President Biden in March released his fiscal 2023 defense budget proposal. In it is a proposed 5.2% pay raise for active-duty and civilian military personnel, which would be the largest such increase in pay in 20 years for active-duty and 40 years for civilians.

As in business, military members are paid based on their rank (entry level vs. four-star general) and how long they have served. And while in the first few years the pay is equivalent to that of many entry-level civilian positions, it can increase considerably higher up the ranks and with more years of service.

To find the military pay grades that pay the most, 24/7 Wall St. reviewed 2023 basic pay tables from the Defense Finance and Accounting Service for the Department of Defense. Pay grades are ordered by the maximum possible annual base pay (we used the monthly pay to calculate annual pay). Comparable ranks for each pay grade also came from the DOD. Coast Guard ranks are mostly the same as Navy ranks.

The Defense Department classifies pay grades using letters and numbers. An “E” stands for enlisted, while “W” means warrant officer, and “O” corresponds to commissioned officer. A number after the letter classification represents the level of pay. For example, “1” means an entry-level pay grade. So an E-1 in the Army signifies a private. O-1E to O-3E officers – those with previous enlisted active-duty service – get paid extra in acknowledgement of their service time and experience.

A newly signed Army private makes a little over $23,000 a year. That is less than a fast-food cook at $25,490, per the Bureau of Labor Statistics. But that is just base pay, and enlisted personnel receive additional pays and benefits, including housing allowance, travel pay, health care, special and incentive pays – such as hazardous duty and hardship duty pays – and more.

Further, the pay increases the longer someone serves and moves up the ranks. The base pay of a sergeant with 10 years of service is $46,220, excluding additional pays and benefits. The mean annual wage for all occupations at all levels is $58,260. (What about government service? Here is what every governor is paid in every state.)

People who join the military often do so to serve their country rather than pay. Still, after several years they can pull a decent salary, especially in the higher ranks. A four-star Army or Marine Corps general receives an annual base salary of $212,101 after 20 years in service, which is not far off from the mean annual compensation for CEOs at $213.020.

Click here to see how much members of the US military are paid at every pay grade.

28. E-1<4 months

> Rank example, by military branch: Army, Marine Corps: Private; Navy: Seaman Recruit; Air Force: Airman Basic

> Pay with <4 months of service: $1,773 per month

[in-text-ad]

27. E-1>4 months

> Rank example, by military branch: Army, Marine Corps: Private; Navy: Seaman Recruit; Air Force: Airman Basic

> Annual pay with <2 and at 40 yrs of service: $23,011 to 23,011

> Annual pay with over 4 yrs of service: $23,011

> Annual pay with over 10 yrs of service: $23,011

> Annual pay with over 20 yrs of service: $23,011

26. E-2

> Rank example, by military branch: Army, Marine Corps: Private Second Class; Navy: Seaman Apprentice; Air Force: Airman

> Annual pay with <2 and at 40 yrs of service: $25,790 to 25,790

> Annual pay with over 4 yrs of service: $25,790

> Annual pay with over 10 yrs of service: $25,790

> Annual pay with over 20 yrs of service: $25,790

25. E-3

> Rank example, by military branch: Army, Marine Corps: Private First Class; Navy: Seaman; Air Force: Airman First Class

> Annual pay with <2 and at 40 yrs of service: $27,119 to 30,571

> Annual pay with over 4 yrs of service: $30,571

> Annual pay with over 10 yrs of service: $30,571

> Annual pay with over 20 yrs of service: $30,571

[in-text-ad-2]

24. E-4

> Rank example, by military branch: Army, Marine Corps: Corporal or Specialist; Navy: Petty Officer Third Class; Air Force: Senior Airman

> Annual pay with <2 and at 40 yrs of service: $30,042 to 36,472

> Annual pay with over 4 yrs of service: $34,978

> Annual pay with over 10 yrs of service: $36,472

> Annual pay with over 20 yrs of service: $36,472

23. E-5

> Rank example, by military branch: Army, Marine Corps: Sergeant; Navy: Petty Officer Second Class; Air Force: Staff Sergeant

