BlackBerry Ltd. (NASDAQ: BBRY) is scheduled to report its fiscal third-quarter financial results before the markets open on Friday. The consensus estimates from Thomson Reuters call for a net loss of $0.14 per share on $489.06 million in revenue. The same period from the previous year had earnings of $0.01 per share on $793.00 million in revenue.

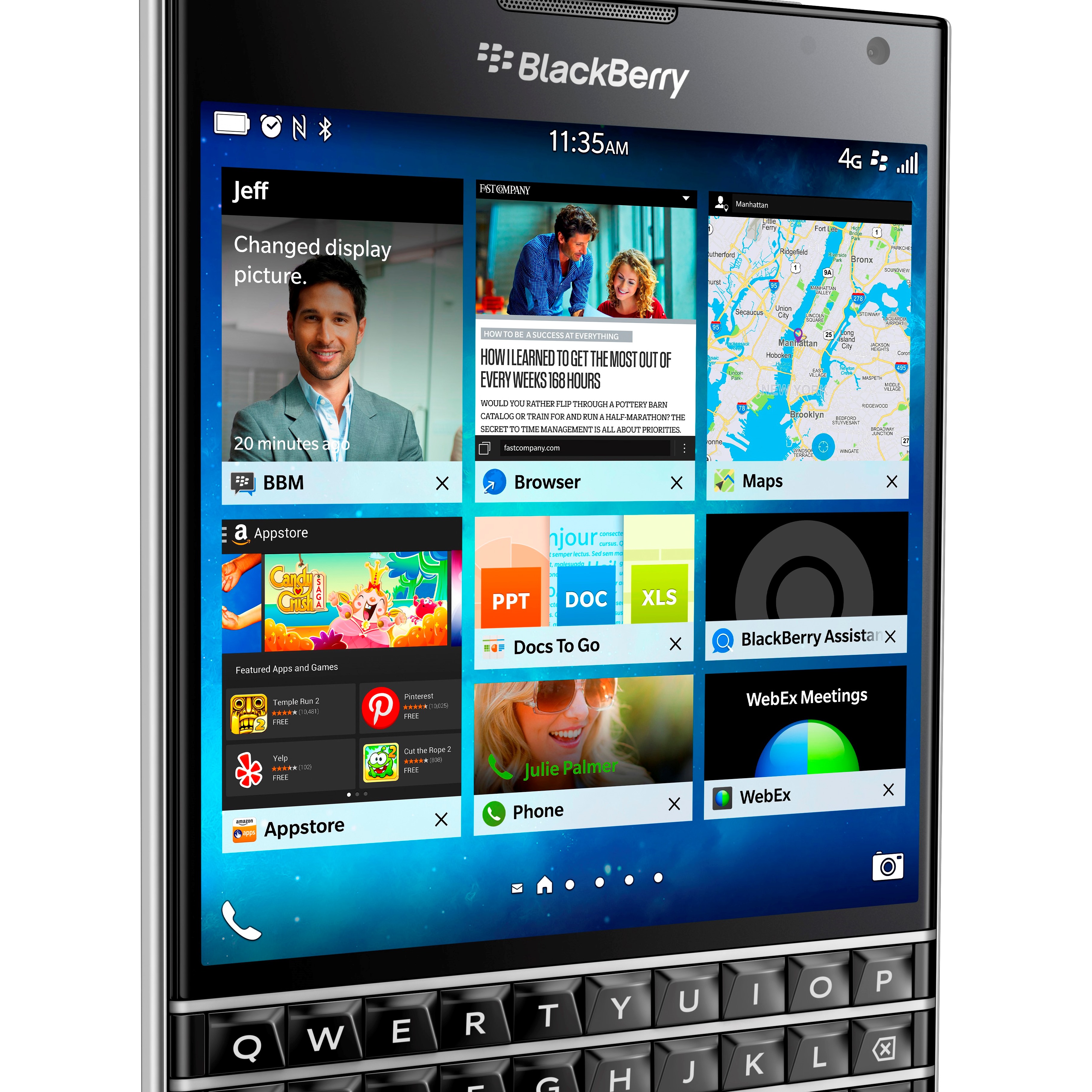

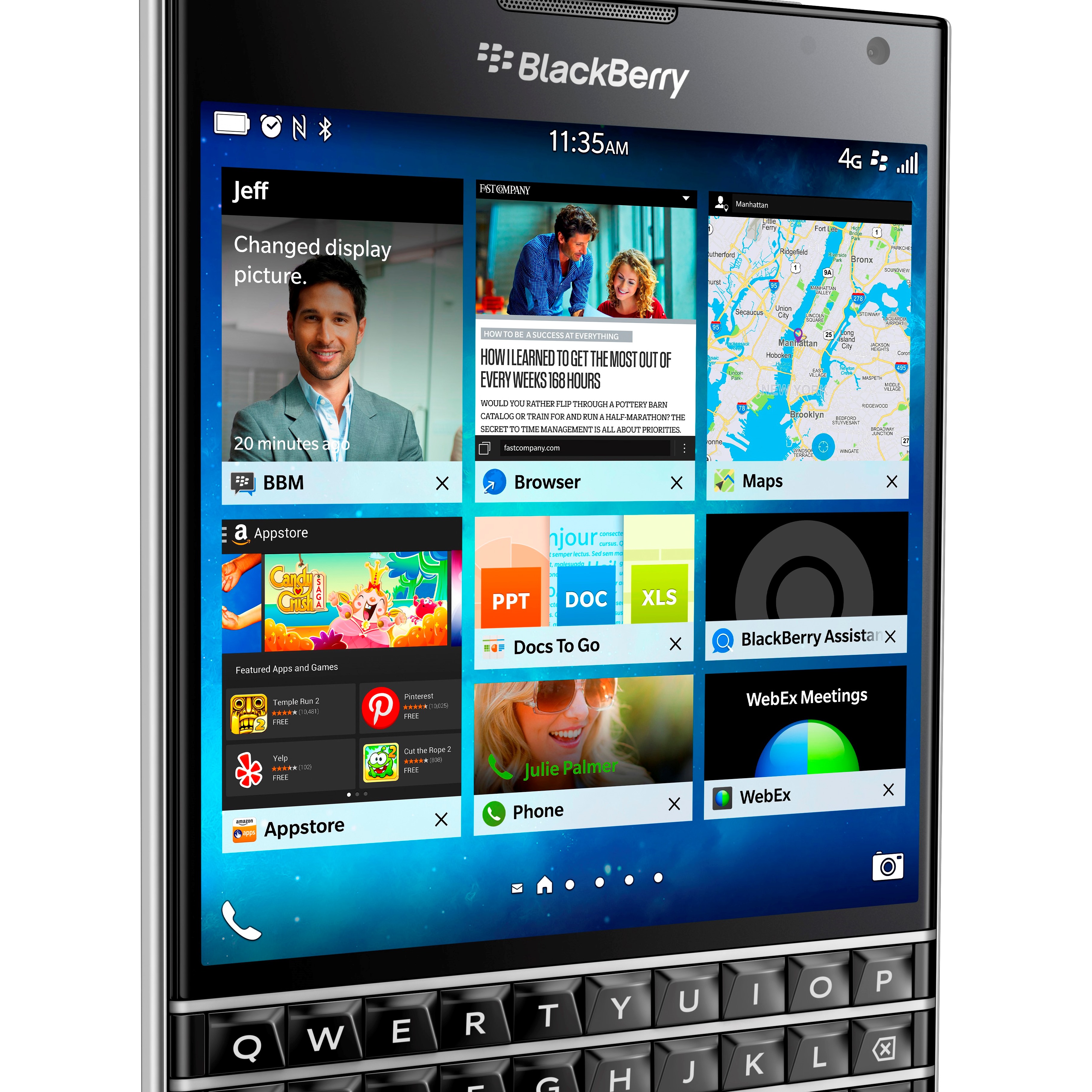

After having a rough 2015 so far, BlackBerry finally starting building some positive momentum in November. The company announced the completion of its acquisition of Good Technology, and investors responded positively.

BlackBerry will integrate Good’s software solutions and services with its own software suites to offer what it believes is the industry’s most complete end-to-end solution to secure the entire mobile enterprise, across all platforms and applications, while protecting personal privacy.

The company anticipates this acquisition to be accretive to earnings and cash flow within the first year after closing. The company also expects to realize roughly $160 million in revenue from Good in the first year, including the impact of an expected write-down of certain of Good’s deferred revenues.

A few analysts weighed in on BlackBerry ahead of earnings:

- Credit Suisse reiterated a Sell rating.

- RBC Capital reiterated a Sector Perform rating with an $8 price target.

- Wells Fargo reiterated a Hold rating.

- Robert Baird reiterated a Hold rating.

As 2015 is coming to a close, BlackBerry is underperforming the market with the stock down over 25% year to date.

Shares of BlackBerry were last trading down 3.4% at $7.90, with a consensus analyst price target of $7.25 and a 52-week trading range of $5.96 to $12.63.

ALERT: Take This Retirement Quiz Now (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.