President Joe Biden’s administration released in March its proposed $6 trillion federal government budget for the 2023 fiscal year that begins in October. Among the proposals is raising the statutory corporate income tax rate from 21% to 28% after Republicans and President Donald Trump slashed that rate from 35% to 21% under the Tax Cuts and Jobs Act of 2017 and tax breaks enacted in 2020.

Statutory tax rates are higher than what companies actually pay after legal tax deductions and exemptions. This lower rate is the effective tax rate. In some tax years, especially since 2017, the tax rate of dozens of large corporations was below zero, at least 55 of them in 2020, according to the Institute of Taxation and Economic Policy.

To identify the worst tax offenders, 24/7 Wall St. reviewed tax data in a report published by the Institute of Taxation and Economic Policy report, 55 Corporations Paid $0 in Federal Taxes on 2020 Profits. ITEP considered only S&P 500 or Fortune 500 public corporations. The 55 companies on the list are ordered by their U.S. pre-tax income, from low to high. All data came from the report.

These profitable companies that paid zero or less in taxes collectively earned $40.5 billion in U.S. pretax earnings in 2020 but received federal tax rebates of more than $3.5 billion. Had they paid the 21% statutory tax rate, they would have paid $8.5 billion in taxes, meaning the total tax avoidance amounted to $12 billion, ITEP notes.

Five of them, including athleticwear giant Nike and cloud-based software provider Salesforce, earned $13.9 billion in pretax income and received federal tax rebates totaling nearly a half-billion dollars. (Some individuals pay more in taxes than these highly profitable corporations. Here are the best paid athletes and what they owed in taxes.)

The company on this list with the largest pretax earnings in 2020 is telecommunications and media company Charter Communications. It reported $3.7 billion in pretax earnings in 2020, the same year it raised broadcast TV fees to its customers and spent $10.6 billion on share repurchases. Charter is one of several companies that “used a tax break for executive stock options to sharply reduce their income taxes,” according to ITEP.

The six companies that received federal tax rebates of more than $200 million in 2020 include Washington D.C.-based manufacturing conglomerate Danaher, Colorado’s satellite TV provider Dish Network, and Memphis, Tennessee-based FedEx, the world’s second-largest package carrier. (Not just corporations know how to pay less taxes. Wealthy people do too. Here are the most tax friendly states for the rich.)

Here are the biggest U.S. tax avoiders

55. Treehouse Foods

> US pre-tax income: $8 million

> Current federal income tax (including tax rebates): -$96 million — #14 lowest

> Effective tax rate: -1,167.1% — #1 lowest

> Industry: Food & beverages & tobacco

[in-text-ad]

54. Akamai Technologies

> US pre-tax income: $40 million

> Current federal income tax (including tax rebates): -$2 million — #45 lowest

> Effective tax rate: -4.4% — #29 lowest

> Industry: Computers, office equipment, software, data

53. Albemarle

> US pre-tax income: $42 million

> Current federal income tax (including tax rebates):

> Effective tax rate: -0.3% — #50 lowest

> Industry: Chemicals

52. Owens & Minor

> US pre-tax income: $74 million

> Current federal income tax (including tax rebates): -$4 million — #43 lowest

> Effective tax rate: -6.0% — #27 lowest

> Industry: Retail & wholesale trade

[in-text-ad-2]

51. Howmet Aerospace

> US pre-tax income: $86 million

> Current federal income tax (including tax rebates): -$2 million — #45 lowest

> Effective tax rate: -2.3% — #38 lowest

> Industry: Miscellaneous manufacturing

50. Mohawk Industries

> US pre-tax income: $87 million

> Current federal income tax (including tax rebates): -$34 million — #25 lowest

> Effective tax rate: -38.9% — #5 lowest

> Industry: Miscellaneous manufacturing

[in-text-ad]

49. Sanmina-SCI

> US pre-tax income: $95 million

> Current federal income tax (including tax rebates): -$1 million — #50 lowest

> Effective tax rate: -1.0% — #43 lowest

> Industry: Computers, office equipment, software, data

48. Ecolab

> US pre-tax income: $95 million

> Current federal income tax (including tax rebates): -$50 million — #20 lowest

> Effective tax rate: -52.6% — #4 lowest

> Industry: Chemicals

47. Tutor Perini

> US pre-tax income: $96 million

> Current federal income tax (including tax rebates): -$36 million — #23 lowest

> Effective tax rate: -37.7% — #6 lowest

> Industry: Engineering & construction

[in-text-ad-2]