> Annual pay with <2 and at 40 yrs of service: $32,764 to 46,498

> Annual pay with over 4 yrs of service: $38,390

> Annual pay with over 10 yrs of service: $46,220

> Annual pay with over 20 yrs of service: $46,498

[in-text-ad]

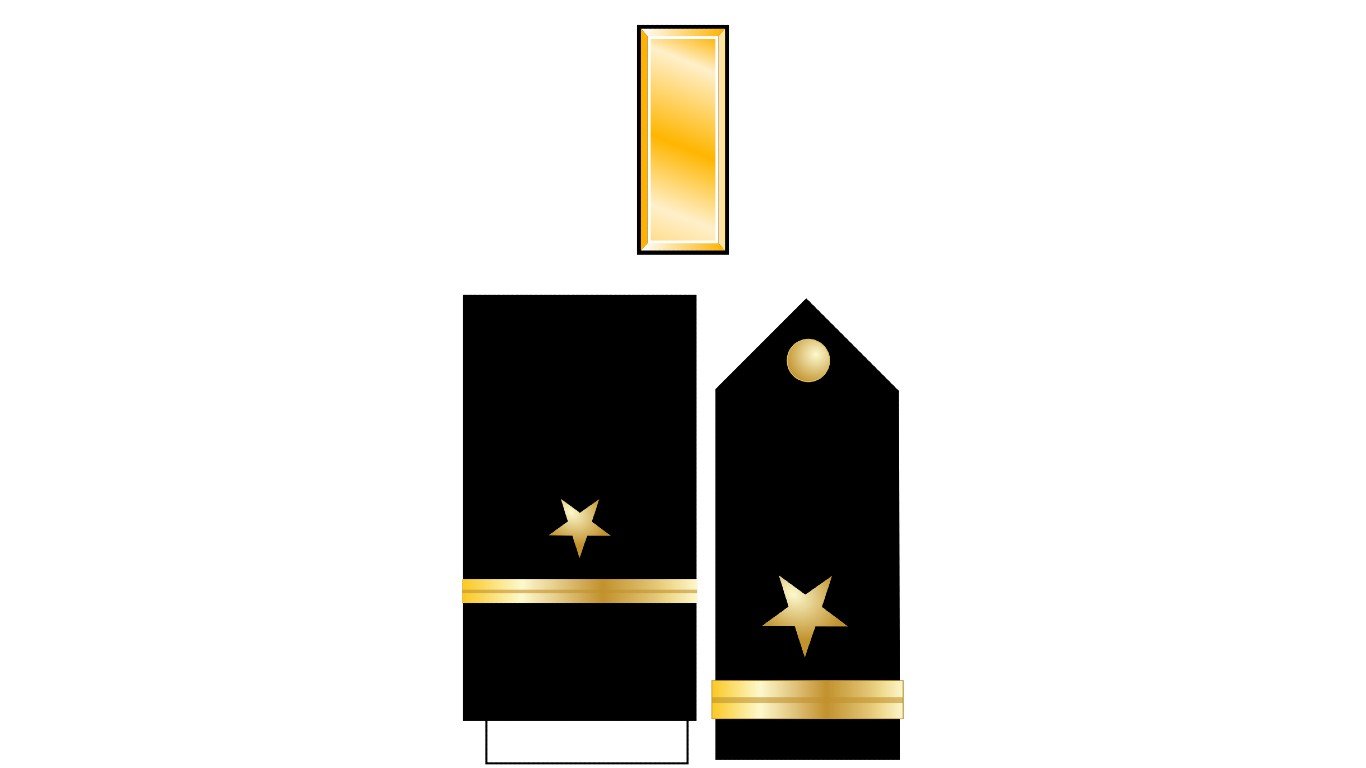

22. O-1

> Rank example, by military branch: Army, Marine Corps: Second Lieutenant; Navy: Ensign; Air Force: Second Lieutenant

