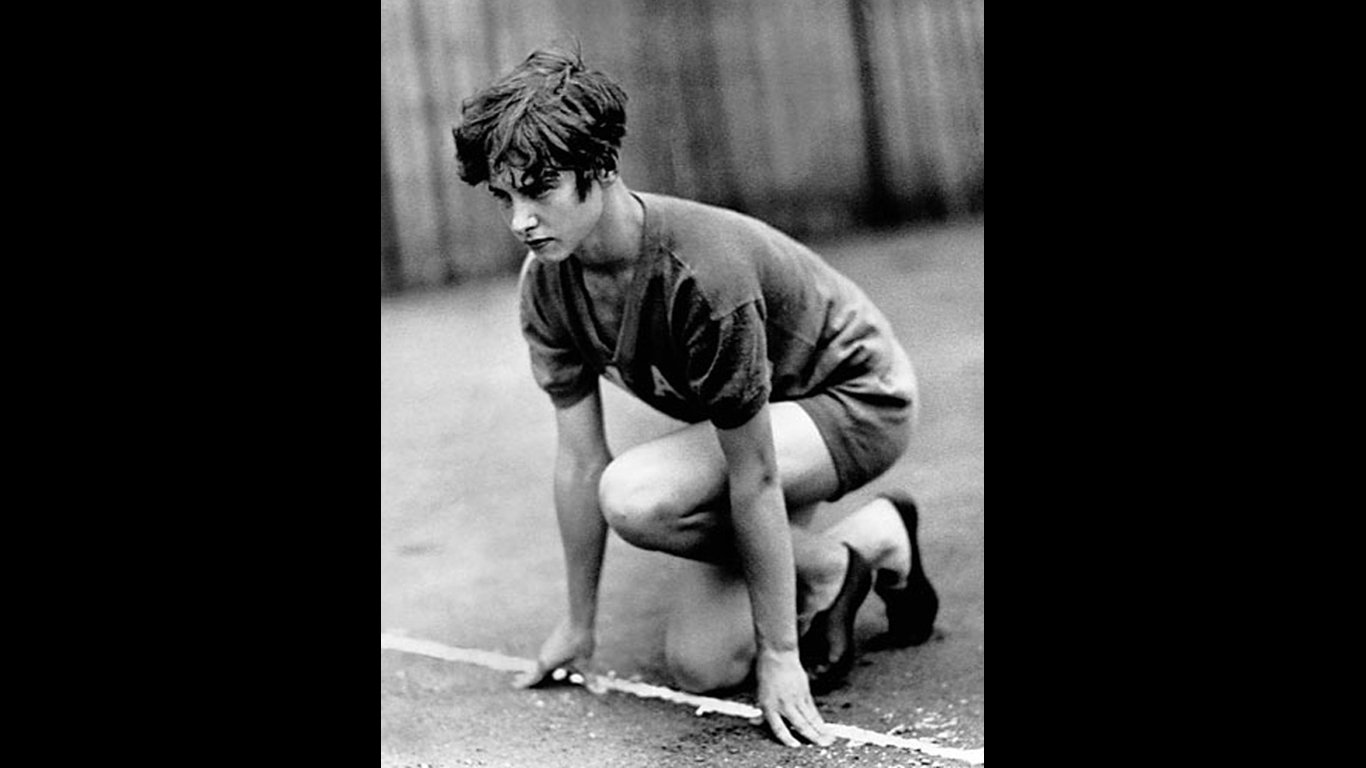

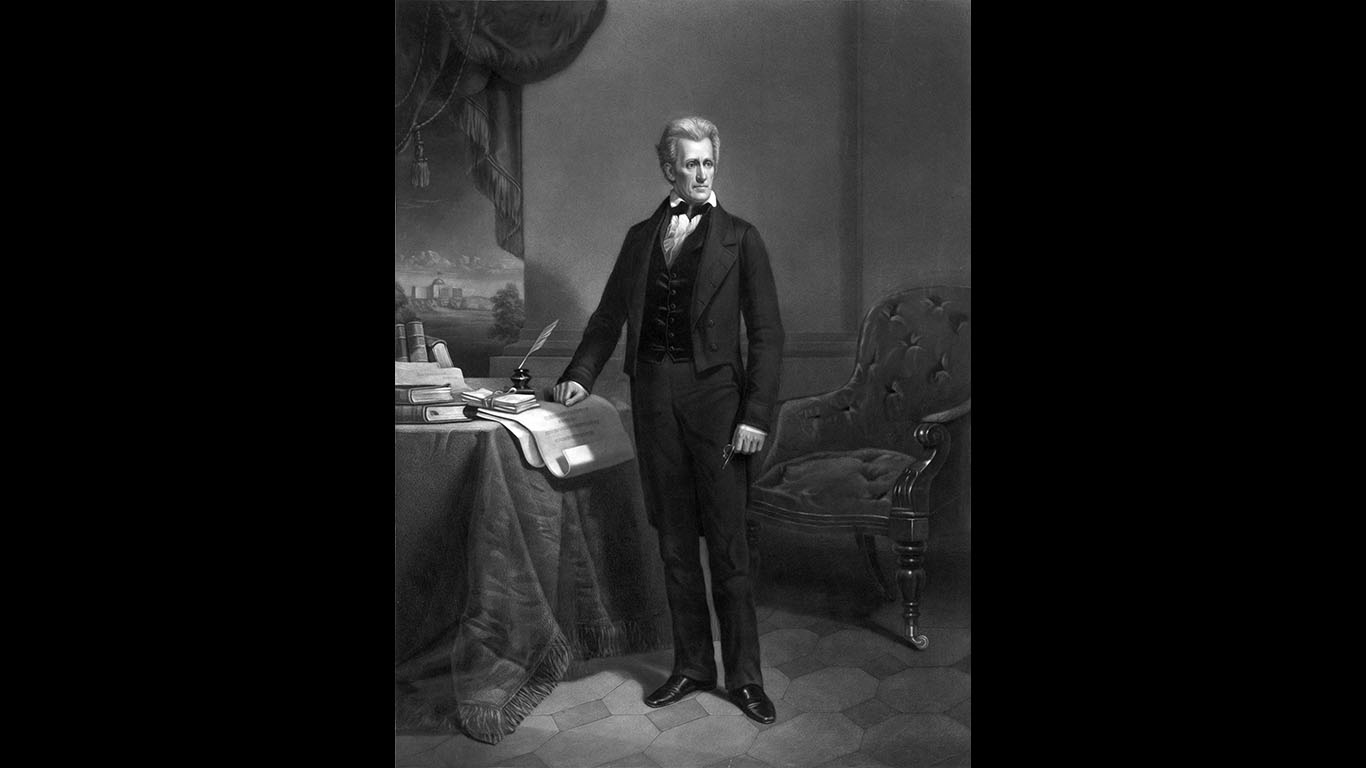

19. Jackson

> Occurrences per 100,000 people: 240.1

> Total occurrences: 708,099

> Growth since 2000: 5.9%

> Heritage: England, Ireland

18. Moore

> Occurrences per 100,000 people: 245.6

> Total occurrences: 724,374

> Growth since 2000: 3.5%

> Heritage: Ireland, England

17. Taylor

> Occurrences per 100,000 people: 254.7

> Total occurrences: 751,209

> Growth since 2000: 4.1%

> Heritage: England, Ireland

[in-text-ad-2]

16. Thomas

> Occurrences per 100,000 people: 256.3

> Total occurrences: 756,142

> Growth since 2000: 6.0%

> Heritage: England

15. Anderson

> Occurrences per 100,000 people: 265.9

> Total occurrences: 784,404

> Growth since 2000: 2.8%

> Heritage: Sweden

[in-text-ad]

14. Wilson

> Occurrences per 100,000 people: 271.8

> Total occurrences: 801,882

> Growth since 2000: 2.3%

> Heritage: England, Ireland, Scotland

13. Gonzalez

> Occurrences per 100,000 people: 285.1

> Total occurrences: 841,025

> Growth since 2000: 28.9%

> Heritage: Spain

12. Lopez

> Occurrences per 100,000 people: 296.5

> Total occurrences: 874,523

> Growth since 2000: 28.9%

> Heritage: Spain

[in-text-ad-2]

11. Hernandez

> Occurrences per 100,000 people: 353.7

> Total occurrences: 1,043,281

> Growth since 2000: 32.3%

> Heritage: Spain

10. Martinez

> Occurrences per 100,000 people: 359.4

> Total occurrences: 1,060,159

> Growth since 2000: 26.9%

> Heritage: Spain

[in-text-ad]