46. Seaboard

> US pre-tax income: $136 million

> Current federal income tax (including tax rebates): -$50 million — #20 lowest

> Effective tax rate: -36.8% — #8 lowest

> Industry: Food & beverages & tobacco

45. Xilinx

> US pre-tax income: $140 million

> Current federal income tax (including tax rebates): -$2 million — #45 lowest

> Effective tax rate: -1.5% — #40 lowest

> Industry: Computers, office equipment, software, data

[in-text-ad]

44. Tyler Technologies

> US pre-tax income: $176 million

> Current federal income tax (including tax rebates): -$11 million — #37 lowest

> Effective tax rate: -6.0% — #27 lowest

> Industry: Computers, office equipment, software, data

43. Ball

> US pre-tax income: $193 million

> Current federal income tax (including tax rebates): -$33 million — #26 lowest

> Effective tax rate: -17.1% — #16 lowest

> Industry: Miscellaneous manufacturing

42. Voya Financial

> US pre-tax income: $195 million

> Current federal income tax (including tax rebates): -$9 million — #39 lowest

> Effective tax rate: -4.0% — #31 lowest

> Industry: Financial

[in-text-ad-2]

41. Jacobs Engineering Group

> US pre-tax income: $213 million

> Current federal income tax (including tax rebates): -$37 million — #22 lowest

> Effective tax rate: -17.4% — #15 lowest

> Industry: Engineering & construction

40. Westlake Chemical

> US pre-tax income: $227 million

> Current federal income tax (including tax rebates): -$208 million — #6 lowest

> Effective tax rate: -91.6% — #2 lowest

> Industry: Chemicals

[in-text-ad]

39. Cabot Oil & Gas

> US pre-tax income: $240 million

> Current federal income tax (including tax rebates): -$32 million — #27 lowest

> Effective tax rate: -13.2% — #21 lowest

> Industry: Oil, gas & pipelines

38. Dexcom

> US pre-tax income: $265 million

> Current federal income tax (including tax rebates):

> Effective tax rate:

> Industry: Pharmaceuticals & medical products

36. Williams

> US pre-tax income: $278 million

> Current federal income tax (including tax rebates): -$29 million — #28 lowest

> Effective tax rate: -10.4% — #23 lowest

> Industry: Oil, gas & pipelines

[in-text-ad-2]

36. Textron

> US pre-tax income: $278 million

> Current federal income tax (including tax rebates): -$1 million — #50 lowest

> Effective tax rate: -0.4% — #49 lowest

> Industry: Aerospace & defense

34. Telephone & Data Systems

> US pre-tax income: $284 million

> Current federal income tax (including tax rebates): -$175 million — #8 lowest

> Effective tax rate: -61.6% — #3 lowest

> Industry: Telecommunications

[in-text-ad]

34. Interpublic Group

> US pre-tax income: $284 million

> Current federal income tax (including tax rebates): -$53 million — #19 lowest

> Effective tax rate: -18.5% — #14 lowest

> Industry: Miscellaneous services

33. Michaels

> US pre-tax income: $322 million

> Current federal income tax (including tax rebates): -$11 million — #37 lowest

> Effective tax rate: -3.5% — #35 lowest

> Industry: Retail & wholesale trade

31. Sealed Air

> US pre-tax income: $323 million

> Current federal income tax (including tax rebates): -$14 million — #33 lowest

> Effective tax rate: -4.4% — #29 lowest

> Industry: Miscellaneous manufacturing

[in-text-ad-2]

31. Community Health Systems

> US pre-tax income: $323 million

> Current federal income tax (including tax rebates): -$1 million — #50 lowest

> Effective tax rate: -0.3% — #50 lowest

> Industry: Health care

30. Kansas City Southern

> US pre-tax income: $327 million

> Current federal income tax (including tax rebates): -$2 million — #45 lowest

> Effective tax rate: -0.6% — #46 lowest

> Industry: Transportation

[in-text-ad]