> Annual pay with <2 and at 40 yrs of service: $43,646 to 54,922

> Annual pay with over 4 yrs of service: $54,922

> Annual pay with over 10 yrs of service: $54,922

> Annual pay with over 20 yrs of service: $54,922

21. E-6

> Rank example, by military branch: Army, Marine Corps: Staff Sergeant; Navy: Petty Officer First Class; Air Force: Technical Sergeant

> Annual pay with <2 and at 40 yrs of service: $35,766 to 55,397

> Annual pay with over 4 yrs of service: $42,786

> Annual pay with over 10 yrs of service: $50,051

> Annual pay with over 20 yrs of service: $55,397

20. O-1E

> Rank example, by military branch: Army, Marine Corps: Second Lieutenant; Navy: Ensign; Air Force: Second Lieutenant

> Annual pay with 4 and at 40 yrs of service: $54,922 to 68,191

> Annual pay with over 4 yrs of service: $54,922

> Annual pay with over 10 yrs of service: $63,032

> Annual pay with over 20 yrs of service: $68,191

[in-text-ad-2]

19. O-2

> Rank example, by military branch: Army, Marine Corps: First Lieutenant; Navy: Lieutenant Junior Grade; Air Force: First Lieutenant

> Annual pay with <2 and at 40 yrs of service: $50,288 to 69,592

> Annual pay with over 4 yrs of service: $68,191

> Annual pay with over 10 yrs of service: $69,592

> Annual pay with over 20 yrs of service: $69,592

18. W-1

> Rank example, by military branch: Army, Marine Corps: Warrant Officer 1; Navy: USN Warrant Officer 1; Air Force: N/A

> Annual pay with <2 and at 40 yrs of service: $42,660 to 73,721

> Annual pay with over 4 yrs of service: $51,098

> Annual pay with over 10 yrs of service: $60,847

> Annual pay with over 20 yrs of service: $73,721

[in-text-ad]

17. E-7

> Rank example, by military branch: Army, Marine Corps: Sergeant First Class; Navy: Chief Petty Officer; Air Force: Master Sergeant or First Sergeant

> Annual pay with <2 and at 40 yrs of service: $41,350 to 74,322

> Annual pay with over 4 yrs of service: $49,144

> Annual pay with over 10 yrs of service: $55,739

> Annual pay with over 20 yrs of service: $65,678

16. O-2E

> Rank example, by military branch: Army, Marine Corps: First Lieutenant; Navy: Lieutenant Junior Grade; Air Force: First Lieutenant

> Annual pay with 4 and at 40 yrs of service: $68,191 to 80,590

> Annual pay with over 4 yrs of service: $68,191

> Annual pay with over 10 yrs of service: $75,546

> Annual pay with over 20 yrs of service: $80,590

15. W-2

> Rank example, by military branch: Army, Marine Corps: Chief Warrant Officer 2; Navy: USN Warrant Officer 2; Air Force: N/A

> Annual pay with <2 and at 40 yrs of service: $48,604 to 81,122

> Annual pay with over 4 yrs of service: $55,588

> Annual pay with over 10 yrs of service: $66,067

> Annual pay with over 20 yrs of service: $78,206

[in-text-ad-2]

14. E-8

> Rank example, by military branch: Army, Marine Corps: Master Sergeant or First Sergeant; Navy: Senior Chief Petty Officer; Air Force: Senior Master Sergeant or First Sergeant

> Annual pay with 8 and at 40 yrs of service: $59,486 to 84,838

> Annual pay with over 4 yrs of service: N/A

> Annual pay with over 10 yrs of service: $62,118

> Annual pay with over 20 yrs of service: $73,562

13. O-3

> Rank example, by military branch: Army, Marine Corps: Captain; Navy: Lieutenant; Air Force: Captain

> Annual pay with <2 and at 40 yrs of service: $58,198 to 94,687

> Annual pay with over 4 yrs of service: $77,638

> Annual pay with over 10 yrs of service: $88,081

> Annual pay with over 20 yrs of service: $94,687

[in-text-ad]