9. Rodriguez

> Occurrences per 100,000 people: 371.2

> Total occurrences: 1,094,924

> Growth since 2000: 26.5%

> Heritage: Spain

8. Davis

> Occurrences per 100,000 people: 378.5

> Total occurrences: 1,116,357

> Growth since 2000: 3.9%

> Heritage: England, Ireland

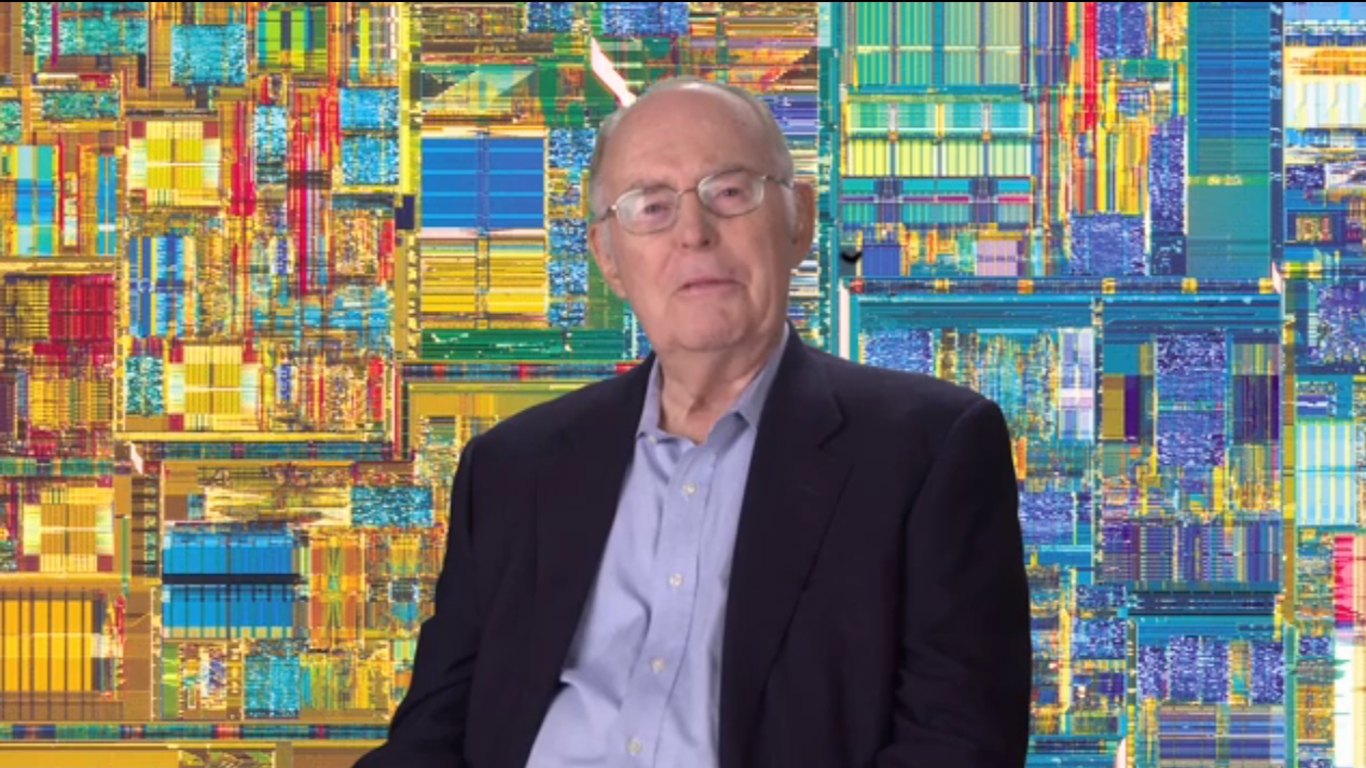

7. Miller

> Occurrences per 100,000 people: 393.7

> Total occurrences: 1,161,437

> Growth since 2000: 2.9%

> Heritage: Germany, England

[in-text-ad-2]

6. Garcia

> Occurrences per 100,000 people: 395.3

> Total occurrences: 1,166,120

> Growth since 2000: 26.4%

> Heritage: Spain

5. Jones

> Occurrences per 100,000 people: 483.2

> Total occurrences: 1,425,470

> Growth since 2000: 4.4%

> Heritage: England, Wales, Ireland

[in-text-ad]

4. Brown

> Occurrences per 100,000 people: 487.2

> Total occurrences: 1,437,026

> Growth since 2000: 4.0%

> Heritage: England, Ireland

3. Williams

> Occurrences per 100,000 people: 551.0

> Total occurrences: 1,625,252

> Growth since 2000: 5.6%

> Heritage: England, Wales

2. Johnson

> Occurrences per 100,000 people: 655.2

> Total occurrences: 1,932,812

> Growth since 2000: 3.9%

> Heritage: Sweden, England

[in-text-ad-2]

1. Smith

> Occurrences per 100,000 people: 828.2

> Total occurrences: 2,442,977

> Growth since 2000: 2.7%

> Heritage: England

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.