Commodities & Metals

Sterne Agee Defends the Price of Gold and Gold Demand

Published:

Last Updated:

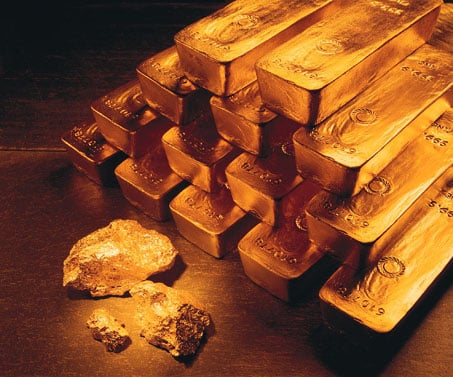

Gold is turning out to be one of the worst investments of modern day portfolios. But what if the rapid drop in prices is not really warranted from the market fundamentals nor from the demand for gold? We recently have shown how value investors suddenly have had no choice but to start looking at the battered and depressed mining stocks. May was so bad that we said gold has joined silver equally as the Devil’s Metal. Now an analyst report from Sterne Agee defends the actual price of gold due to global demand. Source: Thinkstock

Source: Thinkstock

Stern Agee’s research team covering the energy and industrials sectors is defending gold, while also admitting some of the ongoing issues around exchange traded fund (ETF) flows. Despite continued ETF outflows and net long position liquidation, strong physical demand in the form of coins, gold bars and jewelry from Asia is coming at the same time that central banks from emerging countries continue to buy gold.

The report says:

Even if US investors continue to liquidate their ETFs and net long positions on COMEX in near future, we believe buyers/investors in India, China and Middle East would continue to take long view on gold prospects, and step up and accumulate gold on price dips.

Stern Agee puts the gold ETF outflows at nearly 4.0 million ounces, with the SPDR Gold Shares (NYSEMKT: GLD) having seen the strongest redemption pressure. That was after gold ETFs saw about 5.5 million ounces outflow in April. Stern Agee showed that this 10 million ounces or so represents about 13% of total ETF holdings, but the outflows in the silver ETFs have been about 22 million ounces. That is just about 3% of total silver ETF holdings in April and May alone.

Monday’s note suggests that speculators continue to reduce their bullish bets on gold and silver. Speculative net long positions on COMEX even have dropped recently to the lowest levels since 2001 to 2002. The net reportable short contracts for gold are sitting at close to all-time highs. Stern Agee now suggests that a short squeeze could come on strong by saying, “We believe any upside catalyst could lead to short squeeze on COMEX and drive gold and silver prices higher.”

Other demand remains strong as well. Central bank purchases totaled more than 100 tons for the seventh consecutive quarter in the first quarter of 2013. Central banks also were said to be buyers of almost 1 million ounces of gold in April. Physical buying in India and China more than made up for recent ETF outflows, and the firm reminds that ETFs represent just 6.5% of overall annual gold demand, versus 72% of all demand for consumer purchases of bars, coins and jewelry.

Physical demand also was shown to have surged in India and China after gold’s historic sell-off in April. The firm said:

“Strong demand led to shortage of metal in many emerging countries, with gold dealers facing a tough time bringing physical supplies to meet demand. In China, Shanghai Gold Exchange saw premiums reach US$40/oz. Gold auctions run by the State Bank of Vietnam were fully subscribed with premiums at US$150/oz. In India, premiums were as high as US$26/oz, before settling to around US$10/oz.

A 12 p.m. EST quote on Kitco gold shows the metal up 1.9% at $1,415.50, and silver is up even more with a gain of $0.61 to $22.88 per ounce. The SPDR Gold Shares (NYSEMKT: GLD) is up 2.1% at $136.78, and the iShares Silver Trust (NYSEMKT: SLV) is up just over 3% at $22.08.

We see even stronger performance in the miners today. Monday’s mid-day gain in the Market Vectors Gold Miners ETF (NYSEMKT: GDX) is up more than 3.5% at $30.57.

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.