12. W-3

> Rank example, by military branch: Army, Marine Corps: Chief Warrant Officer 3; Navy: USN Chief Warrant Officer 3; Air Force: N/A

> Annual pay with <2 and at 40 yrs of service: $54,932 to 96,354

> Annual pay with over 4 yrs of service: $60,332

> Annual pay with over 10 yrs of service: $72,670

> Annual pay with over 20 yrs of service: $89,140

11. O-3E

> Rank example, by military branch: Army, Marine Corps: Captain; Navy: Lieutenant; Air Force: Captain

> Annual pay with 4 and at 40 yrs of service: $77,638 to 101,052

> Annual pay with over 4 yrs of service: $77,638

> Annual pay with over 10 yrs of service: $88,081

> Annual pay with over 20 yrs of service: $101,052

10. O-4

> Rank example, by military branch: Army, Marine Corps: Major; Navy: Lieutenant Commander; Air Force: Major

> Annual pay with <2 and at 40 yrs of service: $66,197 to 110,524

> Annual pay with over 4 yrs of service: $82,876

> Annual pay with over 10 yrs of service: $99,058

> Annual pay with over 20 yrs of service: $110,524

[in-text-ad-2]

9. W-4

> Rank example, by military branch: Army, Marine Corps: Chief Warrant Officer 4; Navy: USN Chief Warrant Officer 4; Air Force: N/A

> Annual pay with <2 and at 40 yrs of service: $60,149 to 112,036

> Annual pay with over 4 yrs of service: $68,378

> Annual pay with over 10 yrs of service: $77,796

> Annual pay with over 20 yrs of service: $97,052

8. E-9

> Rank example, by military branch: Army, Marine Corps: Sergeant Major or Command Sergeant Major; Navy: Master Chief Petty Officer or Fleet /Command Master Chief Petty Officer; Air Force: Chief Master Sergeant or First Sergeant or Command Chief Master Sergeant

> Annual pay with 10 and at 40 yrs of service: $72,666 to 112,828

> Annual pay with over 4 yrs of service: N/A

> Annual pay with over 10 yrs of service: $72,666

> Annual pay with over 20 yrs of service: $85,234

[in-text-ad]

7. O-5

> Rank example, by military branch: Army, Marine Corps: Lieutenant Colonel; Navy: Commander; Air Force: Lieutenant Colonel

> Annual pay with <2 and at 40 yrs of service: $76,720 to 130,342

> Annual pay with over 4 yrs of service: $93,532

> Annual pay with over 10 yrs of service: $104,407

> Annual pay with over 20 yrs of service: $126,536

6. W-5

> Rank example, by military branch: Army, Marine Corps: Chief Warrant Officer 5; Navy: USN Chief Warrant Officer 5; Air Force: N/A

> Annual pay with 20 and at 40 yrs of service: $106,945 to 139,950

> Annual pay with over 4 yrs of service: N/A

> Annual pay with over 10 yrs of service: N/A

> Annual pay with over 20 yrs of service: $106,945

5. O-6

> Rank example, by military branch: Army, Marine Corps: Colonel; Navy: Captain; Air Force: Colonel

> Annual pay with <2 and at 40 yrs of service: $92,030 to 162,918

> Annual pay with over 4 yrs of service: $107,737

> Annual pay with over 10 yrs of service: $113,400

> Annual pay with over 20 yrs of service: $144,605

[in-text-ad-2]