29. UGI

> US pre-tax income: $420 million

> Current federal income tax (including tax rebates): -$85 million — #15 lowest

> Effective tax rate: -20.2% — #12 lowest

> Industry: Utilities, gas and electric

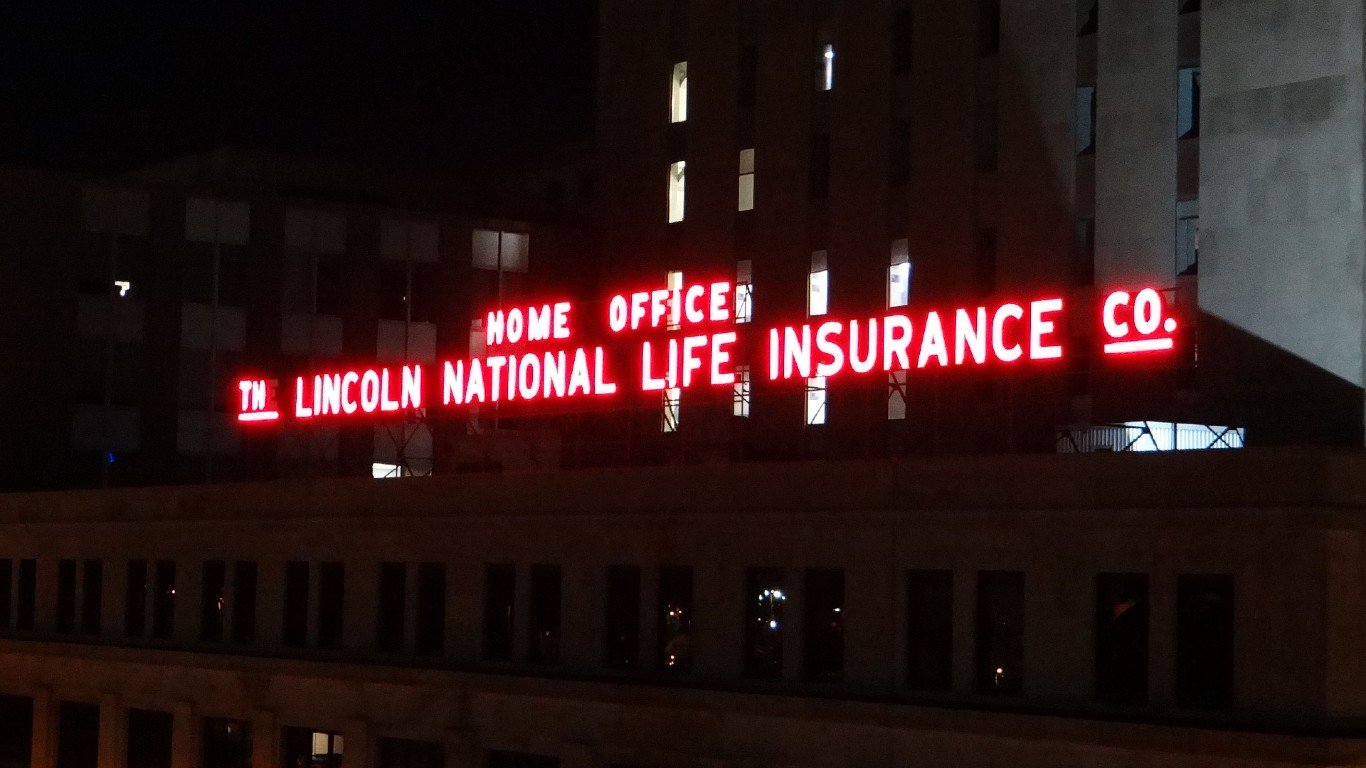

28. Lincoln National

> US pre-tax income: $423 million

> Current federal income tax (including tax rebates): -$61 million — #18 lowest

> Effective tax rate: -14.4% — #20 lowest

> Industry: Financial

27. Archer Daniels Midland

> US pre-tax income: $438 million

> Current federal income tax (including tax rebates): -$164 million — #9 lowest

> Effective tax rate: -37.4% — #7 lowest

> Industry: Food & beverages & tobacco

[in-text-ad-2]

26. Verisign

> US pre-tax income: $447 million

> Current federal income tax (including tax rebates): -$124 million — #11 lowest

> Effective tax rate: -27.7% — #10 lowest

> Industry: Computers, office equipment, software, data

25. Penske Automotive Group

> US pre-tax income: $505 million

> Current federal income tax (including tax rebates): -$78 million — #16 lowest

> Effective tax rate: -15.5% — #18 lowest

> Industry: Motor vehicles and parts

[in-text-ad]

24. Booz Allen Hamilton Holding

> US pre-tax income: $561 million

> Current federal income tax (including tax rebates): -$3 million — #44 lowest

> Effective tax rate: -0.5% — #47 lowest

> Industry: Computers, office equipment, software, data

23. Kinder Morgan

> US pre-tax income: $654 million

> Current federal income tax (including tax rebates): -$20 million — #32 lowest

> Effective tax rate: -3.1% — #36 lowest

> Industry: Oil, gas & pipelines

22. Qurate Retail Group

> US pre-tax income: $687 million

> Current federal income tax (including tax rebates): -$8 million — #41 lowest

> Effective tax rate: -1.2% — #42 lowest

> Industry: Internet services & retailing

[in-text-ad-2]