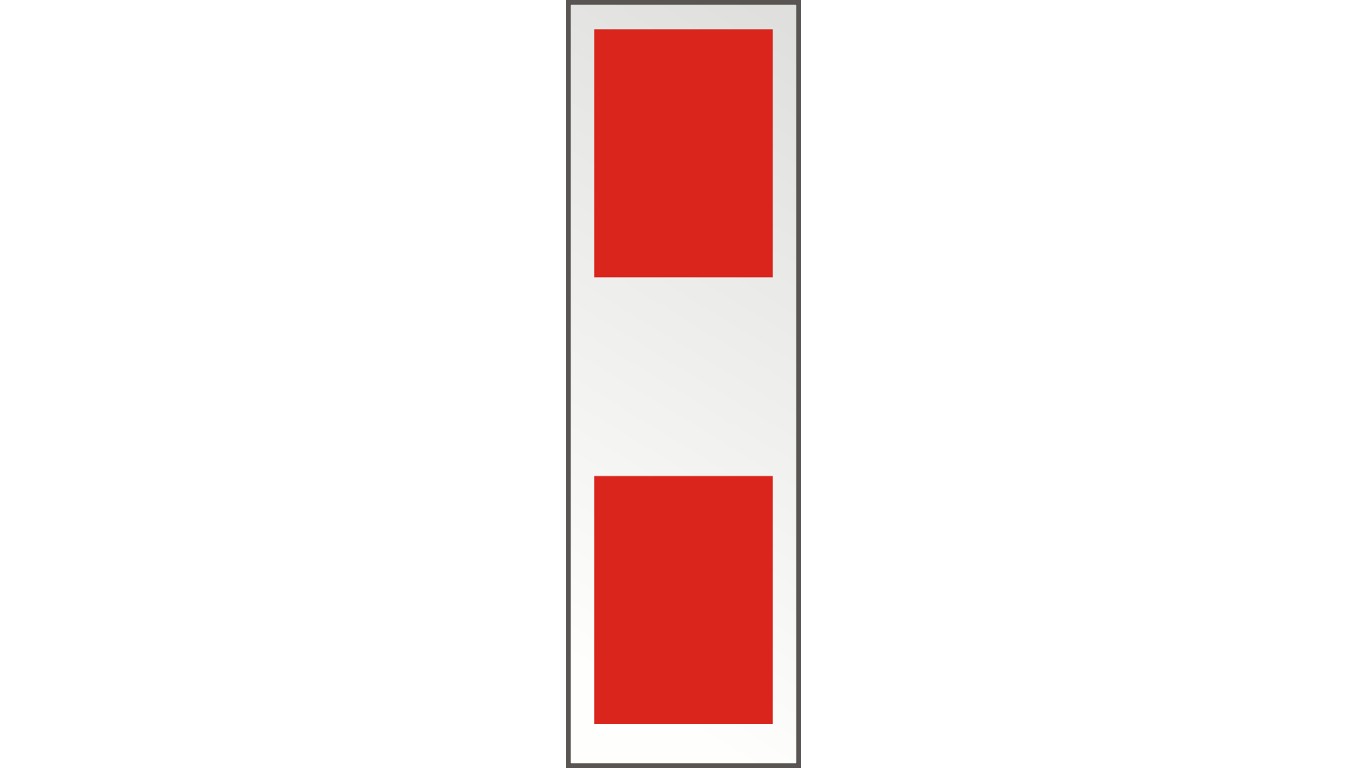

4. O-7

> Rank example, by military branch: Army, Marine Corps: Brigadier General (1 star); Navy: Rear Admiral Lower Half (1 star); Air Force: Brigadier General (1 star)

> Annual pay with <2 and at 40 yrs of service: $121,356 to 181,321

> Annual pay with over 4 yrs of service: $131,681

> Annual pay with over 10 yrs of service: $143,431

> Annual pay with over 20 yrs of service: $176,854

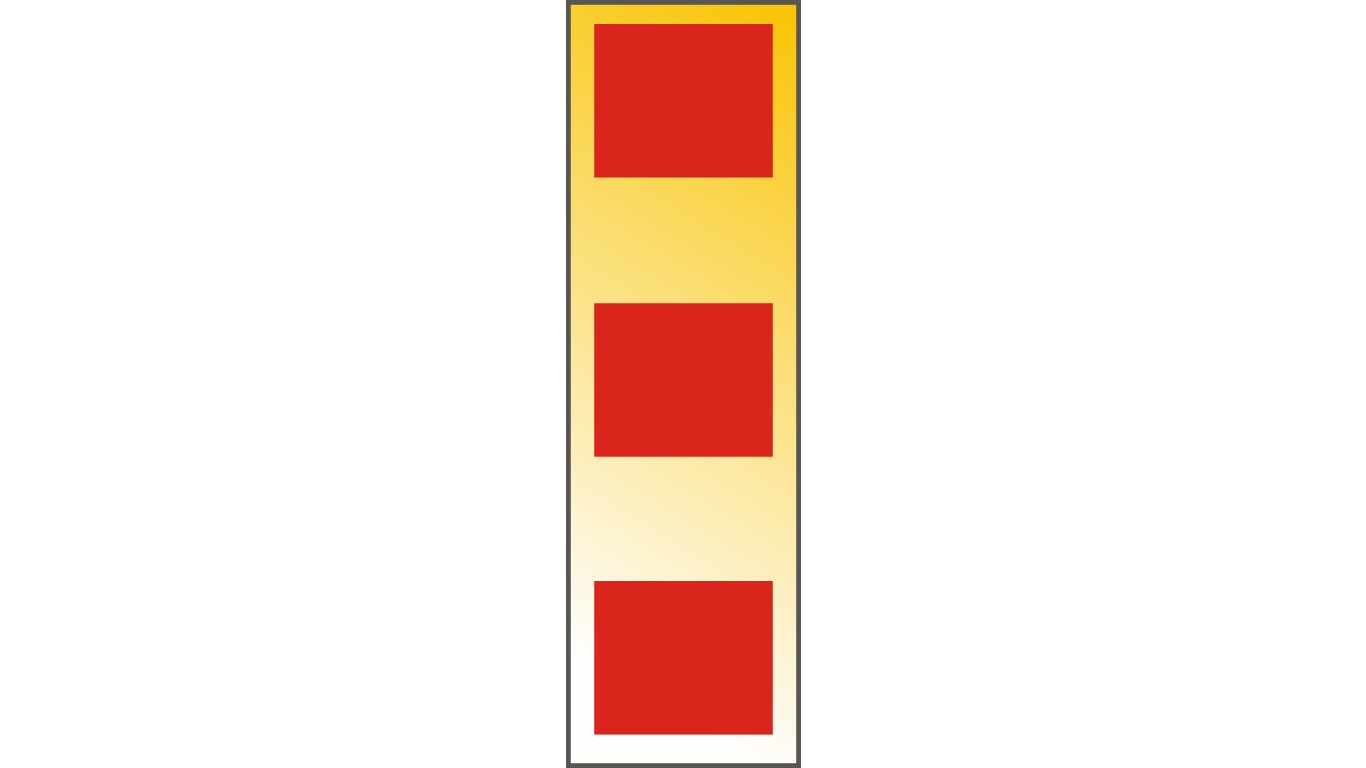

3. O-8

> Rank example, by military branch: Army, Marine Corps: Major General (2 stars); Navy: Rear Admiral Upper Half (2 stars); Air Force: Major General (2 stars)

> Annual pay with <2 and at 40 yrs of service: $146,048 to 210,550

> Annual pay with over 4 yrs of service: $154,897

> Annual pay with over 10 yrs of service: $167,018

> Annual pay with over 20 yrs of service: $195,577

[in-text-ad]

1. O-9

> Rank example, by military branch: Army, Marine Corps: Lieutenant General (3 stars); Navy: Vice Admiral (3 stars); Air Force: Lieutenant General (3 stars)

> Annual pay with 20 and at 40 yrs of service: $206,417 to 212,101

> Annual pay with over 4 yrs of service: N/A

> Annual pay with over 10 yrs of service: N/A

> Annual pay with over 20 yrs of service: $206,417

1. O-10

> Rank example, by military branch: Army, Marine Corps: General (4 star); Navy: Admiral (4 star); Air Force: General (4 star)

> Annual pay with 20 and at 40 yrs of service: $212,101 to 212,101

> Annual pay with over 4 yrs of service: N/A

> Annual pay with over 10 yrs of service: N/A

> Annual pay with over 20 yrs of service: $212,101

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.