21. Evergy

> US pre-tax income: $722 million

> Current federal income tax (including tax rebates): -$27 million — #29 lowest

> Effective tax rate: -3.7% — #34 lowest

> Industry: Utilities, gas and electric

20. Duke Energy

> US pre-tax income: $826 million

> Current federal income tax (including tax rebates): -$281 million — #2 lowest

> Effective tax rate: -34.0% — #9 lowest

> Industry: Utilities, gas and electric

[in-text-ad]

19. HP

> US pre-tax income: $861 million

> Current federal income tax (including tax rebates): -$24 million — #31 lowest

> Effective tax rate: -2.8% — #37 lowest

> Industry: Computers, office equipment, software, data

18. PPL

> US pre-tax income: $878 million

> Current federal income tax (including tax rebates): -$9 million — #39 lowest

> Effective tax rate: -1.0% — #43 lowest

> Industry: Utilities, gas and electric

17. CMS Energy

> US pre-tax income: $885 million

> Current federal income tax (including tax rebates): -$35 million — #24 lowest

> Effective tax rate: -4.0% — #31 lowest

> Industry: Utilities, gas and electric

[in-text-ad-2]

16. Hologic

> US pre-tax income: $887 million

> Current federal income tax (including tax rebates): -$62 million — #17 lowest

> Effective tax rate: -7.0% — #25 lowest

> Industry: Health care

15. Unum Group

> US pre-tax income: $923 million

> Current federal income tax (including tax rebates): -$98 million — #13 lowest

> Effective tax rate: -10.7% — #22 lowest

> Industry: Financial

[in-text-ad]

14. Fiserv

> US pre-tax income: $1.1 billion

> Current federal income tax (including tax rebates): -$25 million — #30 lowest

> Effective tax rate: -2.3% — #38 lowest

> Industry: Financial data services

13. FirstEnergy

> US pre-tax income: $1.1 billion

> Current federal income tax (including tax rebates): -$14 million — #33 lowest

> Effective tax rate: -1.3% — #41 lowest

> Industry: Utilities, gas and electric

12. Advanced Micro Devices

> US pre-tax income: $1.2 billion

> Current federal income tax (including tax rebates):

> Effective tax rate:

> Industry: Computers, office equipment, software, data

[in-text-ad-2]

11. FedEx

> US pre-tax income: $1.2 billion

> Current federal income tax (including tax rebates): -$230 million — #5 lowest

> Effective tax rate: -18.9% — #13 lowest

> Industry: Miscellaneous services

10. Nucor

> US pre-tax income: $1.2 billion

> Current federal income tax (including tax rebates): -$177 million — #7 lowest

> Effective tax rate: -14.5% — #19 lowest

> Industry: Metals & metal products

[in-text-ad]

9. Consolidated Edison

> US pre-tax income: $1.2 billion

> Current federal income tax (including tax rebates): -$2 million — #45 lowest

> Effective tax rate: -0.2% — #52 lowest

> Industry: Utilities, gas and electric

8. Xcel Energy

> US pre-tax income: $1.5 billion

> Current federal income tax (including tax rebates): -$13 million — #35 lowest

> Effective tax rate: -0.9% — #45 lowest

> Industry: Utilities, gas and electric

7. DTE Energy

> US pre-tax income: $1.5 billion

> Current federal income tax (including tax rebates): -$247 million — #3 lowest

> Effective tax rate: -16.1% — #17 lowest

> Industry: Utilities, gas and electric

[in-text-ad-2]

6. Danaher

> US pre-tax income: $1.6 billion

> Current federal income tax (including tax rebates): -$321 million — #1 lowest

> Effective tax rate: -20.3% — #11 lowest

> Industry: Miscellaneous manufacturing

5. American Electric Power

> US pre-tax income: $2.2billion

> Current federal income tax (including tax rebates): -$138 million — #10 lowest

> Effective tax rate: -6.4% — #26 lowest

> Industry: Utilities, gas and electric

[in-text-ad]

4. Dish Network

> US pre-tax income: $2.5 billion

> Current federal income tax (including tax rebates): -$231 million — #4 lowest

> Effective tax rate: -9.1% — #24 lowest

> Industry: Telecommunications

3. Salesforce.com

> US pre-tax income: $2.6 billion

> Current federal income tax (including tax rebates): -$12 million — #36 lowest

> Effective tax rate: -0.5% — #47 lowest

> Industry: Computers, office equipment, software, data

2. Nike

> US pre-tax income: $2.9 billion

> Current federal income tax (including tax rebates): -$109 million — #12 lowest

> Effective tax rate: -3.8% — #33 lowest

> Industry: Miscellaneous manufacturing

[in-text-ad-2]

1. Charter Communications

> US pre-tax income: $3.7 billion

> Current federal income tax (including tax rebates): -$7 million — #42 lowest

> Effective tax rate: -0.2% — #52 lowest

> Industry: Telecommunications

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.